Choose Language

February 10, 2025

Weekly InsightsWeekly Investment Insights

US equities ended lower last week, amid tariff uncertainty stemming from the Trump administration. While proposed tariffs on Canada and Mexico were postponed for thirty days after the President spoke with their respective leaders, reaching compromises on border control, 10% tariffs on China went ahead. China responded with tariffs on an estimated $14Bn of US goods (less than 10% of total imports from the US in 2023), including LNG, crude, and farm equipment. Overall, however, the response was not perceived as escalatory, rather as a way to approach negotiations.

Trade is again capturing the headlines this morning, after Trump, over the weekend, suggested he would impose 25% tariffs on all steel and aluminum going into the US. We await more details on the intended timeline, and insofar as now, the market reaction has been contained.

On Friday, the pan-European STOXX Europe 600 Index ended 0.60% higher (in local terms) —just shy of its recent record high —defying concerns about US trade policy. Oil, on the other hand, saw its third weekly decline, with traders concerned about how tariffs will affect growth (especially in China), and thus energy demand.

Elsewhere, the bulk of corporate earnings have now been delivered. In the US, where over three-quarters of S&P 500 firms have now reported, Q4 earnings growth has been stronger than initially expected, at +13.29% YoY. 74% of firms have beat EPS estimates, bringing an aggregate positive surprise of 6%. In terms of sectors, Communication Services and Tech are still important drivers of overall EPS growth, but the spread between Mag-7 and S&P500-ex-Mag-7 earnings growth has closed to the smallest degree seen over the past eight quarters.

The continued resilience we are seeing in corporate earnings suggests that the soft-to-no-landing scenario is still intact.

In Europe, with 44% of companies having reported, EPS growth is coming in at +0.5% YoY vs -1.3% expected. 49% of the companies that have reported have beat EPS estimates, surprising positively by 2%.

