Choose Language

March 7, 2025

Weekly InsightsWeekly Investment Insights

This newsletter was written on 07 March 2025.

Last week, the euro reached its highest level versus the USD year-to-date, with traders anticipating an influx of cash into Europe’s defense sector.

The European Government Bond market underwent a sharp uptick in long-term yields, particularly Germany, where borrowing costs rose by the most in 28 years. The reason is the fiscal impulse from European Governments keen to urgently increase defence spending after the Trump Administration’s pivot on Ukraine.

Europe’s policymakers have expedited steps to unlock hundreds of billions of euros in military spending, a move that might give the economy an additional tailwind. On Tuesday, European Commission President Ursula von der Leyen announced almost EUR 800 Bn of potential funding.

Thereafter, German Chancellor-in-waiting Friedrich Merz agreed with prospective coalition partners that they would propose exempting spending of more than 1% of GDP on defence from rules that limit the government’s ability to borrow money. They also said they will seek to set up a EUR 500Bn fund to finance spending on Germany’s infrastructure over the next 10 years. The sheer magnitude of the proposed fiscal expansion is considered a game changer and analysts are rushing to revise up their growth forecasts for the Eurozone’s largest economy. The impact will also likely spill beyond Germany’s borders.

On the other side of the Atlantic, US President Trump's trade tariffs continued to rattle markets. His promised 25% trade tariffs on goods imported from Canada and Mexico came into effect on Tuesday, along with an additional 10% tariff on Chinese imports. The decision came after Trump said the three countries had not done enough to stop the flow of fentanyl into the US. Canada responded with reciprocal tariffs shortly afterwards, warning that a trade war would damage relations between trading partners and disrupt business on both sides of the border. Mexico also vowed to retaliate, and China responded with 10-15% retaliatory tariffs on US agricultural exports, affecting some $21 billion of US exports. However, before the end of the week, Trump delayed tariffs on goods under the Mexico-Canada trade deal until April 2, when Trump is expected to impose a global system of reciprocal tariffs on all US trading partners.

Weekly Highlights

ECB cuts interest rates by 25 basis points, stating that the disinflation progress is “well on track”

The European Central Bank (ECB) cut interest rates by 25 basis points on Thursday, bringing the deposit facility rate to 2.5%, as inflation eases and growth falters. Inflation data earlier in the week suggested that disinflation is moving in the right direction, allowing the bank to continue its rate cut path as expected.

Despite heading in the right direction, the bank now sees inflation averaging at 2.3% this year, above the 2.1% seen three months ago, due to stronger energy price dynamics. The bank noted that its “monetary policy is becoming meaningfully less restrictive, as the interest rate cuts are making new borrowing less expensive for firms and households and loan growth is picking up.”

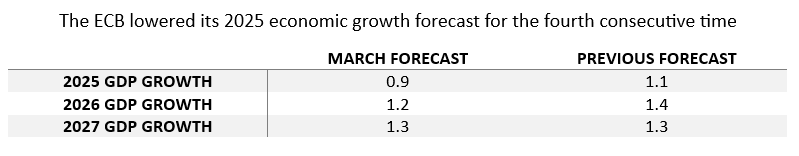

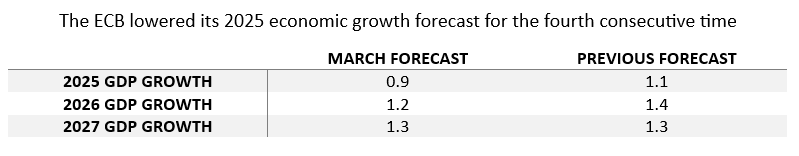

Along with its interest rate decision, the ECB also downgraded its growth forecasts, noting that the economy continues to face challenges with potentially lower exports and continued weakness in investment. Growth forecasts were updated to 0.9% for 2025, 1.2% for 2026 and 1.3% for 2027. Rising real incomes and the fading effects of past interest rate increases are expected to underpin the expected pick-up in growth over time.

To ensure that inflation stabilises at the ECB's 2% target, the bank said it will continue to “follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance”, and that it will not commit to a specific rate path.

For now, investors are expecting the ECB to continue its rate cut path this year, despite a surge in budget spending that could eventually alter the outlook, with markets pricing in almost two more rate cuts this year.

US job growth picked up in February while the unemployment rate rose to 4.1%

US employers added 151 000 jobs last month, after a downwardly revised increase of 125 000 in January. Employment increased in health care, financial activities, transportation and warehousing, and social assistance. Meanwhile, federal government employment fell by 10 000. The unemployment rate rose to 4.1%, up from 4% in January.

