Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be regaining momentum and the onset of policy easing might provide an additional boost. Up to now, decent earnings growth and the AI theme have kept equities well-supported, though macro volatility and mercurial monetary policy expectations have at times hurt sentiment. As we enter the second half of the year, the disinflation, growth and policy trends should become clearer, making for a more amenable investment landscape…

Macro Context

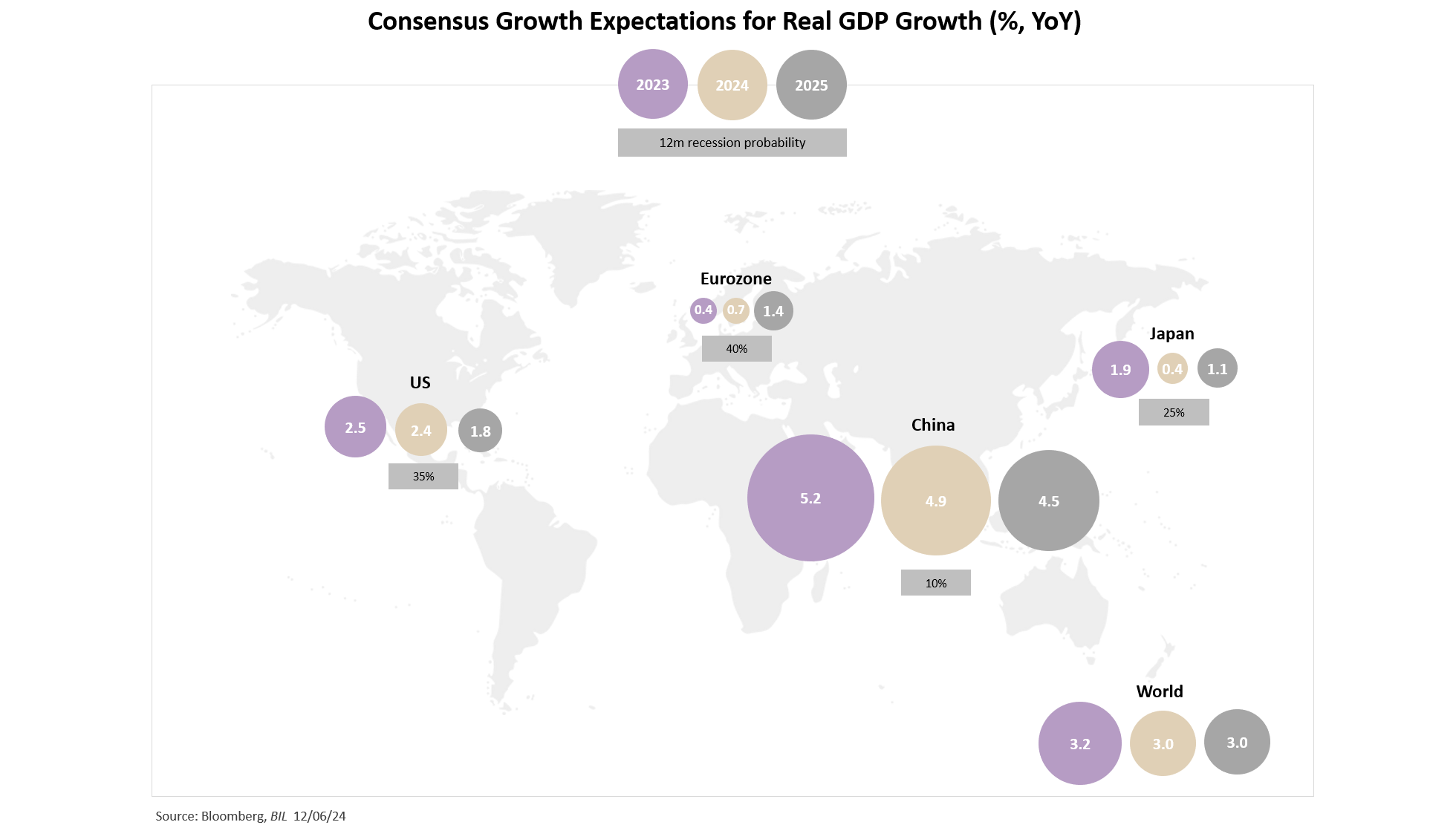

Zooming in on the US, Q1 growth undershot expectations, slowing from 3.4% to just 1.3% QoQ, versus 2.5% expected. We think that this soft reading, which was in a large part due to the volatile trade and inventory components, probably masks some underlying strength and that Q2 growth will come in stronger. While activity is still humming along nicely, particularly in services, there are some indications that US macro exceptionalism could fade in Q2 as the consumption engine slows. Excess savings have been spent, the labour market is weakening, and credit card delinquencies are rising, putting question marks over future spending.

In our 2024 Outlook, we surmised that the Eurozone might already be in recession. It avoided this by a hairline (0% growth QoQ in Q3 2023 and -0.1% growth in Q4), before staging a rebound in Q1 of this year (+0.3% QoQ). We still expect meagre growth throughout the course of 2024, but economic risks are now more tilted to the upside than the downside. This is due to successful short-term fixes to the energy situation and the fact that the manufacturing sector appears to be bottoming out. Rising real incomes and unspent pandemic savings pave the way for a gradual consumption rebound.

The stimulus package we, and many others, expected in China did not come to fruition. Domestic demand is weak, and the economy is flirting with deflation. A key pillar of support is the accelerating export sector – a pillar that looks quite shaky when considering new tariff announcements. Now, all eyes are on the July Politburo meeting which will provide more insight on policy intentions.