Weekly roundup

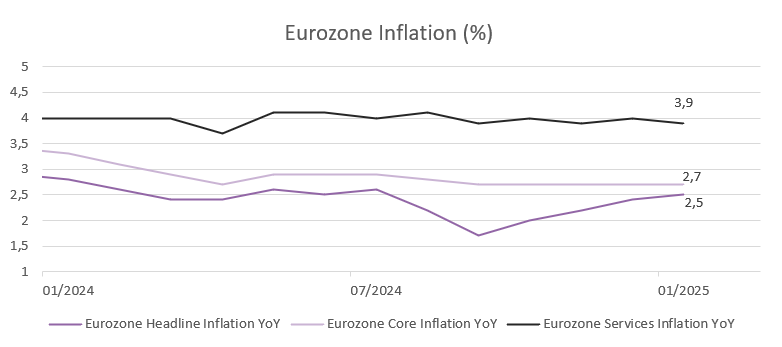

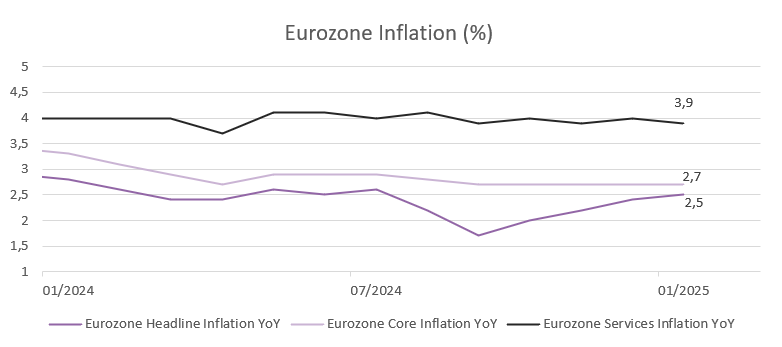

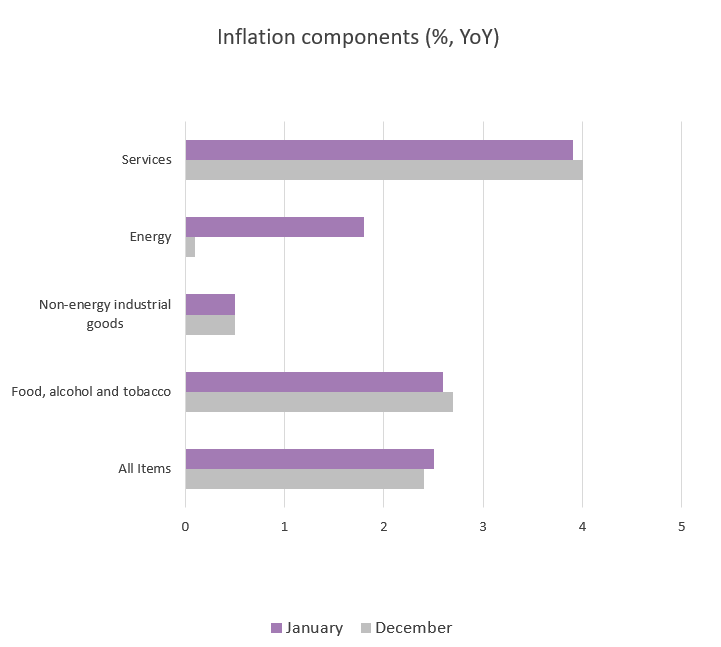

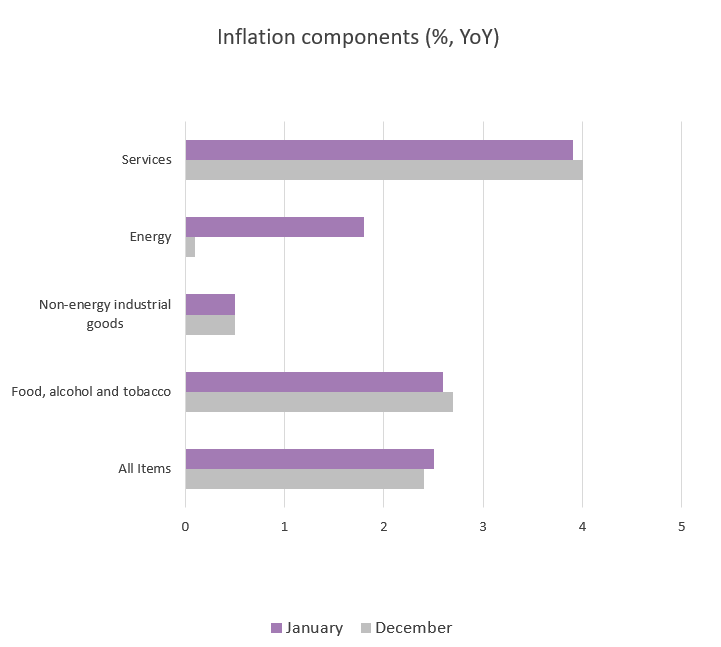

Eurozone inflation inches up in January

Headline inflation in the Euro Area rose from 2.4% YoY, to 2.5% in the first month of 2025, driven by a sharp acceleration in energy costs (1.8% YoY, vs 0.1% in December).

Inflation for non-energy industrial goods remained steady at 0.5%, while price increases slowed for both services (3.9% vs 4.0%) and food, alcohol, and tobacco (2.3% vs 2.6%). The core inflation rate, which excludes volatile food and energy prices, remained unchanged at 2.7% for the fifth consecutive month.

Despite the gradual increase in headline inflation that began in September, at the ECB’s January monetary policy meeting, President Christine Lagarde said, “the disinflation process is well on track,” hinting that further rate cuts were likely. The one sticking point is that services inflation is still uncomfortably above the 2% target. Nonetheless, the central bank does believe it will come down this year as wage pressures ease.