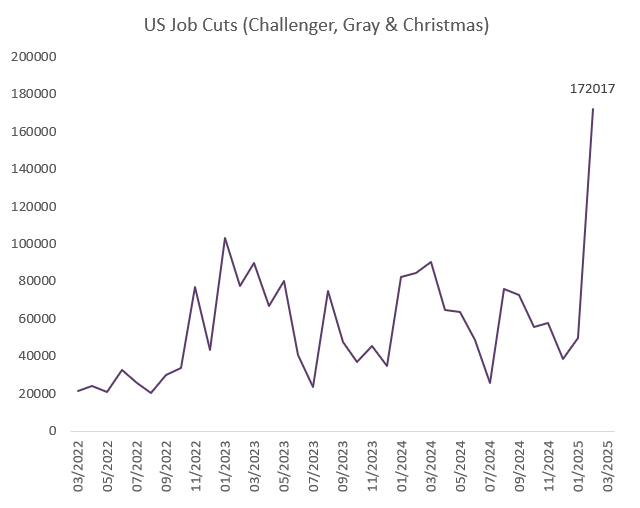

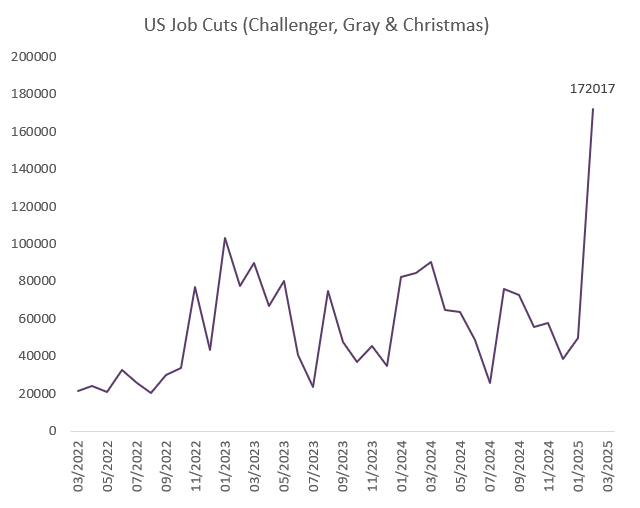

Data released last week also showed that US employers announced over 172 000 job cuts in February, up 245% from January and the highest monthly count since July 2020. More than a third of these job cuts were a result of DOGE (Department of Government Efficiency) efforts, with about 75,000 federal employees having accepted deferred resignation offers to leave their jobs in exchange for financial incentives as of February 12. Trade war fears, the cancellation of government contracts and bankruptcies also contributed to job cuts soaring.

Source: Bloomberg, BIL

Total job cuts across the first two months of the year in the US now stands at 221,812. That’s the highest for the period since 2009 and up 33% from the same time range in 2024.

