Choose Language

March 17, 2025

Weekly InsightsWeekly Investment Insights

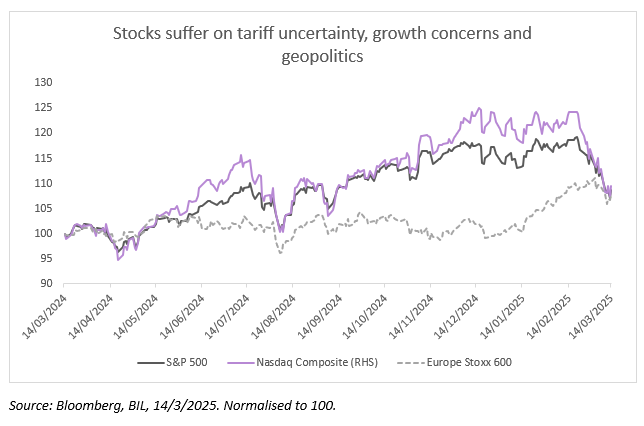

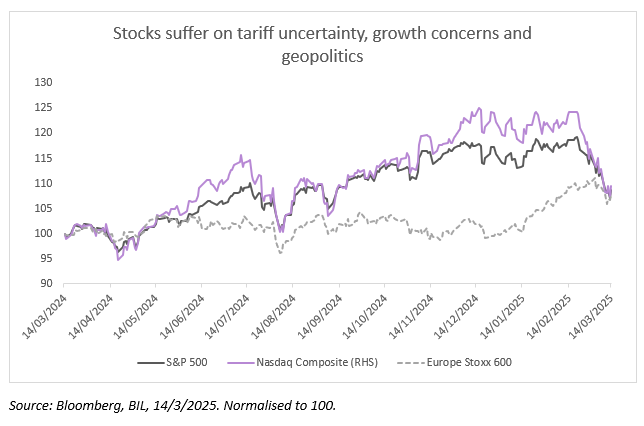

It’s St. Patrick’s Day, but the colour green has been rare on our Bloomberg screens over the past week, with trade frictions, growth fears and ongoing geopolitical concerns weighing on risk assets. Last week even saw key US indices, namely the S&P 500 and the NASDAQ, enter correction territory before attempting a slight rebound on Friday. It appears that markets had mistakenly assumed that Trump, using the stock market as a barometer of success, would dilute policies if he saw a negative market reaction. Comments from the President and Treasury Secretary, Scott Bessent implied that the new Administration is willing to accept a degree of pain as it reorientates the US economy.

On this side of the Atlantic, Germany’s newfound willingness to increase public spending beyond constitutional budget limits, and the desire of EU leaders to ramp up spending on defence, has been painful for a swathe of fixed income assets, exerting strong upwards pressure on long-term yields (when yields rise, prices fall). The German Bund has been particularly affected, with the yield approaching 3%.

The market turmoil, trade uncertainty and central bank buying served to enhance gold’s sparkle, with the precious metal shooting past USD 3,000 / Oz for the first time on Friday. Central banks in China, Poland, India and Turkey are among the largest buyers.

Weekly Highlights

Alcohol becomes a key point of contention in EU-US trade tensions

After US tariffs of 25% on steel and aluminum imports came into effect on Wednesday, the EU responded rapidly, with countermeasures on EUR 26Bn of US goods (including steel and aluminum products, textiles, home appliances and agricultural goods, motorcycles, bourbon, peanut butter, jeans…). In response, Trump has threatened to slap a 200% tariff on wine, champagne, cognac and other alcohol imports from Europe, opening a new front in a trade war that has rattled financial markets and lathered up recession fears.

Despite the stock market’s clear protests, Trump doubled down on his tariff stance, saying he he didn't plan to "bend".

