Choose Language

February 3, 2025

Weekly InsightsWeekly Investment Insights

By Friday, it seemed as though a volatile week for stocks had ended on a positive note. The damage caused after Chinese AI app DeepSeek hit the financial markets like a cannonball, was quite quickly mended, with the NASDAQ 100 having recovered losses by the end of the week. DeepSeek's claim that its model was created at a fraction of the cost of its rivals caused a huge tech slump as investors began to question the amount of money that has gone into creating Western AI models. However, the market recovered on positive earnings results, eco data and from dip-buying activity. In Europe, stocks climbed to a record high on Wednesday after a chipmaker earnings report brought renewed optimism.

After-hours trading, however, saw equity futures sink over the weekend, with President Trump announcing 10% tariffs on China, and 25% trade tariffs on Mexico and Canada, effective Tuesday. According to the fact sheet, the purpose is to hold the three countries "accountable to their promises of halting illegal immigration and stopping poisonous fentanyl and other drugs from flowing into [the US]." In response to the news, the US dollar surged, with traders anticipating that tariffs will fan inflation and galvanise the case for “higher for longer” interest rates. The Canadian dollar fell to its weakest level since 2003 and Canadian Prime Minister Trudeau announced a 25% counter-tariff on USD 106 Billion worth of goods.

China, still in the midst of the Lunar New Year break, vowed “corresponding countermeasures”.

Trump also said that tariffs on European goods would “definitely happen”, noting the large trade deficit and lack of US exports to the bloc. The single-currency headed closer to parity with the USD.

Amid the sudden escalation in trade tensions, Monday morning saw the sell-off spread across asset classes.

Weekly roundup

Central bank watch

On Wednesday, the US Federal Reserve’s monetary policy meeting was somewhat of a non-event for markets. It kept rates on hold at a target range of 4.25% to 4.5%, with Chair Powell explaining that the central bank would need to see “real progress on inflation or some weakness in the labour market” before it considers making adjustments, iterating that he was in no rush. The Fed said that the "unemployment rate has stabilised at a low level" and that labour market conditions "remain solid". Weekly jobless claims data would concur.

Powell also revealed that he had not communicated with President Trump since he insisted interest rates come down immediately in Davos and said the Fed is rather “focusing on using our tools to achieve our goals and really keeping our heads down and doing our work”. He also commented that the Fed awaits clarity on the Trump Administration’s policies, “before we can even begin to make a plausible assessment of what their implications for the economy will be.”

Fears have been rising in recent weeks that policies on immigration and trade could stoke inflation. The monetary policy statement removed a reference to inflation making progress toward the 2% objective, but Chairman Powell emphasised the change in wording was more of a clean-up excercise than a policy signal. On Friday, the Fed’s preferred inflation gauge, the PCE Index, came in at 2.6% YoY, while the core (which excludes volatile categories like food and energy) came in at 2.8%. Both prints were in line with expectations.

On the heels of the Fed, on Thursday, the European Central Bank lowered its main rate by 25 basis points to 2.75%, as was widely expected. It marked the fifth rate cut of the cycle and the decision was unanimous. The ECB’s assessment is that “monetary policy remains restrictive”, indicating that further cuts are in the pipeline. Governor Lagarde indicated the same at the press conference, stating that “we know the direction of travel”, although she also noted that discussions about where to stop cuts is premature.

The press release maintained the message from December, saying the ECB “will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance”, and that the Governing Council is “not pre-committing to a particular rate path”.

The ECB describes the disinflation process as “well on track”, despite continued high headline inflation. While the economy is “still facing headwinds”, the central bank expects rising real incomes and gradually fading effects of restrictive monetary policy to “support a pick-up in demand over time”.

Market reactions to the ECB’s rate decision were limited, as the rate cut had already been fully priced in.

The Bank of Canada reduced rates by 25 basis points and announced the end of quantitative tightening in March. It refrained from offering guidance because of tariff threats.

Can consumption continue driving US growth?

