2024 will usher in the Chinese year of the dragon, considered the luckiest sign of the zodiac. This, and the fact that 24 is the carat count of pure gold, might be taken as an omen of a fortuitous year ahead. However, as BIL explains in its 2024 outlook, the terrain ahead for investors is rather complex, making smooth sailing and easy gains unlikely.

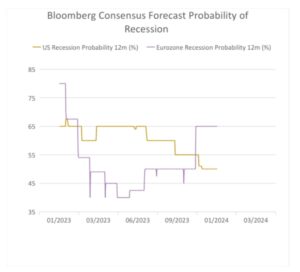

Throughout 2023, market sentiment oscillated between optimism and pessimism. At the onset of the year, economists widely expected that recession was just around the corner, following some of the fastest central bank rate hiking campaigns on record. Using Bloomberg’s compilation of economist expectations, we can see that in December 2022, consensus saw an 80% probability of a US recession within twelve months; 65% in the Eurozone.

Source: Bloomberg, BIL

However, thanks in a large part to strong labour markets and demand, growth and inflation turned out to be more persistent than expected, and recession probabilities were revised down meaningfully. The market adopted a “good news is bad news” mindset, assuming that continued economic strength would only serve to postpone a central bank pivot towards less restrictive policy.

It wasn’t until December, when the Fed effectively closed the door on further tightening, that the market could breathe a collective sigh of relief, ending the year on optimistic shores. The subsequent “buy everything” rally pushed up stock prices and meant that most of 2024’s potential capital gains on bond markets were gorged in a matter of weeks.

We believe the market might be too optimistic about how quickly central banks will begin easing policy, and by how much. Their optimism has led to a loosening in financial conditions, which risks undoing some of central banks’ progress. Until we have decisive communication about the commencement of rate cuts, the tug-of-war between central banks (eager to avoid a 1970s-style reacceleration in inflation) and markets (eager for monetary easing) is likely to persist, creating market volatility.

When rate cuts do finally arrive, investors should bear in mind that they will be accompanied by slowing economic growth. 2024 will bring the moment of truth as to whether central banks have managed to control inflation without causing a hard landing for economies - something we will only know after the fact, given the 18-24 month lag with which monetary policy actions show up in the real economy. While the prospect of a soft landing is increasingly conceivable in the US, growth is still expected to be about half of what it was in 2023. In the Eurozone, the economy might have already tipped into a shallow recession, and from here, we expect only very meagre growth at best.

Macroeconomic uncertainty is compounded by geopolitical tensions and the fact that it will be the biggest election year in history. Not only will we have the highly polarised US Presidential election in November, 39 other countries will hold elections, meaning roughly 41% of the global population will take to the polls in the next twelve months. As the tectonic plates of power shift, policy uncertainty will be higher.

All of the above suggests a challenging terrain for risk assets.

For equity investors, earnings delivery will ultimately take over from policy expectations in driving returns. Slowing growth will make it more challenging for companies to deliver. We believe the US, with its sturdier macro landscape, is best-poised in this sense. Moreover, the region offers exposure to structural themes such as artificial intelligence, digitalisation and cloud computing, which we believe will continue to energize markets. An asymmetric approach is advisable, balancing exposure to aggressive corners of the market (like IT), with more defensive plays, like utilities and staples. Overall, we suggest a bottom-up approach, aimed at identifying quality companies with relative earnings stability.

In the bond space, we’ve spent the past twelve months gradually building up duration and yield-generating capabilities; this proved beneficial amid December’s rapid repricing. Now, as expectations about the timing and magnitude of rate cuts are buffeted by cross currents of central bank communication, macro data, hope and fear, we believe it is time to actively manage duration and size opportunities to capture and lock in income. We see the most value in investment grade credit, where investors can enjoy steady income, even if directional bets have now largely played out. At the same time, corporate balance sheets in this segment appear robust enough to weather a macro slowdown.

Considering the macro context, perhaps 2024 shouldn’t conjure up ideas of golden returns. Rather, we should think about the ancient wisdom of the “golden mean”. The idea, which was reportedly carved at the entrance of the temple of Delphi, means “nothing in excess”. In an investment context, this means staying diversified and not taking outsized bets on any one sector, idea, or region. It can also apply to investor behaviour. Investors need to find the right amount of courage to remain invested through volatile episodes, but not too much, in that they take reckless bets. Those that strike the right balance, can use 2024 to continue progressing towards their long-term investment objectives.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 19, 2025

Weekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....

December 15, 2025

Weekly InsightsWeekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...