Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global market indices turned crimson too on Wednesday, after the Fed signaled fewer rate cuts next year. But all’s well that ends well, and by the end of the week, the selloff was judged as an “overreaction” and US stocks were on the up again. European markets remained under pressure at the end of the week, with a well-known pharma player (and Europe’s biggest stock by market cap) tumbling after a disappointing drugs trial.

Please note that the Weekly Investment Insights will be paused over the holiday period and will resume on the 10th of January. We wish you a safe and happy holiday period.

Weekly roundup

US Federal Reserve cuts rates but signals slower easing next year

At the Fed’s last monetary policy committee of 2024, the US central bank lowered its main rate by 25bp, as expected, bringing it to a target range of 4.25-4.50%. One participant (Cleveland Fed President Hammack) voted against the move, preferring to leave rates unchanged.

The cut was accompanied by a refreshed a dot plot indicating that Fed members only see two additional cuts in 2025, down from the four foreseen in September. Still, the plot indicates a further two cuts in 2026 (as in September), and one final cut in 2027. The neutral rate estimate was lifted further to 3.0%.

The new macro forecasts show higher inflation then previously expected in Q4 next year. PCE inflation was lifted from 2.1% YoY to 2.5% YoY, while core inflation was lifted from 2.2% YoY to 2.5% YoY. During the press conference Powell said the rationale for this was stronger-than-expected economic growth and a lower unemployment rate this year.

Following the decision, the 2-year US treasury yield rose markedly, and stock markets retreated on the prospect of less monetary easing. The USD strengthened against the EUR, from 1.05 prior to the release to 1.0350 after the press conference.

Is private sector activity in the Eurozone bottoming out?

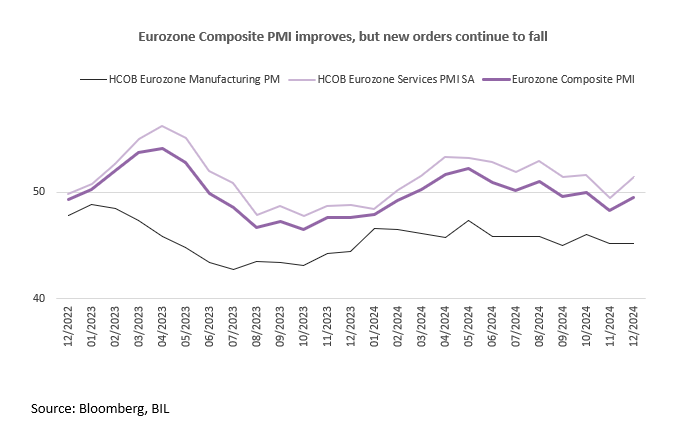

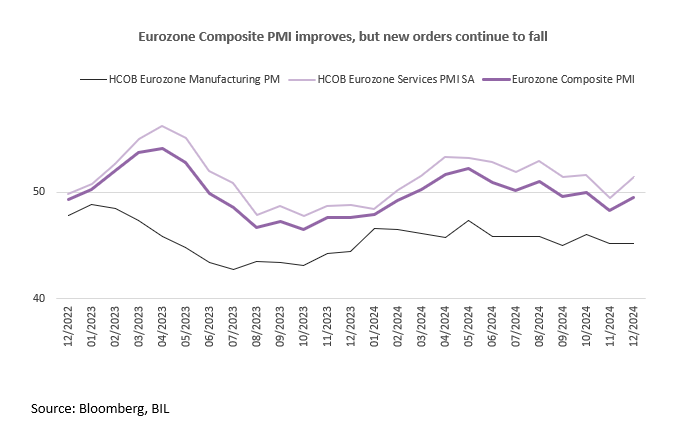

Don’t count the chickens just yet, would be our response to that question following the latest slate of PMI data. While the Composite PMI increased to 49.5 in December, up from 48.3, and trouncing forecasts of 48.2, the underlying details were not very promising. New orders continued to decline across the economy, while the pace of job cuts accelerated to its fastest in four years as firms adjusted to reduced workloads (primarily in manufacturing, with stagnation in services). With both Germany and France firmly in contraction, the reality is that the broader Eurozone economy is without two key engines: Without them, it will be difficult for it to get airborne again.

Giving us more colour about the situation in the Eurozone’s largest economy, last week, we also had the IFO Business Climate Index, the most prominent leading indicator for German GDP growth. It decreased for a second month to 84.7, reaching the lowest level since May 2020, with the IFO reporting that "The weakness of the German economy has become chronic."

