Choose Language

January 13, 2025

Weekly InsightsWeekly Investment Insights

Looking back on 2024, it was a year marked by conflict and political uncertainty, but it also saw major advances in space exploration, the AI revolution making further inroads into our daily lives, and rising stock markets. After the final closing bell, major market indices and commodities recorded impressive climbs:

- In the US, the S&P 500 rose roughly 24% in 2024, hitting 57 new highs. What makes this even more remarkable is that it followed on the heels of an already-impressive 2023. However, this leads many investors to believe that 2025 might be more challenging.

- The Nasdaq rose by around 30%, and the Dow by just over 12%

- In Europe, the Euro Stoxx 50 climbed 8.5%

- Gold rose nearly 28%

Oil had a series of ups and downs, but ended virtually where it started.

In a glimpse of the volatility we might expect after Trump takes office on January 20th, last week, a newspaper report stating that his tariff plans would not be as extensive as previously thought, sent markets higher. Trump quickly responded to the report saying that it was not true, and markets retreated while the US dollar fell against a basket of other currencies. This exemplifies how sensitive markets are to possible policy changes, even considering how difficult it might be to decipher what is bluff and bluster under the new administration.

Weekly roundup

US job growth rises more than expected in December

The US economy added 256,000 jobs in December, the most in nine months. Employment rose in health care, government and social assistance, and retail trade. Meanwhile, manufacturing employment fell. At the same time, the unemployment rate fell to 4.1% from 4.2% in November.

