Choose Language

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on all imports, effective April 5. “Reciprocal tariffs” on several countries were significantly bolder than markets had expected, ushering in new uncertainty. For the EU, this means an additional 20% levy on goods entering the US. For China, it is a 34% levy on top of existing levies, bringing total tariffs to at least 54%. The UK received the minimum 10% tariff on its exports to the US.

Even before the announcement, US stocks had posted their worst quarterly performance in nearly three years, with stagflation fears mounting in the world’s biggest economy. The S&P 500 fell 4.6% in the first quarter of the year, while the Nasdaq slid more than 10%. Following the trade announcement on Wednesday, global stocks fell, and government bonds rallied on fears that we are on the brink of a global trade war. Investors rushed to safe haven assets in the midst of volatility. The S&P 500 experienced its biggest one-day fall since 2020.

Governments and companies around the world are now trying to estimate the impact that Trump’s tariffs will have. We see three potential scenarios:

Tariff: path forward:

- Trump starts cutting deals and tariffs are reduced.

- Courts or Congress block the tariffs; and/or

- Trump stays the course, and we see a historic realignment of global trade.

In the coming weeks, from a policy perspective, we can expect to see an increased focus on Congress passing tax cuts and their potential stimulative effects. If this is achieved, in tandem with trade deals, an increased focus on deregulation, and potential cuts/easing by the Federal Reserve, the current market narrative could shift quite dramatically.

Fears that trade tariffs will trigger a US recession means futures markets are now pricing 125bp of Fed rate cuts through January 2026.

Weekly Highlights

China retaliates against Trump tariffs

China announced last week that it would impose a 34% tariff on all imports from the US from 10 April, matching the 34% “reciprocal” tariff imposed by the US administration on Chinese imports. Beijing also announced other measures to be implemented as part of its response, including immediately restricting exports of seven types of rare earth metals, halting imports of poultry products from two US companies, adding 11 US defence companies to a list of "unreliable entities", and imposing export controls on 16 US companies.

China's retaliatory announcement caused global equity markets to fall further. Now, Beijing is discussing accelerating stimulus to counter the impact of tariffs.

