Last week, we had the news that the iconic brand Tupperware had filed for bankruptcy. So dominant was the company in its heyday that when you hear the word Tupperware, you probably think of an item, not a brand, similar to how Hoover became colloquially synonymous with “vacuum cleaner” in the UK. The news is perhaps a sign of the times, plastic is frowned upon, and brands face increased online competition. Clearly the exodus of working from home has also meant that no one is bringing their leftovers to work anymore. However, that trend might be tapering off. Amazon made a hardline announcement last week, calling its employees back to the office 5 days a week.

Most importantly last week, the US Federal Reserve finally announced its highly anticipated rate decision. Its bold decision to cut interest rates by 50 basis points was warmly welcomed by markets. The S&P hit a record high on Thursday following the decision. The Fed was not the only central bank that met to discuss its monetary policy last week. The Bank of England and Bank of Japan were less keen on change, and both kept their rates steady. Markets expect the BoE to cut rates for a second time this year in November, while the BoJ indicated that if the economy develops in line with its forecasts that more hikes should be expected this year and next.

Weekly Roundup

The Fed lowers rates by 50 basis points

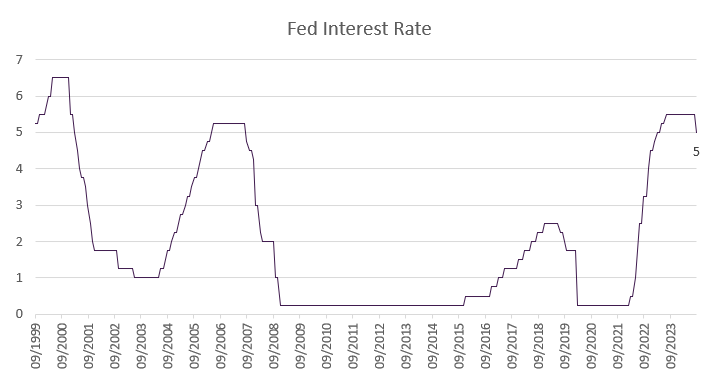

The US central bank made a bold first move in the easing of its monetary policy on Wednesday by cutting rates by half a percentage point, to a range of 4.75%-5.00%. The decision comes amid clear signs that inflation is coming under control and that the labour market is weakening. The Fed stated that “The Committee has gained greater confidence that inflation is moving sustainably toward 2%, and judges that the risks to achieving its employment and inflation goals are roughly in balance."

The language on economic activity was unchanged: “Recent indicators suggest that economic activity has continued to expand at a solid pace.” In his statement Powell said, “The US economy is in a good place and our decision today is designed to keep it there.”

The cut brings an end to the 23-year high interest rates that the Fed has maintained for more than a year. The latest “dot plot” of officials’ forecasts implies another 50 basis points worth of cuts in 2024. The funds rate is then expected to fall by another percentage point in 2025.

Updated economic projections showed inflation expectations revised lower, unemployment slightly higher, and growth projections largely unchanged.

When asked if this move indicated that the Fed have fallen behind the economic data, Fed Chair Jerome Powell said they are not behind, but timely in their decision, and that that this move should be taken as a sign of the Fed’s commitment to staying ahead.

Equity investors welcomed the Fed’s effort to support economic growth now that inflation has eased, increasing the perceived probability of a soft landing. The dollar weakened and Treasuries steadied after an initial decline.

Source: Bloomberg, BIL

US Retail Sales reveals that labour market doubts have not restrained consumers

US retail sales rose a modest 0.1% month-on-month in August after a 1.1% leap in July, confounding expectations that retail sales would fall amidst labour market uncertainty. The US consumer is a powerful force for the economy, and it is not yet showing signs of weakness.

Strong online sales (which increased by 1.4%) easily offset a decline in auto dealership sales. A big increase was also seen in sales at miscellaneous stores (1.7%), while sales declined at petrol stations and for food and beverage. Lower petrol prices have likely also left consumers with more money to spend elsewhere.

On an annual basis, Retail Sales rose 2.1%.

When this data was released earlier last week, questions were raised as to whether the Fed would need to begin its easing cycle with a larger 50bps cut, given that the economy appears to be doing well, a decision the Fed made at its meeting on Wednesday, stating that the goal is to keep the economy in the good place it is in.

In other good news, figures on Tuesday showed a rebound in manufacturing output in August, with factory production rising on the back of an increase in motor vehicle production.

Economic sentiment in the Eurozone continues its downward trend

The ZEW Indicator for Economic Sentiment measures analysts’ level of optimism for the expected economic developments over the next 6 months. The indicator continued to fall in September, dropping to 9.3, well below the 16.3 forecast. Optimism regarding economic development in the Eurozone has been falling for the past three months, with uncertainty about the strength of the economy and the impact of potential changes in the monetary policy weighing on sentiment. Germany’s ZEW indicator dropped significantly to 3.6 in September, from 19.2 in August, as the country struggles to find its footing.