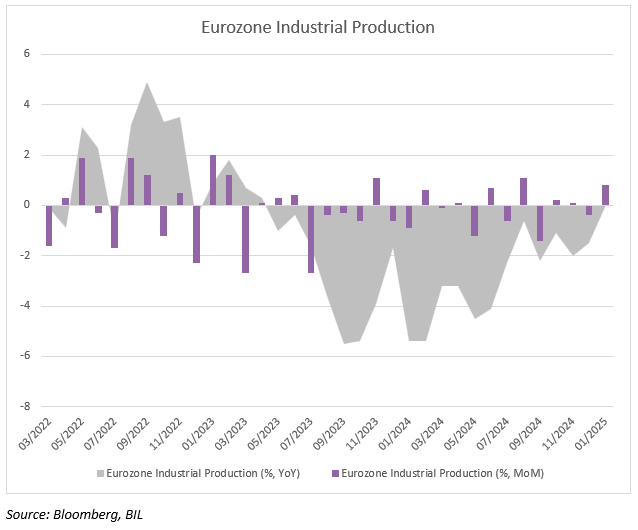

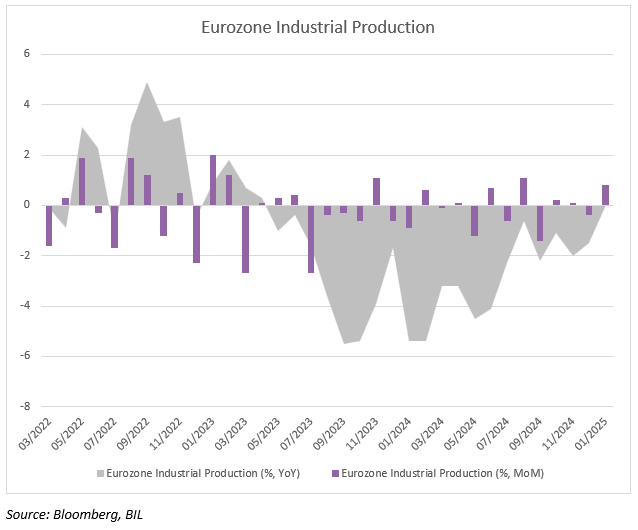

Eurozone industry stabilises

Eurozone industrial output rebounded by 0.8% MoM in January, surpassing market expectations of 0.6% growth. The increase was driven by a strong recovery in intermediate goods production and a modest rise in capital goods output. On a yearly basis, Eurozone industrial output stabilised in January, compared with market expectations of a 0.9% decline and ending a 20-month period of contraction.

Zooming in on Germany, Industrial Production in the Eurozone’s largest economy rose by 2% MoM in January, recovering from a 1.5% decline in December. The upturn was driven by a hat-trick of sub-industries:

- The auto sector grew 6.4%

- The food industry grew 7.5%

- Machine maintenance and assembly grew 15.6%

On the other hand, output in the manufacture of fabricated metal products contracted by 7.7% (perhaps due to the fact that companies were already being haunted by tariff banshees, with 25% levies on aluminum and steel coming into effect on 12th March).

Annual industrial production is still negative, at -1.6%.

Looking ahead, a newfound willingness in Berlin to invest could provide tailwinds in the months and years to come, helping industry get off the ground.

Last week, the EU Council approved a proposal that could provide as much as EUR 800 billion in defence spending.

In Germany, Chancellor-in-waiting Friedrich Merz has now reached a deal with the Green party on a debt-funded spending package for defence and infrastructure. As part of the agreement, 20% of a planned EUR 500bn infrastructure fund to be disbursed over the next 12 years will be allocated to the green transition. Under the plan, defense spending exceeding 1% of GDP will be exempted from the strictures of the country’s debt brake, which is enshrined in the constitution. Following demands from the Greens, the exemption also now also includes aid for countries unlawfully attacked under international law. Spending to counteract cyber threats as well as intelligence services will also be included under the debt-brake exemption, said Merz.

Now, all of the above must pass through Parliament. Any bill that involves amending the German constitution requires a go-ahead from a two-thirds majority in the Bundestag. Merz should be able to achieve this with both the SPD and the Greens now on board. His goal is to have the amendments to the constitution passed by March 25, by which time the newly elected parliament is set to convene.

“Germany is back”, Merz told reporters on Friday.

China’s CPI falls back into contraction

According to data released by China’s National Statistics Bureau, consumer prices in the world’s second largest economy dropped 0.7% YoY in February, reaching the lowest level in more than a year.