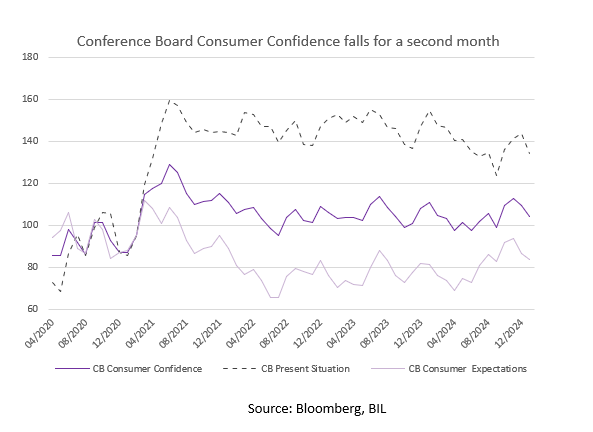

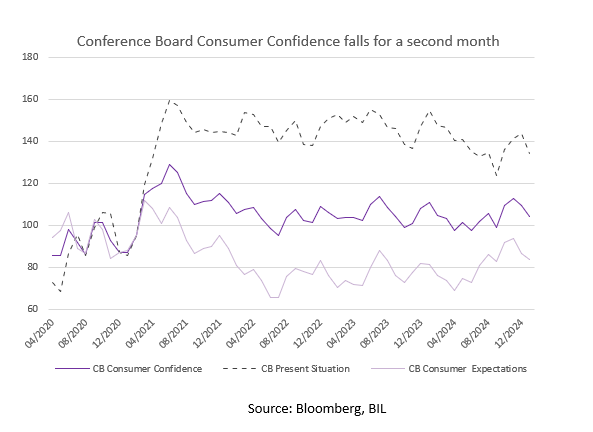

According to the Conference Board, US consumer confidence declined to 104.1 in January, dragged down by both the current situation and expectations components. This is largely pinpointed to renewed inflation fears in light of policies promoted by the Trump Administration. One-year inflation expectations have been rising since November, reaching +5.3% in January. Also worth noting is that labour market perceptions softened for the first time since September, with fewer respondents saying that jobs are "plentiful". The measure of Americans’ short-term expectations for income, business and the job market fell 2.6 points to 83.9. The Conference Board purports that a reading under 80 can signal a potential recession in the near future.

Until now, consumers have been the lynchpin of a strong US economy. Data released on Thursday showed that the US economy grew 2.8% in 2024, marking another year of good growth, after an expansion of 2.9% in 2023. However, the final quarter did hint at some weakening. Quarter-on-quarter growth came in at 2.3%, below the 2.6% expected by economists and the slowest pace seen in three quarters. Personal consumption remained the main driver of growth, increasing 4.2%, the most since Q1 2023, but recent confidence readings question whether this momentum can continue.

Fixed investment contracted for the first time since Q1 2023 (-0.6% vs 2.1%), due to equipment (7.8% vs. 10.8% prior) and structures. Investment in intellectual property products continued to rise and residential investment rebounded. Private inventories were a strong drag, while the contribution from net trade was negligible. Government expenditure rose at a slower pace (2.5% vs 5.1%).

Projections from the Federal Reserve, as displayed on its December “dot-plot”, suggest the US economy will grow 2.1% in 2025 in real terms, and 1.9% in 2026.

