Choose Language

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the conservatives will be able to form a coalition quickly. Protracted talks will delay long-awaited and necessary measures such as budget reforms and spending increases to revive Europe's largest economy.

Weekly Highlights

US Services sector contracts for the first time in over two years

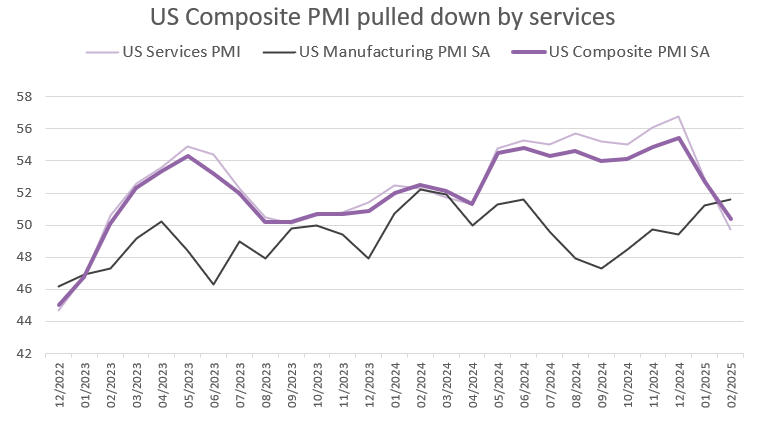

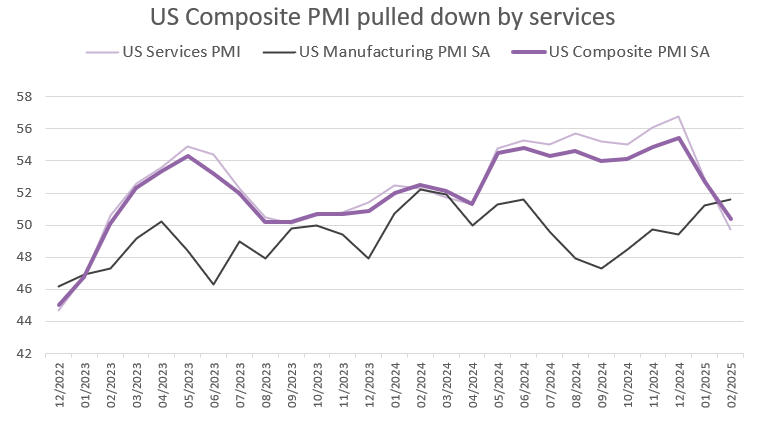

According to Friday's flash PMIs, the US composite PMI fell to 50.4 in February from 52.7 in January due to a contraction in the services sector. In February, the services PMI fell to 49.7, well below expectations, from 52.9 in the previous month. The services sector moved into contraction territory as new orders approached stagnation due to political uncertainty. The spending cuts and potentially inflationary policies of President Trump's administration, combined with concerns over tariffs and geopolitical uncertainty, caused the optimism index to fall to its lowest level in five months.

The manufacturing PMI rose to 51.6 in February from 51.2 in the previous month, suggesting optimism for a recovery in the sector. Factory output grew at the fastest pace in almost a year, while the drag from falling input stocks eased. However, new orders slowed, and employment growth almost came to a standstill.

It is increasingly evident that [trade] policy uncertainty is causing concern not only for businesses around the world, but also at home. We explore this topic more in our latest BILBoard, now online.