The decline was partly influenced by base effects caused by an earlier-than-usual Lunar New Year holiday which fell entirely in January this year, compared with the previous one that extended into February, but clearly, deflationary pressures are still present.

Digging into the details, food prices fell the most in 13 months (-3.3% vs 0.4% in January), dragged down by plummeting costs for fresh vegetables (-12.6% vs 2.4%) and a steep drop in pork prices (4.1% vs 13.8%).

Core inflation, excluding volatile food and fuel prices, fell 0.1% in February.

Weak consumer spending, an uncertain labour market outlook and a prolonged downturn in the property sector continue to weigh on the economy. At the same time, external uncertainty is rising with the White House targeting China with an additional 10% tariff on a whole swathe of goods.

Despite these challenges, Beijing has set an economic growth target of 5% for this year, the same as last year, which it just, and only just, managed to meet. It also lowered its target for the consumer price increase this year to 2% from 3% last year. One key priority highlighted at the recent annual Two Sessions was addressing “inadequate domestic demand, particularly insufficient consumption,” as well as making “domestic demand the main engine and anchor of economic growth.”

Today (Monday), Chinese officials from the Finance Ministry, Commerce Ministry, Central Bank and other Government bodies will hold a press conference to discuss measures to boost consumption, and they will have the markets' full attention.

US Consumer Confidence is falling off a cliff as inflation expectations rise

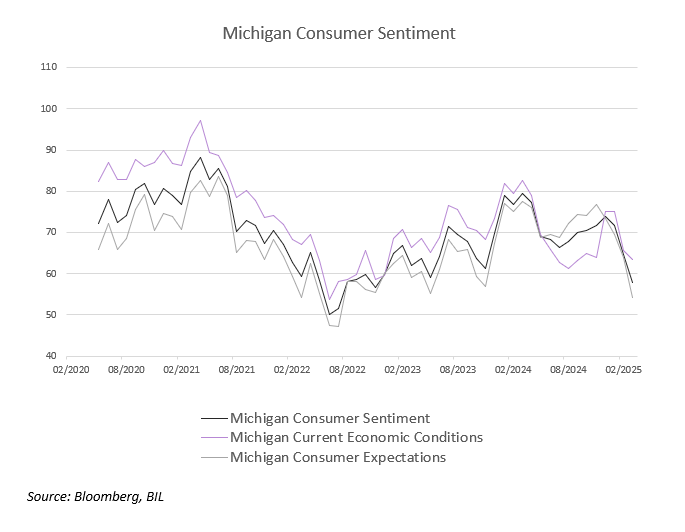

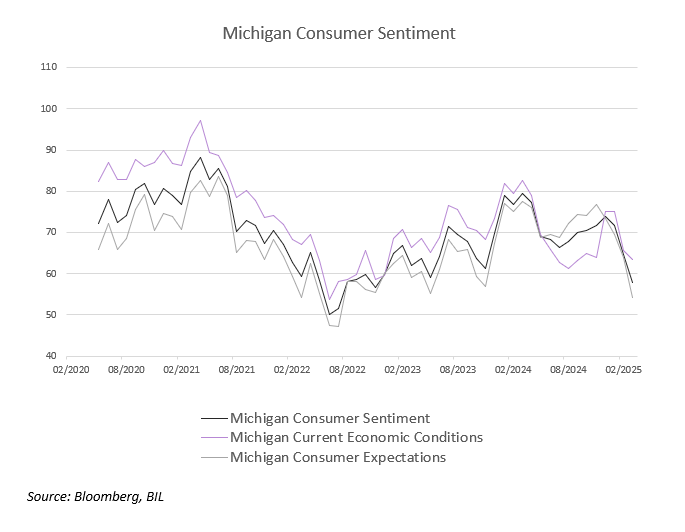

The widely-watched Michigan consumer sentiment index for the US fell to 57.9 in March, its lowest level since November 2022. Many consumers cited the high level of uncertainty around policy and other economic factors. Expectations for the future deteriorated across multiple vectors of the economy, including personal finances, the labour market, inflation, business conditions, and stock markets. Expectations for inflation over the next year surged to 4.9%. For the next 5-10 years, it rose to 3.9%, the highest level since 1993.

