Choose Language

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits in your pocket, you wouldn't expect CD and vinyl sales to be enjoying a resurgence. One would have thought that the days of taking your CD out of your turntable and rubbing it against the sleeve of your sweater to get it to play were long gone. But that doesn't seem to be the case - as the Financial Times highlighted last week, music industry revenues soared last year, overtaking even cinema revenues. Much of it due to the popularity of streaming platforms, of course, but they are not the only ones that have benefited - physical music sales of CDs and vinyl have also risen, with vinyl up 15.4% last year.

Turning to the markets, President-elect Trump's nomination of Wall Street old timer Scott Bessent as Treasury Secretary came as a relief, with markets happy to see a familiar face in the role of chief economic spokesperson. Their hope is that Bessent will be able to soften the edges of Trump's proposed trade tariffs, which have prompted warnings from companies within the US about the negative impact they will have on their businesses. Trump's latest tariff announcement last week was a 25% tariff on all imports from Canada and Mexico, seemingly as a bargaining chip to compel them to do more to curb illegal immigration and drug trafficking into the US. The announcement caused the Canadian dollar and Mexican peso to fall.

US stock indices continued to rise last week, with the small cap Russell 2000 index hitting a new intraday high. European gas prices also remained elevated as colder weather and the approaching end of Russian gas transit through Ukraine raised supply concerns.

