Choose Language

October 21, 2024

Weekly InsightsWeekly Investment Insights

During the autumn months, bears all over the world prepare for their winter hibernation. The market bears appear to already be asleep, with the current bull market broadening out last week, as evidenced by the fact that the Russell 2000 (which measures the performance of smaller US companies) outperformed both the S&P 500 and the Nasdaq. The lifeblood of the rally is the fact that cooling inflation is allowing central banks around the world to kick off monetary policy easing.

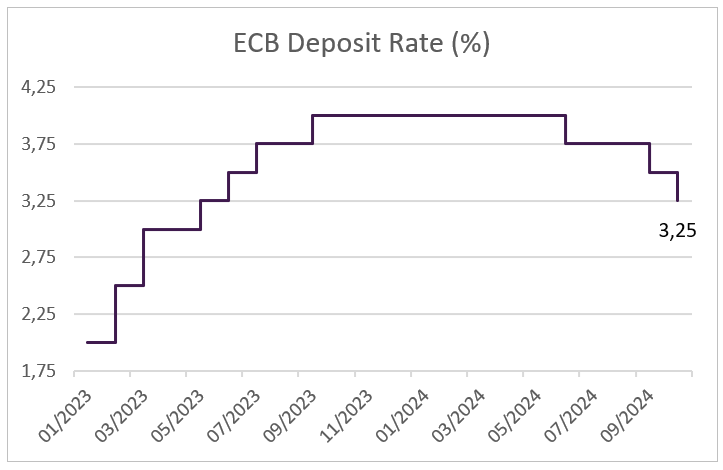

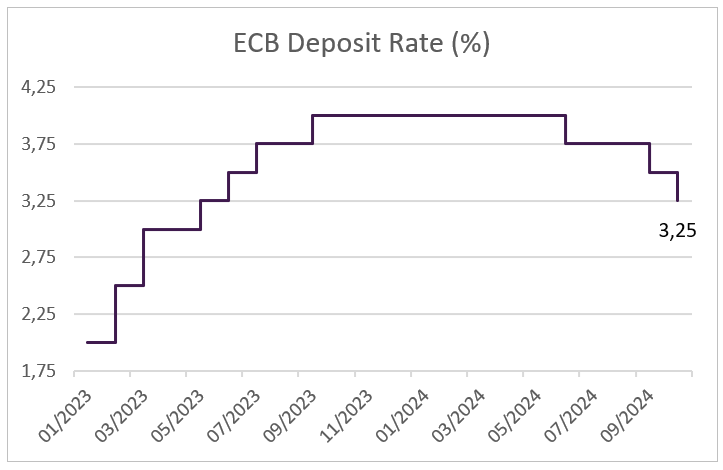

On that note, on Thursday, the ECB lowered interest rates by 25 basis points for the third time this year, bringing the deposit rate to 3.25%. The euro fell to a two-month low ahead of the ECB meeting on expectations that the central bank would take a more dovish stance on rate cuts. It dropped further on the day of the decision before making a mild recovery on Friday. The Pound also fell as UK inflation fell below the Bank of England's target to 1.7%, prompting traders to increase bets on further easing by the BoE this year.

Another strong earnings season is also adding impetus in equity markets. With around 15% of companies on the S&P 500 having reported their Q3 earnings, the aggregate surprise is 6.2%. Highlights of the earnings calendar next week will be SAP, General Electric, Coca-Cola, Nextera Energy, and Tesla among others.

Weekly roundup

The ECB lowers interest rates for a third time this year

At its October meeting, the ECB decided to cut interest rates by 25bp, bringing the deposit rate down to 3.25%. The widely expected decision comes amid weak growth in the Eurozone and inflation falling below the ECB's 2% target.

Eurozone inflation fell to 1.7% in September and the central bank said the decision to cut rates was based on an "updated assessment of the inflation outlook". This suggests that inflation is expected to fall faster than anticipated in their forecast last month.

Wage growth remains high, but the pressure is easing, making it less of a concern.

Markets are still pricing in another 25bp cut this year, but the ECB gave no indication of the next steps in its monetary policy on Thursday, saying that it was “not pre-committing to a particular rate path”.

Source: Bloomberg, BIL

With inflation at a more comfortable level, the ECB’s increasing focus will be to battle the Eurozone’s weak growth outlook.