Eurozone inflation fell for the second consecutive month in March

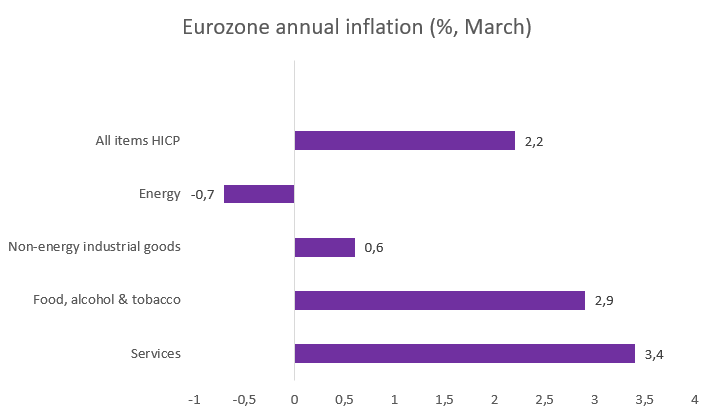

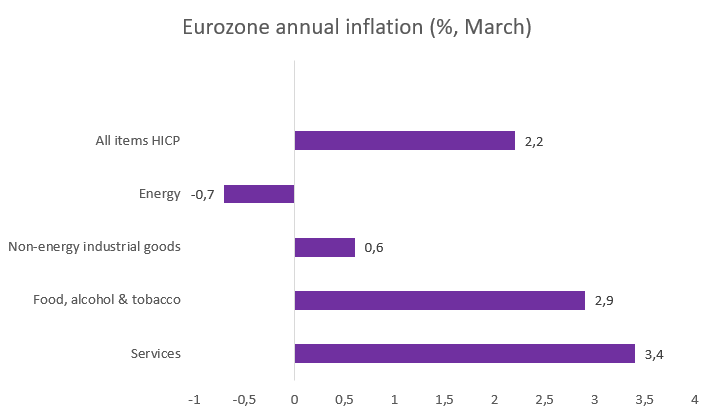

According to flash estimates, the annual inflation rate in the Eurozone eased to 2.2% in March, down from 2.3%. Price growth continued to slow for services (3.4% vs 3.7% in February) and energy (-0.7% vs 0.2% in February), but picked up for food, alcohol & tobacco (2.9%, compared with 2.7%). Prices for non-energy industrial goods remained stable at 0.6%.

Core inflation, which excludes volatile categories like food and energy, slowed to 2.4%, slightly below forecasts of 2.5% and marking the lowest level since January 2022.

Source: Eurostat, BIL

After delivering its sixth interest rate cut in March, the ECB signaled that it may slow the pace of rate cuts due to the inflationary risks from US President Trump’s trade policies. However, this latest inflation print, with services inflation slowing to its lowest level in more than three years, should be a welcome sign for policymakers as they decide on the pace of further rate cuts.

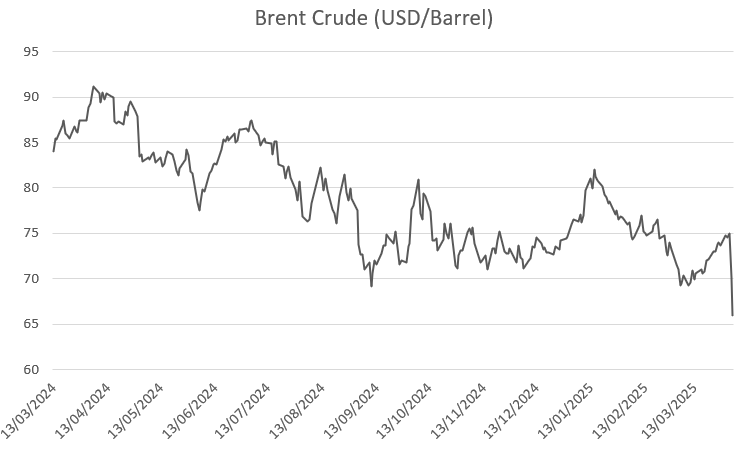

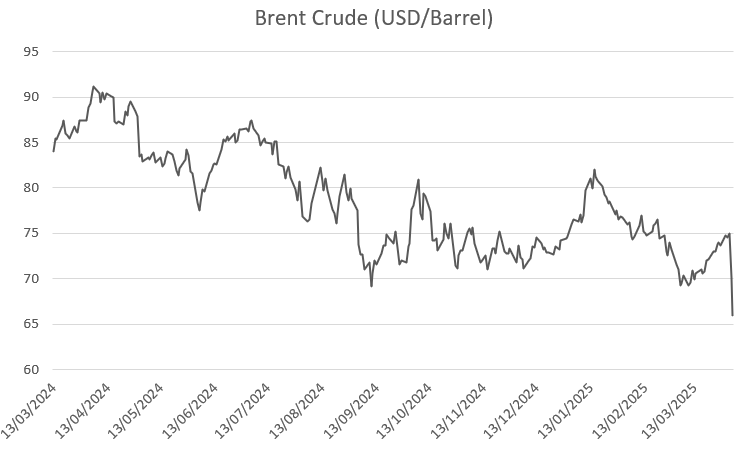

Oil sinks on growth fears and OPEC plans to increase production

Volatility is no stranger to the oil markets at the moment. Having entered another year of price volatility due to fears of a global trade war, possible changes to US sanctions on major oil producers, lower demand and increased production, oil prices fell further on Thursday following Trump's tariff announcements.

