Donald Trump takes office for the second time this week and the new administration is sure to have a major impact on the economy both at home and abroad. Guessing games as to how fast and furious tariffs will be have been tangibly impacting markets and any potential clarity following his inauguration this week will be warmly welcomed.

Politics aside, equities had their best week since the election in the final week before Trump returned to the White House, with somewhat reassuring inflation data giving fixed income markets a break and allowing stocks to pick up on renewed rate cut hopes. A strong start to the earnings season also helped.

Oil ended last week on a four-week winning streak as new sanctions on Russian oil sparked supply fears.

Weekly roundup

US banks kick off earnings season with a bang

Last week, the US earnings season kicked off Wall Street banks beating estimates for both the top and bottom-line, while guidance has been generally well-received as well. The strong results were largely powered by a boom in dealmaking and trading; the Presidential election played a part, with clients at bulge-bracket banks looking to re-risk and stock up on equities after the results became known. There were even some very tentative signs of recovery in the luxury sector, at least in the Americas and Europe, while demand in China remains weak. Firms therein which cater to the ultra rich appear to be holding up better than those brands with a broader appeal. LVMH, the world’s largest luxury group, will report its earnings on January 28th, giving more clarity.

According to FactSet, the S&P 500 is currently expected to report earnings growth of 11.7% YoY for Q4, which would mark the highest growth rate reported by the index since Q4 2021. The hurdle is high for companies. The key risk, however, is that forward guidance disappoints. ETF holders should pay attention as the risks are concentrated around few names (particularly those with an AI halo)…

Currency risk is another thing we will be paying attention to this reporting season. For a long time, investors didn’t have to worry too much about currency risk, but it is now emerging as a watch item as the USD has risen 8% versus the euro since September, edging closer to parity. This upward lurch could upset investment strategies, especially at big US multinationals with a large proportion of sales coming from overseas markets. If such companies have not hedged the risk of a stronger USD, they could see the value of their repatriated profits come down. Earnings season will reveal which companies have been swimming naked.

Eurozone house prices continued to rebound in Q3 2024

According to freshly-released Eurostat figures, annual house price growth across the bloc continued to rebound in Q3 2024, though divergences across countries persist. House prices in the euro area, as measured by Eurostat’s House Price Index, increased by 2.6% (YoY) in Q3, quickening from a pace of 1.4% recorded in Q2. Rents increased by 3.2% compared with Q3 2023.