EU stands firm on banning new petrol cars in 2035

The European car industry has been under pressure to move away from petrol-powered cars and increase production of electric vehicles (EV). Today, car manufacturers in Europe are struggling to sell their EVs with high production costs and increasing competition coming from China, putting immense pressure on the manufacturing industry.

Last week, Brussels assured that it will stick to its plans to ban the sale of new petrol-driven cars in the EU from 2035, despite pushback from both the car industry and individual member states.

As written last month, Volkswagen said it was considering closing plants in Germany because of the challenges it faces. A decision that would be a major blow to the German car industry and its approximately 800 000 jobs. In addition, profit warnings have been issued by all the major European car manufacturers this year, with the exception of Renault.

Tougher regulations coming into force in 2025 could also see companies facing hefty fines if they don't keep up with the European Commission's planned pace of reducing car emissions in Europe.

Italy, Germany and France have urged the European Commission to review the ban.

On Friday, Italian car workers gathered in Rome for a nationwide protest against job cuts caused by the slowdown in the Italian car industry due to slowing demand for electric vehicles. The eight-hour general strike was the first strike by the Italian automotive sector in 20 years.

With the EU standing firm on their plan, the European auto industry stands at risk with their struggle to electrify their fleets on time, and in budget.

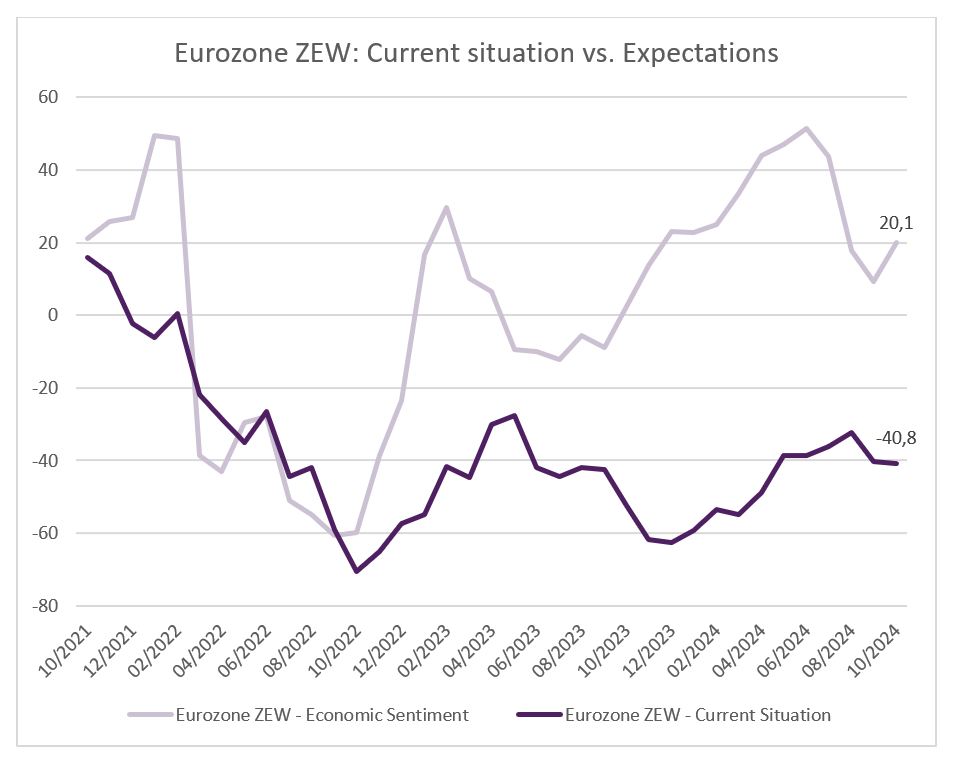

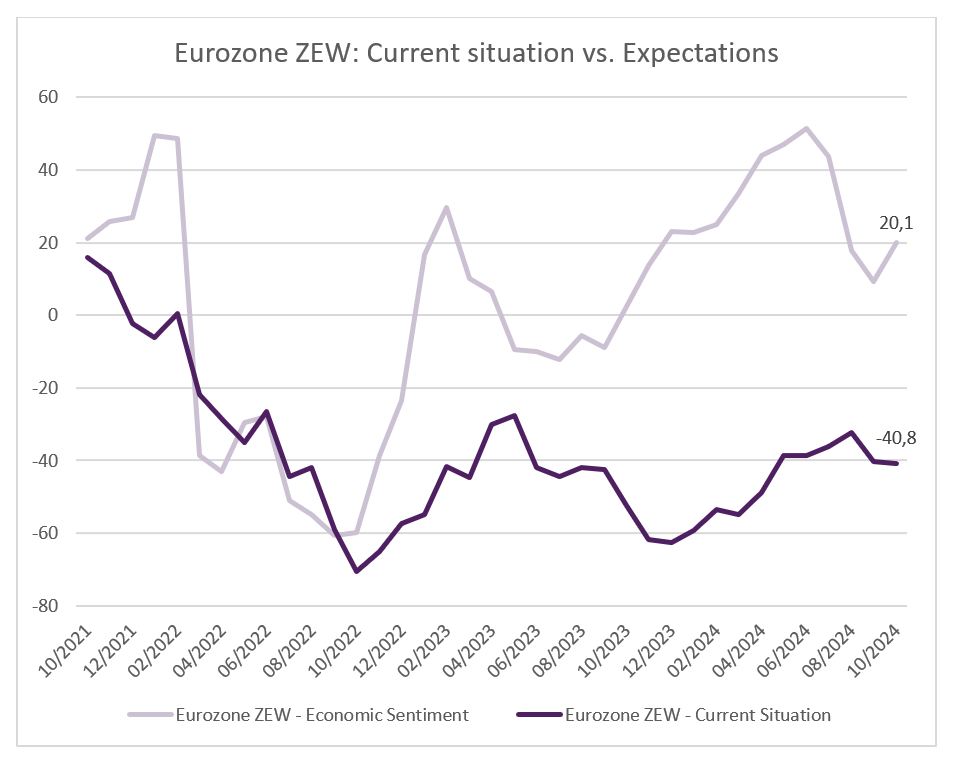

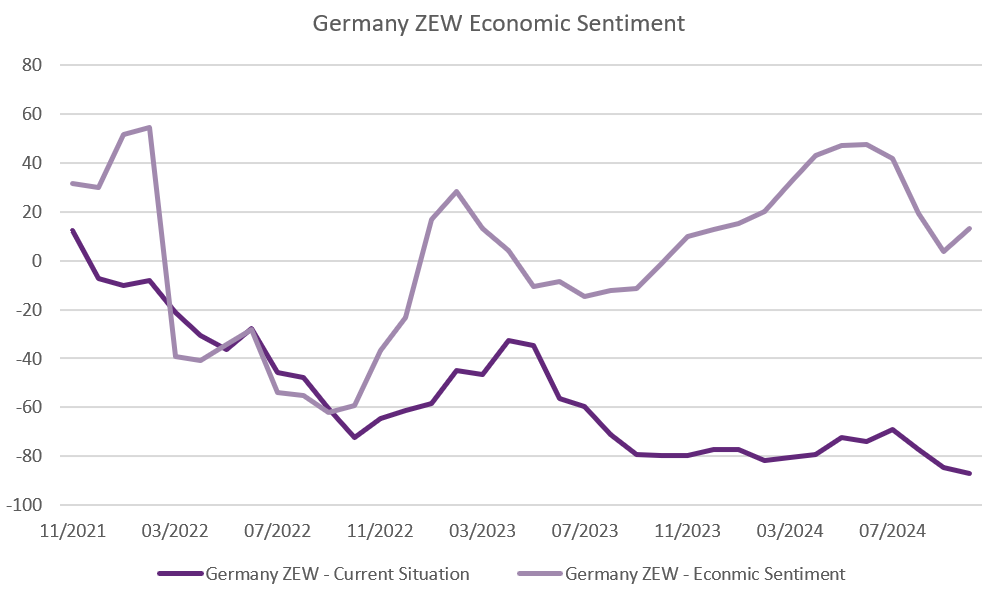

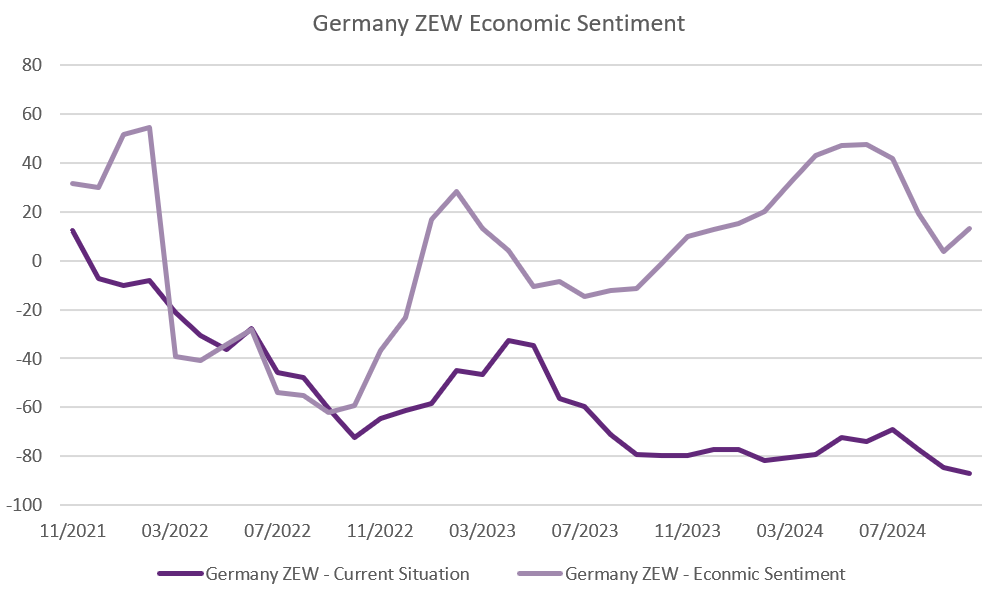

Professional investors grow less pessimistic on the Eurozone

The Eurozone ZEW Indicator of Economic Sentiment for October came in at 20.1 last week, with growing optimism about the inflation outlook, further rate cuts and improved economic forecasts. This is a 10.8-point climb from September, indicating growing optimism about the economic outlook for the Eurozone.

Source: Bloomberg, BIL

The same indicator also rose sharply in Germany, from 3.6 in September to 13.1 in October. In addition to the aforementioned drivers, the improvement also derived from positive signals coming from the German export market. The indicator of the current economic situation, however, continued to worsen.

Source: Bloomberg, BIL

Another encouraging data release was Eurozone industrial production, which rose by 1.8% on the month in September, driven by rising demand for capital and durable consumer goods. The year-on-year figure was up 0.10%, the first growth figure of the year. Germany impressed with a 3% rise on the month. This release gives more confidence with regard to the Q3 GDP print (due 30th October), but underlying issues remain, including low demand from China, high energy costs and increased competition.