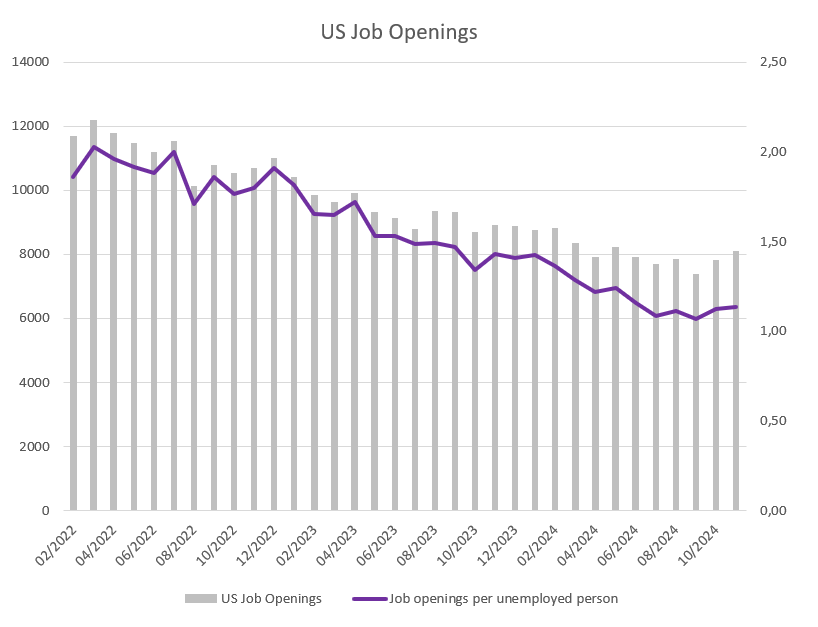

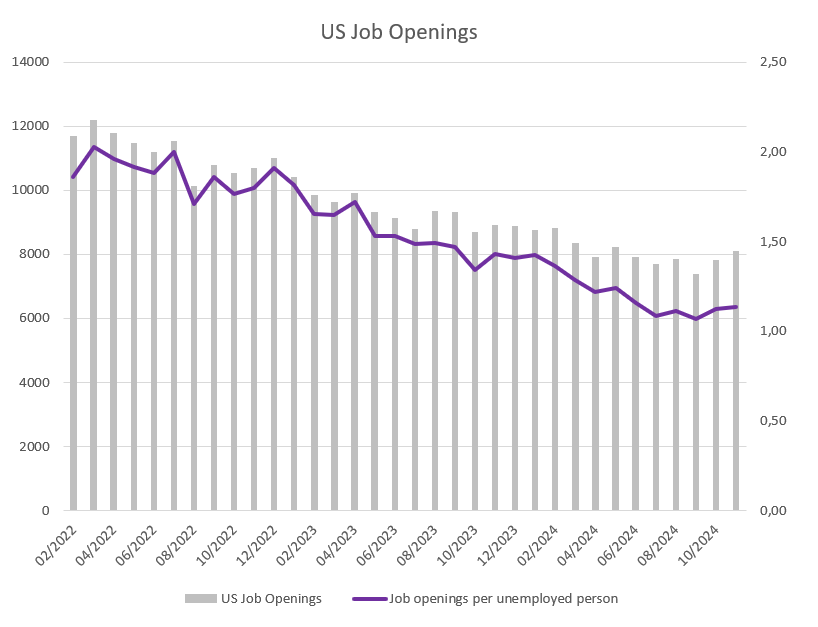

The JOLTs survey also showed that the number of job openings in the US increased to 8,098 million in November. Job openings increased in professional and business services, finance and insurance, and private educational services. The vacancies-to-unemployed ratio also rose, meaning that there are increasingly more jobs than unemployed people.

Source: Bloomberg, BIL

However, the survey also showed that the number of people quitting their jobs fell, which means that people are less confident that they will be able to find a new job if they leave their current one.

On aggregate, incoming labour market data remains strong and means that the Fed is unlikely to see it as a reason to cut interest rates any time soon. With fears growing that Trump policies may fan inflation, the Fed might once again put greater emphasis on keeping inflation in check. Following the labour market data, futures markets were pricing just one 25bp rate cut for this year. The Fed’s official dot-plot, released in December, indicates two rate cuts this year.

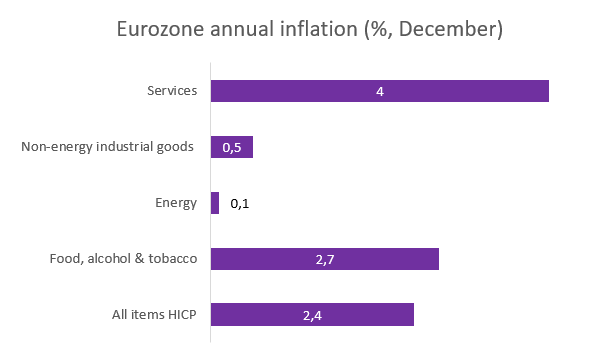

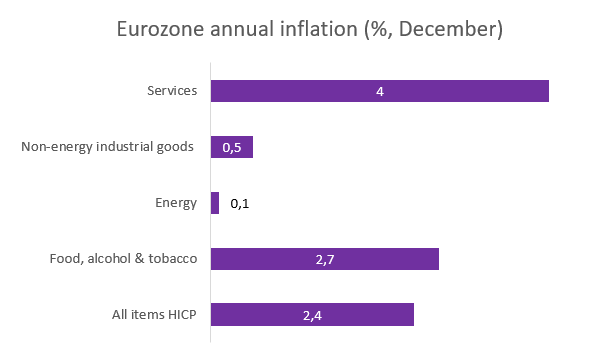

Eurozone inflation rose to 2.4% in December

According to flash estimates, inflation in the Eurozone rose for the third consecutive month to 2.4% YoY in December, up from 2.2%. This increase in inflation towards the end of the year was largely expected due to base effects, as last year's sharp falls in energy prices are no longer included in the calculation.

Energy prices rose by 0.1%, marking the first increase in energy prices since July. The inflation rate for services also picked up, reaching 4% in December. The cost of food, alcohol and tobacco rose by 2.7%, the same as in November. Inflation for non-energy goods slowed slightly to 0.5% from 0.6% in the previous month.

Source: Eurostat, BIL

The annual core inflation rate, which excludes volatile categories such as energy, food, alcohol and tobacco, held steady at 2.7%, the same as in the previous month. The ECB expects inflation to move back to its 2% target by the end of the year and the uptick in the headline print is unlikely to derail its easing plans.