Source: Bloomberg, BIL. As at 04/04/2025

Although oil and gas imports were not included in the list of Trump's tariffs, there are growing fears of a potential economic slowdown in the US as a result of the tariffs. This would add to the already falling demand from China, putting demand from the world's biggest oil consumers at risk. At the same time, OPEC+ agreed to go ahead with its plan to phase out production cuts in May by increasing output by more than planned, which could lead to a further oversupply in the market, causing oil prices to extend its losses.

On Friday, prices fell further as China announced retaliatory tariffs of 34% on US imports starting on April 10.

US labour market remains sturdy, on balance

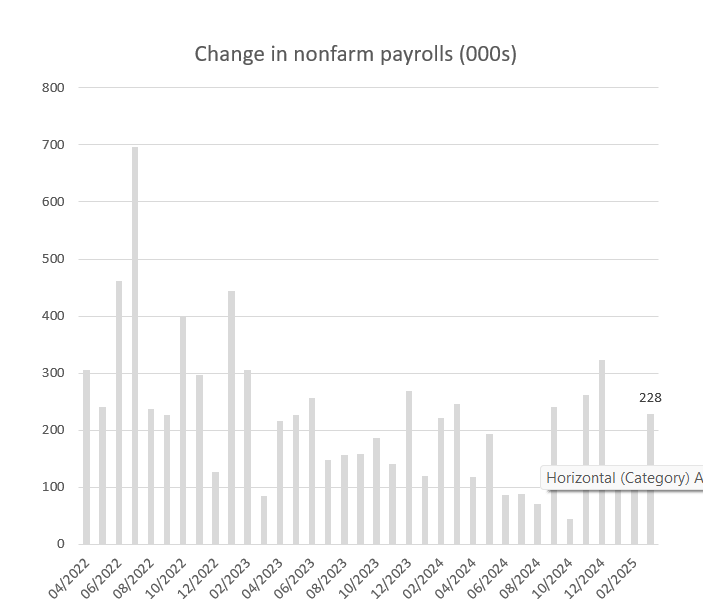

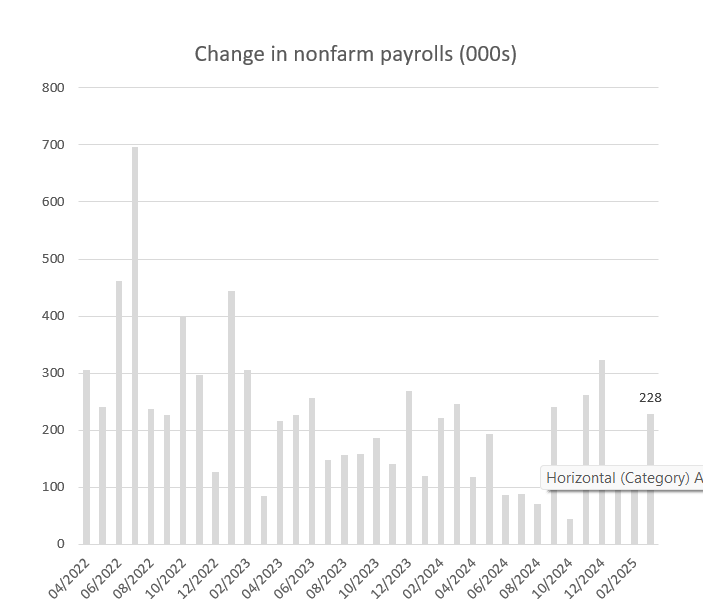

In a tumultuous week for markets, economic data pointed to residual strength in the US labour market. Nonfarm payrolls rose to 228k, far above the 140K expected, while average hourly earnings grew 0.3% MoM, as expected. Job gains were led by health care (supported by demographic forces, including an ageing population) and leisure and hospitality. The end of two strikes in March (at supermarket chain Kroger and Providence Health), boosted payrolls by some 15k.