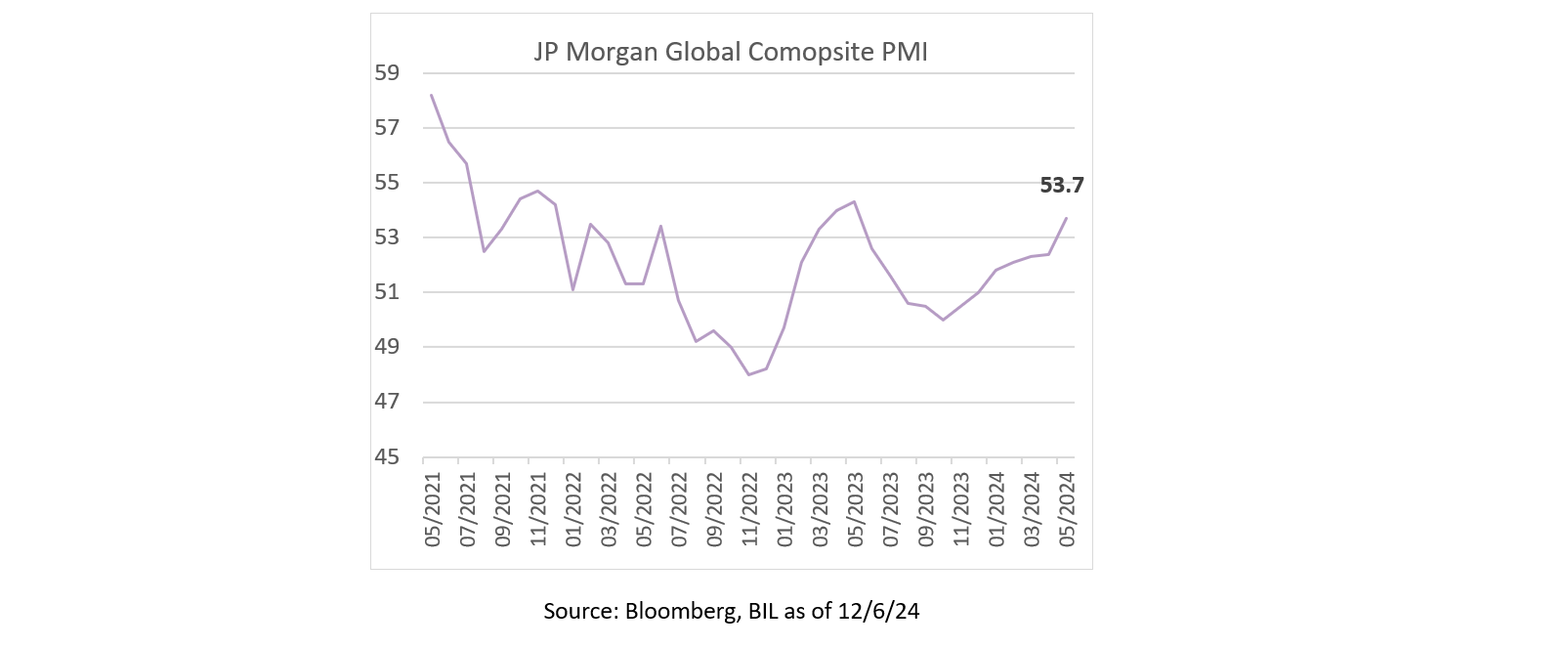

On balance, the global economic situation is brighter than many had expected at the beginning of the year. According to the worldwide composite PMI, the economic growth rate hit a 12-month high in May. The forward-looking new orders subindex is on an upward trajectory and, encouragingly, new export orders have started to rise again, after being in a deep-freeze since February 2022. For the full year, the OECD expects global trade in goods and services to grow by 2.3% – more than double the 1% growth seen in 2023.

The services sector continues to serve as a pillar of strength, with business activity continuing to accelerate across the business, consumer, and financial services sectors. Prospects are also now brightening for manufacturing, which saw production growth hit a near two-and-a-half year high in May.

Overall, the PMI is consistent with global growth of 3.4% this year, with activity broadening out beyond services and across regions.

Monetary Policy

But good news on the economy has at times been bad news for markets in that it has meant higher rates for even longer. As we pointed out in our 2024 Outlook, markets were clearly too optimistic regarding the amount of rate cuts they expected this year – for example, futures markets were betting on 150bp worth of cuts in the US, double the amount signalled on the Fed’s dot-plot at the time! Only now at midpoint of the year, are we starting to see G10 central banks slowly switch into easing mode.