This is more extreme than what was evidenced in the NY Fed’s Consumer Expectations survey, released on Monday. That gauge showed inflation expectations for the year ahead edge up to 3.1%. Meanwhile, inflation expectations for the three-year horizon and the five-year-ahead were unchanged at 3%. Unemployment expectations jumped 5.4 percentage points to 39.4%, its highest reading since September 2023. Expectations for household income growth increased by 0.1 percentage point to 3.1%.

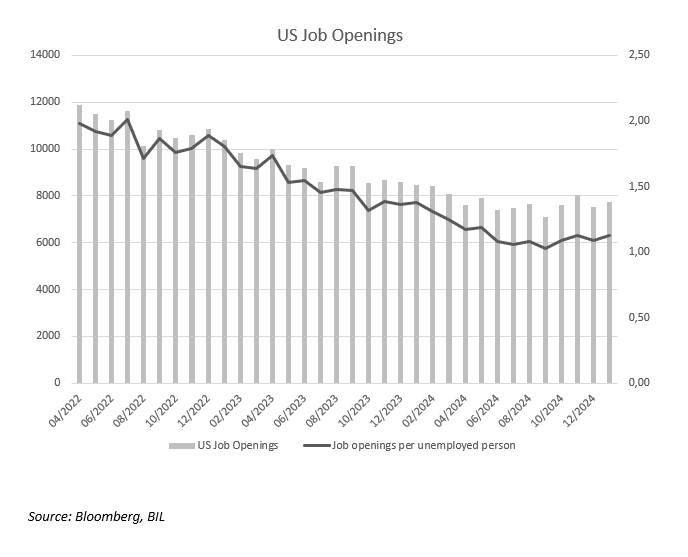

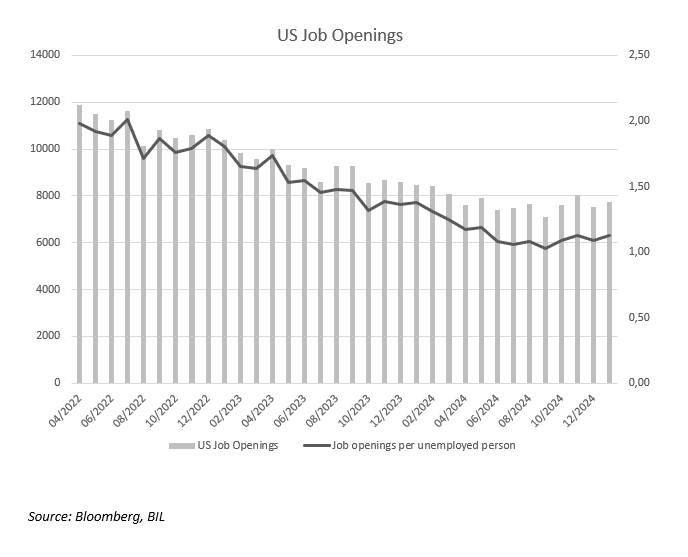

Up until now, hard data on the labour market has remained relatively robust. Job openings actually rose in January, reaching 7.74 million, from 7.51 million and surpassing the market expectations of 7.63 million. Notable increases occurred in retail trade (+143,000), finance and insurance (+77,000), and health care and social assistance (+58,000).

