Choose Language

November 4, 2024

Weekly InsightsWeekly Investment Insights

With the US Presidential election on the doorstep, all eyes are on the US this week. People, companies, and even countries are awaiting an end to the uncertainty so that they can begin to assess what the outcome might mean for them. The potential outcomes vary significantly given the polarised nature of the candidates’ campaigns. Trump's focus is on low taxes, regulation and energy costs, and higher tade tariffs, while Harris emphasizes tax credits for lower middle-income families, a Federal ban on grocery price gouging and higher corporate taxes.

Markets and polls are still largely split on who will take the presidency. However the election turns out, the removal of uncertainty will likely bring around a thaw in business activity. To keep in mind, is the fact that the balance of power across the House and the Senate can also have a major impact on the ability of the President-elect to deliver on campaign promises.

It was a busy week for markets last week, with lots of data and earnings releases resulting with some major indexes in both Europe and the US finishing in the red. This week, markets will be laser focused on the US, with the next President finally being announced.

The Bank of Japan kept its key short-term interest rate at 0.25% last week, at the highest level since 2008. The central bank noted that it remains committed to further rate increases should the economic situation align with its forecasts. Later this week we will find out what the next monetary policy steps are for both the US Fed, and the Bank of England, both of which are expected to cut interest rates by 25 basis points.

