Choose Language

December 9, 2024

Weekly InsightsWeekly Investment Insights

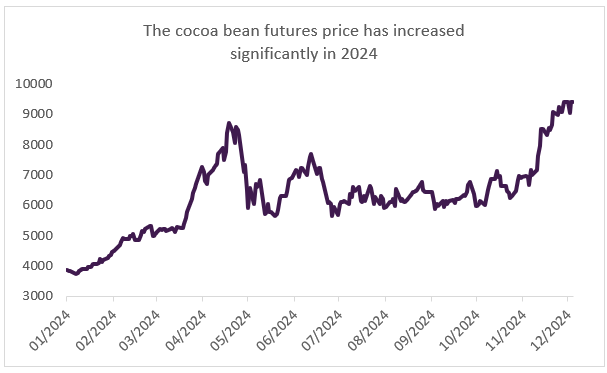

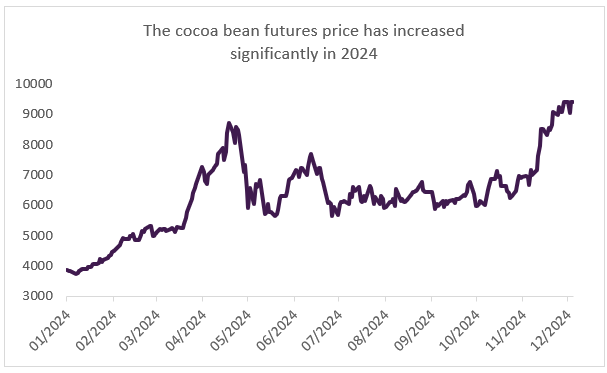

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in. In Luxembourg, the holiday season kicked off last week with Kleeschen, when children woke up to find chocolate treats in their slippers. Behind the scenes, in world cocoa markets, the situation is less gleeful. This year, the price of cocoa bean futures soared, almost tripling in the first four months alone. Now, the prospect of a multi-year structural deficit between supply and demand looms, due to warmer weather, new deforestation laws and the spread of a plant shoot virus. This, in turn, could mean much higher prices and costly chocolate advent calendars next year…

Source: Bloomberg, BIL. As on 04/12/2024

Risk assets have also been on the upswing, despite continued uncertainty with the threat of rising inflation in the US, political turmoil in Europe and conflict in the Middle East. The MSCI All Country World Index is at a record high, with US equities leading the way. The S&P 500 recorded a new record close last week after jobs data boosted market confidence in an imminent Fed rate cut.

OPEC+ continues to do what it can to stabilise oil prices. Last week, the group agreed to extend its production cuts for another year in order to combat the growing oversupply in the oil markets. Brent crude was flat around the $70 per barrel mark following the announcement, only finding support early this week after China, the top importer, signalled looser monetary policy, for the first time since 2010, to boost growth. The fall of Basher al Assad’s regime in Syria was also a factor, bringing further uncertainty to the region, with the world now on standby, waiting for more clarity on the new geopolitical context in the Middle East.

The price for both Brent Crude and WTI rose by over 1% on Monday. Gold also strengthened.

Weekly roundup

Uncertainty in France grows as government collapses

The French minority government led by Michel Barnier collapsed last week as far-right and left-wing lawmakers pushed a no-confidence vote against the government through with a majority 331 votes. As the no-confidence vote was largely expected following growing opposition to the proposed 2025 budget, broader European markets were largely unchanged by the announcement. However, French markets received a boost with stocks and bonds rallying as investors turned their attention to the announcement of who might succeed Barnier, the head of the shortest-lived government since France's Fifth Republic began in 1958.

However, more uncertainty looms on the horizon. Even if President Macron quickly appoints a new prime minister, the new government will face the same problems as that of Barnier - a minority government that is likely to struggle to push through its agenda. Whoever is appointed will take on the challenging task of pushing through a 2025 budget in a divided parliament.

The collapse of the French government exacerbates the uncertain political situation in which Europe finds itself. Strong governments are missing from the helm of two of Europe's largest economies at a time when decisiveness and cohesion are increasingly crucial, especially with Trump set to take office on January 20th.

US Labour data increases optimism for Fed rate cut

Data from the US labour market was scattered throughout last week, with investors watching closely for signs about the health of the economy. A collective sigh of relief was evident on markets after Friday’s jobs report which pointed to a “Goldielocks” labour market that is neither too hot, not too cold. Nonfarm payrolls rose by 227k in November, versus 214k expected. Employment increased in health care, leisure and hospitality, government and social assistance, and transportation equipment manufacturing, largely due the conclusion of Boeing strikes. Average hourly earnings rose 0.4% MoM and 4% YoY, with both numbers 0.1pp above expectations. However, tempering this, is the fact that the unemployment rate rose to 4.2% in November from 4.1% in October.