UK budget under pressure as borrowing costs soar

The UK's long-term borrowing costs hit their highest level since 1998 and 10-year borrowing costs rose to their highest level since the global financial crisis last week amid an intensifying global bond sell-off driven partly by fears over inflationary policies in the US that may alter the Fed’s policy pathway. The sell-off is particularly worrying for the UK as borrowing costs there have risen much faster than in other major economies this year, and could threaten the government's ability to meet its own fiscal rules.

The Autumn Budget announced in October last year revealed £40bn of tax increases and little room for fiscal manoeuvre. In recent months, rising government bond yields have put pressure on this fiscal spending headroom. If higher yields persist, it could mean that the Chancellor will be forced to raise taxes further, or cut spending to keep her budget on track. However, no significant tax changes are expected before the autumn. Investors are therefore more concerned about potential spending cuts that could hurt growth.

These soaring borrowing costs comes at a fragile time for the UK economy, with the economy having contracted in both October and November last year.

The pound sterling fell to its weakest level against the dollar in 14 months on the news and the FTSE 250 index retreated.

China announces another stimulus package

Beijing has announced additional fiscal stimulus to inject some energy into the struggling economy. This newly released package will increase funding from ultra-long term government bonds to boost corporate investment and fund consumer initiatives.

A programme launched last year, which allows consumers to trade in old appliances or cars and receive a discount on a new purchase, will be expanded, while subsidies will also be made available for households to buy microwaves, rice cookers, dish washers and water purifiers, as well as phones, tablets and smartwatches. There will also be subsidies for businesses to upgrade large equipment.

With the economy struggling to keep up with its 5% growth target last year, China has vowed to unveil initiatives to boost consumption in 2025. In a first attempt to boost spending this year, millions of Chinese government workers received an unexpected pay rise at the start of the month.

To maintain the 5% growth target in 2025, Chinese leaders have agreed to raise the budget deficit to 4% of GDP, the highest on record for China.