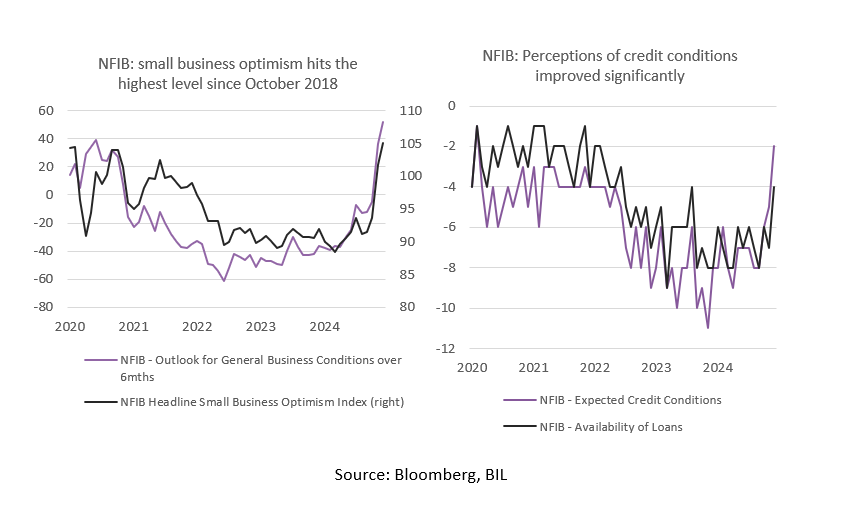

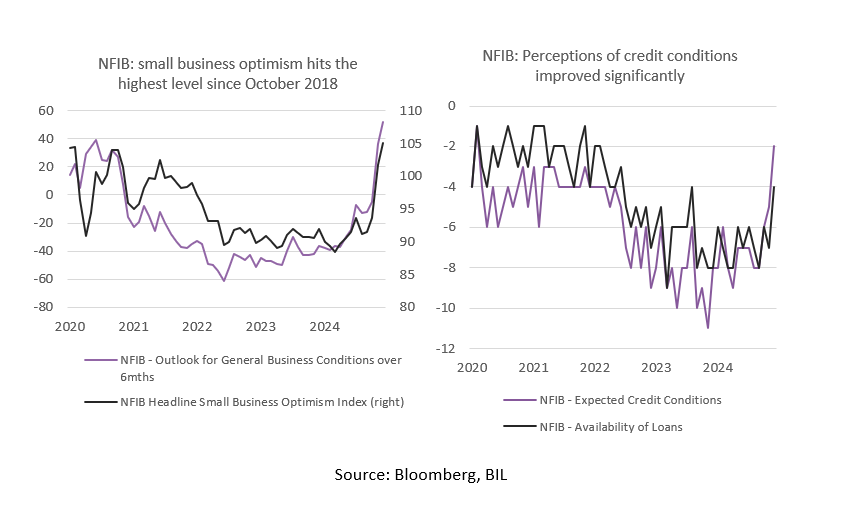

Optimism amid US small business rises to the highest level since October 2018

Main street businesses in the US are starry-eyed on the prospect of the incoming administration, with Trump set to take the Oval Office on January 20th. The NFIB optimism index rose to 105.1 in December, after recording its sharpest monthly rise on record in November after the elections. The sub-index measuring expectations about business conditions in the future rose to the highest level since 2002, while. The net percent of owners expecting the economy to improve rose 16 points to 52%, the highest since Q4 1983! Feelings of uncertainty among small businesses dissipated, while those expecting higher sales rose to the highest level since January 2020.

Interestingly and despite the fact that the Fed has clearly shifted down a gear in its rate cutting plans, perceptions of credit conditions improved significantly. Let’s see if the surge in bond yields at the onset of 2025 changes that.

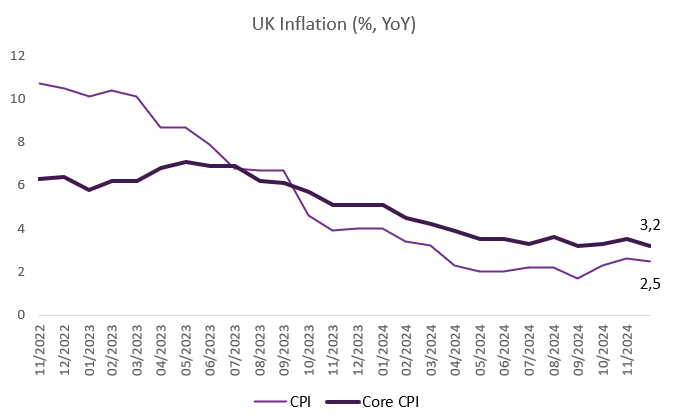

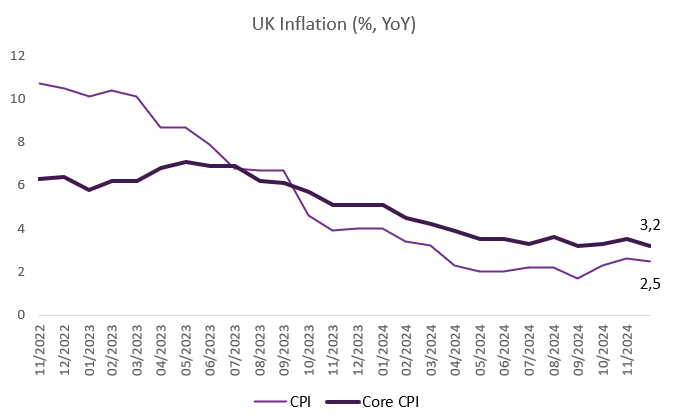

Risk assets rise on UK and US inflation data

UK inflation unexpectedly slowed in December, with core measure, which is closely watched by the Bank of England (BoE), falling sharply. The annual rate of inflation fell to 2.5% in December from 2.6% in November. Core inflation, which excludes energy, food, alcohol and tobacco prices, fell to 3.2% from 3.5% in November. There was also a surprising fall in services inflation, which fell to 4.4% in December from 5% in the previous month.

Although inflation is expected to pick up this year, the fall at the end of 2024 has increased market bets that the BoE will cut interest rates, with the first cut expected on 6 February. Two rate cuts in 2025 are now fully priced in by markets.

The prospect of rate cuts will come as a relief to Finance Minister Rachel Reeves after a spike in borrowing costs last week threatened the government's ability to meet its own fiscal rules. It is hoped that the slight dip in price pressures will reassure investors that the BoE will continue to cut interest rates. The softer inflation figures sent UK equities upward.