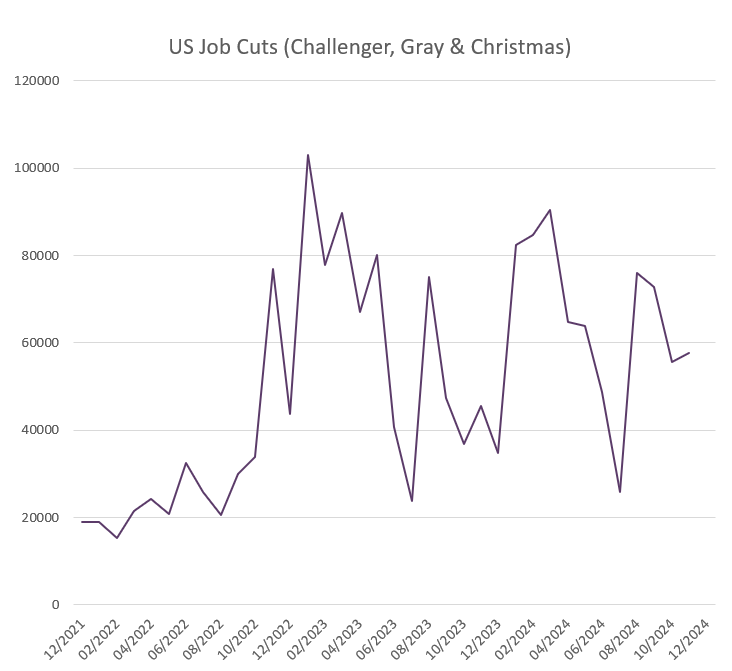

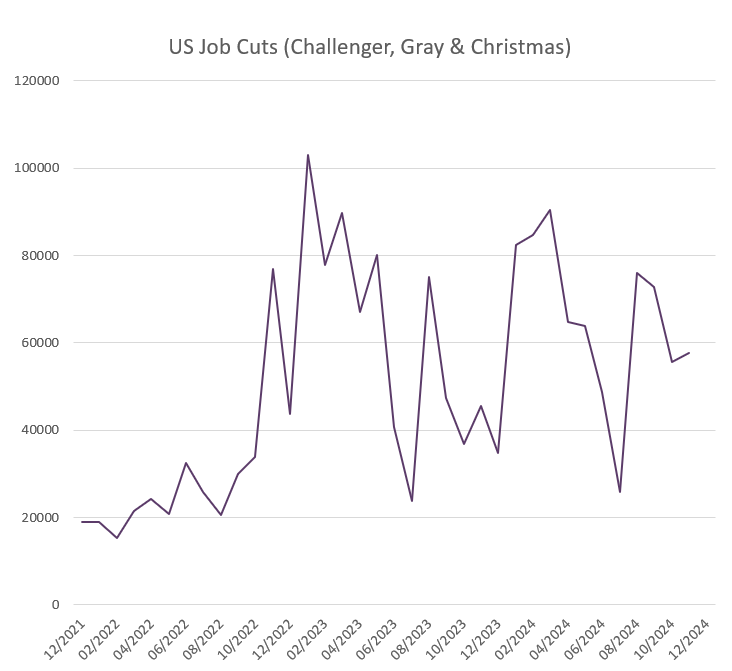

US employers also announced slightly more layoffs in November than in October, with most of those concentrated in the automotive sector. As in Europe, challenges are mounting in the industry on the back of increasing competition from China on electric vehicles, while Trump’s potential trade tariffs could also harm the sector, as we wrote in last week's newsletter.

Source: Bloomberg, BIL

On balance, the data suggests that the Fed can go ahead with another rate 25bp cut at its meeting on 17-18 December. Important to watch this week will be CPI inflation, due Wednesday. The pace thereafter remains in question. As Fed Chairman Jerome Powell said, the economy is in "remarkably good shape", while Trump’s agenda risks rekindling inflation. Much now depends which of his key policies he prioritizes and how quickly he rolls them out.

US shoppers spent record $10.8bn online on Black Friday

Adding to the evidence of continuing strength in the US economy, consumers continued spending big over the Thanksgiving period, with sales totalling no less than $41.1 billion, according to Adobe Analytics, as they hunted for deals. On Black Friday alone, retailers raked in $10.8 billion as shoppers spent record amounts on toys, personal care products, jewellery, Bluetooth speakers and espresso machines. Overall spending during the period was up 8.2% on last year.

Over the past few years, shoppers have been abandoning the malls in favour of doing their Black Friday shopping from the comfort of their own sofas, and the trend is only growing. This year, consumers spent $100 million on social media platform TikTok during Black Friday, as discounts are made even more appealing by well-presented live streams and videos.