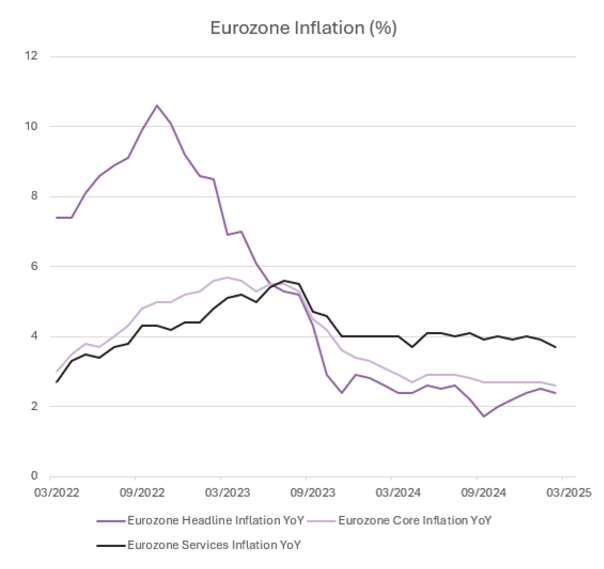

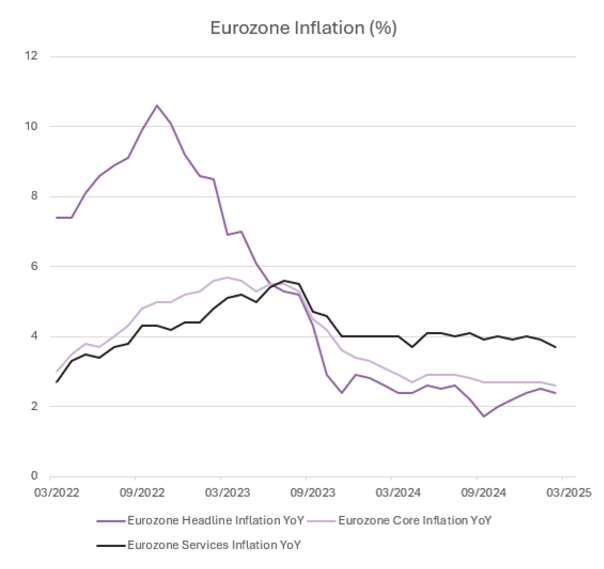

Eurozone inflation slows to 2.4% in February

According to flash estimates, the headline inflation rate in the Eurozone eased to 2.4% YoY in February, from 2.5% the month prior. Price growth slowed for services (3.7% vs. 3.9% in January) and energy (0.2% vs. 1.9%), but picked up for food, alcohol & tobacco (2.7%, compared with 2.3% in January) and non-energy industrial goods.

Core inflation, which excludes volatile categories like food and energy, also eased to 2.6%, marking the lowest level since January 2022.

The slight decline in the core rate, combined with slower price growth in services, is a reassuring sign that inflation is heading in the right direction, which was a welcome indicator for the ECB ahead of its monetary policy meeting last week.

Source: Bloomberg, BIL

Eurozone unemployment rate holds steady at 6.2%

Eurostat data released Tuesday showed that the Eurozone unemployment rate held steady at 6.2% for a third consecutive month in January; a record low. Despite a wave of layoffs, especially in the manufacturing sector and in the bloc’s largest economies, the data indicates that overall, the Eurozone labour market remains tight.

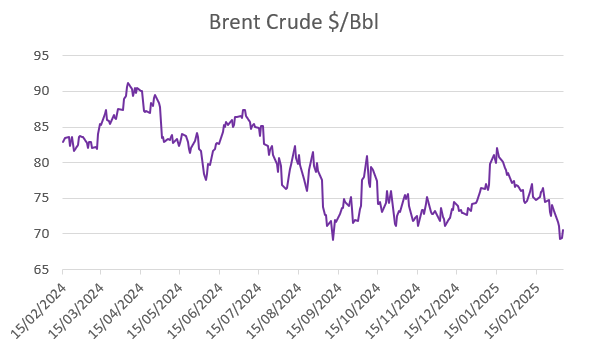

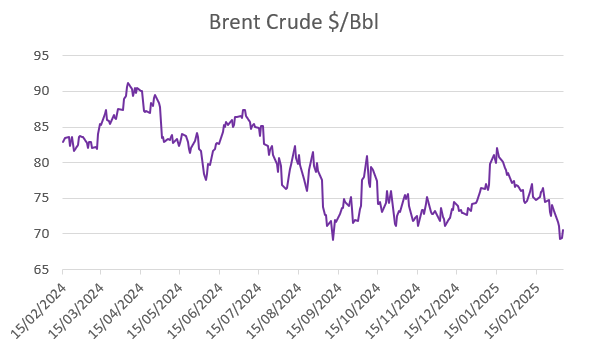

OPEC+ to go ahead with planned oil production increase

The Organization of the Petroleum Exporting Countries (OPEC+) announced last week that it will proceed with the planned increase in oil production in April. The increase will be the first since 2022, and follows pressure from US President Trump on OPEC and Saudi Arabia to lower prices. Oil prices fell on the announcement.

Although the production increase will go ahead, OPEC said it could be paused or reversed depending on market conditions, giving the group some flexibility on how best to support the oil market.

After a volatile 2024, oil markets continue to long for stability. With a potential trade war that could disrupt supply, possible changes to US sanctions on major oil producers and lower demand from China, oil prices have fluctuated in recent weeks.

Prices have also fallen recently on the hopes that a peace deal between Russia and Ukraine will be reached, boosting Russian oil flows. However, whether this will be a direct outcome of a peace deal is still to be seen.

Source: Bloomberg, BIL as of 7/3/25

Calendar for the week ahead

Monday – Germany Balance of Trade, Industrial Production (January). Switzerland Consumer Confidence (February). US Consumer Inflation Expectations (February).

Tuesday – US JOLTS Job Openings & Quits (January).

Wednesday – US Inflation Rate (February).

Thursday – Eurozone Industrial Production (January). US PPI (February), Jobless Claims.

Friday – UK GDP, Industrial Production Balance of Trade (January). US Michigan Consumer Sentiment (Prel, March).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...