Weekly roundup

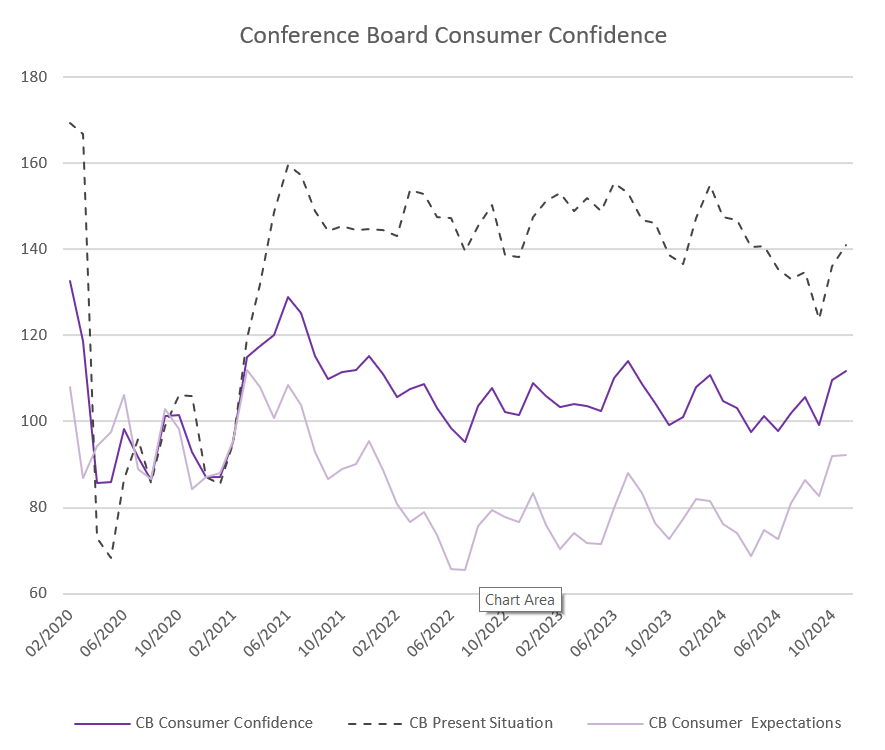

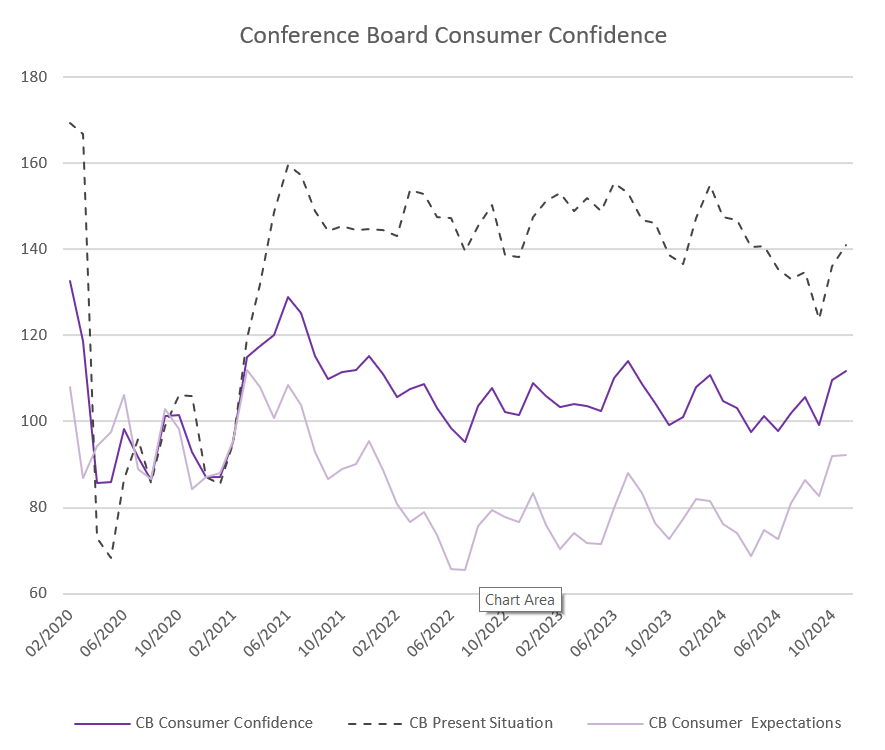

US consumer confidence and personal spending on the rise

The Conference Board consumer confidence index rose to 111.7 in November, from 109.6 in October. The survey showed that consumers have grown more confident about current and future conditions, as well as the one-year inflation expectations. These results show a growing optimism among US consumers, which was also highlighted in last week's personal spending report, which showed a 0.4% increase in October.

The increase in spending was largely driven by demand for services, including healthcare, housing, utilities, financial services and insurance, eating out, hotel stays, transportation and recreation. The spending is underpinned by strong household balance sheets and low layoffs. Furthermore, we have entered a busy holiday shopping season, which should continue to support spending in the coming months despite higher prices.

The rise in both confidence and spending suggests that the outcome of the US election, and President-elect Trump's potential trade war, have so far not caused much concern among US consumers.