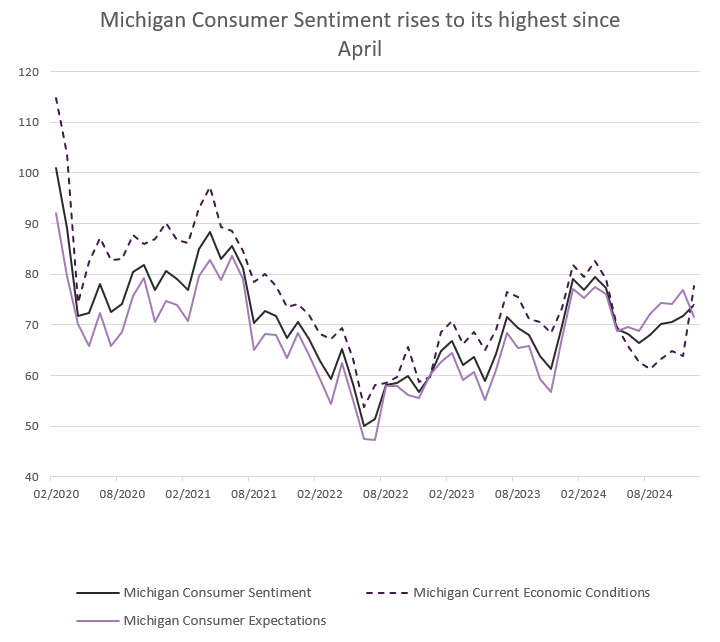

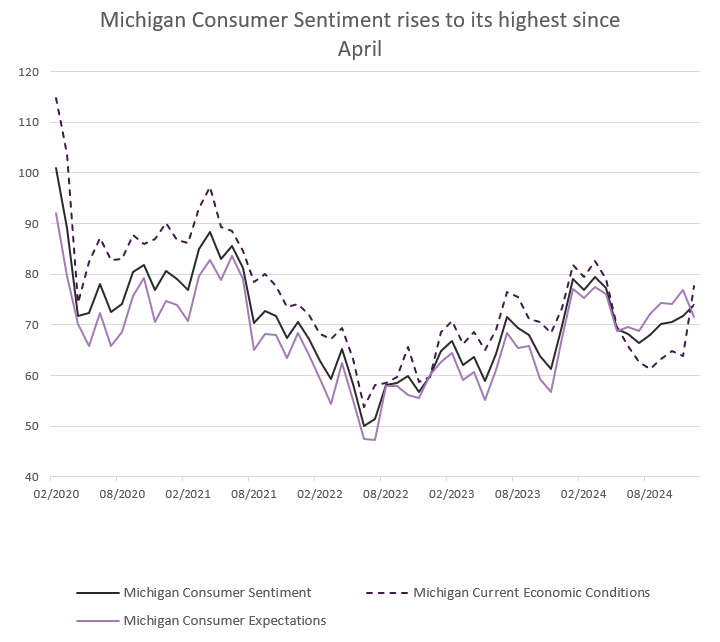

In keeping with this data, consumer sentiment rose to the highest level since April last week, driven by more positive consumer assessments of the present situation. The expectations index, on the other hand, fell by 2.5 points, most likely with talk of inflation back in the airwaves.

Source: Bloomberg, BIL

On the other side of the Atlantic, the European consumer continues to lag. Retail sales in the eurozone fell by 0.5% month-on-month in October, after rising by 0.5% in September. Sales of non-food items and automotive fuel fell, while sales of food, beverages and tobacco rose slightly. Although Black Friday should have provided a significant boost to spending in November, the European consumer remains somewhat more cautious.

EUs record low birth rate and the looming aging population

One of the major challenges facing Europe in the coming years is an ageing population, which will put pressure on healthcare and pension systems. Last year, the number of babies born in the EU hit a record low, falling 5.5% from the previous year, according to Eurostat.

The post-war baby boom in the EU has been in sharp decline since the 1960s and is becoming an increasing threat to public finances. Experts believe this trend will continue as more people choose not to have children amid growing concerns about climate change and geopolitical conflict and uncertainty.

Not only has the number of babies born changed, but the age at which mothers give birth has also increased. It has become much more normal to have children after the age of 40. In the EU, the proportion of mothers who gave birth after the age of 40 rose from 2.49% in 2002 to 5.97% in 2022. In Ireland, as many as 11.2% of births in 2022 were given by mothers aged over 40.

Several EU economies face a growing public debt problem, with Greece, Italy and France at the top of the list. This debt problem will only be exacerbated by a growing population putting pressure on public services and will be a key challenge for European economies in the coming years.

Economic calendar for the week ahead

Monday – Switzerland Consumer Confidence (November).

Tuesday – US Nonfarm Productivity QoQ (Final, Q3).

Wednesday – US Inflation Rate (November).

Thursday – UK GDP (October), Industrial Production (October), Balance of Trade (October). Switzerland National Bank Interest Rate Decision. ECB Interest Rate Decision. US Jobless Claims.

Friday – UK GfK Consumer Confidence (December). Germany Balance of Trade (October). Eurozone Industrial Production (October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...