Choose Language

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s fourth Prime Minister of the year. Bayrou has received a lukewarm welcome and will now have to take on the great challenge of getting a 2025 budget through parliament.

Donald Trump has been named Time Magazine's Person of the Year, as the figure who is considered to have had the greatest impact on world affairs in 2024, “for better or for worse”, as described by editor in chief Sam Jacobs. To celebrate the recognition, Trump kicked off the trading day by ringing the opening bell at the New York Stock Exchange on Thursday morning.

In the US, tech stocks brought the broader market lower at the end of the week, while European markets were little moved by the ECB’s interest rate decision.

All eyes will be on the US next week as investors patiently await another much-anticipated rate cut from the Fed, along with fresh economic forecasts.

Weekly roundup

ECB cuts deposit rate by 25bps to 3%, keeping the door open to further easing

The ECB cut interest rates by 25 basis points at its December meeting, removing the reference to the need for a "sufficiently restrictive" policy rate. At the same time, it lowered its inflation and growth forecasts. The euro was unchanged after the widely anticipated cut.

This is the fourth cut in borrowing costs since the ECB began lowering rates in June this year, taking the rate to its lowest level since March 2023. The decision was accompanied by a warning that growth in the Eurozone will be weaker than originally forecast, reaching 0.7% in 2024 and 1.1% in 2025.

The ECB noted that inflation is heading in the right direction and is expected to fall to 2.1% in 2025, just shy of its 2% target. However, the EBC said it will continue to monitor progress and take a 'data-dependent and meeting-by-meeting approach' to determine the future path of monetary policy based on potential changes to this inflation outlook.

With Donald Trump likely to reignite inflation at home, and the Eurozone lagging the US in terms of growth, the ECB is expected to cut rates more than the Fed next year until it reaches a neutral rate. The key question now is: what is a neutral rate for the ECB? Markets expect up to five more 25bps cuts by September 2025, which would take the deposit rate to 1.75%. On the other hand, most policymakers see the neutral rate as being somewhere between 2% and 2.5%.

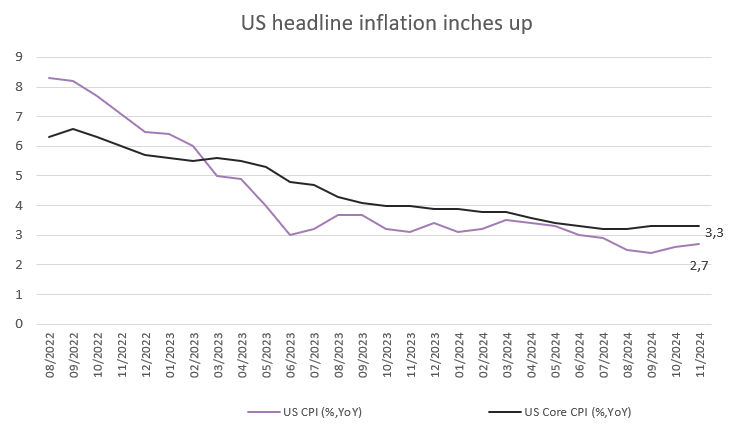

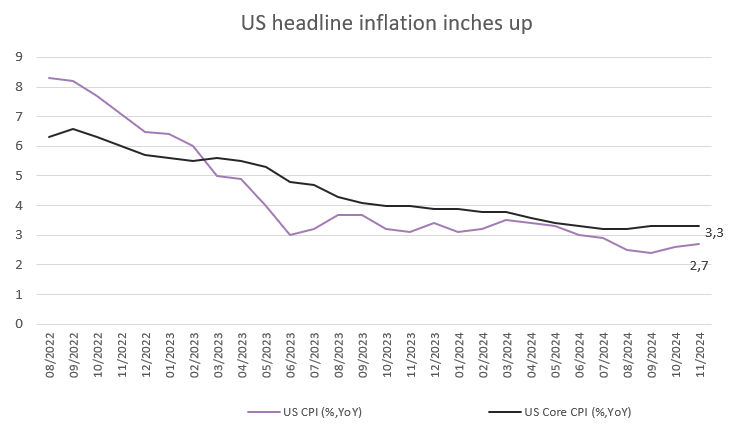

US inflation rises to 2.7% in November

US inflation edged up to 2.7% YoY last month, up from 2.6% prior and matching expectations. The rise is partly influenced by low base effects from last year: Energy costs declined less (-3.2% vs -4.9% in October). Around 40% of the monthly increase in inflation was due to the shelter component, with government figures slow to catch up with more timely real-life trackers which show costs therein are already on a downward slope.

Core inflation held steady at 3.3%, also in line with forecasts.

Following the release, which was free from any nasty upside surprises, traders see another 25bp cut at next week’s FOMC as a “done deal”. That would bring interest rates to a new target range of 4.25-4.5%. However, as we move into the new year, that trajectory of rates becomes trickier to chart. The Fed must keep policy firm enough to anchor inflation close to 2% but relaxed enough to prevent further cooling in the labour market. Potentially inflationary policies from Trump, including trade tariffs and an immigration crackdown, complicate that task further. The Fed will likely want to give itself as much optionality as possible.