Source: Bloomberg, BIL

Source: Bloomberg, BIL

Incoming data points to only gradual cooling in the US labour market

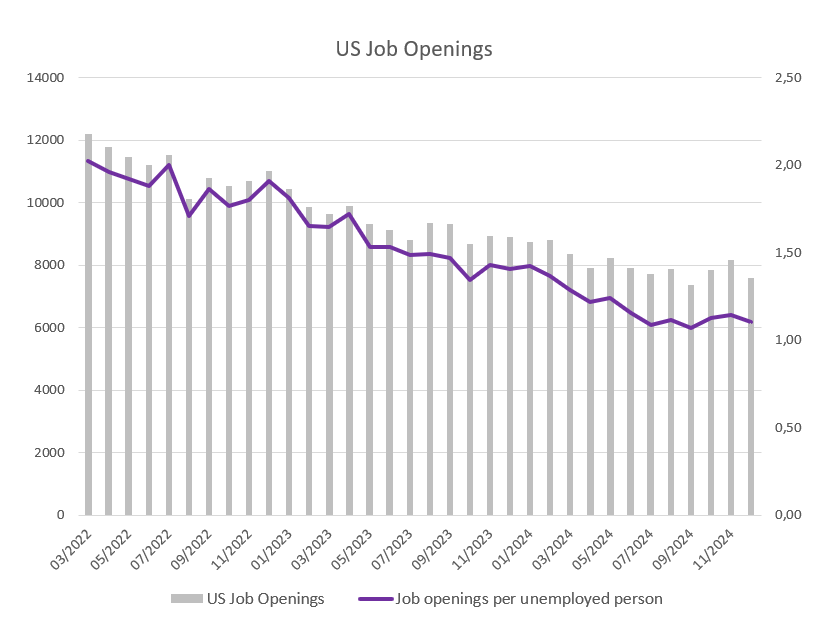

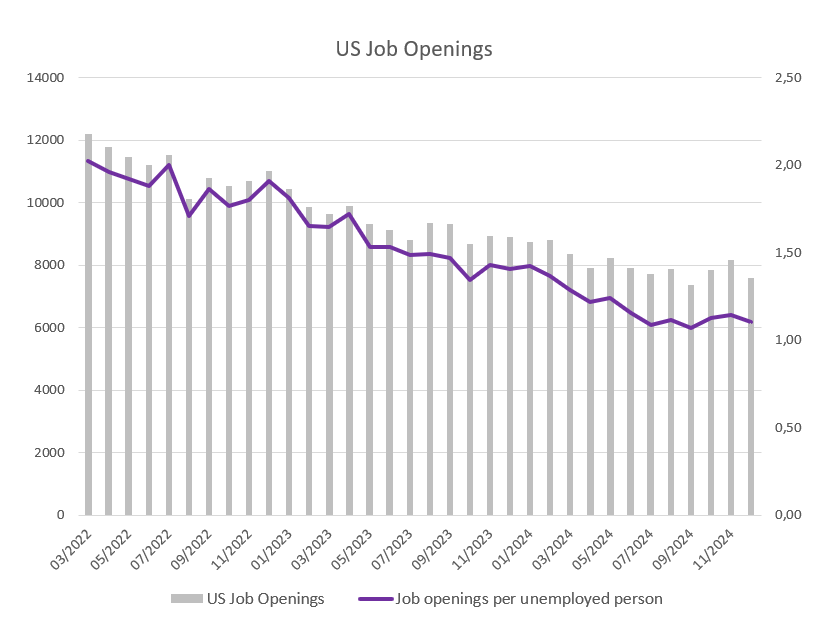

Data released on Tuesday showed that there were 7.6 million job openings in the US in December, 556k fewer than in the previous month. At the same time, however, the number of layoffs declined modestly while more people quit their jobs: both indicators push back against worries about deterioration in the job market. After all, people are unlikely to quit if they aren’t confident that they will be able to find something else.