Source: Bloomberg, BIL

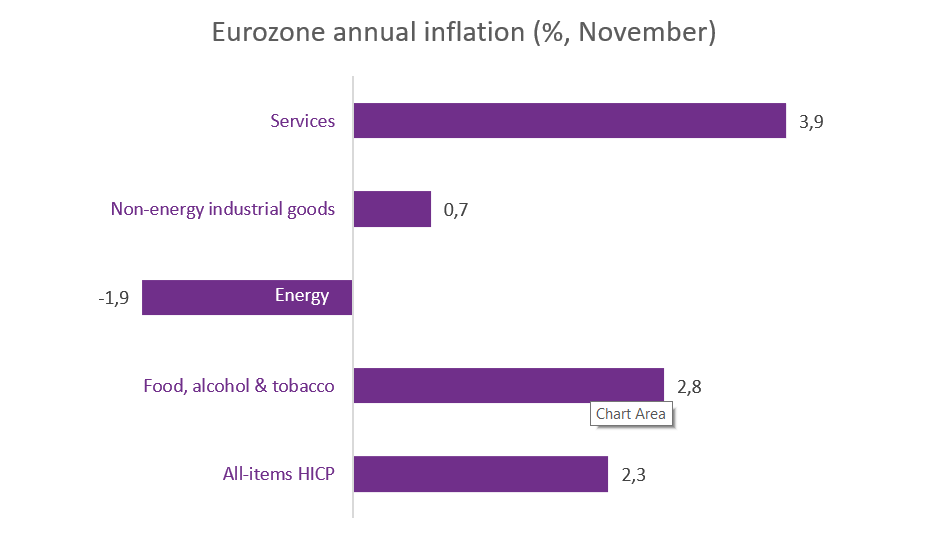

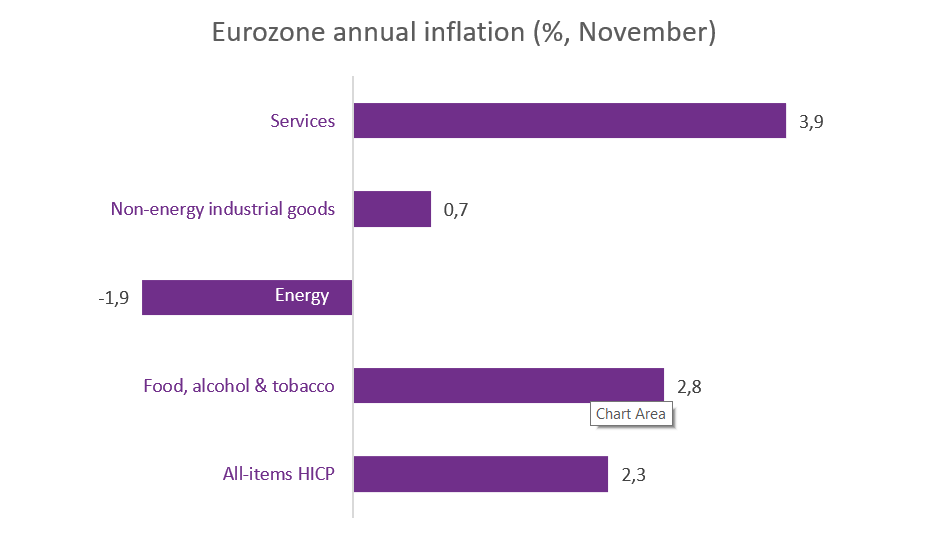

Eurozone inflation rose for the second consecutive month in November

According to flash estimates, inflation in the Eurozone rose to 2.3% YoY in November, from 2% in October. This increase in inflation towards the end of the year was largely expected due to base effects, as last year's sharp falls in energy prices are no longer included in the calculation.

Energy prices continued to fall in November, but at a slower pace than in October. The cost of food, alcohol and tobacco rose by 2.8%, slightly slower than the 2.9% in October. Inflation also slowed for services, but picked up for non-energy industrial goods.

Source: Eurostat, BIL

The annual core inflation rate, which excludes volatile categories such as energy, food, alcohol and tobacco, held steady at 2.7%, the same as in the previous month.

As the rise in inflation was largely due to base effects rather than underlying price pressures, it is unlikely to prevent the ECB from cutting rates again in December. However, the market continues to price in a 25bp cut rather than 50bp.

US automotive industry under the threat of Trump’s tariffs

The European car industry's struggle to stay afloat during the painful transition to electric vehicles has frequented headlines this year. President-elect Donald Trump's promise of trade tariffs could mean the same for the American auto industry in 2025.

Last week, Trump said that one of his first executive orders in office would be to impose a 25% tariff on all products from Mexico and Canada, blaming the US neighbours for letting drugs and migrants into the US. The problem this could cause for the American car industry is that there is no such thing as an entirely American-made car, with many of the cars sold by American brands having been produced across the borders, or using parts imported from neighbouring countries.

The introduction of these tariffs would not only make these cars more expensive for the American consumer, but it could also cut into company profits, putting pressure on payrolls. Furthermore, cars assembled in the US would also likely become more expensive, given that Mexico and Canada account for over 50% of all auto parts exported to the US.

Shares in several major carmakers that would be affected fell on the announcement.

Some of Trump's proposed tariffs are now seen as potential negotiating tactics to pressure partners on completely different issues, rather than proposals that are set in stone.

