Choose Language

January 27, 2025

Weekly InsightsWeekly Investment Insights

Last week, world leaders gathered in Davos for the annual five-day meeting of the World Economic Forum. On the agenda were geopolitics, US-EU-China relations, climate and energy, the global economic outlook and much more. But what made the headlines was a little further away from Switzerland, in the US: Trump's first week in the Oval Office. Markets were turbulent as investors hung on every word Trump uttered, providing a taste of what the next four years could be like.

European stocks hit a record high last week, with investors showing optimism about Trump’s Davos announcement saying that he will demand lower interest rates. Oil prices declined after Trump declared an energy emergency and the US dollar fell on hints of a softer stance on China tariffs.

This week sees monetary policy meetings from both the Fed and the ECB. The Fed is expected to hold rates steady while the ECB is expected to cut rates by 25bps.

Weekly roundup

Trump’s first week in office

President Donald Trump has only been back in the Oval Office for a week, but he has wasted no time in making good on his campaign promises. To the surprise of many, his first order of business was not to implement his promised trade tariffs but instead focused on immigration, the environment and diversity initiatives. It was not long, however, before Trump doubled down on his promise to impose trade tariffs.

In his first week back in office, Trump signed more than 70 executive orders, some of which include:

- Barring asylum from people arriving at the southern border

- Move to end birthright citizenship

- The suspension of the Refugee Admissions Program

- Assessing China's compliance with a trade deal signed by Trump in 2020, as well as the United States-Mexico-Canada Agreement

- Ordering the government to study the feasibility of creating an "External Revenue Service" to collect tariffs and duties

- Withdrawing the United States from the Paris Agreement

- Rolling back electric vehicle targets

- Declaring a national energy emergency, unlocking the power to waive certain environmental regulations

These are just some of the executive orders signed by Trump during his first week in office, but they are some that investors will be watching closely for their potential impact on the economy.

In addition to these orders, Trump has vowed to hit China, Mexico, Canada and the European Union with tariffs, some of which as early as 1 February.

All of these announcements made for turbulent markets last week as investors tried to make sense of the potential impact of Trump's promises.

Services continues to drive growth on both sides of the Atlantic

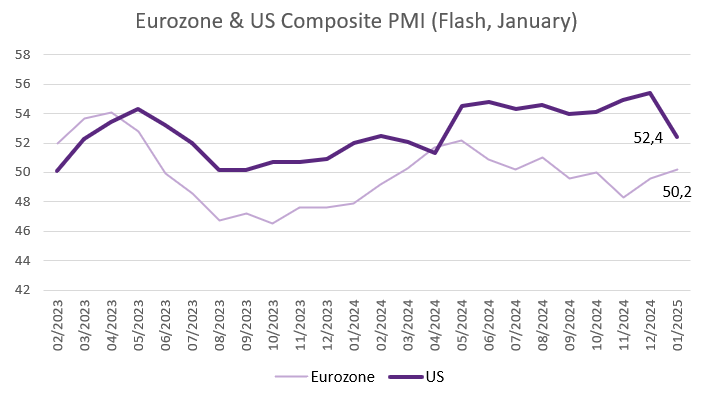

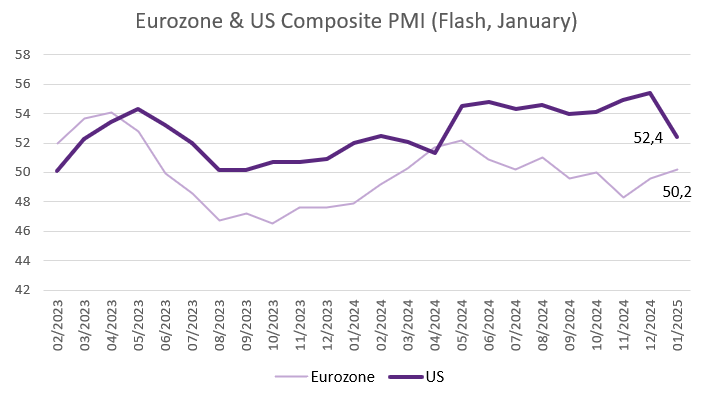

The eurozone composite PMI rose to 50.2 in January from 49.6 the previous month. The increase was driven by an improvement in manufacturing, while services activity declined slightly to 51.4 in January. New business rose in the services sector, but demand from abroad fell. On the employment side, the number of people in work rose at the fastest pace in six months. Input prices also rose sharply, at the fastest rate in nine months.

