Choose Language

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central bank is in no hurry to cut rates, and that the goal is to adjust monetary policy “over time towards a more neutral stance”. He reminded markets that the Fed is “recalibrating policy to maintain the strength in the economy, not because of weakness in the economy” and said that the “baseline” was two more quarter-point cuts rather than another half-point move. Friday’s strong US jobs report dampened rate cut hopes further. In an interview, the UK's Bailey hinted at the BoE becoming a “bit more aggressive” in cutting interest rates, sending the Pound tumbling. In Japan, a dovish policymaker said that the BoJ will raise rates again if the economy stays in line with forecasts but that it will need to do so slowly and cautiously. Japan's new Prime Minister Ishiba on the other hand, said that Japan should not rush to raise interest rates just yet. A comment which caused the Yen to fall and Japanese equities to rally.

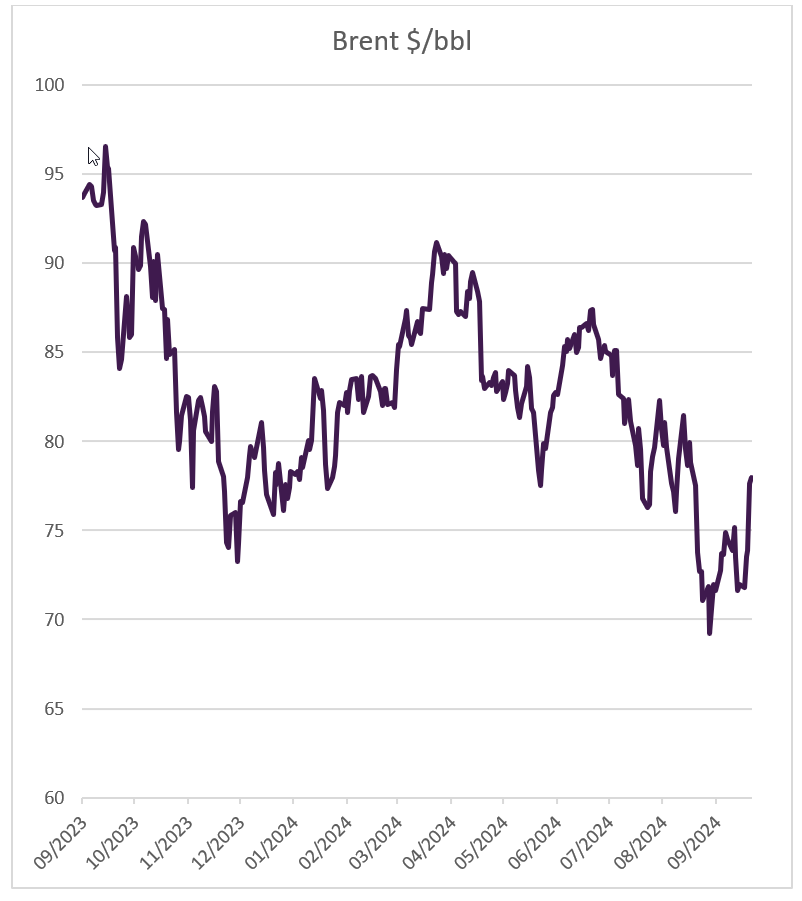

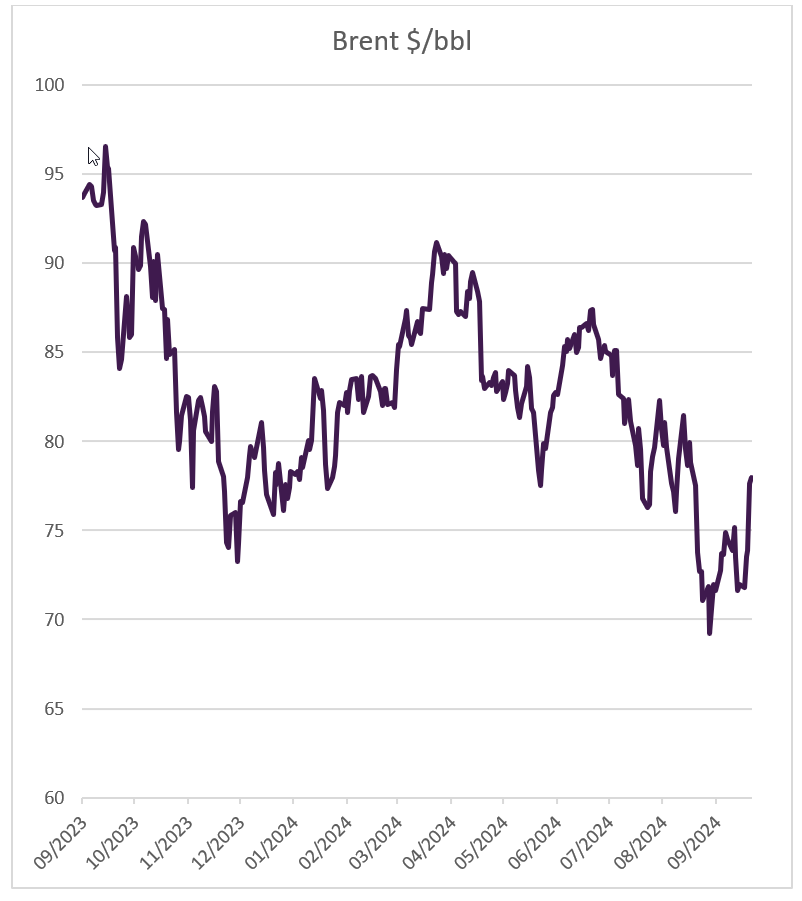

A flare up in Middle East tensions pushed up the oil price, with Brent heading for its strongest weekly increase in two years at the time of writing on Friday.

