Choose Language

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing the probability of a 50 basis point cut. The euro fell to its lowest level in two years on the weak PMI report and bets that the ECB will have to accelerate its monetary easing.

In the US, major stock indexes ended last week in the green, despite ongoing uncertainty of what policies will actually come in place in January when Donald Trump takes office for the second time.

Gold got shinier last week as tensions rose in Russia and Ukraine and investors once again turned to the safe-haven asset. European gas prices rose amid colder weather and increased demand.

Weekly roundup

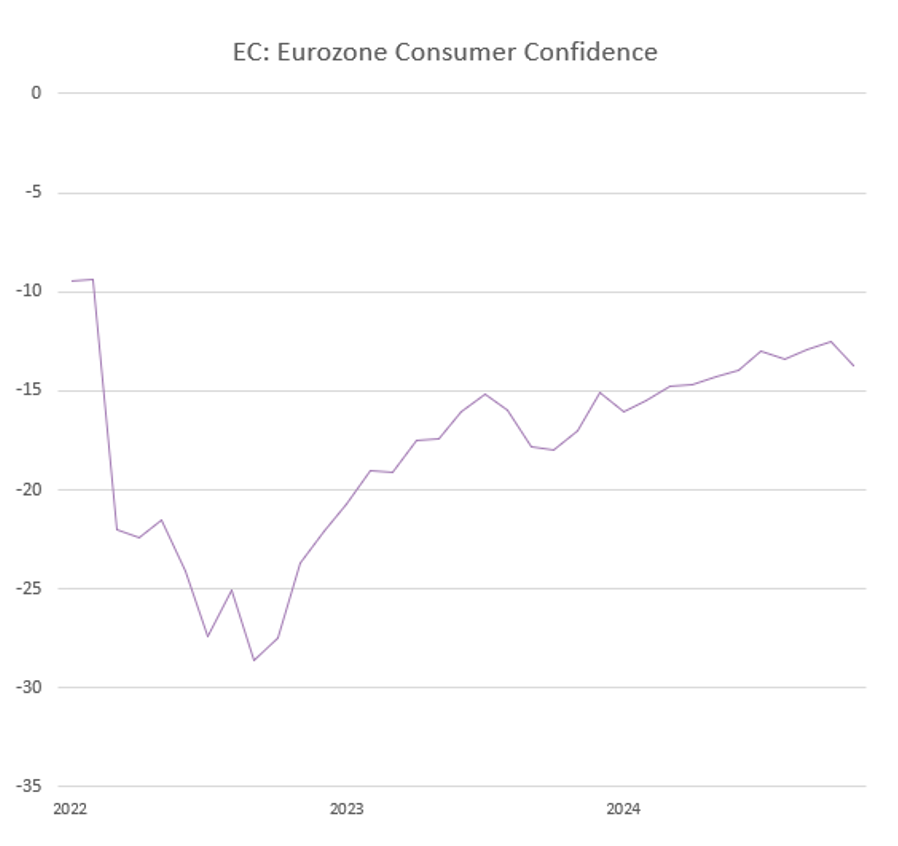

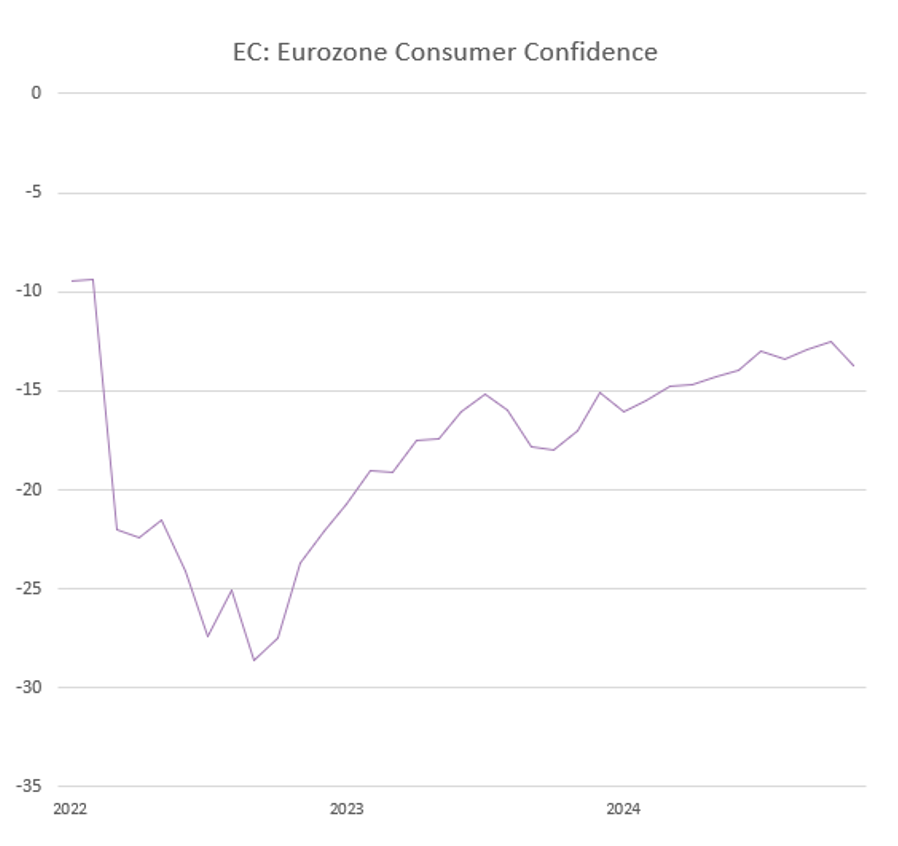

Eurozone negotiated wage growth surged in Q3 but consumer confidence softened

Negotiated wage growth in the Eurozone rose from 3.54% to 5.42% in the third quarter, the biggest increase since 1993. Despite a struggling economy, the rise was largely driven by Germany, where negotiated pay rose by 8.8% year-on-year.

However, the surge in negotiated wage growth is not expected to be a continuing trend, with the ECB forecasting a slowdown in wage growth in 2025 and 2026. Indeed, the strong release did little to support the Euro, suggesting that traders don't believe the data will have a significant impact on the ECB's rate cut path. Governing Council member Yannis Sournaras has argued for a cut at every meeting from now until the ECB reaches the neutral rate which estimates place around 2%.

Source: Bloomberg, BIL

But rising wages are not helping boost consumer confidence in the face of political uncertainty (whether stemming from Trump’s, France’s budget situation or early elections in Germany). Across the Eurozone, it softened by 1.2 points in November, to -13.7.