The unemployment rate ticked up slightly to 4.2%, as the participation rate climbed (62.5%)

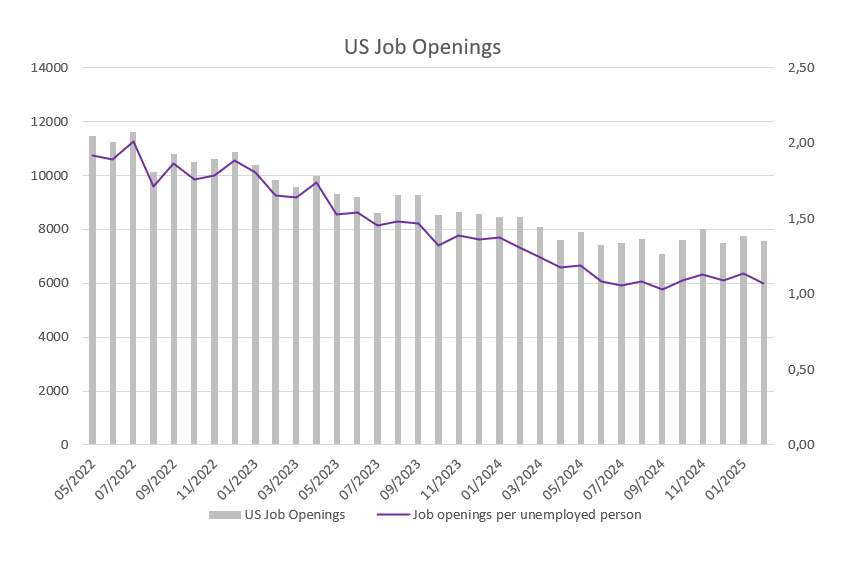

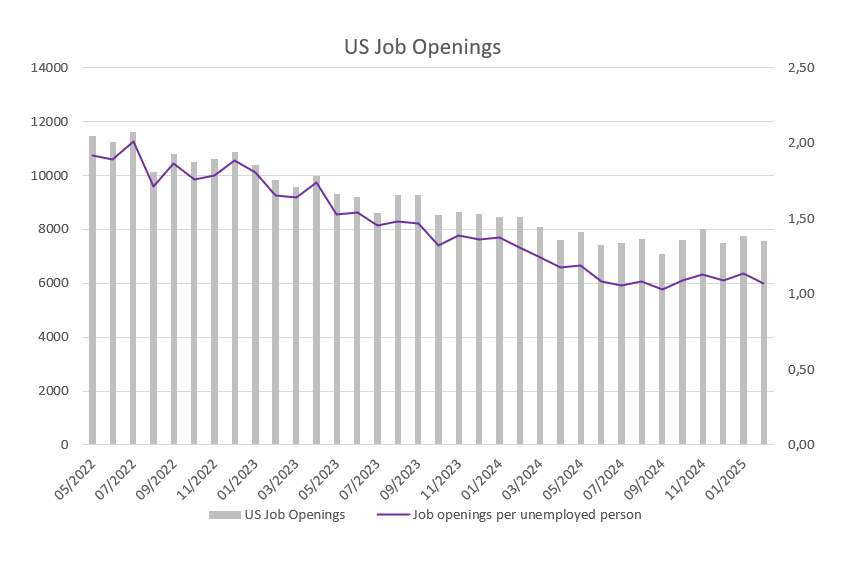

Job openings fell to 7.57 million in February, driven by declines in retail trade, financial activities and accommodation & food services. The hiring and quits rates were unchanged at 3.4% and 2% respectively.