Source: Bloomberg, BIL

Weekly roundup

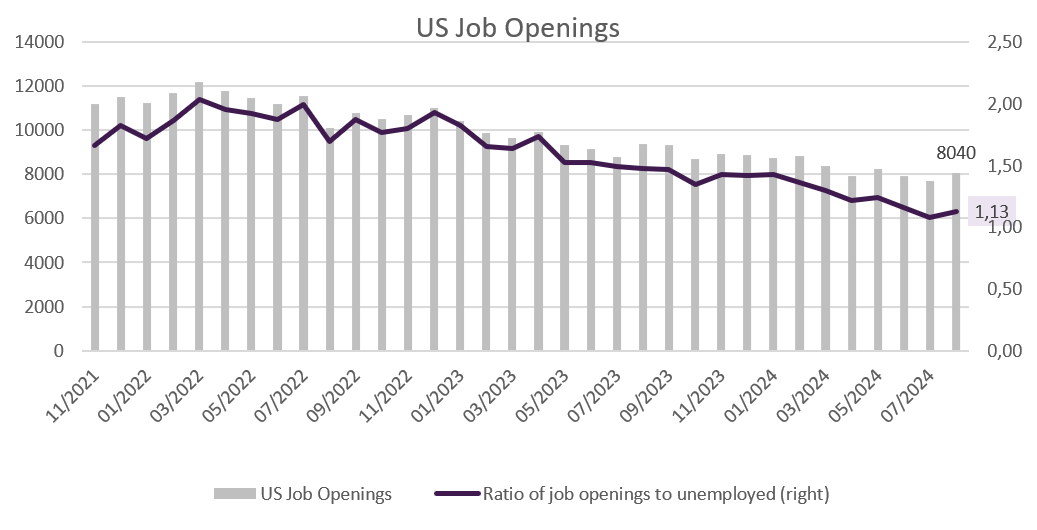

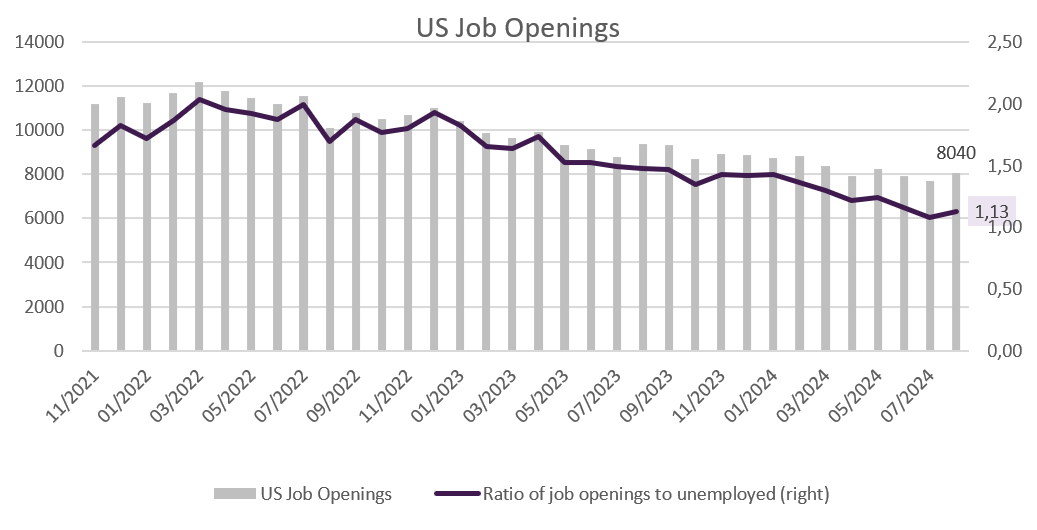

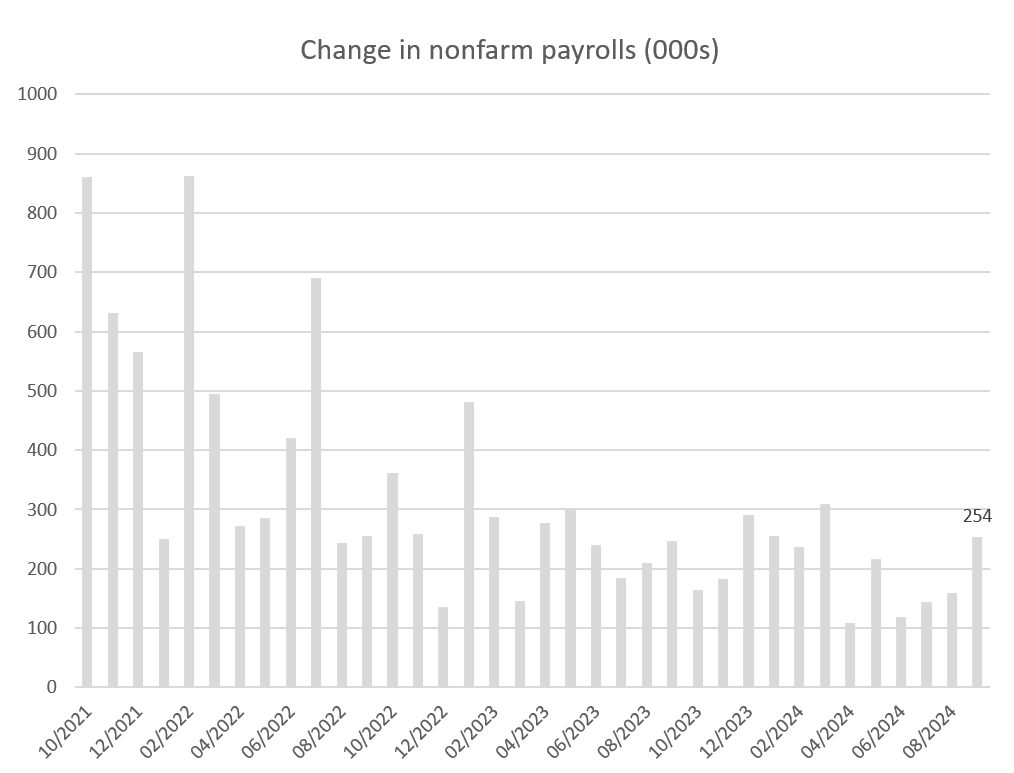

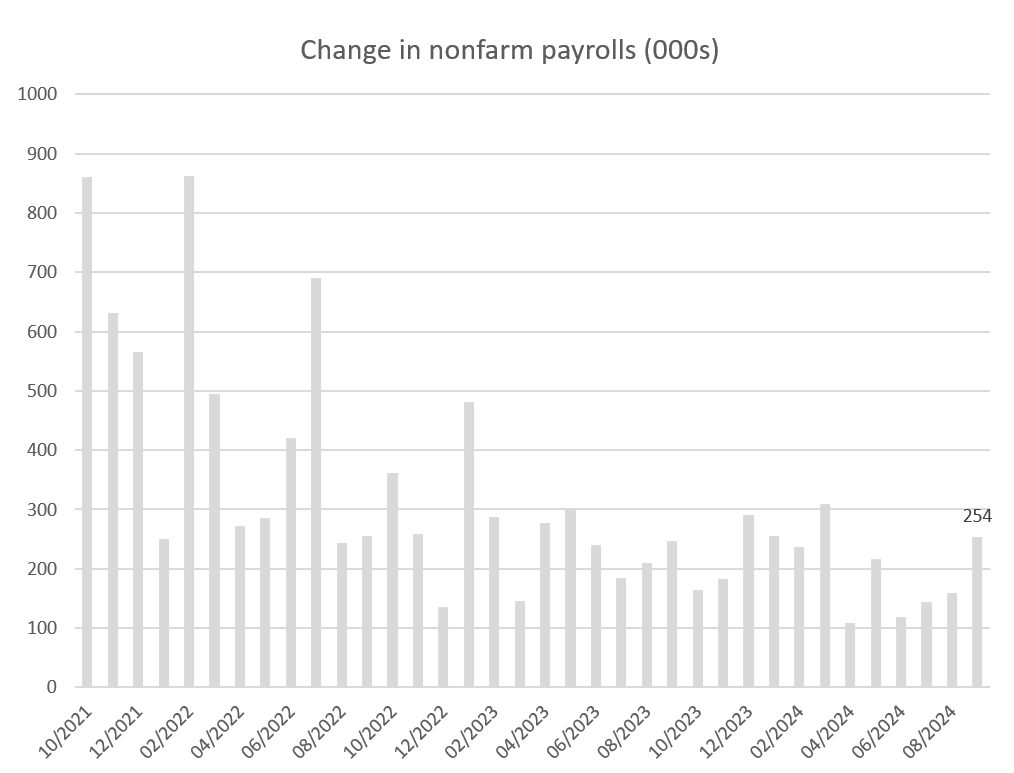

Undercurrents of strength in the US labour market

As of late, the US labour market has cooled considerably, but without breaking. The Fed wants to prevent any further deterioration, and this was one of the reasons underpinning its decision to enact a 50 basis point bumper rate cut in September. While the impact of that move will take several months to impact the real economy and employer costs, Powell said this week that the Fed has growing confidence that with an appropriate recalibration of its policy stance, “strength in the labour market can be maintained in an environment of moderate economic growth and inflation moving sustainably down to our objective.”

Last week, data seemed to support those claims. Job openings picked up, rising to 8.040 million in August, led by construction (+138k new positions). This brought the overall vacancies-to-unemployment ratio up to 1.13. For context, averaged 1.19 in 2019, and it peaked at 2.0 amid the “Great Resignation”. The quits rate fell to just 1.9%, with the level of quits at the lowest since August 2020, implying that caution is creeping into the collective psyche.

Source: Bloomberg, BIL

The Challenger report revealed job cuts were slightly lower in September and that they remain concentrated in Technology. This is somewhat unsurprising given years of hyper-hiring and the enormous changes sweeping through the industry. Looking at the year-to-date figures, job cuts are up 0.8% from the same period last year. Though less than a percentage point separates them, this is the first time this year that year-to-date cuts are higher than those tracked in 2023. Has the Fed done enough to prevent the job market tipping over at this inflection point?

Buried in the report was a nugget of optimist. The researchers noted that a projected uptick in consumer spending could lead to more demand for workers in consumer-facing sectors.

Finally, on Friday, we had the all-important jobs report. It showed that US employers created 254,000 jobs in September, above estimates of 150,000. Wage growth accelerated to 4% YoY (the quickest since May), and the unemployment rate fell to 4.1%.