French markets shaken by budget tension

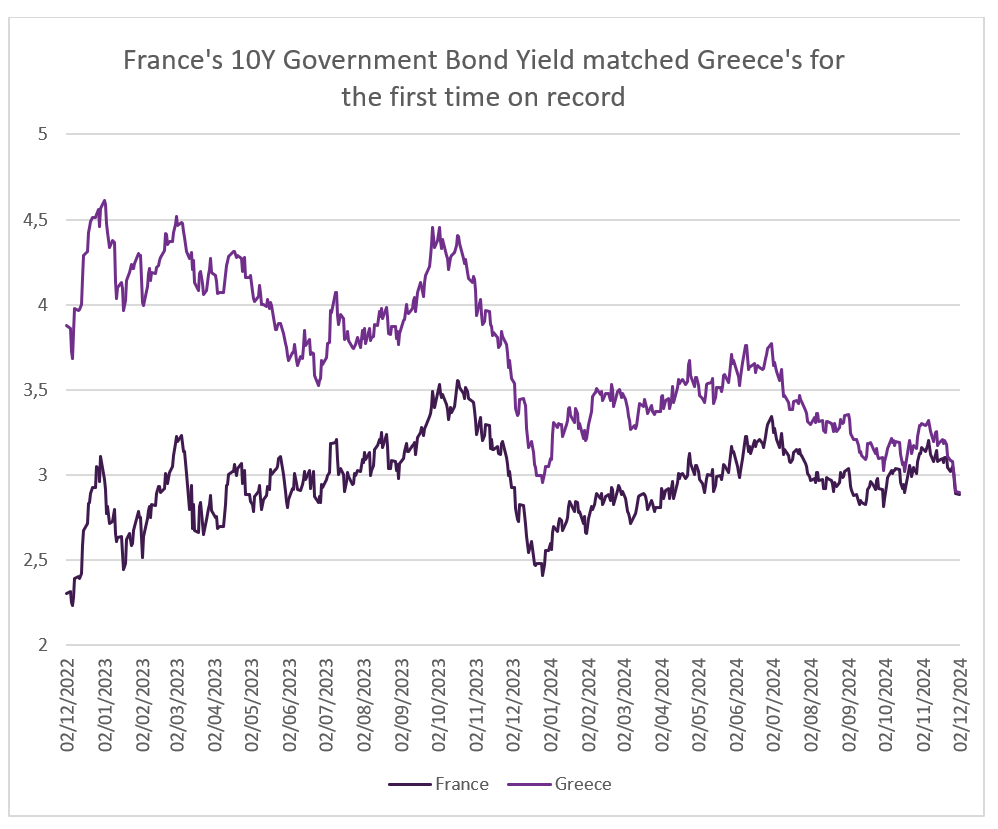

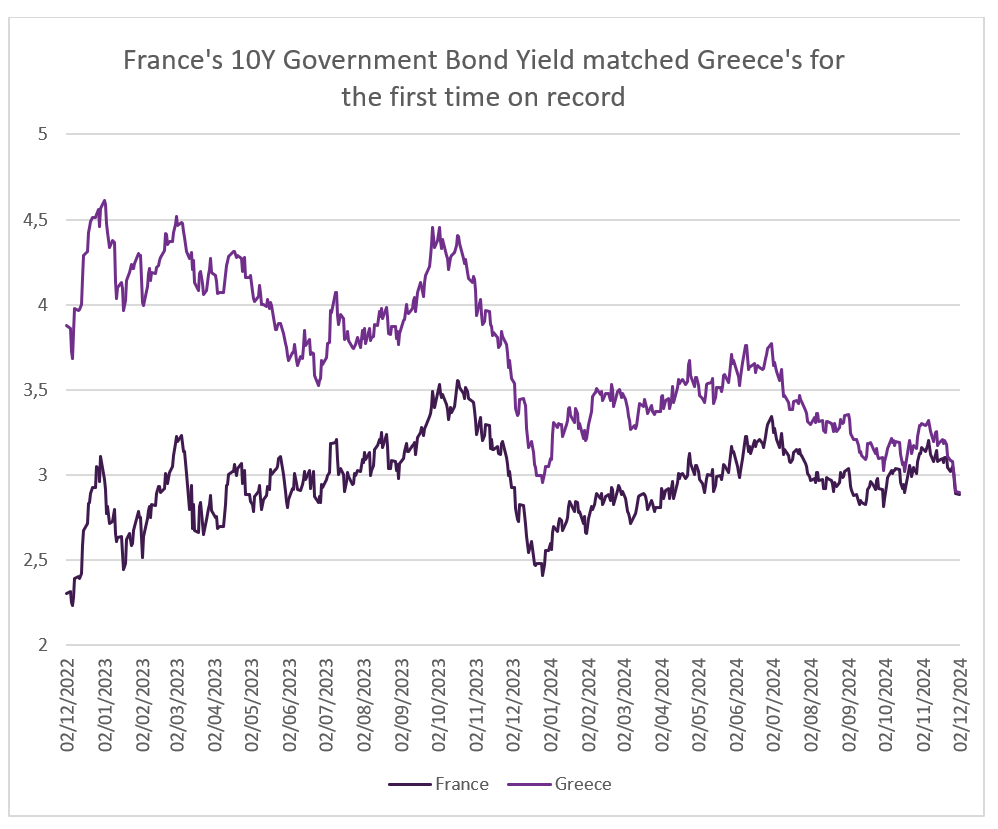

The ongoing budget debate in France has made markets concerned about the economic outlook of the country and the fate of the new government. The budget proposal put forward by Prime Minister Barnier’s minority government includes 40 billion euro of spending cuts and 20 billion in tax hikes aimed at putting a stop to France’s increasing debt problem. Barnier’s proposal has been strongly questioned by his opposition, however, and he is now under pressure to pass his budget by the 21 December.

This has caused French stocks to fall, borrowing premiums to soar and bonds to hit parity with Greece. France’s heavy debt burden has long been a concern for investors and bonds have especially taken the hit for the current uncertain political situation.