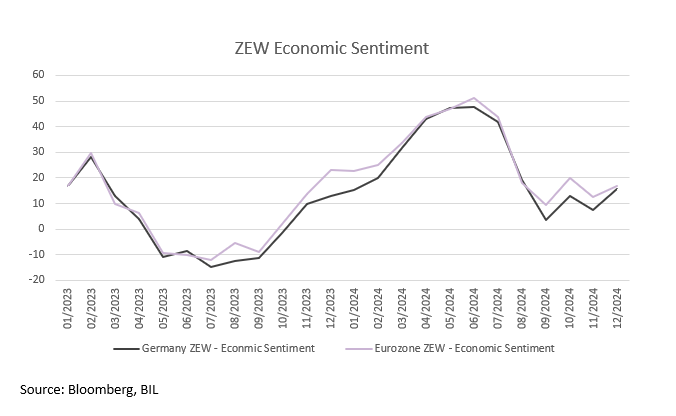

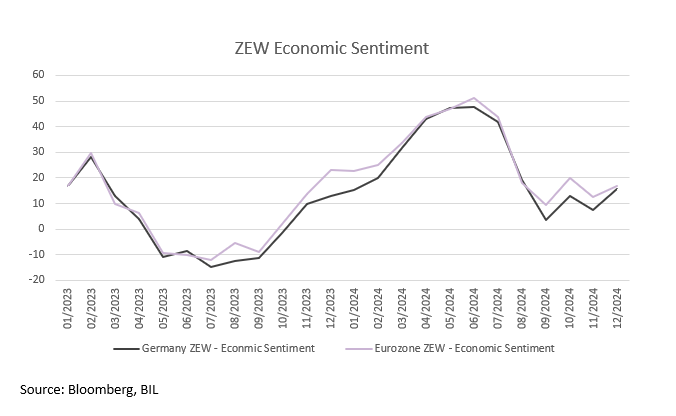

But the macro data is not entirely “Bah! Humbug!”. The latest ZEW survey of investment professionals suggests that while the situation might be depressed for the time being, there is a renewed sense of optimism about the future creeping in. The German sentiment index unexpectedly jumped to 15.7 in December, the highest in four months, up from 7.4 in November and well above forecasts of 6.5. In turn, that pulled up the broader Eurozone index, which rose from 12.5 to 17.0. The ZEW press release attributed the improvement in expectations to the upcoming snap elections in Germany, which investors suspect will result in “an investment-friendly economic policy”, and the prospect of further rate cuts from the ECB.

Last week, German Chancellor Olaf Scholz lost a confidence vote in Parliament, paving the way for Federal elections to take place on 23rd February.

Retail sales signal that the US economy remains in good shape

US Retail Sales increased 3.8% YoY in November, the biggest annual rise since December last year, and following an upwardly revised 2.9% gain in October. Car sales were the strongest in over three years, amid lower interest rates and year-end discounts. We also speculate that the figure was boosted by people replacing vehicles damaged by the recent hurricanes in the south. Notably, spending at restaurants and bars (the only services related category in the data) fell for the first time since March.