Source: Bloomberg, BIL

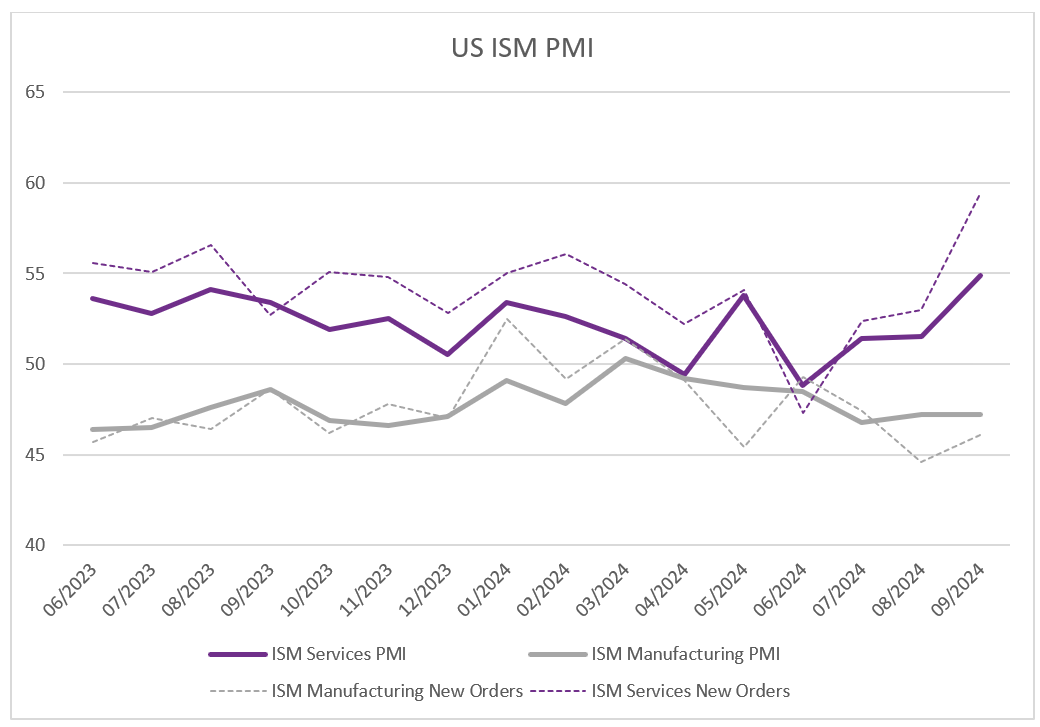

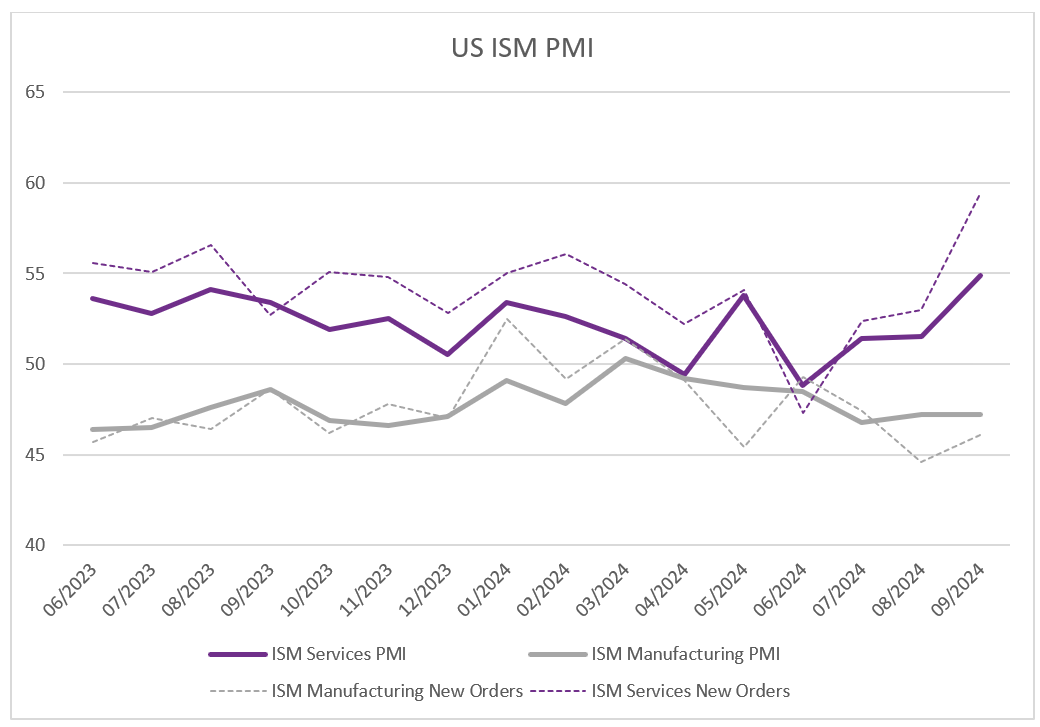

ISM PMI points to enduring service sector strength in the US

The mammoth US services sector accounts for over three-quarters of US economic activity. Data last week suggests that it remains in great health and continues to serve as the backbone of growth.