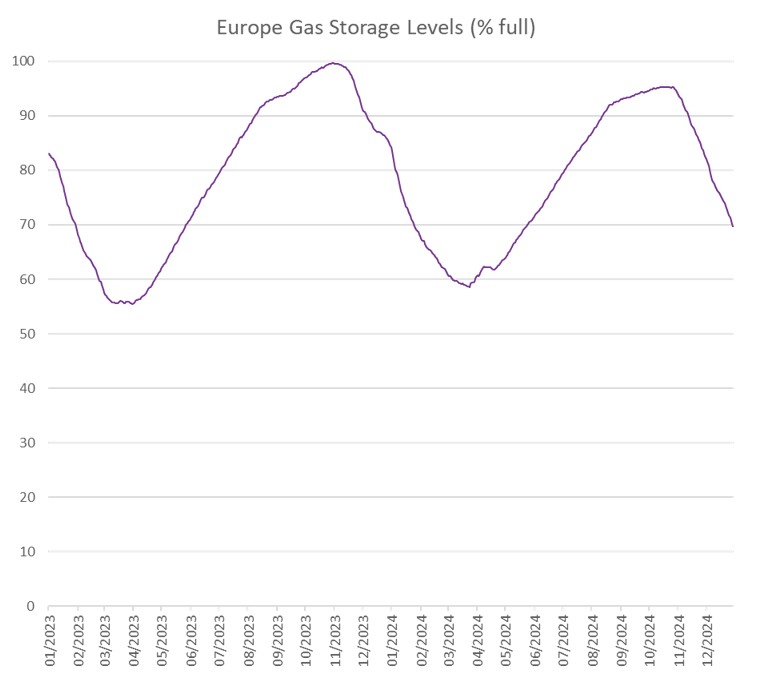

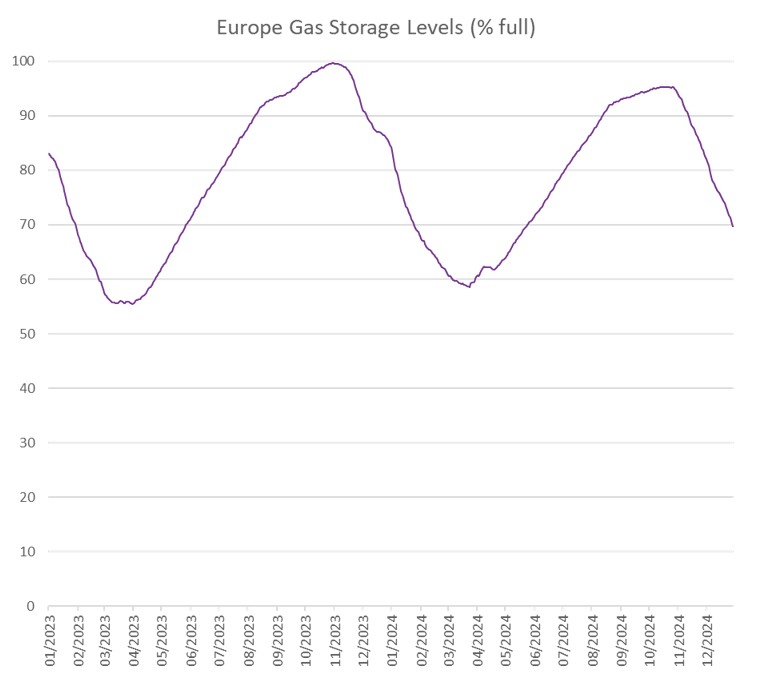

Russian gas stops flowing through Ukraine

On New Year's Day, Russian piped gas stopped flowing through Ukraine to Europe, marking a key moment in the end of Russia's dominance of European gas supplies. Until now, Russian gas has continued to flow to certain European countries through pipelines that run through Ukraine. With the later refusing to renew the transit agreement, those flows will dry up.

Since the start of the war, Europe has reduced its dependence on Russian gas by buying more pipeline gas from Norway and significantly increasing its LNG (liquefied natural gas) import capacity, meaning that gas supplies should not be put at risk by the end of the transit agreement. Colder weather is, however, causing Europe to burn through gas reserves more quickly than at any point in the last seven years as heating needs ramp up.

Source: Bloomberg, BIL

Hungary, Serbia and Turkey will be able to continue receiving Russian piped gas via the TurkStream pipeline under the Black Sea. Although the end of the flow was widely expected, and most countries dependent on the pipeline flow have arranged alternative supply, Moldova has seen heating and hot water supplies cut off.

The end of the transit agreement does not mean that Europe is not able to import any gas from Russia at all. In fact, Europe imported markedly high levels of LNG from Russia in 2024 and this could potentially continue in 2025 as well.

Calendar for the week ahead

Monday – US Consumer Inflation Expectations (December). Switzerland Consumer Confidence (December).

Tuesday – US NFIB Business Optimism Index (December), PPI (MoM, December).

Wednesday – UK Inflation Rate (December). Eurozone Industrial Production (November). US Inflation Rate (December).

Thursday – UK GDP, Industrial Production, Balance of Trade (November). Eurozone Balance of Trade (November). US Retail Sales (December), Jobless Claims.

Friday – China GDP Growth Rate (YoY, Q4), Industrial Production, Retail Sales (YoY, December). UK Retail Sales (December). Eurozone Inflation Rate (Final, December). US Housing Sats (December), Industrial & Manufacturing Production (December).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 10, 2025

Weekly InsightsWeekly Investment Insights

US equities ended lower last week, amid tariff uncertainty stemming from the Trump administration. While proposed tariffs on Canada and Mexico were postponed for...

February 3, 2025

Weekly InsightsWeekly Investment Insights

By Friday, it seemed as though a volatile week for stocks had ended on a positive note. The damage caused after Chinese AI app DeepSeek...

January 28, 2025

NewsNavigating Europe’s Demographic...

Europe faces a multitude of structural challenges that threaten its economic stability and future growth. In addition to the ongoing malaise in manufacturing, political...

January 27, 2025

Weekly InsightsWeekly Investment Insights

Last week, world leaders gathered in Davos for the annual five-day meeting of the World Economic Forum. On the agenda were geopolitics, US-EU-China relations,...