Weekly roundup

Spain’s economy continues to shine, US remains strong

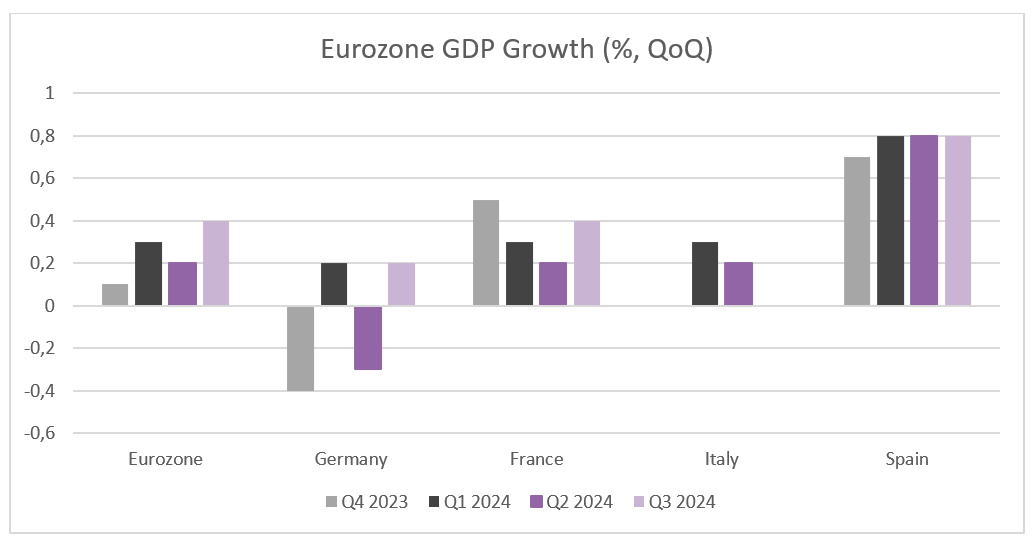

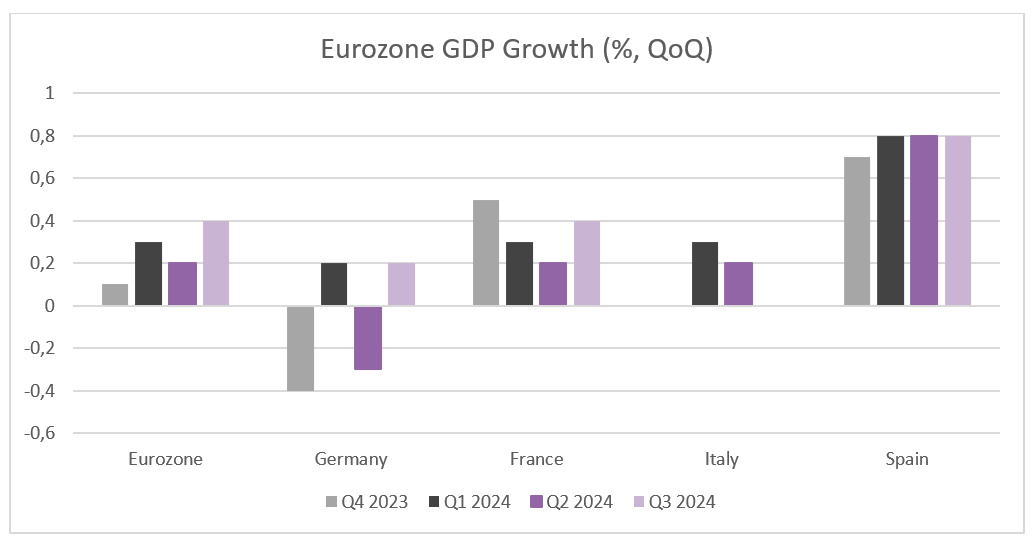

The Eurozone GDP had its strongest growth in two years in Q3, expanding by 0.4% QoQ. Even though this figure was a positive surprise, on the whole, growth for 2024 remains disappointing. Looking at the main economies, Germany surprised with a small rise of 0.2% of GDP growth, defying expectations that growth would decline, driven by private and public consumption. France’s boost from the Olympics is clearly visible in its 0.4% growth in Q3, which doubled compared to Q2. Italy’s growth stalled in the last quarter, putting its 1% growth target in 2024 in question. Spain outperformed its peers, with GDP growing by 0.8%, largely attributed to tourism, foreign investment, and public spending. Immigration is also noted as factor, having boosted labour supply and household consumption. Out of the world’s largest economies, the International Monetary Fund expects Spain to be the fastest growing this year, expanding 2.9% year on year.

Source: Bloomberg, BIL

Looking to the US, the economy grew by 2.8% year on year in Q3, slightly below the 3% forecast. Personal spending contributed a major boost, increasing at the fastest pace since Q1 2023. This corroborates the idea that the US economy’s major growth engine remains intact, despite headwinds from a cooling labour market, slowing wage growth and the depletion of excess savings.

In an encouraging sign for Q4, the Conference Board (CB) Consumer Confidence Index rose to a nine-month high in October. The proportion of consumers anticipating a recession in the next 12 months fell to its lowest level since the board first posed the question as part of its survey in July of 2022. Consumers’ short-term expectations for income, business and the job market rose to 89.1. A reading below 80 can indicate that a recession could come shortly, according to the Conference Board.