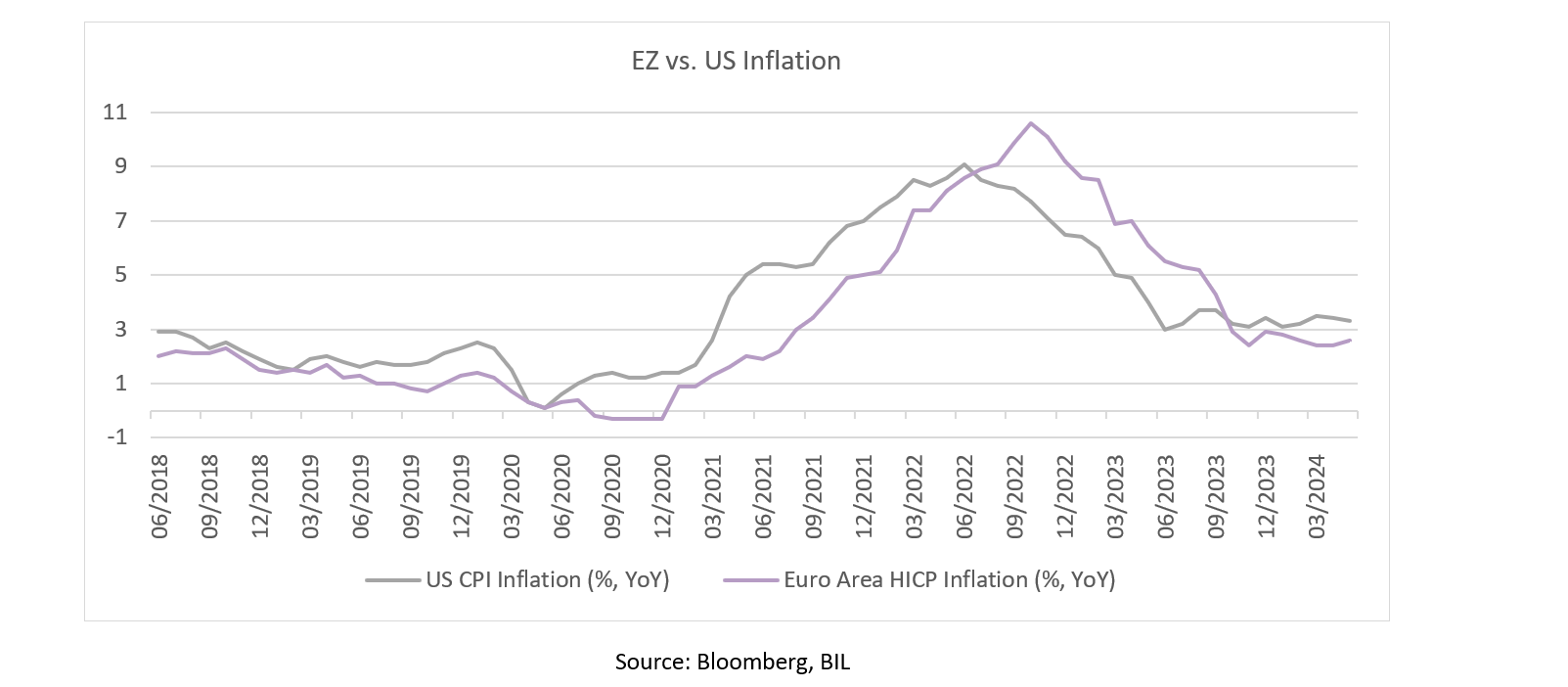

Having made more convincing progress towards its inflation target, the ECB cut rates by 25bps in June, pre-empting the Fed. The fact that the ECB is easing into an improving situation means it is not in a hurry to continue lowering rates from here – roughly one 25bp cut per quarter is expected for this year.

US inflation has proven stickier than expected and leading indicators of both input and selling prices suggest the last mile to the 2% target won’t be straightforward. The Fed’s June dot-plot pencilled in only one rate cut this year, two less than in March. The good news is that market expectations are not out of sync with the dot-plot like they were at the beginning of the year.

While we do see inflation moderating as supply and demand factors fall into better alignment throughout the course of the year, central bank targets could remain elusive, especially in the US. Indeed, the Fed thinks it will be 2026 before the 2% milestone is reached. That probably means higher policy rates and bond yields than we have experienced in recent history. The risk, however, is that if the Fed waits too long to start cutting, the more it puts the “no landing” scenario in jeopardy.

Global Risks

There are plenty risks for investors to contend with from a global perspective.

Our expectation that 2024 would be characterized by heightened [geo]political uncertainty was accurate, with defence moving up political agendas in what is becoming an increasingly fragmented world.

2024 has also been volatile on the political front amid one of the busiest election calendars in decades. The European Parliamentary elections saw France’s far-right Rassemblement National take victory, compelling President Macron to announce snap elections. This decision led to a sell-off in French equities (particularly banks) and bonds, while the euro lost ground against the dollar. Volatility and euro weakness is likely to persist until France’s fate is known (voters will go to the polls on June 30, with a second round on July 7).

Looking to the US, the highly-polarised presidential election in November could have both economic and market implications, which no one can predict with certainty. From an investor’s point of view, the most important policy floated thus far may be Trump’s proposal to impose a tariff of up to 10% on all imported goods, especially given the potential impact on inflation at such a crucial moment for monetary policy.

Tariffs and trade frictions present another risk to our 2024 macro scenario. Potential retaliation from China in response to recent moves by the US and Europe could backfire on firms that sell their goods in China’s vast market. More broadly, continued protectionism could curtail the upturn in global trade.