Source: Bloomberg, BIL

Eurozone composite PMI stabilises as services soften

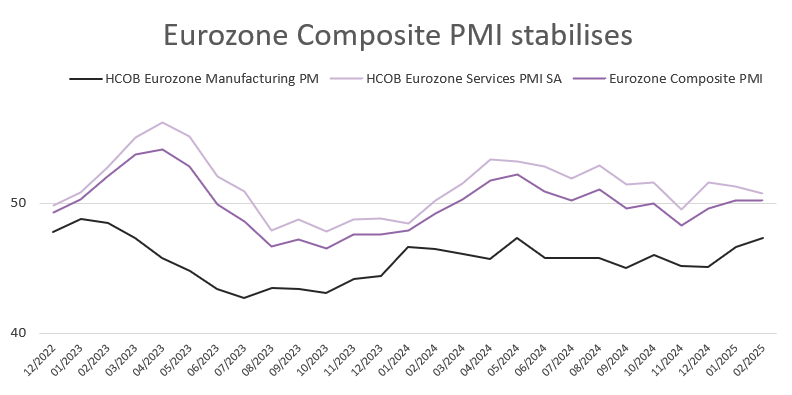

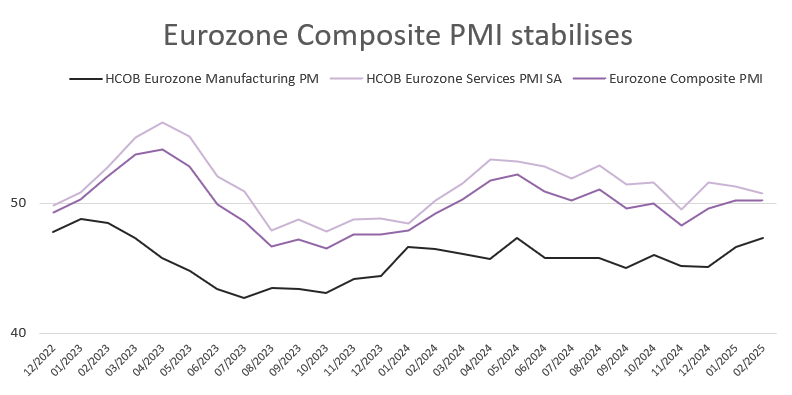

The Eurozone PMIs saw the industrial downturn, which has lasted over two years, ease further. The Manufacturing PMI increased to 47.3 in February, from 46.6. While this is still below 50, considered the line between contraction and expansion, it provides some hope that the situation is at least bottoming out. From there, it is difficult to foresee a major rebound for the time being. New business continued to fall and there was a marked reduction in manufacturing workforce numbers. Eurozone manufacturers continued to lower their purchasing activity, in response to weak customer demand – and that reduction was marked, despite being the weakest for two-and-a-half years.

Source: Bloomberg, BIL

Meanwhile, the Services PMI fell to its lowest level in three months. New business declined for the first time in three months, though employment saw a slight increase. Input cost inflation remained elevated, while output prices continued to rise substantially.

A major detractor was France where the Services PMI dropped to 44.5 in February, versus 48.9 expected, with new orders falling at one of the fastest rates in five years. With demand in decline, companies’ pricing power is being eroded at a time when input costs are rising sharply. Service providers let go workers at the fastest pace since August 2020. Overall, it seems that Bayrou's achievement in passing a budget is seen as more of a temporary success rather than being something that will being long-term stability; he still lacks a majority in Parliament and could be ousted by the opposition at any time. France’s manufacturing PMI improved marginally, from 45 to 45.5.