US Labour Market shows signs of cooling but confidence strengthens

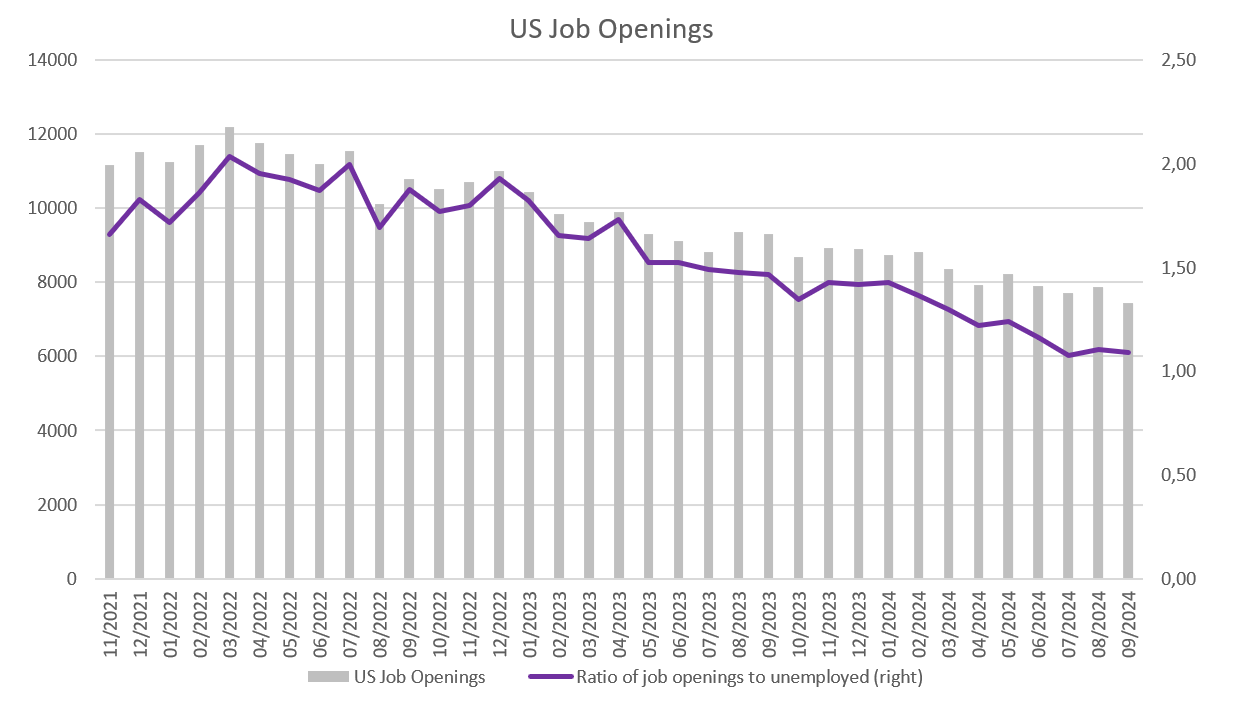

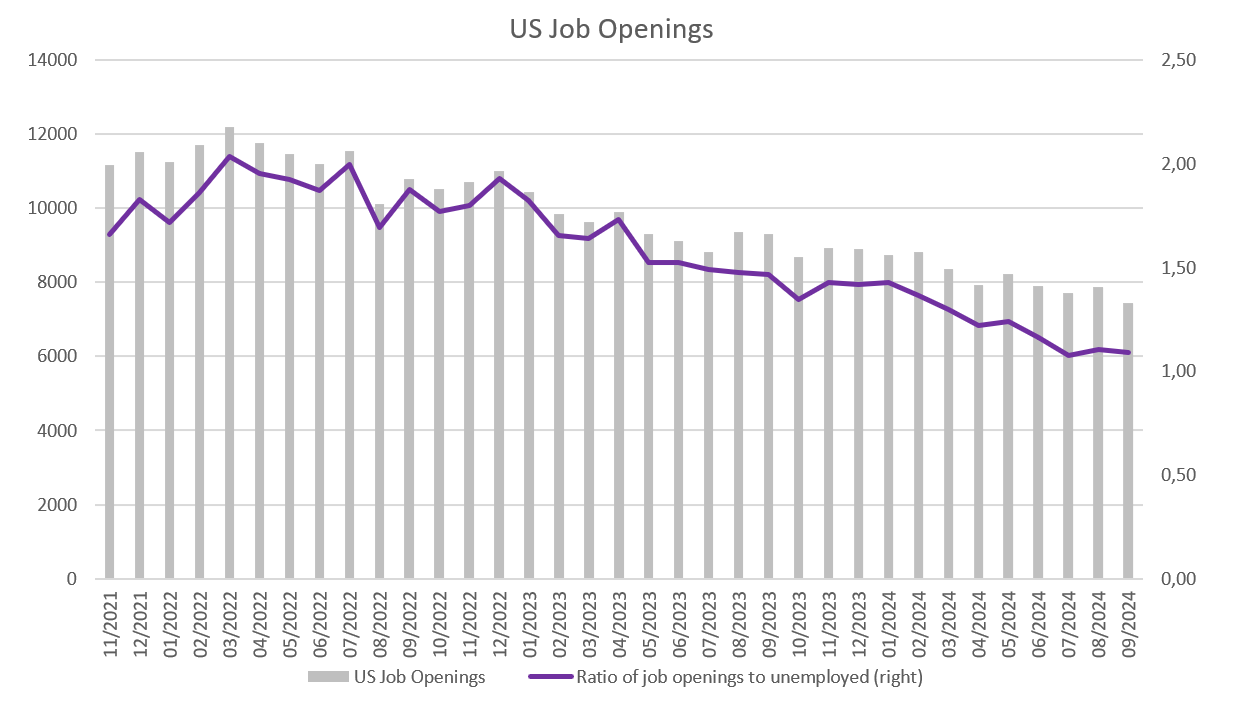

The number of job openings in the US fell by more than 400,000 in September, to the lowest level since January 2021. There were less job openings in health care, social assistance and government, but more in finance and insurance. In terms of location, the decline in vacancies was concentrated in the south, suggesting that the increased demand for labour following hurricanes Helene and Milton has now started to fade. At the same time, job quits were at the lowest level since August 2020, indicating that people are not confident that they will find a new job if they quit their current one.