Investment Strategy

Equities

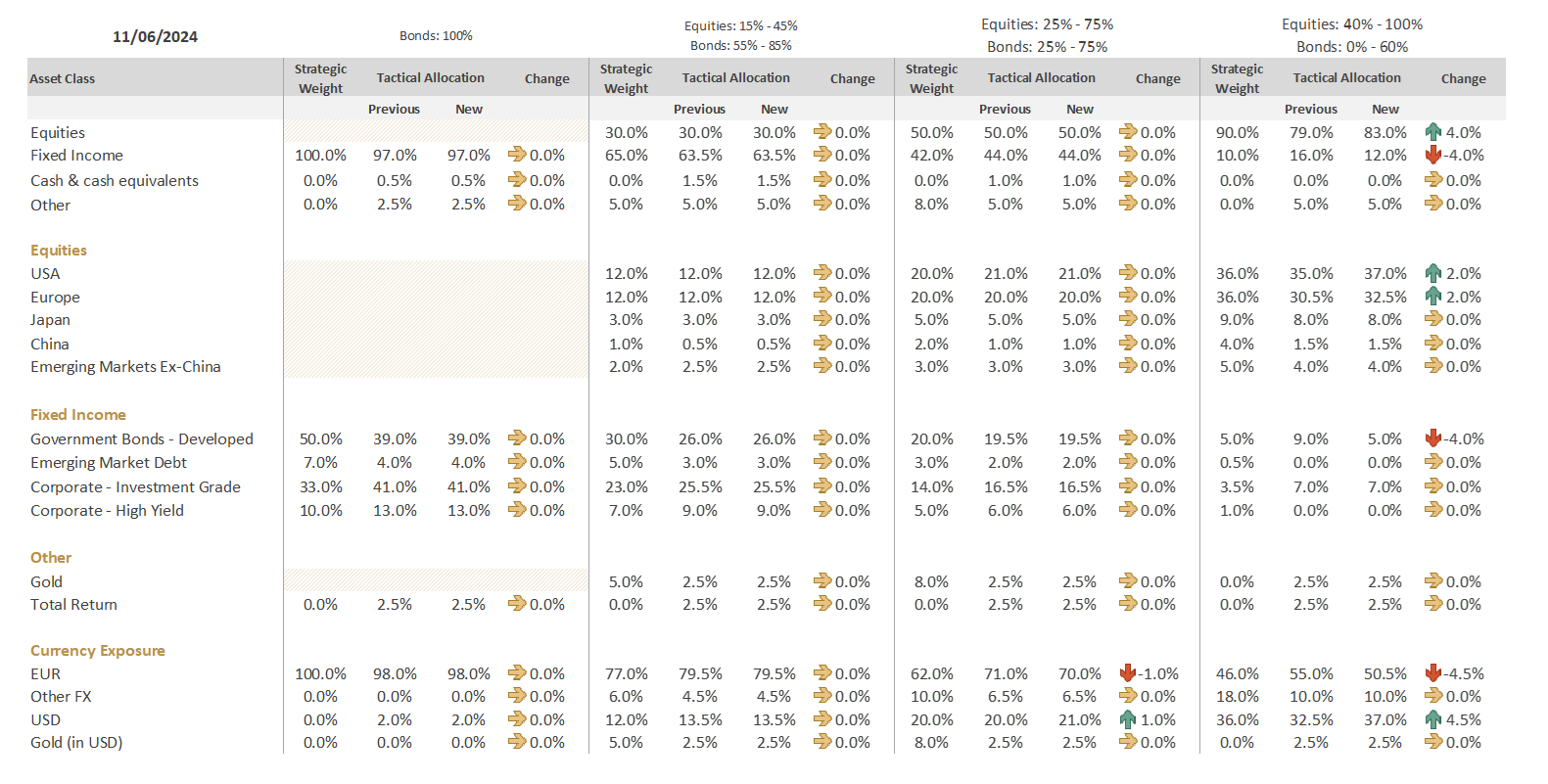

We enter the second half of 2024 broadly neutral on equities. As downside risks in Europe eased while prospects brightened, we have taken incremental steps throughout the course of the year to achieve a more balanced allocation between US and European equities (i.e. we sized opportunities to crystallise gains on our US overweight, while continuing to top up our underweight to Europe).

Equities: Regions

US firms have been delivering strong profit growth, with Q1 earnings growth coming in at more than double estimates (+7.7% YoY vs +3.8%). However, if you strip out the Magnificent Seven stocks, the picture is less impressive: -0.2%! The problem is that from here, the expectations hurdle is very high; analysts see 2024 US earnings going up by 10.5%. This could be challenging in a slowing macro environment, even if we consider an expected margin boost from layoffs and lower commodity prices. The AI revolution is still playing out, and momentum clearly continues to favour companies linked to the theme and large blue chips. For this reason, at our June allocation, we switched remaining exposure to US equally-weighted products into market-cap weighted equivalents.