Source: Bloomberg, BIL

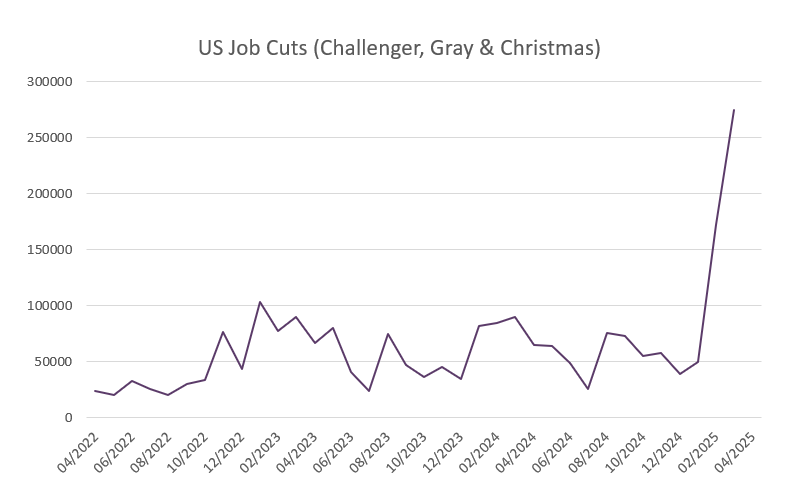

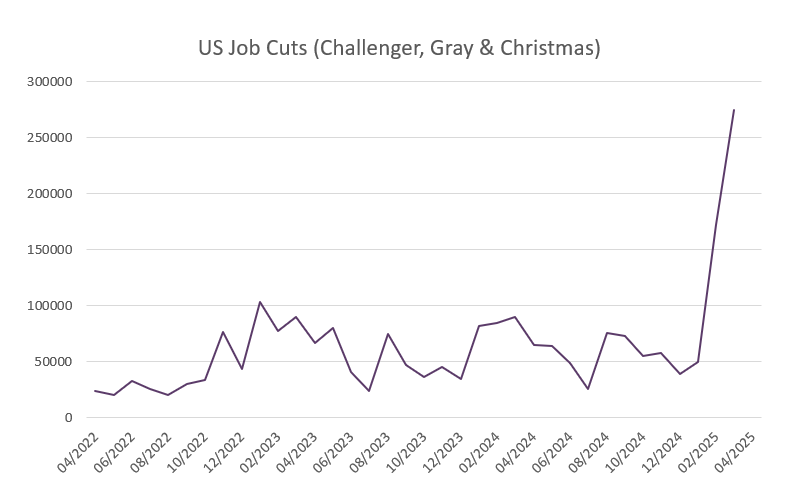

However, one data point leaned against these benign statistics and Powell’s assertion that the labor market is in a “low firing, low hiring situation”: Challenger Job Cuts. US employers announced over 275 000 job cuts in March, the highest number since May 2020. Dominating the job cut announcements was federal layoffs by the Department of Government Efficiency (DOGE). In the past two months, more than 280 250 federal layoffs have been announced as a result of the actions of DOGE and some analysts estimate that figure might rise as high as 500k this year.

Source: Bloomberg, BIL

So far in 2025, US employers have announced over 497 000 layoffs, the highest since the first quarter of 2009.

Calendar for the week ahead

Monday – Germany Balance of Trade (February), Industrial Production (February). Eurozone Retail Sales (February).

Tuesday – France Balance of Trade (February).

Wednesday – Japan Consumer Confidence (March).

Thursday – China Inflation Rate (March). Italy Industrial Production (February). US Inflation Rate (March), Jobless Claims.

Friday – Germany, Spain Inflation Rate (Final, March). UK GDP (MoM, February), Industrial Production (February), Balance of Trade (February). Switzerland Consumer Confidence (March). US PPI (March), Michigan Consumer Sentiment (Prel, April).

Saturday – China Balance of Trade (March).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...

April 2, 2025

BILBoardBILBoard April 2025 – Tariffs, turbul...

Written as at April 1 The first quarter of 2025 was anything but smooth. Market volatility surged, equity markets diverged, bonds offered little in the...

March 28, 2025

Weekly InsightsWeekly Investment Insights

Another week, another set of changes to US trade policy – and that’s before the April 2 deadline where reciprocal tariffs on several trading partners...