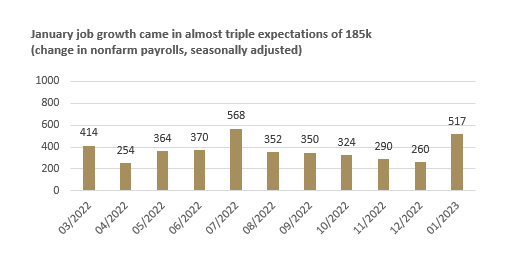

A Goldilocks nonfarm payroll report for December (which showed job growth slowing but not plummeting) raised hopes that the US economy could be on its way to a “soft landing”. Some might have assumed that the subsequent report for January had dashed those hopes. Job growth was through the roof, with the economy adding some 517k nonfarm payrolls, almost triple the 185k expected. That brought the unemployment rate to 3.4%, its lowest level in 53 years.

While strong job growth would be seen as something favourable in normal times, for now good news is somewhat bad news while the Fed tries to prevent the economy from overheating. The fear is that an incredibly resilient labour market will keep inflation stubbornly high, especially in the services sector. The kneejerk reaction of markets was negative following the strong data as it potentially heralded an extended period of Fed hawkishness. Indeed Fed Chair Jerome Powell has indicated he’s focusing on the labour market, which he described at the most recent FOMC press conference as “out of balance.”

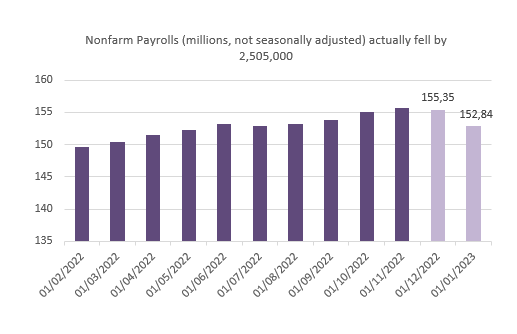

However, we have to take January’s data with a pinch of salt. Removing seasonal adjustments (intended to smooth the data given the large amount of seasonal workers that are habitually laid off every January), the change in nonfarm payrolls was actually a negative 2,505,000.

At first glance, January’s seasonally adjusted payrolls data leaves the overall macro picture looking like a painting by Chagall, full of contrasts and contradictions. It portrays a vibrant, booming economy, while inflation, consumption and manufacturing data all point to a slowdown. In the months to come, I suspect that the macro picture will become more harmonised, when seasonal adjustments are less pronounced. Chagall often employed overlapping images, like double-exposure photography, suggesting there’s more to life under the surface. Beneath the strong headline data, indeed cracks are already apparent in the labour market (a rising number of part-time workers, a pronounced fall in the average number of hours worked per day as companies cut shifts, new layoffs announced almost daily, notably by Disney and Zoom this week…)

Source: Bloomberg, BIL

Chagall’s frescoes on the ceiling of the Opéra Garnier in Paris. Source: Unsplash

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 9, 2026

Weekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...

January 26, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...

January 19, 2026

Weekly InsightsWeekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...