Turning to the manufacturing sector, the PMI surprised on the upside, rising to 46.1 in January from 45.1 in December. Output, new business and employment continued to fall, though the contraction in output was the slowest in 8 months. Input costs also rose for the first time in five months.

Across the Atlantic in the US, the composite PMI eased to 52.4 in January from 55.4 in December, driven by a slowdown in the services sector. In the manufacturing sector, growth resumed after six months of contraction, rising to 50.1 from 49.4 in December. The services sector continued to expand, but at a slower pace, with the PMI falling to 52.8 in January from 58.8 in the previous month. Businesses' outlook for the year ahead, however, was at its highest level since May 2022, boosted by optimism over the new government's policies.

Source: Bloomberg, BIL

Projections for Germany’s growth slashed after two years of recession

The German economy shrank by 0.2% in 2024. The Bundesbank, Germany’s central bank, has cut its growth forecast for 2025 from 1.1% to 0.2%. The downgrade comes after two years in which the German economy has contracted due to increased competition, high energy costs and political uncertainty.

The ZEW indicator for economic sentiment fell to 10.3 in January, from 15.7 in December, in response to the lack of growth and inflationary pressures on the horizon. This, combined with Trump's recent reassurance that Europe will indeed be hit by tariffs soon, continues to leave little optimism for a German recovery any time soon.

Bank of Japan raises interest rates to a 17 year high

The Bank of Japan (BoJ) raised its short-term interest rate by 25bps to 0.5% on Friday, the highest level since the 2008 financial crisis. The decision was widely expected and was in line with the BoJ's pledge to continue raising rates after the 25bps hike last July, although no guidance was given on when a next hike might be expected.

Just before the monetary policy meeting, Japan's core inflation figures for December came in at 3% year-on-year, the highest level since August 2023. Unlike in other economies, an inflation rate at or above the BoJ's 2% inflation target is more welcome. Japan has long struggled with deflation hanging over the economy and is trying to encourage inflation that will boost wages and increase consumption, breathing more life into the economy.

The BoJ raised its inflation forecasts, noting that the price outlook is now skewed to the upside amid worsening labour shortages, rising rice costs and higher import costs due to a weak yen.

The yen rallied after the BoJ's rate decision and inflation upgrade.

Calendar for the week ahead

Monday – Germany Ifo Business Climate (January).

Tuesday – France Consumer Confidence (January). Spain Unemployment Rate (Q4). US CB Consumer Confidence (January).

Wednesday – Germany GfK Consumer Confidence (February). Fed Interest Rate Decision.

Thursday – Switzerland Balance of Trade (December), KOF Leading Indicators (January). Eurozone, France, Germany, Italy GDP Growth Rate (Flash, Q4). Eurozone Unemployment Rate (December), Consumer Confidence (Final, January). ECB Interest Rate Decision. US GDP Growth Rate (Adv, Q4), Jobless Claims.

Friday – Germany, Switzerland Retail Sales (December).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 28, 2025

NewsNavigating Europe’s Demographic...

Europe faces a multitude of structural challenges that threaten its economic stability and future growth. In addition to the ongoing malaise in manufacturing, political...

BILBoard January 2025 – Snakes ...

While western New Year celebrations are already behind us, January 29th will usher in the Chinese New Year of the Snake. People belonging to that...

January 20, 2025

Weekly InsightsWeekly Investment Insights

Donald Trump takes office for the second time this week and the new administration is sure to have a major impact on the economy...

January 13, 2025

Weekly InsightsWeekly Investment Insights

Looking back on 2024, it was a year marked by conflict and political uncertainty, but it also saw major advances in space exploration, the...