Choose Language

October 25, 2024

Weekly InsightsWeekly Investment Insights

Global trade has been a hot topic over the past week as the US election draws closer, and as Trump appeared to top polls in what is a very tight election race. Economists around the world are apprehensive about a potential trade war should Donald Trump take office for a second time. The International Monetary Fund has warned that a trade war would be a major threat to to its forecasts for underwhelming global growth in 2025. On a similar note, EU-China trade tensions continued to flare up, with Italian tomato sauce maker Mutti urging Brussels to protect farmers from Chinese competition. This call for protection comes at the heels of the EU's decision to impose tariffs on imports of Chinese electric vehicles, which caused controversy a few weeks ago.

A few impressive earnings reports boosted markets last week, with some consumer discretionary and tech companies publishing particularly good earnings.

Gold surged to a new all-time high due to geopolitical tensions and the anticipation of further rate cuts. Silver was also pushed higher, hitting a 12-year high for a moment last week amidst tight supply and high industrial demand.

Weekly roundup

IMF predicts stable but underwhelming growth ahead

The International Monetary Fund (IMF) published their October 2024 world economic outlook last week, in which it increased US growth expectations, and reduced expectations for the Eurozone and China for 2024 and 2025. The IMF expects the world economy to expand by 3.2% both this year and next, however, it warned that the higher tariffs and a potential trade war that could come as a result of the US election, would impact these forecasts significantly. “Greater global protectionism will endanger the world’s growth outlook”, said the IMF.

Pierre‑Olivier Gourinchas, the IMF’s Chief Economist, noted that “the decline in inflation without a global recession is a major achievement.” Global headline inflation is expected to continue to fall in the coming years, to an annual average of 5.8% in 2024 and 4.3% in 2025, with emerging markets and developing economies lagging slightly behind advanced economies. However, geopolitics, trade frictions and climate events could all lead to supply shocks, short-term price spikes and inflation volatility in the coming years. The Bank for International Settlements (think of it like the central bank of central banks) recently put out a paper saying that while inflation expectations remained well anchored this time around, next time, workers and firms will likely be more vigilant in protecting their purchasing power and profits. As such, central banks may have to lean more forcefully against inflation in the future.

A "deeper-for-longer-than-expected" contraction in the Chinese property sector is also seen as a threat to global growth, given the potential spillovers. The long-running housing crisis has wiped an estimated $18 trillion from household wealth, and recent measure from Beijing to stabilise the real estate market were viewed skeptically by markets. On top of lowering borrowing costs and easing rules for second-home purchases, Beijing has announced a 4 trillion yuan (around $562 billion) loan quota for the “white list” program. This scheme aims to ensure that unfinished homes are delivered to buyers and thus prevent mortgage boycotts. The number of homes that have been sold but not built is estimated at some 48 million according to Bloomberg.

The European economy continues to struggle

While the IMF is predicting stable global growth, the Eurozone will be a laggard. The latest composite PMI remains below 50, at 49.6, indicating contraction. Growth in the services sector eased (PMI 51.2 from 51.4), while manufacturing remains mired in a downturn, even if that downturn appears to be shallower than it was in September (PMI of 45.9 versus 45.0 in September). That said, new business fell, with firms reducing purchases and lowering stocks of materials and finished goods.

An environment of meager demand in both the services and manufacturing sectors strengthens the ECB’s case for another rate cut in December.

Looking in more granularity on a country-by-country basis, the boost that France’s services sector enjoyed from the Olympics is fading further in the distance. France’s Services PMI dropped to 48.3 in October, driven by lower output amidst weak demand. New overseas business declined, with export orders plunging at the fastest rate since May 2020. The manufacturing PMI also declined, down to 44.5 in October from 44.6 in September, marking the 21st consecutive month of contraction with little pointing to a potential recovery. Slowing demand in both services and manufacturing caused companies to reduce workforce in October, contributing to a bleak outlook for French industry.

In Germany, the manufacturing PMI rose from a one-year low of 40.6 in September, to 42.6 in October. Despite the rise, Germany’s manufacturing sector remains in a deep contraction. New business inflows fell sharply, and sentiment remains negative. The services PMI showed a slightly more positive outlook, however, rising to 51.4 in October, from 50.6 the month before. Despite new business inflow falling and companies reducing their workforce, business expectations improved significantly. The Ifo Business Climate indicator also rose slightly for the first time in six months, increasing to 86.5 in October. Both the perception of current conditions and business expectations improved. Could it be that the so-called sick man of Europe is entering convalescence?

Resilience in the US economy

Contrastingly, flash PMIs from across the pond signaled a further rise in US business activity with the composite PMI at 54.3 in October. The services PMI rose slightly to 55.3 in October, from 55.2 in September. This is the fifth consecutive reading above 55, proving the continued strength of the service sector. New orders increased the most since April 2022, with domestic demand helping to offset slowing new export business. Optimism rose to a 16-month high according to the survey, despite election uncertainty still being present.

On the manufacturing side, the PMI increased to 47.8 from 47.3 in September, which was a 15-month low. Business conditions deteriorated with falling new orders and stocks of new purchases; however, the rate of the deterioration is slowing. We expect activity to thaw once election uncertainty is in the rearview mirror. Selling price inflation cooled and input cost growth fell to a seven-month low.