Source: Bloomberg, BIL

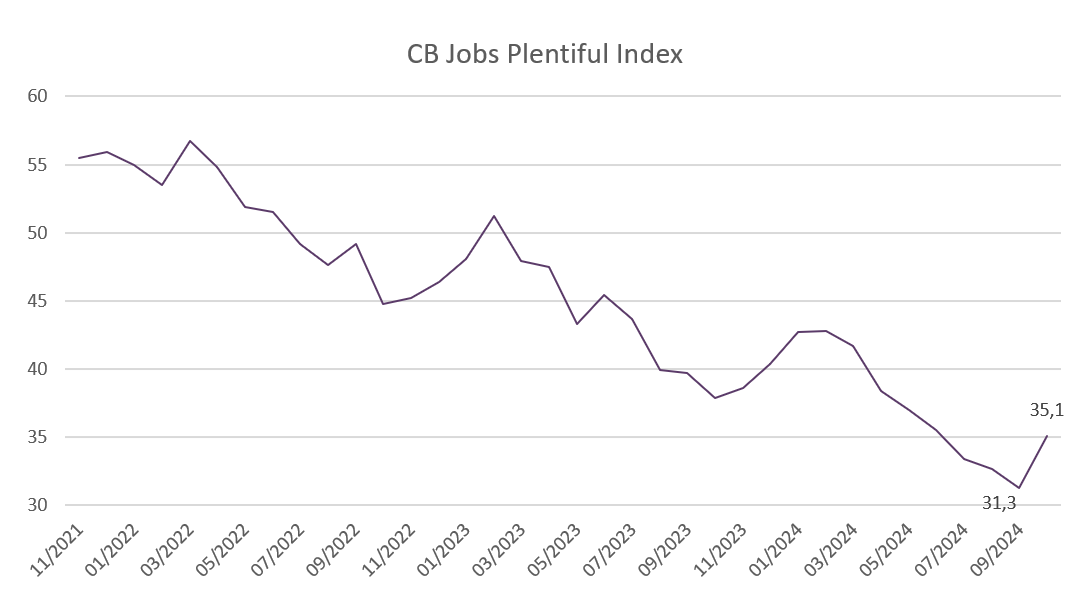

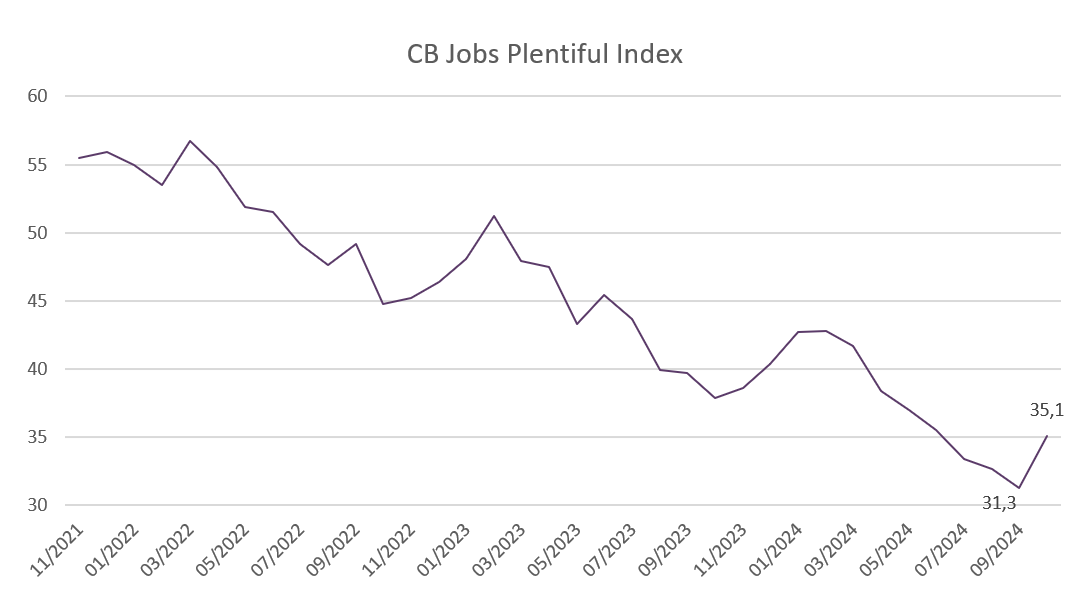

On a brighter note, the Conference Board (CB) consumer confidence survey showed that perceptions of the labour market improved significantly in October, with those considering jobs as being “plentiful” rising quite sharply in September. However, it is yet to be seen if consumers actually begin to act on this newfound optimism. If so, the quits rate might begin to bottom out.

Source: Bloomberg, BIL

As of now, we take the job openings data with a pinch of salt, knowing that observations might be temporary, linked to the recent hurricanes and factory worker strikes in the aerospace industry. According to the Non-Farm Payrolls, the US economy added 12 000 jobs in October, compared to the 223 000 in September, with the factory worker strikes in the aerospace industry listed as a main cause. The report card on whether the Fed has managed to prevent further cooling in the labour market is yet to be finalized…

The UK Autumn Budget increases taxes by £40bn

British Chancellor Rachel Reeves released the much-anticipated Autumn Budget last week, which includes plans to raise taxes by £40bn and increase investment in the NHS, housing, and education. Market reactions were limited, mainly because a lot of the announced measures were in line with expectations. However, the increased government borrowing needed to fund the extra £100bn of capital spending was highlighted as a key concern.

Measures outlined in the Budget include:

- An increase of employers’ national insurance contributions

- The income tax threshold to be increased in line with inflation from 2028 – 2029

- Increased capital gains tax

- The abolishment of the non-dom tax regime

- A freeze on fuel duty next year

- Rise in stamp duty for second homes

- The extension of the freeze on an inheritance tax threshold allowing £325,000 to be inherited tax free

- An increase in the minimum wage for people over the age of 21

- Increased tax on tobacco and vapes while tax on draught drinks will be cut

- Raise in air passenger duty for private jets

- The introduction of VAT on private school fees

- Investments on schools and education, the NHS, housing, defense, transport and making buildings more energy efficient

It is estimated that the National Insurance measures alone will raise £25bn a year by the end of the forecast period, but business groups have also warned that this could have an impact on the labour market, with fewer job openings and more layoffs.

The move to abolish the non-dom tax regime is accompanied by an end to the use of offshore trusts to shelter assets from UK inheritance tax. However, the tax regime is to be replaced by a new residence programme, according to Reeves.