Source: Bloomberg, BIL

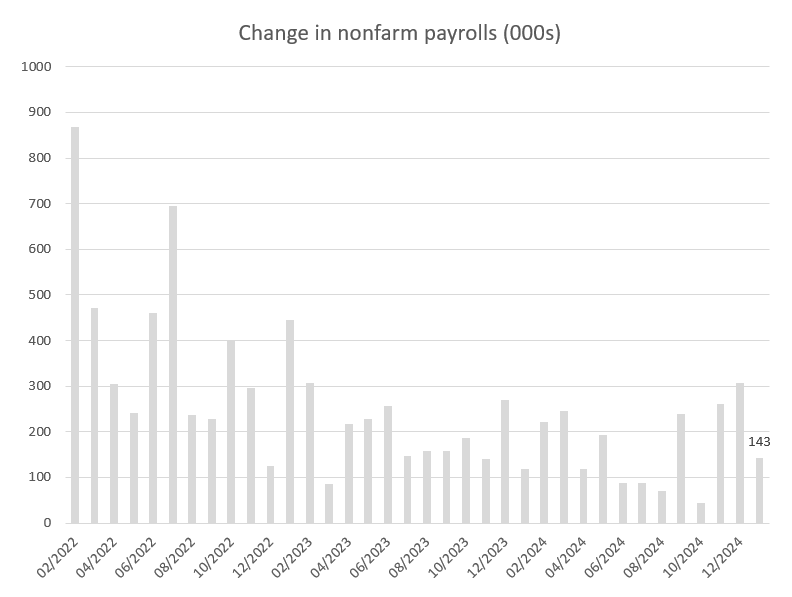

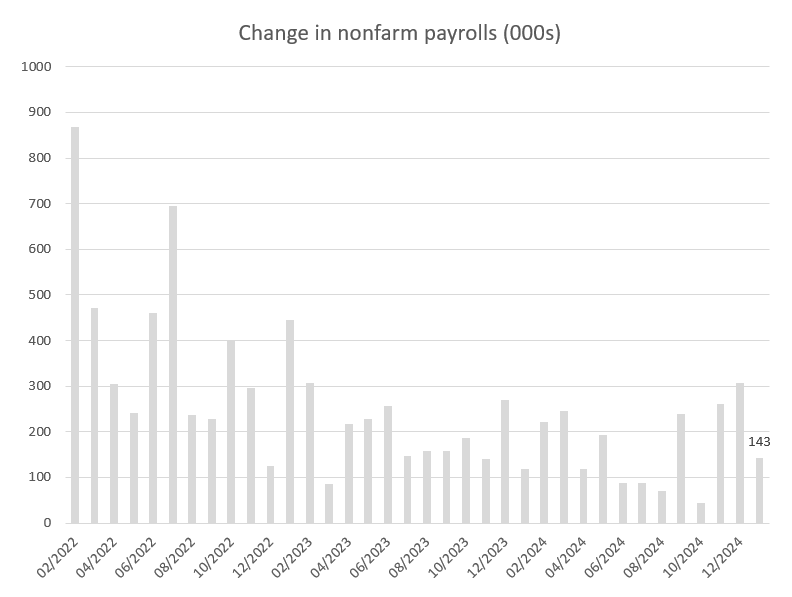

The same idea was reiterated in Friday’s payroll data. While the headline number of jobs added came in slightly below expectations in January (143k versus 170k), the broader picture is still one of labour market resilience and sustained wage pressure. Job gains across November and December were collectively revised up by +100k, while the unemployment rate dipped by 0.1 percentage point to 4.0%, marking its lowest level since May. Wage growth was also stronger than expected, jumping 0.5% MoM or 4.1% YoY. This was partly due to minimum wage hikes that took effect last month in 21 states and dozens of municipalities.

Source: Bloomberg, BIL

On balance, both reports would seem consistent with the Fed’s view that the labour market is healthy enough to tolerate a more cautious approach to policy easing, especially given the uncertainty surrounding tariff policy and the recent PMI data pointing to renewed price pressures.

Bank of England cuts interest rates to 4.5% amid weak growth

On Thursday, the Bank of England (BoE) cut interest rates by 25 basis points to 4.5%, while halving its growth forecast. The Bank now expects growth to be 0.75% in 2025 and inflation to peak at 3.7%. The Bank said that before carefully deciding when and by how much to cut rates next, it will monitor inflation closely and needs to be "confident that inflation will remain low and stable in a lasting way".