Source: Bloomberg, BIL

Without the needed support for his budget, Barnier now faces the threat of a no-confidence vote by the far-right Rassemblement National, led by Marine Le Pen, unless their demanded changes in the budget are met.

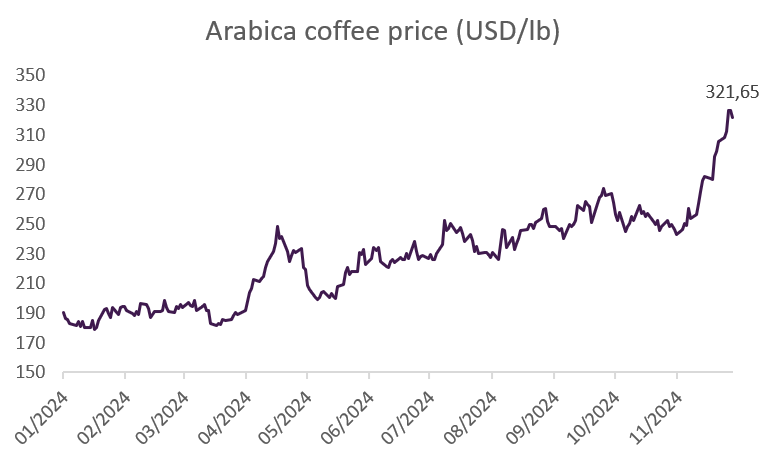

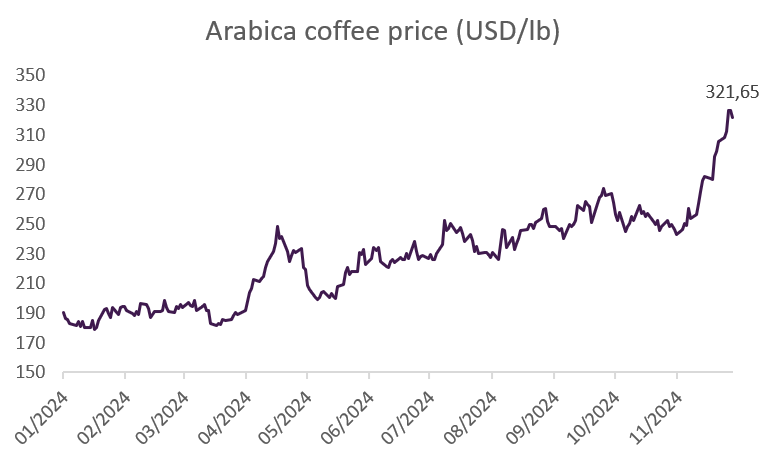

Arabica coffee bean price surges

Coffee drinkers were worried last week when the futures for luxury Arabica coffee beans rose to their highest price since 1977 on supply fears. A severe drought in Brazil this year has raised concerns that production in one of the world's biggest coffee producers will fall significantly next season. Similar concerns have already arisen in Vietnam, the market leader for the cheaper robusta bean, as the growing season has been hit by dry weather and the harvest has been flooded by rain.

Coffee manufacturers have scrambled to secure as many beans as possible, pushing up the price of Arabica beans by more than 70% this year. It appears that coffee growers in Brazil have already sold much of their current crop, meaning that supplies are likely to be tight until the next harvest starts in May.

On top of the unpredictable weather that dictates harvests, EU legislation on deforestation is due to come into force in January, forcing importers to prove that the coffee beans they buy haven't been grown on deforested land. EU authorities are due to delay the legislation for 12 months, but until it is made official, European importers will continue to buy up beans to secure their supply.

Source: Bloomberg, BIL (As at 29/11/2024)

Economic calendar for the week ahead

Monday – Switzerland Retail Sales (October), Manufacturing PMI (November). Eurozone, France, Germany, UK, US Manufacturing PMI (Final, November). Eurozone Unemployment Rate (October).

Tuesday – Switzerland Inflation Rate (November). US JOLTs Job Openings/Quits (October).

Wednesday – Eurozone, France, Germany, UK, US Services PMI (Final, November). US Factory Orders (October).

Thursday – Switzerland Unemployment Rate (November). Germany Factory Orders (October). Eurozone Construction PMI (November), Retail Sales (October). US Challenger Job Cuts (November), Balance of Trade (October), Jobless claims.

Friday – Germany Balance of Trade (October), Industrial Production (October). US Non-Farm Payrolls (November), Unemployment Rate (November), Michigan Consumer Sentiment (Prel, December).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....