Believing that euro volatility and weakness is likely to persist in the short-term, we also used this switch to remove currency hedging. This continues a move initiated in May, to increase our dollar exposure given the Fed’s higher-for-longer stance and to hedge EU political risk.

Earnings expectations in Europe are more manageable at 4.3% for this year. A typical boost from interest rate cuts, a pick-up in domestic demand and an improving earnings outlook could support European stocks into the year-end. That said, Europe remains vulnerable to global trade momentum, and we should not be so complacent as to consider the energy crisis done and dusted. While the situation has ameliorated considerably (in large part thanks to warm weather and demand reduction at home and in China), Europe must now turn to volatile and competitive international markets to meet its energy needs.

We remain neutral on Japan and Emerging Markets ex-China, while being underweight China.

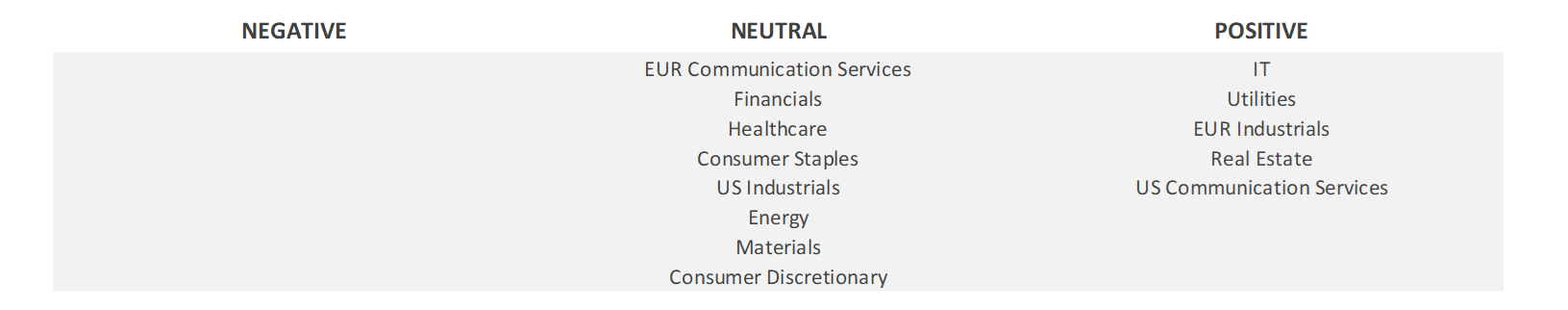

Equities: Sectors

Entering the second half, we have decided to downgrade European Consumer Discretionary to neutral. The sector consists of several sub-segments, luxury, cars and consumer discretionary retail, and performance across them is heterogenous.

In luxury, demand is struggling to keep up with ever-higher prices. Since 2019, major luxury players have increased prices by 33%, on average. But as the cost of living has skyrocketed around the world, consumers have become more discerning, questioning these pricing strategies. We fear that price increases have excluded or alienated consumers and that brands have limited growth levers in the short term.

Carmakers warn of a challenging year on rising costs and muted EV demand, while the price war in China is getting tougher every day. European car producers are vulnerable to China’s retaliation to new EV tariffs imposed be the European Commission.

Retail, on the other hand, is a bright spot. Current trading among high street names is better than expected and growth opportunities are still there. Given the diversity of the sector, we bring our opinion down to Neutral, opting to cherry-pick retail names while reducing exposure to the car sector and luxury companies.

We have also upgraded European Industrials to overweight. Portfolios have a defensive/bond proxy tilt thanks to our Utilities overweight, and we wanted to counterbalance this with Industrials, a sector that is more cyclical in nature. In terms of weightings in the index, Industrials is Europe’s third most important sector, behind financials and health care. The sector has already had a good run this year, but we think there is more to come. Sales and growth are both a few percentage points higher than what we see for the rest of the market because Industrial firms are benefiting from new, higher-growth trends: selling products to makers of EVs, clean energy projects, data centres and defence spending.