One month of data doesn’t make a trend and it is yet to be seen if consumer confidence resumes its positive trend. For now, the increase in negotiated wages should support consumption growth over the holiday season.

Source: Bloomberg, BIL

European car industry continues to struggle despite slight uptick in new car registrations

Passenger car registrations in the EU rose by 1.1% year-on-year in October, the first increase in three months. At the national level, Spain led the way with a 7.2% increase, while Germany recorded a rise of 6%. In France and Italy, passenger car registrations fell by 11.1% and 9.1% respectively.

In the first ten months of 2024, total car registrations rose by 0.7% year-on-year, with the market share of new battery electric cars falling from 14% in the previous year to 13.2%. This decline is largely due to a 26.6% drop in Germany after Berlin ended its EV subsidies in December last year.

Europe's difficulty in making the transition to electric vehicles (EVs) remains one of the biggest challenges facing the European automotive industry. Last week, Ford announced it would cut 4,000 jobs in Europe, about 14% of its European workforce, citing weak demand for EVs and increased competition from China.

In a further blow to Europe's EV transition last week, Swedish battery maker Northvolt filed for Chapter 11 bankruptcy protection in the US. Northvolt has been carrying a heavy weight on its shoulders as one of Europe’s most prominent battery makers with the aim to wean carmakers off their dependence on China. But with EV demand growing more slowly than expected, Northvolt has struggled to stay afloat.