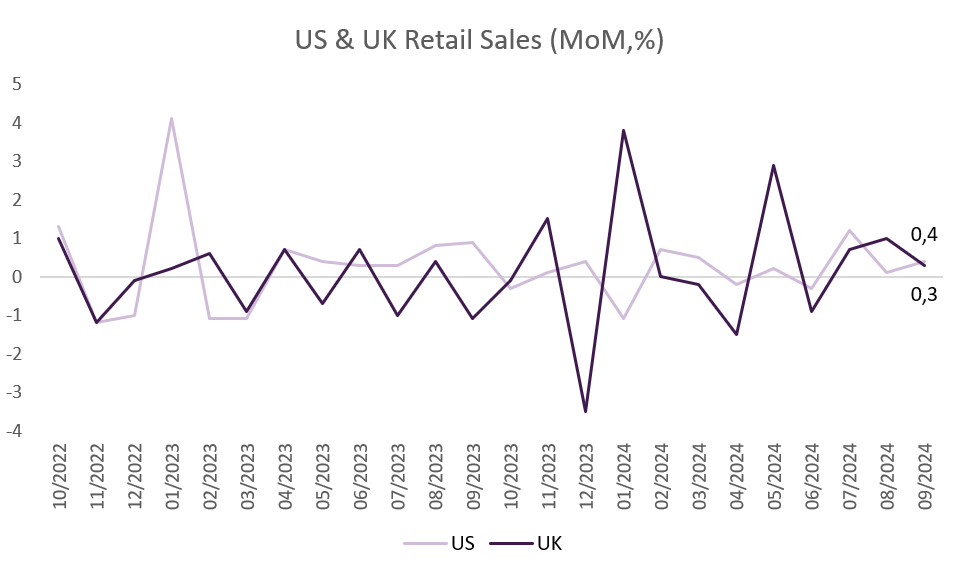

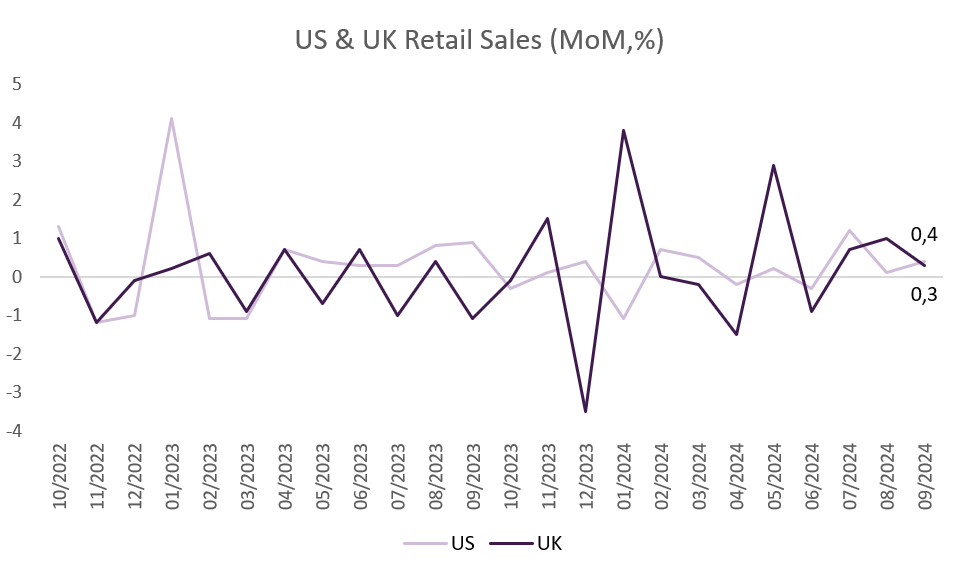

US & UK consumers continue to show resilience

US retail sales rose by a stronger-than-expected 0.4% month-on-month in September, well above the 0.1% increase in August. Consumers spent more on clothing, personal care products, food and beverages, sporting goods, hobbies, musical instruments, books, building materials and garden equipment. Meanwhile, they spent less on electronics, petrol and furniture.

Sales excluding food services, car dealers, building materials stores and petrol stations, which are used to calculate GDP, rose by 0.7%, the most in three months. This points to a continued consumer-driven expansion in the US, powered by strong demand for goods and services and real wage growth.

Across the Atlantic, UK retail sales also beat expectations, rising 0.3% in September. Non-food sales rose 2.5%, while supermarket sales fell 2.4%. On a year-on-year basis, retail sales rose by 3.9%, the biggest annual increase since February 2022.

Consumers in both the US and the UK beat expectations, lending real credibility to the strength of the consumer in the months ahead.

Source: Bloomberg, BIL

US industrial production declined for a third straight month, falling 0.6% YoY in September. However, we do not put too much emphasis on the figure, given that the results are skewed by Boeing strikes, the two hurricanes that struck the South East, and election uncertainty which is causing companies to postpone capital expenditure.

Economic calendar for the week ahead

Monday – Germany PPI (September).

Tuesday – US Money Supply (September).

Wednesday – Eurozone Consumer Confidence (Flash, October). US Existing home sales (September), Fed Beige Book

Thursday – UK Car Production (September), S&P Global Composite PMI (Flash, October). Eurozone, Germany, France HCOB Composite PMI (Flash, October). France Business Confidence (October). US Jobless Claims, S&P Global Composite PMI (Flash, October), New Home Sales (September).

Friday – UK Gfk Consumer Confidence (October). France Consumer Confidence (October). Germany Ifo Business Climate (October). Italy Business & Consumer Confidence (October). US Durable Goods Orders (MoM, September), Michigan Consumer Sentiment (Final, October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

November 8, 2024

Weekly InsightsWeekly Investment Insights

Last week, the result of the US Presidential election was finally announced, with Donald Trump elected as the President of the United States for...

November 7, 2024

NewsThe impact of the US election

The results of the US presidential election have been made clear, with Donald Trump elected as the President of the United States for...

November 5, 2024

NewsEurope heads into winter two years af...

The 2022 energy crisis was a wakeup call for Europe, revealing Europe's energy vulnerability. A lot has been done been since, from reducing dependence...

November 4, 2024

Weekly InsightsWeekly Investment Insights

With the US Presidential election on the doorstep, all eyes are on the US this week. People, companies, and even countries are awaiting an...

October 25, 2024

Weekly InsightsWeekly Investment Insights

Global trade has been a hot topic over the past week as the US election draws closer, and as Trump appeared to top polls...