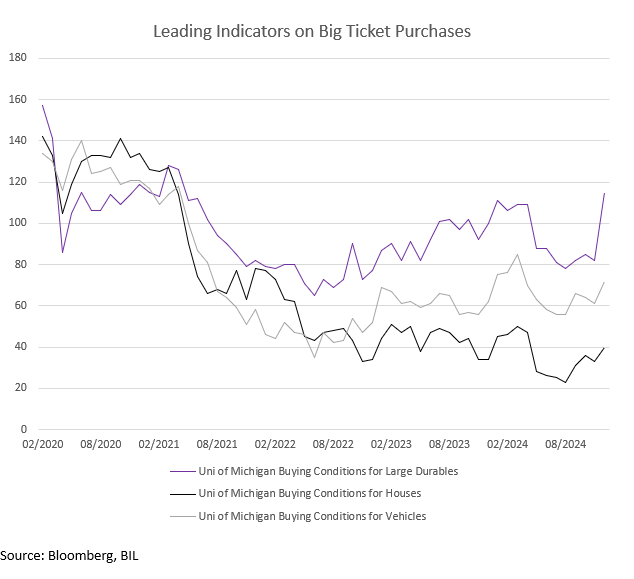

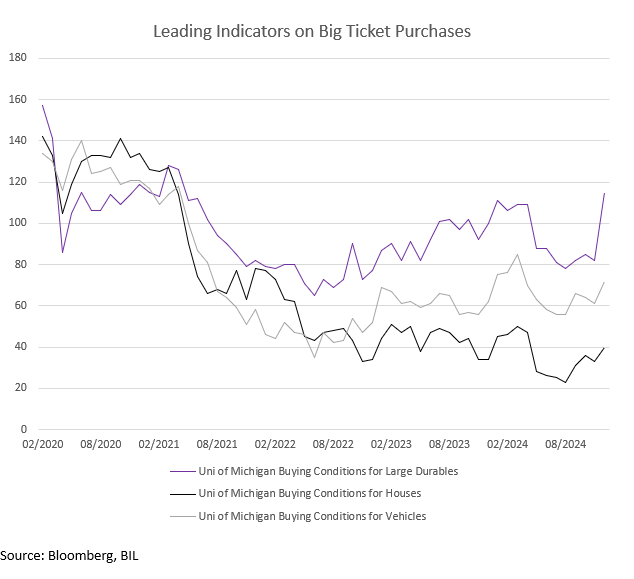

Core retail sales, which are used to calculate GDP, increased 0.4%. Overall, the continued strength of the consumer suggests the US economy remains in good stead as we enter 2025. Trade tariffs (which are essentially a tax on the consumer) risk altering that picture… In fact, some analysts already suggest that the surge in buying we are seeing might be partly due to the fact that buyers are frontloading their purchases, anticipating higher prices later on. This squares with the fact that the buying intentions for large durables rose by the largest amount on record in December (as measured by the University of Michigan).

US election boost is palpable in US PMI data

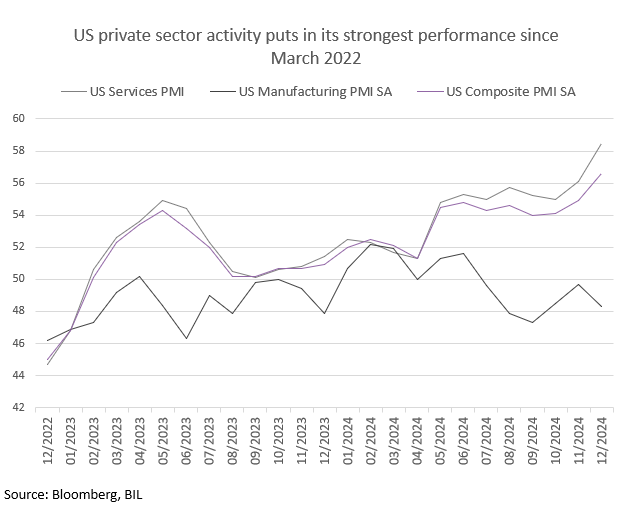

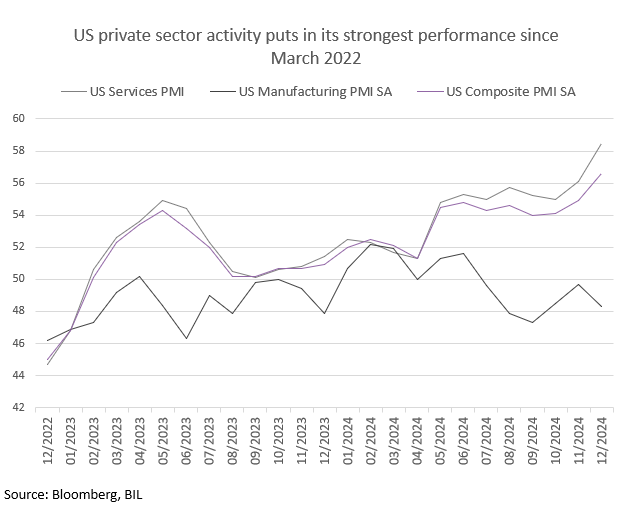

The US composite PMI rose to 56.6 in December, according to a flash release by S&P Global. This points to the strongest performance of the private sector since March 2022, driven by a surge in services (58.5, the highest since October 2021) while the manufacturing downturn deepened (48.3). Activity levels expanded at a quicker pace in response to strengthening demand. Indeed, new orders rose at the fastest rate since April 2022, driven by services, and employment increased for the first time in five months. In addition, inflationary pressures cooled further despite a jump in input cost inflation in manufacturing. Expectations about output in the coming year hit a two-and-a-half year high, reflecting growing optimism about business conditions under the incoming Trump administration. There is, however, also growing nervousness about potential trade tariffs.

The composite PMI is consistent, in isolation, with GDP growth picking up to an annualized pace of around 3.5% around the turn of this year, stronger than the 2.8% pace recorded in Q3.

The Bank of England leaves rate steady at 4.75% amid cooling growth and rising inflation

On Thursday, the Bank of England (BoE) decided to leave its benchmark bank rate unchanged at 4.75%, in line with market expectations. The decision followed indicators pointing to the risk of continued price pressures with rising inflation and higher-than-expected wage growth.