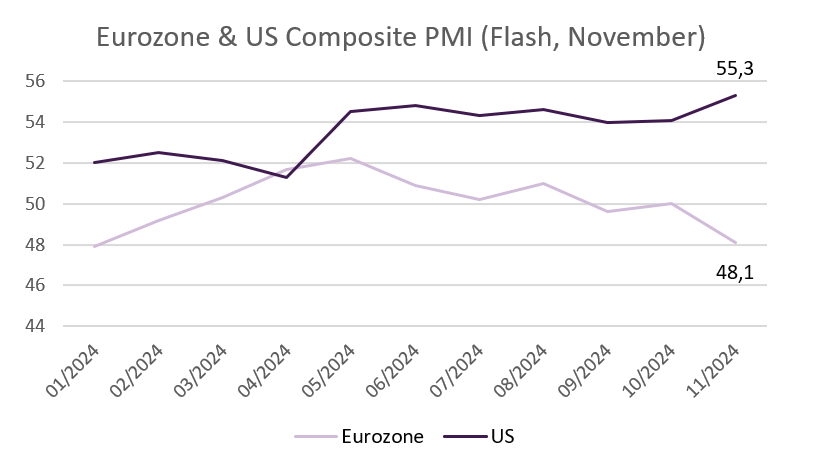

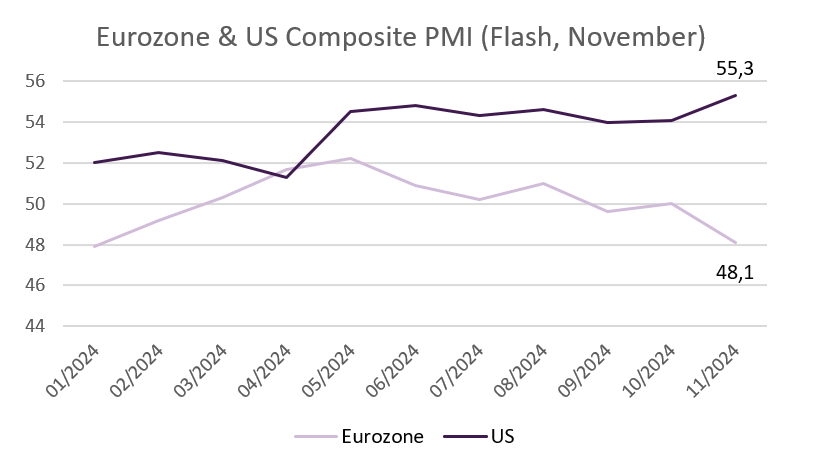

Business activity in Europe takes a hit while the US hits 31-month high

Eurozone manufacturing activity continued to contract in November, with the PMI falling to 45.2, down from 46 in October. The services PMI fell to 49.2, below the growth threshold of 50 for the first time in nine months.

Looking at Europe's largest economies, the downward economic spiral continued in both Germany and France, where business activity fell at the fastest pace since the start of the year.

Germany's manufacturing sector continued to contract, although the PMI edged up slightly to 43.2 from 43 in October. While the rate of decline in factory output has slowed in recent months, it remains historically low. Germany's services sector also fell below 50, to 49.4 in November, amid weak demand and rising inflationary pressures. In further disappointing news, the German economy grew less than previously estimated in Q3, the statistics office reported on Friday.

The weakness in economic activity will further strengthen the case for the ECB to cut interest rates by another 25bp in December.

The US economy is showing robust growth, with the composite PMI reaching a 31-month high of 55.3 in November. The services sector drove the composite PMI higher, rising to 57 from 55 in October. The prospect of lower interest rates and Donald Trump's pro-business agenda have helped to boost optimism and, in turn, business activity. Although the manufacturing sector remains below 50, it rose slightly to 48.8 from 48.5 in October.