Eurozone Inflation rose to 2% in October and unemployment remains low

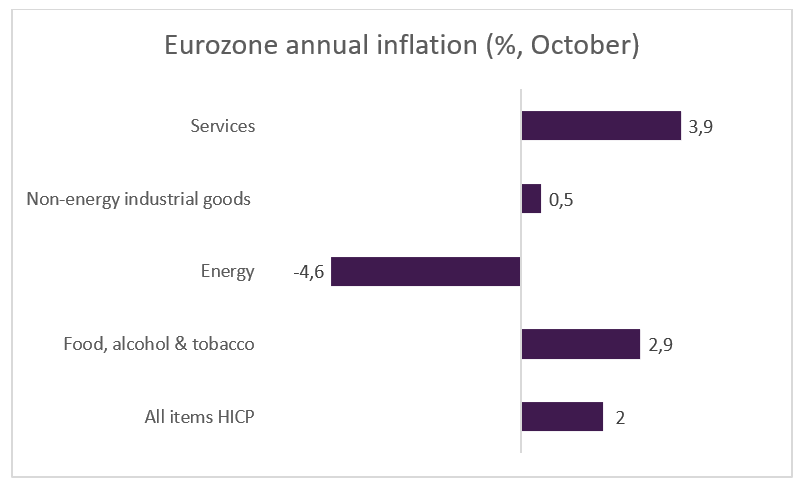

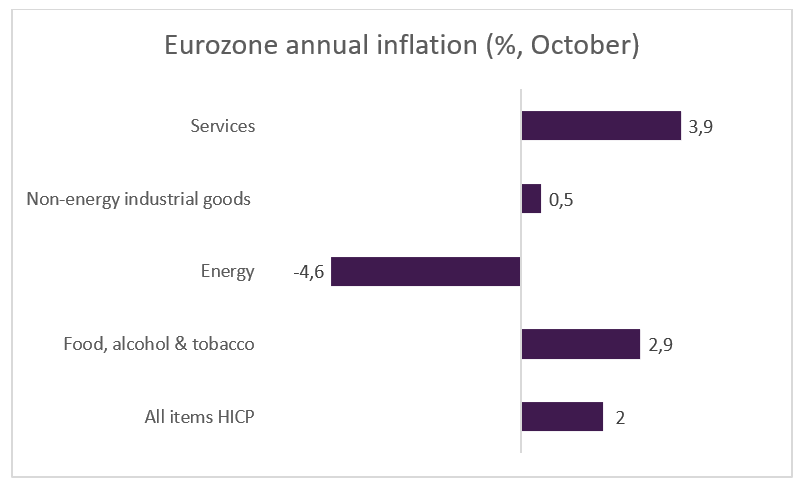

According to flash estimates, inflation in the Eurozone rose to 2% YoY in October, from the more than three-year low of 1.7% in September. Energy prices continued to fall in October, however at a slower pace as base effects began to wash out of the figures. As this was pre-empted, the uptick in headline inflation was anticipated.

Prices for food, alcohol and tobacco increased at a faster pace than the month before. The annual core inflation rate, which excludes volatile categories such as energy, food, alcohol and tobacco, remained unchanged at 2.7%, the lowest since February 2022.

Source: Eurostat, BIL

The Eurozone unemployment rate remained at the record low 6.3% in September, beating market forecasts. Among the main Eurozone economies, Spain still had the highest unemployment rate at 11.2%. Germany had the lowest rate at 3.5%.

With rising inflation and a tight European labour market, hopes for a potential a 50bp cut by the ECB in December have faded but a 25bp rate cut remains likely.

Ukraine and Russia consider sparing each other’s energy infrastructure

Ukraine and Russia have entered preliminary talks about halting attacks on each other’s energy infrastructure. Although discussions are at a very early stage, reaching such a deal would be a significant milestone in the de-escalation of the war. Securing energy supply has been crucial for all of Europe as we head into the winter months, and Russia’s strikes on Ukrainian energy infrastructure has put a strain on supply that is felt far beyond Ukraine.

Although electricity prices have been on a downward trend in 2024, southern Europe, in particular, is still experiencing volatility. Ukraine used to be a net exporter of electricity but is now heavily dependent on energy imports from European neighbours, which is having an impact on supply in other countries. A Greek government official stated that it feels “like there is a mini energy crisis that no one is talking about”, as a result.

Last week, European power grid network ENTSO-E said that it plans to increase export capacity to Ukraine and Moldova from December to battle Ukraine’s power supply shortfall.

Economic calendar for the week ahead

Monday – Eurozone, Italy, France, Germany HCOB Manufacturing PMI (Final, October). US Factory Orders (September).

Tuesday – Switzerland Unemployment Rate (October). US Balance of Trade (September), ISM Services PMI (October). US Presidential Election.

Wednesday – Germany Factory Orders (September). Eurozone, Italy, France, Germany Composite & Services PMI (Final, October). US S&P Global Composite & Services PMI (Final, October).

Thursday – Germany Industrial Production (September). Eurozone HCOB Construction PMI (October), Retail Sales (September). Bank of England Interest Rate Decision. US Jobless Claims, Fed Interest rate decision.

Friday – Switzerland Consumer Confidence (October). US Michigan Consumer Sentiment (Prel, November).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...