Source: Bloomberg, BIL

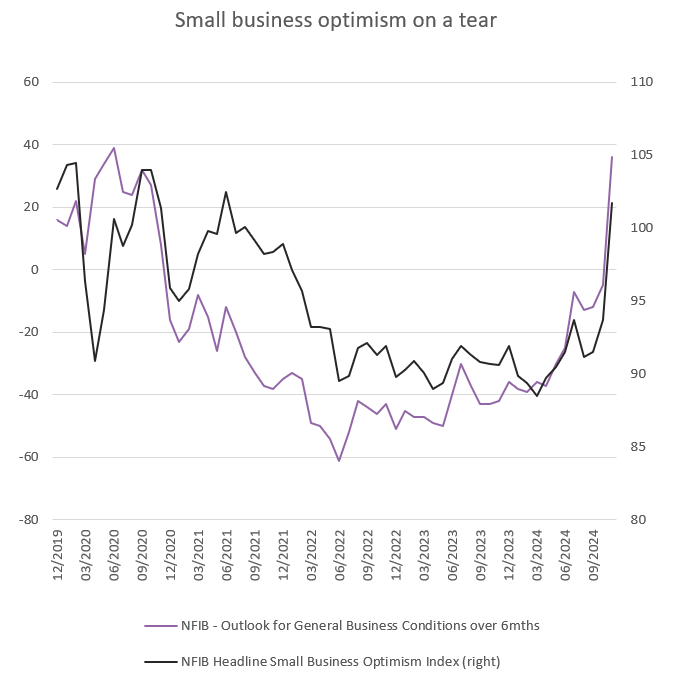

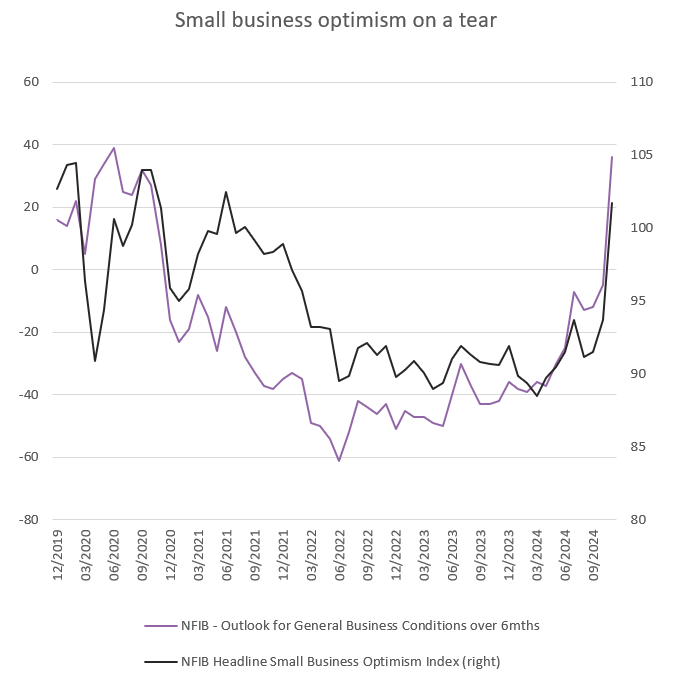

US Small Business Optimism hits highest level since June 2021

With the composite PMI at a 31-month high, we know that activity among America’s large corporates is running strong. But what about the small companies that account for roughly half of US gross domestic output? The NFIB survey, which focuses on Main Street rather than Wall Street, shows that they are increasingly optimistic about the future too. This is particularly following the election of Trump which could usher in a major shift in economic policy: owners are particularly hopeful about tax and regulation policies that promote domestic growth as well as a relief from inflationary pressures. The net percent of owners expecting the economy to improve rose 41 points from October to a net 36%, the highest since June 2020. Expected credit conditions also improved, but from low levels.

Source: Bloomberg, BIL

Swiss Franc Weakens on SNB surprise

On Thursday, the Swiss National Bank cut its interest rate by a larger-than-expected 0.5 percentage points amid undue strength in the Franc with traders having piled into the perceived safe-haven as of late. Consensus expectations among economists had pointed to a smaller 0.25 percentage point cut. The Franc fell by around 0.6% after the announcement, pulling away further from a near-decade high against the euro.

The move marked the steepest drop in borrowing costs since the SNB's emergency rate cut in January 2015 when it suddenly quit its minimum exchange rate with the euro.

Against a backdrop of decreasing inflationary pressures, the SNB tweaked its wording to say it will “adjust its monetary policy”, stepping away from a more explicit statement signaling “further cuts”. However, this doesn’t mean further easing is off the cards. Incoming President Martin Schelgel has said he wouldn’t rule out the use of negative rates.

Calendar for the week ahead

Monday – US, Eurozone, UK, Japan Flash PMI (December). China Industrial Production, House price Index, Retail Sales, Unemployment and 1-Year MLF Announcement. Eurozone Labour Costs and Wage Growth (Q3).

Tuesday – UK Unemployment and Pay data. Germany IFO Business Climate Index (December), ZEW Economic Sentiment (December). US Retail Sales, Industrial Production (both November), and NAHB Housing Market Index (December).

Wednesday – UK Inflation (November). Eurozone Inflation (Final, November). US Building Permits and Housing Starts (November), Federal Reserve Monetary Policy Meeting with refreshed economic projections.

Thursday – Bank of Japan and Bank of England Monetary Policy Meetings. Germany Gfk Consumer Confidence (January). France Business Confidence (December). US GDP Growth (Q3, Final), Weekly Jobless Claims, Existing Home Sales (November)

Friday – Japan Inflation (November). China Loan Prime Rate. UK Retail Sales (November). US Personal Income and Spending and PCE Inflation (November), Michigan Consumer Confidence (December, Final). Eurozone Consumer Confidence (December, Flash).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...