Source: Bloomberg, BIL

UK Inflation rises and retail sales slump

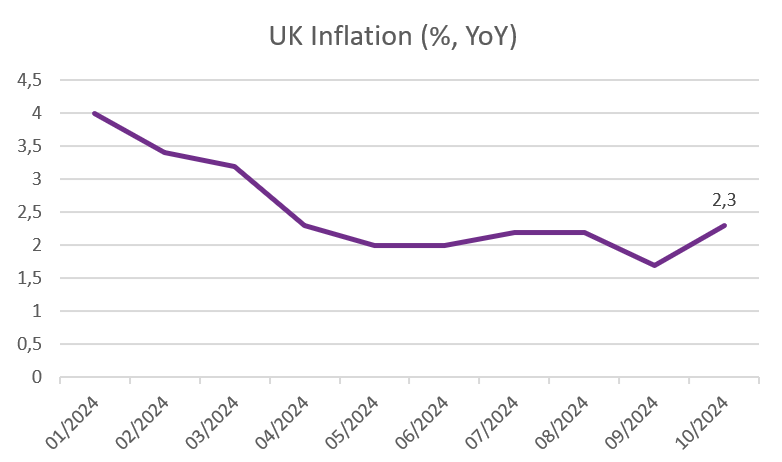

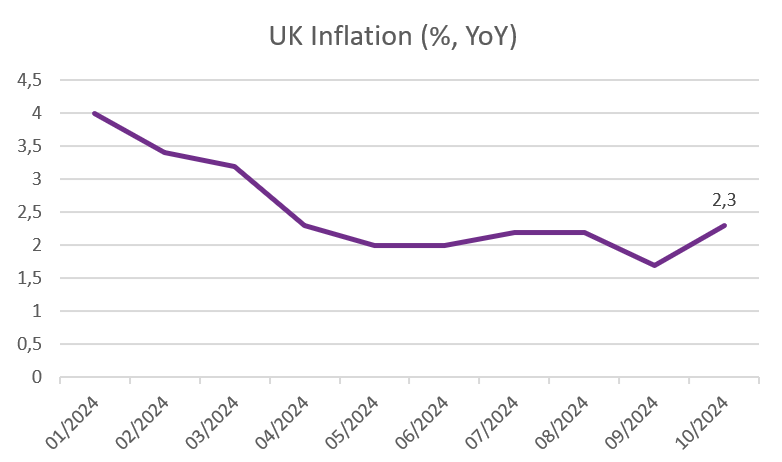

Consumer prices in the UK jumped to a six-month high of 2.3% in October, up from 1.7% in September. The rise puts inflation above the Bank of England's (BoE) 2% target and shows that underlying price growth is gaining momentum. BoE Governor Andrew Bailey has repeatedly stated that the battle against inflation is not yet won and that the BoE “can’t cut interest rates too quickly or by too much.” This latest inflation print underscores the BoE’s more cautious stance.

The increase in inflation was pushed up almost entirely by the rise in the Office of Gas and Electricity Markets (Ofgem) energy price cap in October, pushing up prices for both electricity and gas. Core inflation, which excludes volatile categories such as food and energy, also edged up to 3.3% in October from a three-month low of 3.2% in September.

Source: Bloomberg, BIL

The BoE have said that the new government's budget will add to inflation in 2025, and Donald Trump's threat of tariffs is also likely to have an impact. The Pound strengthened against the US Dollar following the release of the inflation data, before giving back most of the gains.

Retail sales surprised on the downside last week, with volumes falling by 0.7% in October compared with the previous month. This was the sharpest fall in four months and was largely attributed to economic uncertainty ahead of the budget announcement at the end of October. However, this trend is not expected to continue. The GfK consumer confidence index improved for the first time in three months, rising by 3 points in November. The rise in confidence follows the removal of uncertainty ahead of the autumn budget and the US presidential election, lower interest rates and rising wages. The improved confidence is expected to lead to a pick-up in retail sales over the next few months with Black Friday sales and holiday shopping.

Economic calendar for the week ahead

Monday – Germany Ifo Business Climate (November).

Tuesday – US Conference Board Consumer Confidence (November), New Home Sales (October).

Wednesday – Germany GfK Consumer Confidence (December). Switzerland Economic Sentiment (November). US GDP Growth Rate (2nd estimate, Q3), Jobless Claims.

Thursday – Eurozone M3 Money Supply (October), Economic Sentiment (November), Consumer Confidence (Final, November).

Friday – Japan Unemployment Rate (October), Consumer Confidence (November). Germany & Switzerland Retail Sales (October), Switzerland GDP Growth Rate (Q3). Eurozone Inflation Rate (Flash, November).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...