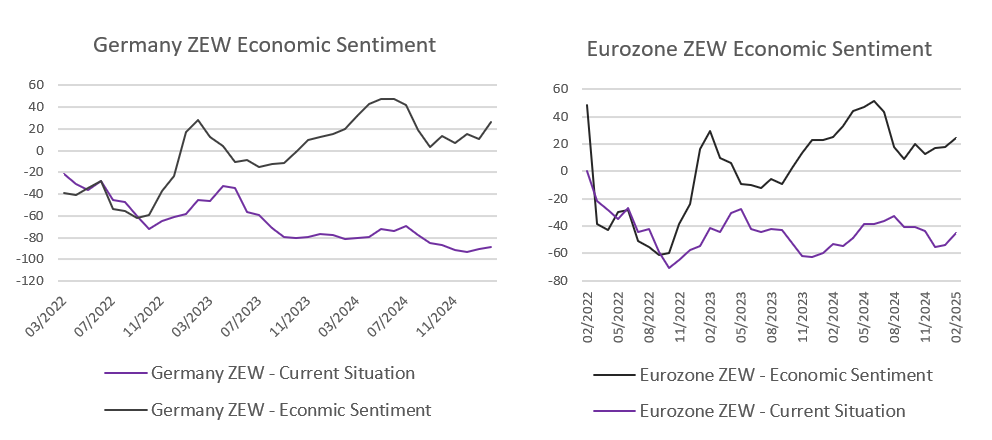

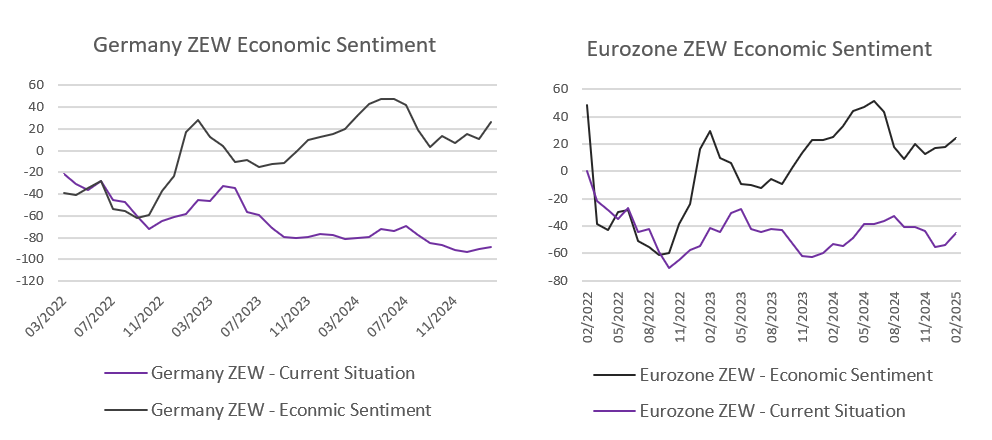

Financial professionals grew more optimistic on Germany ahead of elections

Ahead of Sunday’s general election, the ZEW Indicator of Economic Sentiment for Germany surged 15.7 points to +26, surpassing market expectations of +20 and reaching its highest level since July 2024. The survey is based on the opinions of 350 experts, including financial professionals and analysts.

Sentiment was boosted by hopes for a new German government capable of action and expected growth in private consumption over the next six months. The frontrunner, Merz, promised to rekindle growth by reducing taxes, regulation and social handouts. It was also noted that ECB rate cuts are boosting the outlook for construction sector.

Source: Bloomberg, BIL

Looking at the indicator for the Eurozone as a whole, it rose 6.2 points to 24.2, the highest in seven months. 58% of surveyed analysts expected no change in economic activity, 33.1% saw an improvement and 8.9% anticipated a deceleration.

As of late, markets appear to be taking a glass-half-full view when it comes to Europe. Prospects of a US-brokered peace deal in Ukraine are adding to optimism, while the Trump administration’s shift towards more targeted tariffs as opposed to blanket levies, is also helping. Household confidence in the bloc is also slowly improving on the belief that the ECB will continue cutting rates this year (the European Commission’s consumer confidence indicator registered -13.6 in February, the highest in four months).

Germany's auto industry and Trump's trade tariffs

After contracting for the second year in a row in 2024, the German economy began 2025 with another threat looming on the horizon - US trade tariffs. While we still await more details one what the new trade policy based on “reciprocity” will look like, even the fear of tariffs could weigh on economies around the world. Last week, Trump specifically stated that cars, chips and pharma were in his sights.

Germany is particularly vulnerable to potential tariffs given its export-driven economy. The Bundesbank estimates that GDP growth could fall 1.5% below the baseline scenario as a result of changes in US trade policy.

Trump's threat to impose tariffs "in the neighbourhood of 25%" on cars imported from the EU, up from the current 2.5%, is especially worrying. The German car industry has struggled in recent years with high energy costs, low demand and increased competition from China. As the largest importer of German cars, any change in demand from the US could be another blow to an already struggling sector. Germany is also more at risk than other European countries, with 24% of Germany's non-EU car exports going to the US, compared with just 6% and 5% respectively for Spain and France.

Car makers have long been the crown jewel of German industry. However, in recent years, the car industry has lost momentum, with the number of cars produced in Germany having fallen from 5.6 million in 2017 to 4.1 million in 2023.

One thing that has put carmakers under particular pressure is the transition to electric vehicles (EVs). The decision to phase out petrol and diesel cars over the next decade has forced carmakers to invest heavily in the EV transition, and although battery EVs accounted for 13.6% of new car registrations in the EU in 2024, demand has not grown as quickly as initially expected. Some major German carmakers have recently announced that they will renew focus and continue to invest in combustion engines to keep up with demand.

This year is likely to be another difficult year for German car makers, as they strive to adapt to changing market demands, while also trying to navigate the flood of announcements coming from the Oval Office.