The ISM services PMI rose to an impressive 54.9, indicating the fastest pace of expansion since February 2023. Activity is at a four-month high, while new orders, which gives more insight into the future jumped significantly, pointing to still-solid demand.

However, the same cannot be said for manufacturing, where it seems demand has been suspended as companies await more clarity on the US presidential election, and friendlier financing costs as the Fed lowers rates. The sector has spent six months languishing below the 50 mark and the gap between it and services is now at the widest level since late 2019.

Companies in both sectors noted dockworker strikes as a key near-term risk to business. At the onset of last week, 45,000 port workers from Maine to Texas went on strike, potentially meaning billions of dollars worth of seaborn goods would not be able to enter the US – some of them perishable. However, the historic strike was suspended on Friday amid a tentative agreement that sees workers’ wages by 62% over the life of the 6-year contract.

Source: Bloomberg, BIL

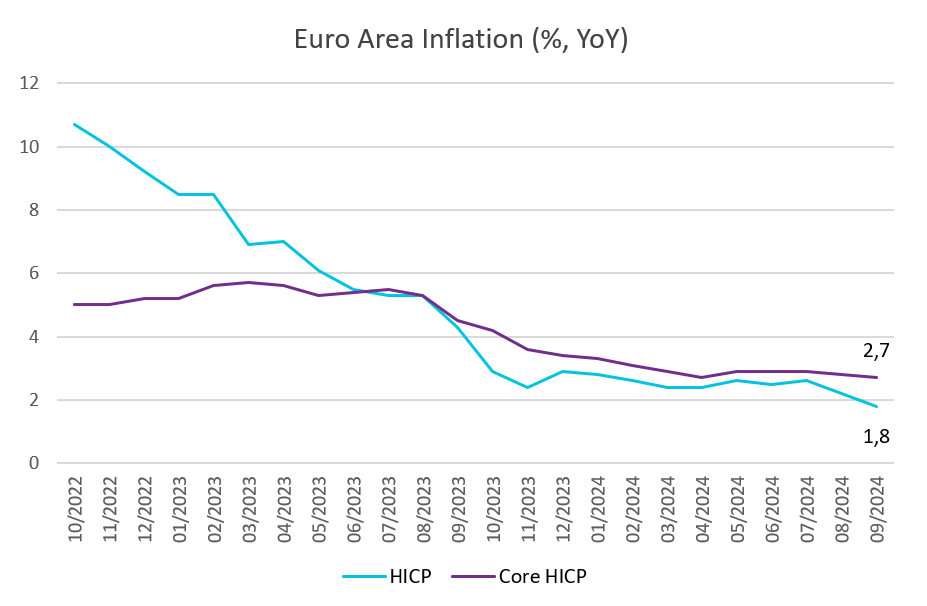

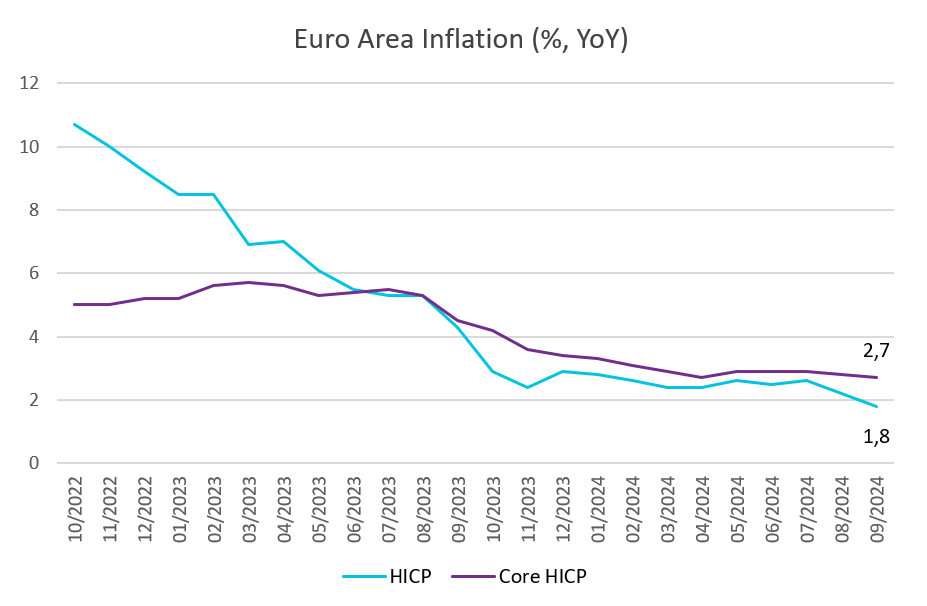

Eurozone inflation dips below ECB target of 2% for the first time in three years, falling to 1.8%