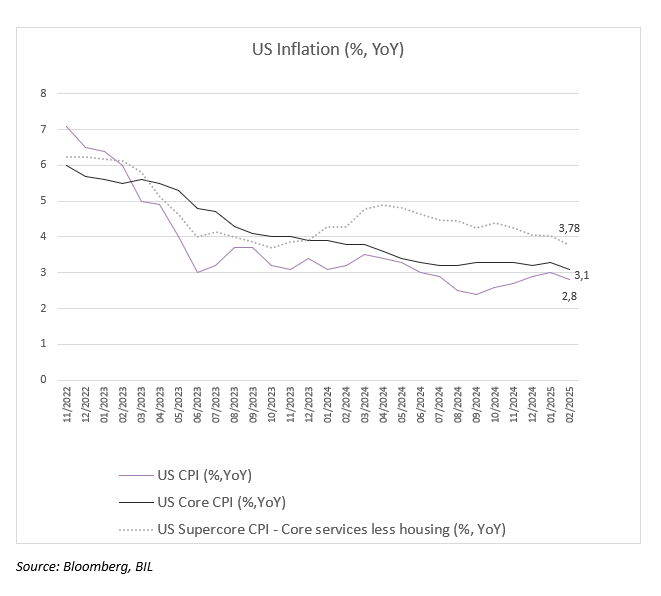

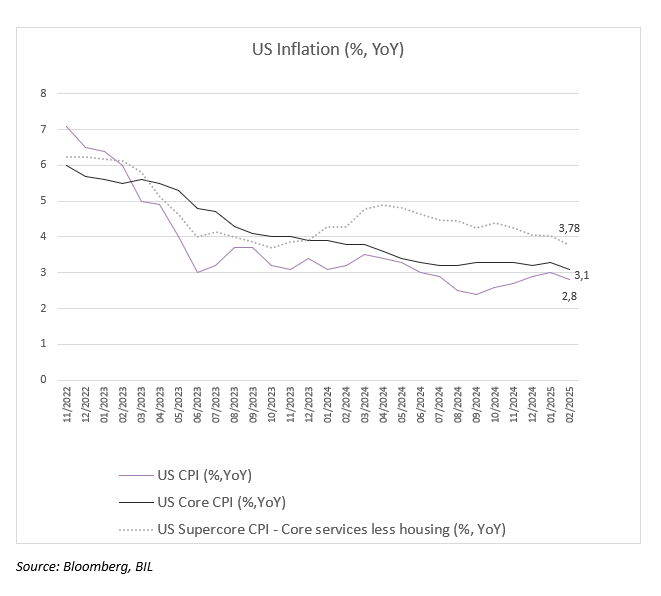

US headline inflation eases ahead of tariffs

In what was likely a welcome development for the Fed, headline inflation in the US eased to 2.8% in February, below forecasts of 2.9%.

- Energy costs declined 0.2% YoY, following a 1% rise in January. Gasoline (-3.1%) and fuel oil (-5.1%) were lower while natural gas prices shot up (6%)

- Inflation slowed for shelter (4.2% vs 4.4%), used cars and trucks (0.8%) and transportation (6%)

- Inflation accelerated for food (2.6% vs 2.5%), with the price of eggs up 59% YoY following the outbreak of an avian flu

The Core CPI, which strips out volatile items, came in at 2.8% YoY - the lowest pace since April 2021. Shelter accounts for over two-thirds of that increase, but we do also see some stickiness in certain service categories such as motor vehicle insurance (+11.1%), medical care (+2.9%), recreation (+1.8%), and education (+3.7%).

Overall, price pressures are alleviating. Trade tariffs, however, could throw a spanner in the works.

Calendar for the week ahead

Monday – China Industrial Production, Retail Sales, Unemployment and Fixed Asset Investment. Chinese officials will hold a press conference to discuss measures to boost consumption. US Retail Sales and NAHB Housing Market Index.

Tuesday – Eurozone and Germany ZEW Economic Sentiment Index. US Industrial Production, Building Permits and Housing Starts.

Wednesday – Bank of Japan Monetary Policy Committee. Eurozone Inflation (final, February) Wage Growth and Labour Costs (Q4). US Federal Reserve FOMC Meeting.

Thursday – UK Unemployment Rate and Pay data. Bank of England Monetary Policy Committee. UK Weekly Jobless Claims, Existing Home Sales.

Friday – Japan Inflation (February). UK Gfk Consumer Confidence. France Business Confidence.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 26, 2025

NewsAn economic Equinox in the US

On Thursday March 20th, the Northern Hemisphere marked the Spring Equinox. During this phenomenon, we experience an identical amount of daylight and night-time hours due...

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 7, 2025

Weekly InsightsWeekly Investment Insights

This newsletter was written on 07 March 2025. Last week, the euro reached its highest level versus the USD year-to-date, with traders anticipating an...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...