The 25 basis point cut was in line with expectations, but the surprise was that two committee members voted for a larger cut of 50 basis points. It is clear that the weakness in growth is a cause for concern for the BoE, with risks tilted to the downside from increased costs for employers as a result of the Autumn Budget, a potential global trade war and rising inflation.

Sterling weakened and two-year UK government bond yields fell as investors increased their bets on another BoE cut this year.

German factory orders rebound in December in another sign that manufacturing might be bottoming out

After a fall of 5.2% in November, German factory orders rose by 6.9% month-on-month in December, thanks to a jump in major orders for aircrafts, ships and trains and a rise in orders for machinery and equipment. Demand in the automotive sector remained weak, falling by 3.2% on the month.

The increase in new orders came mainly from domestic demand, while demand from the euro area rose by 6.2%, but new orders from the rest of the world fell by 1.5%.

Despite this upturn, German industry continues to struggle. Industrial production in Germany fell by 2.4% in December, the biggest drop since July, dragged down by lower output in the car industry and in the maintenance and assembly of machinery.

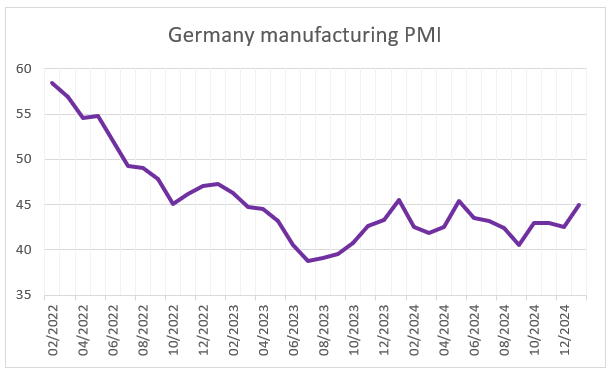

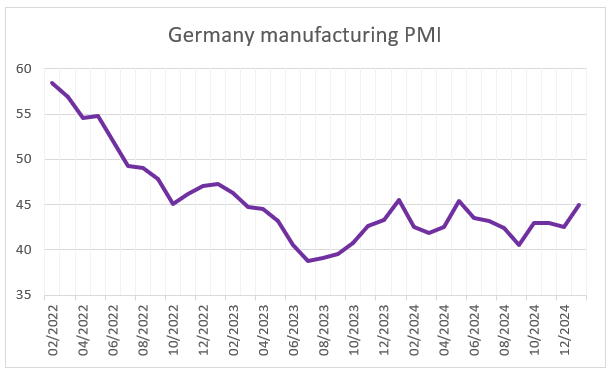

According to PMI data, the German manufacturing sector has been in contraction since the summer of 2022. While it remains to be the case, there are tentative signs that the situation is bottoming out (the PMI rose from 42.5 to 45.0 in January).

Source: Bloomberg, BIL. 50 is considered the mark between contraction and expansion.

For the fragile recovery, a lot now depends on the elections at home, resulting policy tweaks, and Trump’s trade tactics.

As the German election on February 23rd draws nearer, polls suggest the CDU is the frontrunner, with the AFD in second place. Nonetheless, to have a majority, it is more than likely that the leading party will need to form a coalition, meaning little immediate policy changes to support the economy in the near-term.

Calendar for the week ahead

Monday – US Consumer Inflation Expectations (January).

Tuesday – US NFIB Business Optimism Index (January).

Wednesday – Italy Industrial Production (December). US Inflation (January).

Thursday – UK GDP Growth Rate (Q4, Prel), Balance of Trade (December). Switzerland Inflation Rate (January). Eurozone Industrial Production (December). US PPI (January), Jobless claims.

Friday – UK Industrial, Manufacturing, Production (December). Eurozone GDP Growth Rate (Q4, Prel). US Retail Sales (January), Industrial Production (January), Industrial, Manufacturing, Production (January).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...