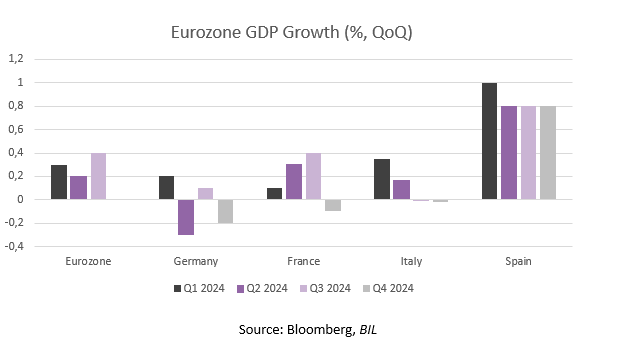

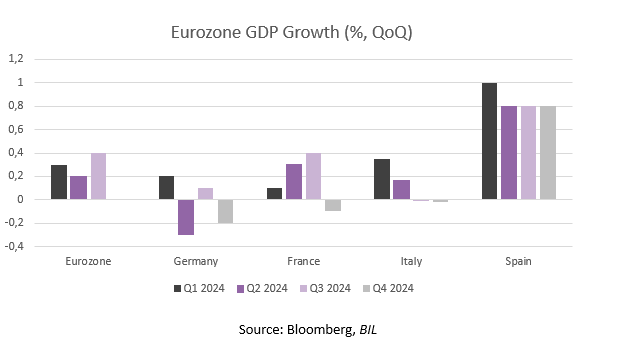

Eurozone economy unexpectedly stalls in Q4; Spain remains the bright spot

The Eurozone economy unexpectedly stalled in the final quarter of last year, while economists were expecting a slight expansion of 0.1%. This meant Q4 contributed the least to the full-year growth rate of 0.7%. Consensus expectations expect the bloc to grow 1.0% in 2025, but risks are tilted to the downside: the manufacturing downturn is now in its second year, the political landscape is turbulent, and the shadow of a tariff-wielding Trump hangs over the outlook.

The Eurozone’s two largest economies saw contractions in Q4, with Germany’s GDP shrinking by 0.2% and France’s by 0.1%.

Spain's economy maintained its pace of growth in Q4 (0.8% QoQ), bringing full-year growth to 3.2% for 2024. Earlier last week, the Spanish Economy Ministry announced it would soon raise its forecast for 2025 above the current 2.4% projection, thanks to a tourism boom, a strong agriculture industry and higher exports. At the same time, France and Germany both lowered their 2025 forecasts to 0.9% and 0.3% respectively.

Portugal also demonstrated robust growth, with 1.5% growth in Q4 – the most in almost three years. However, domestic demand's contribution to growth declined, mainly due to lower investment and a negative impact from changes in inventories. Imports of goods and services fell, resulting in a positive contribution from net external demand.

The unemployment rate in the Euro Area ticked up to 6.3% in December, from a revised record low of 6.2% in November and in line with economists’ expectations. Spain reported the highest unemployment rate at 10.6%, with France at 7.8% and Italy at 6.2%. Germany, by contrast, recorded the lowest rate at 3.4%.

Hardly a glimmer of hope in the German IFO survey…

Germany’s most prominent leading indicator, the IFO Business Climate indicator, ticked up in January to 85.1. Economists had predicted stagnation. The current conditions gauge rose to the highest level since late-Summer, while expectations edged down to the lowest level in a year. It is clear that the prospect of a heavy-handed Trump administration (10% of German exports go to the US), as well as domestic political uncertainty ahead of elections on February 23rd, are weighing on sentiment. It is expected that the elections result in the need for a process of negotiations to form a coalition, meaning little immediate policy changes to support the economy.

The GfK Consumer Climate Indicator declined to -22.4 heading into February, missing market expectations. Economic prospects, income expectations, and the willingness to buy all fell in a reflection of the weak economy, rising layoffs, and factory closures. Meanwhile, the propensity to save increased as the nation prepared for the upcoming federal elections.

Calendar for the week ahead

Monday – Eurozone, UK, US Manufacturing S&P PMI (January, Final). US ISM Manufacturing PMI (January). Eurozone Inflation Rate (January, Flash).

Tuesday – US JOLTs Job Openings and Factory Orders (December).

Wednesday – Eurozone, UK, US Services S&P PMI (January, Final). US ISM Services PMI (January).

Thursday – Switzerland Unemployment Rate (January). Eurozone, UK Construction PMI (January). Eurozone Retail Sales (December). Germany Factory Orders (December). Bank of England Interest Rate Decision. US Challenger Job Cuts (January), Jobless Claims.

Friday – Germany Balance of Trade, Industrial Production (January). Switzerland Consumer Confidence (January). US Non-Farm Payrolls, Unemployment Rate (January), Michigan Consumer Sentiment (February, Prel).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 28, 2025

NewsNavigating Europe’s Demographic...

Europe faces a multitude of structural challenges that threaten its economic stability and future growth. In addition to the ongoing malaise in manufacturing, political...

January 27, 2025

Weekly InsightsWeekly Investment Insights

Last week, world leaders gathered in Davos for the annual five-day meeting of the World Economic Forum. On the agenda were geopolitics, US-EU-China relations,...

BILBoard January 2025 – Snakes ...

While western New Year celebrations are already behind us, January 29th will usher in the Chinese New Year of the Snake. People belonging to that...

January 20, 2025

Weekly InsightsWeekly Investment Insights

Donald Trump takes office for the second time this week and the new administration is sure to have a major impact on the economy...