The Fed released its Beige book last week, summarising the current economic conditions in the US. The tone of the report was more modest, saying that “economic activity was little changed in nearly all Districts since early September, though two Districts reported modest growth”. With inflation pressure easing, and the job market holding steady, the US election at the beginning of November remains the main uncertainty for businesses at this time.

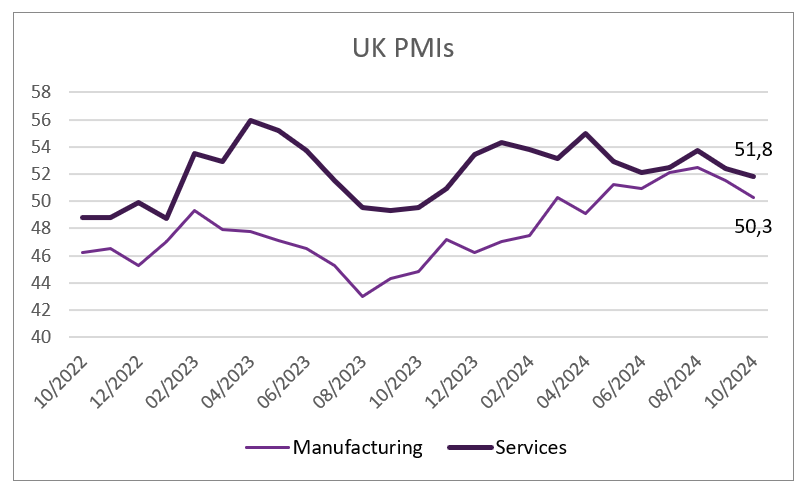

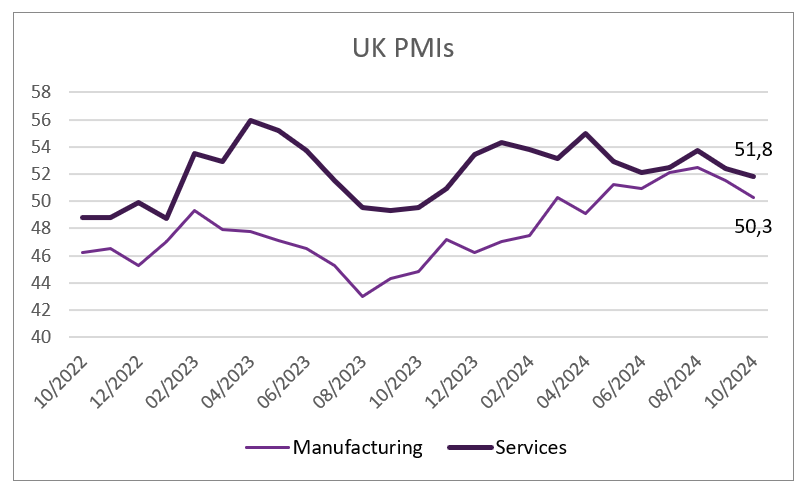

UK Autumn Budget weighing on confidence

As Halloween approaches UK businesses are afraid that the budget contains more tricks than treats. Just as the US election has US companies caught in a freezeframe, UK firms are also stuck in a wait-and-see mode, pending the Autumn budget. Private sector growth dropped to the lowest level in nearly a year, with the composite PMI at 51.7 in October, down from 52.6 in September. “Gloomy government rhetoric and uncertainty ahead of the Budget has dampened business confidence and spending,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

Source: Bloomberg, BIL

The anticipation of the budget is also impacting the mood of the consumers. The GfK Consumer Confidence indicator dropped slightly more in October to -21, from -20 in September. The potential tax increases that are expected to be announced in next week’s Autumn Budget has households and businesses worried.

The Autumn Budget will be announced on 30 October and businesses have put hiring on hold as they wait to get more clarity on the economic outlook. The Budget is expected to include several tax raises including for businesses, the wealthy, private schools, UK residents whose permanent home is outside of the UK, and capital gains tax, which could weigh heavily on businesses and individuals going forward.

Economic calendar for the week ahead

Monday – UK CBI Distributive Trades (October).

Tuesday – Japan Unemployment Rate (September). Germany GfK Consumer Confidence (November). US Goods Trade Balance (Adv, September), House Price Index (August), JOLTs Job Openings (September), CB Consumer Confidence (October).

Wednesday – Japan Consumer Confidence (October). France, Germany, Italy, Eurozone, US GDP Growth Rate QoQ (Prel, Q3). Switzerland KOF Leading Indicators (October), Economic Sentiment Index (October). Germany Unemployment Rate (October), Inflation Rate (Prel, October). Eurozone Consumer Confidence (Final, October).

Thursday – Japan Industrial Production (Prel, September), Retail Sales (September), BoJ Interest Rate Decision. Germany & Switzerland Retail Sales (September). Eurozone, France, Italy Inflation Rate (Prel, October). US Challenger Job Quits (October), Jobless Claims.

Friday – UK Nationwide Housing Prices (October), S&P Global Manufacturing PMI (October). Switzerland Inflation Rate (October), procure.ch Manufacturing PMI (October). US Non-Farm Payrolls (October), Unemployment Rate (October), ISM Manufacturing PMI (October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...