On the other hand, consumers are exhibiting more optimism, with Euro Area consumer confidence hitting its highest level since February 2022 in September, at -12.9, with the prospect of ECB easing being the key driver.

Continuing on this more positive note, the Eurozone trade surplus beat expectations in July with a surplus of EUR 21.2 billion, substantially higher than the 6.7 billion surplus from July 2023. Exports jumped by 10.2% in the last year, indicating that the Eurozone remains competitive in terms of exports despite the current struggles in the manufacturing industry.

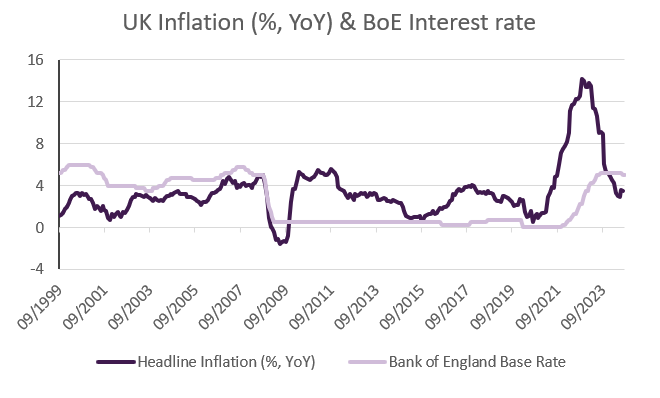

UK interest rates and inflation held steady

At its September meeting last week, the Bank of England announced that it will keep rates unchanged at 5%, as largely expected. Inflation held steady at 2.2% in August, the same as in July. BoE Governor Andrew Bailey stated that inflationary pressure is easing and that if it continues, they will be able to gradually continue cutting rates at upcoming meetings. However, he also reiterated that “it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.” Barring any major surprises in price pressure, markets expect the BoE’s second rate cut of the year at their next meeting in November.

Although headline inflation held steady, persistent price pressure in the services sector, which rose to 5.6%, likely played a role in the central bank’s decision to keep rates unchanged. The rise was largely due to an increase in airfares, which rose a stunning 22% between July and August. However, since airfares is a very volatile category with prices fluctuating depending on the seasons and major events, it is not a major concern. Core inflation, excluding volatile food and energy prices, was at 3.6% in August, up from 3.3% in July.

Source: Bloomberg, BIL

Swiss watchmakers urge the central bank to act on the strong franc

The Federation of the Swiss Watch Industry has expressed concern that the strong franc is threatening exports, which account for 55% of Swiss GDP. With inflation well below the 2% target, they are now calling on the Swiss National Bank (SNB) to intervene against the strong franc to ensure that Swiss exports are not further impacted. The franc's strength concurs with falling global demand for luxury goods such as watches, threatening a key pillar of the economy, which consists of some 700 companies employing around 65,000 people.

Watch exports fell by 2.4% in the first seven months of 2024, after hitting several export records in the past few years. However, Switzerland’s balance of trade in August did reveal that watch exports grew by 5.9% month-on-month in August, which might be the sign of hope the watchmakers have been waiting for.

The SBN lowered its interest rates by 25 basis points to 1.25% in June. During the following press conference, Thomas Jordan, the outgoing Chairman of the SNB, addressed the strength of the franc saying that, “The Swiss franc depreciated from January to the end of May. However, it has increased in value again significantly in the past weeks. ... We will therefore continue to monitor the situation closely and use our monetary policy measures to ensure that inflation remains within the range consistent with price stability on a sustainable basis over the medium term. We also remain willing to be active in the foreign exchange market as necessary.”

The SNB will meet for the next rate decision on September 26.

Economic calendar for the week ahead

Monday – Eurozone, UK, US composite PMI Flash (September).

Tuesday – Germany Ifo Business Climate (September). US Consumer Confidence (September), House Price Index (September), Money Supply (August).

Wednesday – France Consumer Confidence (September). US New Home Sales (August), Building Permits (Final, August).

Thursday – Germany GfK Consumer Confidence (October). Switzerland SNB Interest Rate Decision. Eurozone M3 Money Supply (August). US GDP Growth Rate QoQ (Final, Q2), Initial Jobless Claims, PCE Prices (Final, Q2).

Friday – France & Spain Inflation Rate (Prel, September). EZ Economic Sentiment (September), Consumer Confidence (Final, September). US Core PCE Price Index (August), Personal Income (August), Personal Spending (August), Michigan Consumer Sentiment (Final, September).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 15, 2025

Weekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...