Fixed Income

Bond markets have had a difficult start to the year with only credit managing to post positive returns.

With rate-cut expectations priced increasingly further out, there has been upward pressure on rates. At our June allocation, in high-risk profiles we reduced European Government bond exposure in favour of increasing US and European equities. This meant we could continue building positions that are better aligned with the new strategic equity weights implemented in April.

“Higher for longer” makes us cautious when it comes to further adding duration. The ECB delivered what was considered a “hawkish cut” while increasing its growth and inflation forecasts for this year and signalling a gradual pace of easing. In the US, although we are still of the opinion that the cracks in the US job market could widen, leading to a more convincing reaction by central banks which should bring rates down eventually, we believe it is still premature to make a call on duration. Accordingly, we maintain a neutral duration stance and continue to monitor how the curve evolves.

Credit markets are signalling that they can handle “higher for longer”, providing that rate hikes remain off the table. We consequently continue to overweight investment grade (IG) credit which still offers high yields relative to history. The current macro outlook implies that corporate profitability can hold up, while technicals remain very strong with heavy inflows into IG funds leading to very tight spreads. US spreads are at the tightest level this century, but European spreads still have room for further tightening, hence our preference for the latter region.

We also like high-quality high yield. Though spreads are historically tight on both sides of the Atlantic, the asset class remains supported by high yields and a Goldilocks macro situation in which data is supportive of corporate fundamentals without running so hot as to pose a risk to the disinflation process. Defaults in HY have remained remarkably low, despite the fact that firms in this segment are having to pay much higher coupons following one of the fastest rate-hiking campaigns in decades.

Higher US borrowing costs and a stronger dollar could produce a range of negative effects in emerging economies, dictating our underweight stance on Emerging Market Debt. With regard to the small exposure we do hold, we keep our preference for EM sovereign bonds which trade at a wide differential to corporates.

Commodities

We are constructive on gold over the longer term, but acknowledge that the “higher for longer” narrative might pose some hurdles for this non-yielding asset class in the short term. Just recently, a stronger than expected US jobs report (US nonfarm payrolls at +272,000 versus the forecast of +190,000) and an apparent pause in the PBoC’s bullion buying campaign for the first time in 18 months caused gold’s largest daily drop in three and a half years. Astute investors may wish to take advantage of such pullbacks to build long-term positions.

After an impressive Q1 performance (+16.1%) amid geopolitical tensions and reduced supply, oil registered losses in April (-1.50%) and May (-6%). In early June OPEC+ surprised markets, stating that it intended to gradually unwind voluntary cuts of 2.2 million bpd starting in October 2024. These cuts, however, will remain in place during the summer driving season when demand typically rises. Other supply reduction measures remain in place through 2025 and the alliance has reiterated its flexibility to react to market developments.

Cash

In the short term, cash remains an attractive solution for those unnerved by geopolitical noise (we are not). However, reinvestment risk is rising, as the ECB has already begun to lower rates. This makes cash-like solutions that offer visibility on the yield from a medium-to-long term perspective increasingly more palatable.

Conclusion

While the European summer has been much greyer than anyone could have expected this year, the opposite is true for the global macro picture. Here things are brighter than most economists forecasted at the onset of the year. Growth has held up remarkably well, despite tight monetary policy and inflation in developed economies is now on a path to normalization. This is allowing G10 central banks to begin – or contemplate – rate cuts. This should take the shine off cash, give bonds a renewed role in portfolios and keep risk assets supported.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 26, 2026

Weekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...

January 19, 2026

Weekly InsightsWeekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...

January 9, 2026

Weekly InsightsWeekly Investment Insights

Safe haven assets, including gold, rose at the start of the week in response to the US intervention in Venezuela which sparked questions about the...

January 9, 2026

News2026 Outlook

As we step into 2026, the theme of transition will only intensify. In many ways, 2025 marked the starting gun of a new race –...

December 19, 2025

Weekly InsightsWeekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....