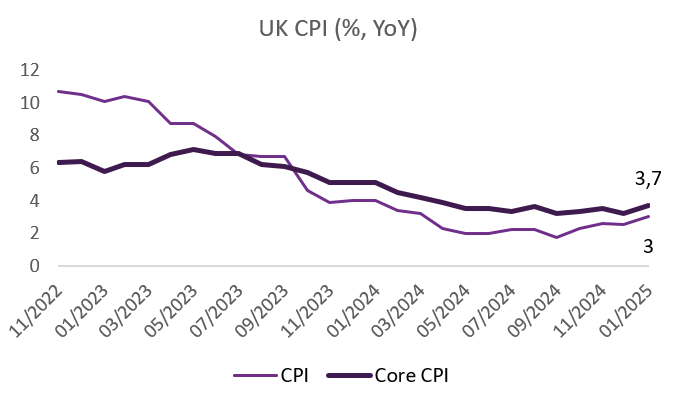

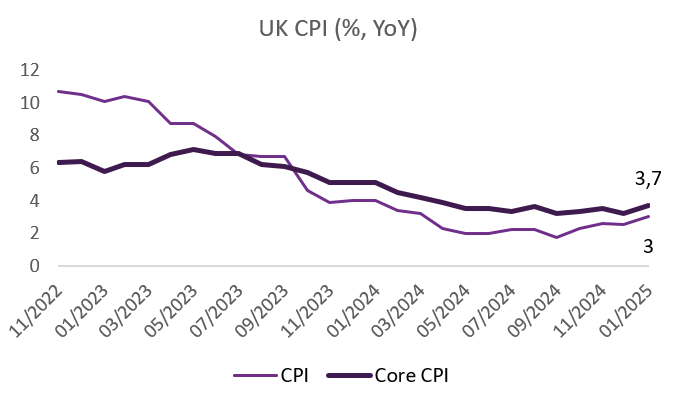

UK inflation rises more than expected in January

Inflation in the UK hit a 10-month high in January, rising to 3% year-on-year from 2.5%. According to the ONS, the rise was driven by a smaller-than-usual fall in air fares in January and a rise in fuel prices. Food costs rose and private school fees increased following the introduction of VAT charges. Core inflation, which excludes volatile categories, rose to 3.7% from 3.2%.

Services inflation, which is closely monitored by the Bank of England (BoE) when deciding whether or not to cut interest rates, also rose to 5% from 4.4%. This, combined with last week's strong wage growth figures, complicates matters for the BoE.

When the BoE cut interest rates to 4.5% at the beginning of February, it also revised its inflation forecasts, predicting that inflation will peak at 3.7% this year and only return to the BoE's target of 2% at the end of 2027. With the increase in employer taxes and the new minimum wage coming into effect in April, underlying cost pressures could intensify. Weaker growth forecasts combined with high inflation point to the risk of a stagflation scenario, which would make the BoE's task of using monetary policy to support growth and keep inflation low even more difficult.

Source: Bloomberg, BIL

Sterling briefly strengthened against the dollar on the release, before retreating again.

On the consumption side, however, consumers were more optimistic at the start of the year. Retail sales rose by a stronger-than-expected 1.7% month-on-month in January, the first month-on-month increase since August last year. Growth was driven by a sharp rise in food sales, offsetting falls in non-food, clothing and footwear, household goods and car fuel sales.

The GfK consumer confidence index also rose in February, up 2 points to -20, reflecting slightly more optimism among households about their personal finances and the wider economic outlook. The interest rate cut has certainly helped, but concerns about sluggish economic growth and persistent inflation remain.

UK PMIs show companies cutting jobs ahead of tax rises

According to Friday's flash PMIs, UK companies are continuing to shed staff at the fastest pace in more than four years ahead of tax rises coming into place in April as per the Autumn Budget. The composite PMI edged down slightly to 50.5 in February from 50.6 the previous month, as growth in the services sector (51.1 in February from 50.8) failed to fully offset a fall in manufacturing activity (46.4 in February from 48.3). Employment continued its decline of previous months, falling from 45.3 to 43.5, the lowest level since November 2020.

The contraction in manufacturing was the sharpest since December 2023, and the fourth consecutive month of falling output. The services sector grew more than expected, as expectations for business activity rose slightly, despite concerns about the wider economic environment and geopolitical uncertainty.

This latest release continues to paint a challenging picture for the UK economic outlook, with more headwinds than tailwinds for the time being.

Calendar for the week ahead

Monday – Germany IFO Business Climate. Eurozone Inflation (Final, January).

Tuesday – US House Price Index, Conference Board Consumer Confidence. Eurozone Negotiated Wage Growth.

Wednesday – Germany and France Consumer Confidence. US New Home Sales and Building Permits.

Thursday – France PPI. Eurozone M3 Money Supply and Economic Sentiment. Spain Inflation (Preliminary, February). US GDP Growth (Q4, 2nd estimate), Durable Goods Orders, Pending Home Sales.

Friday – Japan Industrial Production and Inflation. Germany Retail Sales and Unemployment. UK House Prices. Germany and Italy Inflation (Preliminary, February). US PCE Inflation, Personal Income and Spending (January). ECB Consumer Inflation Expectations.

Saturday – China NBS PMI (February).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...

February 10, 2025

Weekly InsightsWeekly Investment Insights

US equities ended lower last week, amid tariff uncertainty stemming from the Trump administration. While proposed tariffs on Canada and Mexico were postponed for...

February 3, 2025

Weekly InsightsWeekly Investment Insights

By Friday, it seemed as though a volatile week for stocks had ended on a positive note. The damage caused after Chinese AI app DeepSeek...