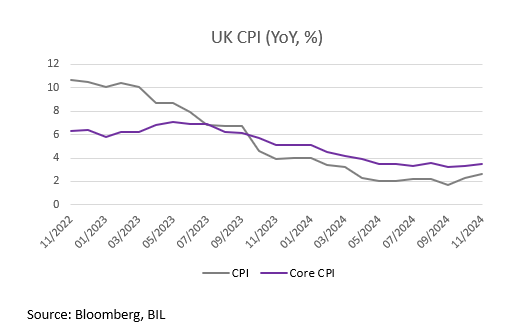

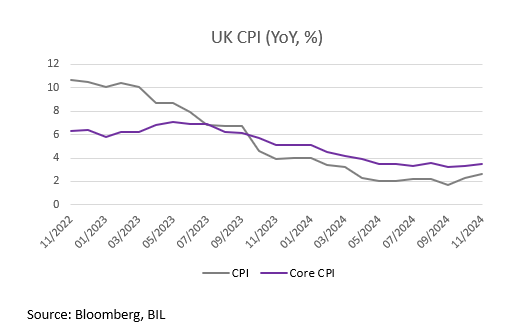

Consumer prices rose at the fastest pace in eight months in November, with the inflation rate rising to 2.6% from 2.3% in October. Services inflation, which is closely monitored by the BoE, held steady at 5%. Core inflation, which excludes energy, food, alcohol and tobacco, rose to 3.5% in November from 3.3% the previous month. Getting inflation under control remains high on the BoE's priority list, as evidenced by its decision not to cut interest rates despite other recent weaker-than-expected data.

According to preliminary data, the UK economy contracted for the second consecutive month in October. Although the preliminary figures for monthly GDP growth are subject to revision, September and October’s figures illustrate the impact of the uncertainty in the run-up to the Autumn Budget announcement and perhaps beyond. The data is part of a string of weaker-than-expected UK economic releases of late, with retail sales, business surveys and inflation data all lacking in optimism. The Pound fell against the US Dollar following the GDP data, before recovering slightly.

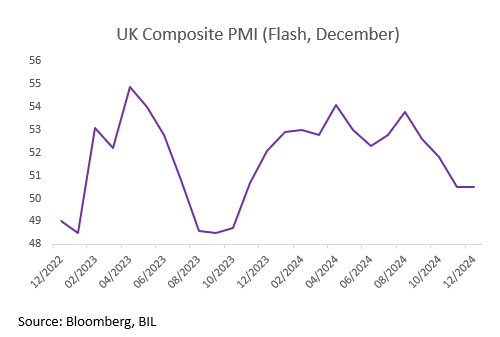

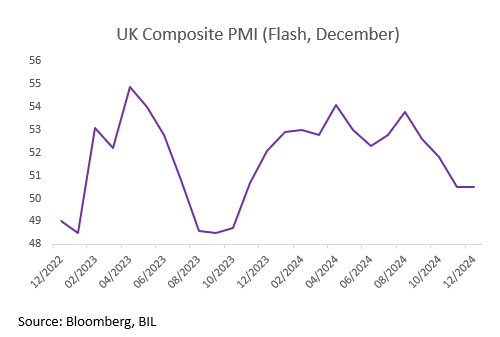

Looking at business activity, In December, the UK Composite PMI held steady at 50.5, just above the growth threshold. However, the manufacturing PMI fell to 47.3, indicating a second consecutive month of declining production and a sharp drop in new orders. The services sector drove growth, rising to 51.4 from a 13-month low of 50.8. Despite this, service providers reported a sharp fall in employment, citing rising costs from higher National Insurance contributions.

While the BoE kept interest rates unchanged in a bid to curb inflation, it warned that the UK economy is on the brink of stagnation and cut its Q4 growth forecast to 0%. The BoE will now have to tread carefully on the path of monetary policy in 2025, continuing to lower borrowing costs to support growth while likely facing rising inflation, geopolitical tensions and a potential trade war.

Calendar for the week ahead

Monday – UK GDP Growth (Q3, Final Print). US Conference Board Consumer Confidence (December)

Tuesday – Bank of Japan Monetary Policy Meeting Minutes. US Durable Goods Orders, New Home Sales, Building Permits (all November). China PBoC 1-Year MLF Announcement

Wednesday – Christmas Day

Thursday – France Unemployment Data. US Weekly Jobless Claims

Friday – Japan Unemployment Rate, Inflation data, Retail Sales, Industrial Production. China Industrial Profits. Spain Retail Sales (November). US S&P/Case-Shiller Home Price Index

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more