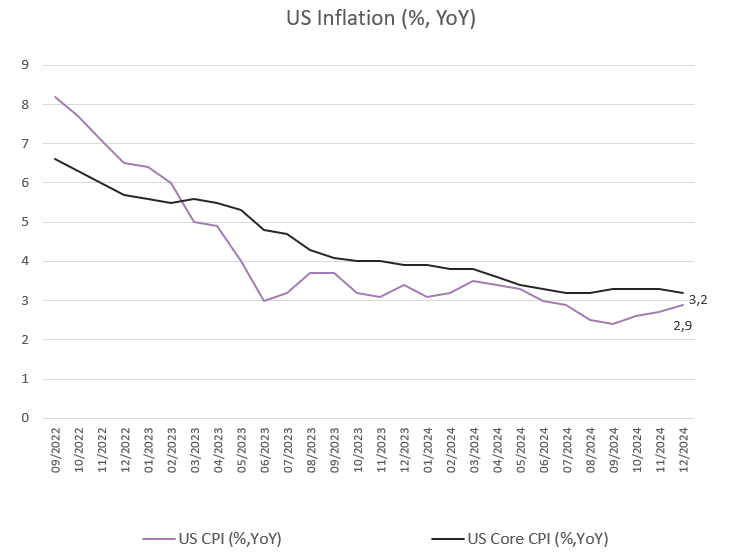

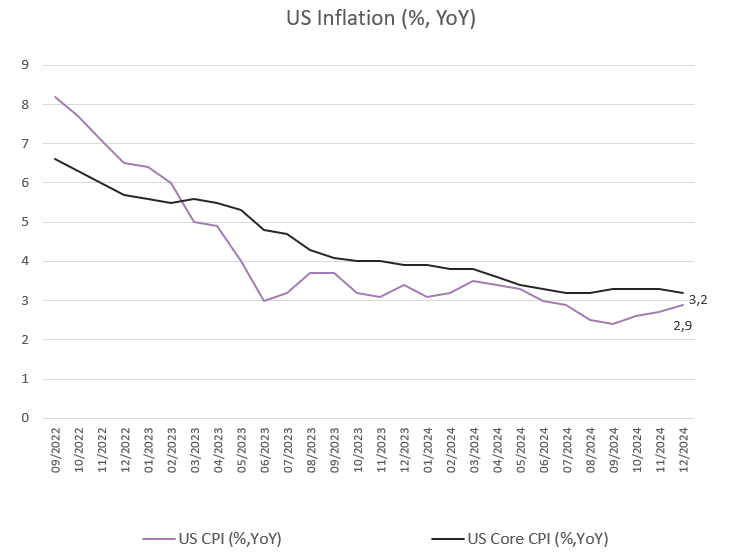

Source: Bloomberg, BIL

Across the pond, US inflation was shown to have risen for a third consecutive month in December, hitting 2.9%. While consumers are still grappling with higher prices when it comes essentials such as groceries (eggs saw a year-on-year rise of 38.6% amid an outbreak of avian flu), housing, and some services such as air fares, a lot of the increase boiled down to energy base effects.

The core print, which strips out volatile categories like food and energy, unexpectedly softened, from 3.2% to 3.3%. That came as a relief to investors, who have been growing increasingly concerned that inflation had become stuck above the Fed’s 2% target after a steady decline in prices in 2023 and through much of last year. Risk assets struggled early 2025, with traders scaling back expectations of Federal Reserve rate cuts, fearing the Trump’s policies on immigration and trade could fan inflation by pushing up the price of goods and labour.

Concerns about a resurgence of inflation have sent Treasury yields higher, which has also pushed up borrowing costs for mortgages, cars, and credit cards, even as the Fed has cut its key rate.

After the somewhat reassuring inflation print, US equities and Treasuries gained.

Source: Bloomberg, BIL

China meets its official economic growth target

China’s fourth quarter growth was reported at 5.4%, ahead of expectations. The reading suggests that a wave of stimulus from Beijing to boost growth might be starting to bear some fruit, and it also meant that economic growth for the full year of 2024 was bang in line with the official 5% target. However, looking beneath the bonnet reveals that growth was imbalanced, driven by industry and exports. Export-led growth has been partly underpinned by PPI deflation which makes Chinese goods more competitive on global markets, as well as a rush by factories to send inventories overseas before Trump takes office.

Weak domestic demand continues as a pain point, while unemployment is creeping up too.

With structural issues still very much present, it is too soon to say China is out of the woods. Especially considering potentially damaging trade tariffs that the Trump administration might implement. In his campaign trail, Trump threatened tariffs as high as 60% on Chinese goods. The unresolved property crisis lingers in the background as another key watch item. Property investment contracted 10.6% in 2024, marking the worst year since records began in 1987.

Calendar for the week ahead

Monday – President Trump’s Inauguration Day. Germany PPI. China Loan Prime Rate.

Tuesday – UK Unemployment Rate, Average Earnings. Eurozone and Germany ZEW Economic Sentiment.

Thursday – Weekly Jobless Claims. Eurozone Consumer Confidence.

Friday – Japan Inflation and Bank of Japan Monetary Policy Meeting. UK Consumer Confidence. Eurozone, UK, US Flash PMI. US Michigan Consumer Confidence (Final), Existing Home Sales.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more