Annual inflation in the Eurozone cooled to 1.8% in September, down from 2.2% in August, according to flash estimates. This marks the softest increase in consumer prices in more than three years.

Energy prices continued to fall sharply by 6%. Inflation began to slow for services, to 4% from 4.1%, but continued to pick up slightly for food, alcohol, and tobacco. Although a slightly slower inflation for services is positive, the rate of 4% remains relatively high.

The core rate — which excludes the more volatile components of energy, food, alcohol and tobacco — eased to 2.7%.

Source: Bloomberg, BIL

The lower inflation rate reflects easing price pressure across the Eurozone, with the inflation rate in several of the largest economies dropping below 2%. By region, harmonized inflation was 1.7% in Spain, 1.5% in France, 0.8% in Italy and 1.8% in Germany. Energy inflation remains a key downward driver for several of the main economies. In Germany, the drop below the ECB target is encouraging, however, the high price increases in the services sector continue to be a concern.

The slowing inflation paves the way for additional rate cuts by the ECB and investors increased their bets on a potential rate cut in October upon the release of the latest inflation figure. However, there are still several releases that could have an influence in the ECB’s pathway ahead of their October meeting.

The ECB has said that it expects inflation to bounce back temporarily at the end of this year, as earlier falls in energy prices are no longer reflected in the Eurostat statistics.

EU presses ahead with tariffs on Chinese EVs

On Friday, EU member states agreed to levy tariffs on imports of Chinese electric vehicles. They will back a European Commission proposal for anti-subsidy tariffs of up to 35.3%, in addition to the existing 10%, despite concerns from Germany and Hungary. China has threatened tariffs on EU brandy imports and opened investigations into EU dairy products and pork.

Eurozone unemployment stable, but manufacturing job cuts on the rise

The unemployment rate in the Eurozone held steady at 6.4% in August, unchanged from the month before. Among Eurozone’s biggest economies, the unemployment rate stood at 11.3% in Spain, 7.5% in France, 6.2% in Italy, and 3.5% in Germany. The ECB expects unemployment to remain stable through 2026. Instead, attention is focused on the increasing number of manufacturing jobs cut.

The Eurozone composite employment PMI fell to 49.3 in September, its lowest level since November 2020. Employment in services is rising, but the rate of increase is slowing. In manufacturing, the number of jobs being cut is the highest in more than a decade. The malaise in the manufacturing sector is having a clear impact, with Germany particularly affected. Uncertainty about the future of the industry is making companies much more cautious about staffing levels.

Lower interest rates start to bear fruit: First rise in Eurozone house prices in more than a year

House prices in the Eurozone rose by 1.3% in the second quarter compared with a year earlier, a small sign of a gradual recovery in the housing market. However, in some of the housing markets prices are still falling. The largest falls were registered in Luxembourg, Finland and France, whilst the highest increases were in Poland, Bulgaria and Lithuania.

Lower interest rates have certainly helped, with mortgage applications starting to rise. In addition, lower inflation and higher real wages could continue to boost the recovery of the housing market.

Economic calendar for the week ahead

Monday – Germany Factory Orders (August). UK Halifax House Price Index (September). Eurozone Retail Sales (August).

Tuesday – Germany Industrial Production (August). US Balance of Trade (August).

Wednesday – Germany Balance of Trade (August).

Thursday – US Inflation rate (September), Jobless Claims.

Friday – UK Industrial & Manufacturing Production (August), Balance of Trade (August). Switzerland Consumer Confidence (September). US PPI (September), Michigan Consumer Sentiment (Prel, October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 30, 2025

Weekly InsightsWeekly Investment Insights

At a summit in the Hague last week, Nato allies pledged to raise defence spending to 5% of GDP by 2035. This was music...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...