Stocks on both sides of the Atlantic advanced last week, clinging onto some positive news on trade, even if concrete details are still largely amiss. President Trump’s comment that he had no intention to fire the Chairman of the Federal Reserve also boosted sentiment, as did better-than-expected corporate earnings.

On the trade front, President Trump signaled that he is willing to reduce trade tensions with China. As it stands, the trade spat between the world’s two largest economies has escalated to such an extent that the US now applies a 145% levy on Chinese goods, while China applies a 125% rate. US Treasury secretary Scott Bessent warned that the US-China trade war was “not sustainable” and that the two would have to de-escalate the situation. He also said that he expected Washington and Beijing would reach a deal in the “very near future” and that the aim is not to “decouple”. Bloomberg News reported that China is considering suspending its 125% tariff on some US imports, while it was reported that Trump said China tariffs will drop ‘substantially – but it won’t be zero’.

Beyond the US-Sino spat, speculation around near-term agreements with several other trading partners also appeased markets. In an interview with Time Magazine, Trump suggested that he expects to conclude trade deals with partners in the next three to four weeks.

In the meantime, and until we have more concrete facts on how the newly-designed trade architecture is going to look, we expect market sentiment will continue to be swayed by all kinds of headlines.

Looking to earnings, companies on the S&P 500 are, until now, reporting solid results for the first quarter. As at the time of writing, 36% of the index had reported earnings, and of those, 73% reported earnings results that were above analyst expectations. On aggregate, companies are reporting earnings that are 10.0% above estimates, which is above the 5-year average of 8.8% and above the 10-year average of 6.9%, according to FactSet.

As of now, the blended earnings growth rate (which combines actual results and estimated results for companies that have yet to report) for Q1 is 10.1%, compared to an earnings growth rate of 7.0% last week and an earnings growth rate of 7.2% at the end of the first quarter (March 31).

If 10.1% is the actual growth rate for the quarter, it will mark the second consecutive quarter of double-digit earnings growth for the index.

While a the lion’s share of Q1 earnings reports are still to come, more than 90% of S&P 500 companies that have reported so far have mentioned the word “tariffs,” according to a Reuters analysis.

This week, markets will be closely watching results from Tech giants such as Apple, Microsoft, Amazon and Meta. Drug-marker Eli Lilly will also report.

Weekly Highlights

IMF Slashes growth forecasts

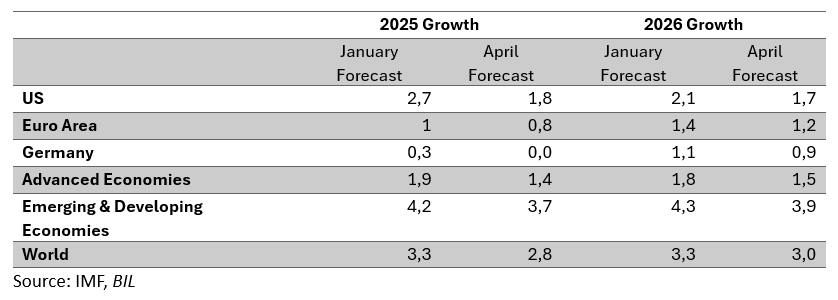

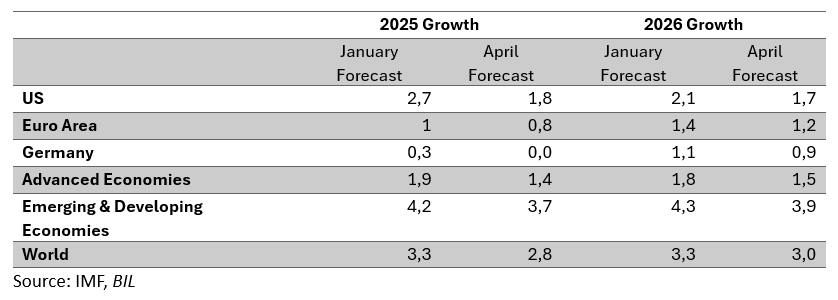

In its April World Economic Outlook, entitled “A Critical Juncture amid Policy Shifts”, the IMF has slashed its growth forecasts for the US, UK, Euro Area and many Asian countries, citing volatile US trade policies.

The report states that while trade developments unfold and uncertainties reach new highs, policies need to be calibrated to rebalance growth-inflation trade-offs.

US multinational firms have been one of, if not the key beneficiary of globalization over the past decades. At the same time, tariffs on inbound goods are essentially a tax on consumers. Consumption is the key driver of the US economy (around two-thirds of all activity), and already, households are beginning to exhibit signs of strain. It is therefore somewhat unsurprising to see that increasingly insular trade policies have led the IMF to cut its growth US forecast quite substantially, from 2.7% to 1.8% for this year.

The IMF slashed the Eurozone forecast by a lesser extent – from 1% to 0.8%. This week, the ECB’s Chief Economist Philip Lane told Bloomberg News that tariff uncertainty would curb economic growth, but a recession was unlikely given the bloc’s diversified trading relationships.

Zooming in on Germany, the IMF now expects zero growth this year. This estimate matches freshly released forecasts from the German government (previously it had expected meagre growth of 0.3%). Bundesbank President Joachim Nagel commented that trade tensions would have a “significant” impact on Germany’s export-oriented economy, which might even lead to a “slight recession.” Germany’s GDP has shrunk for the past two years.

PMIs show trade uncertainty starting to bite at home and abroad

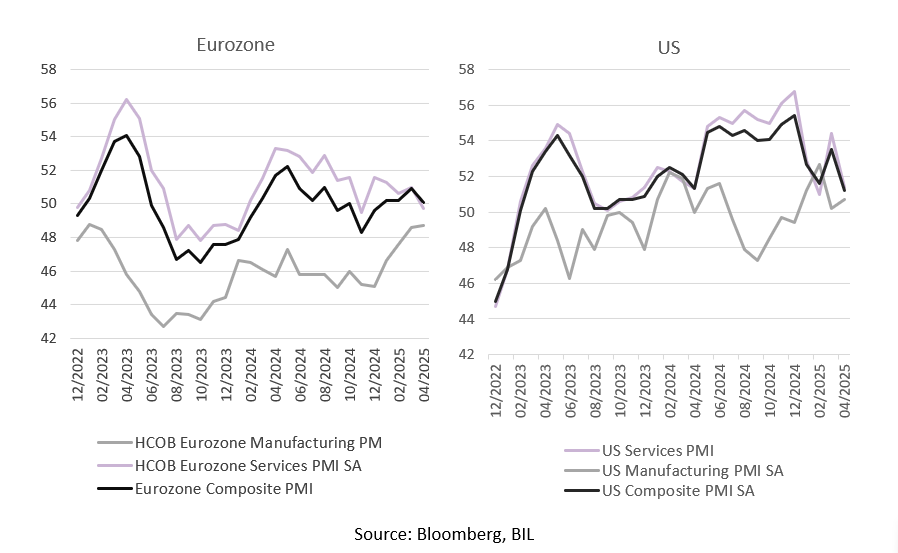

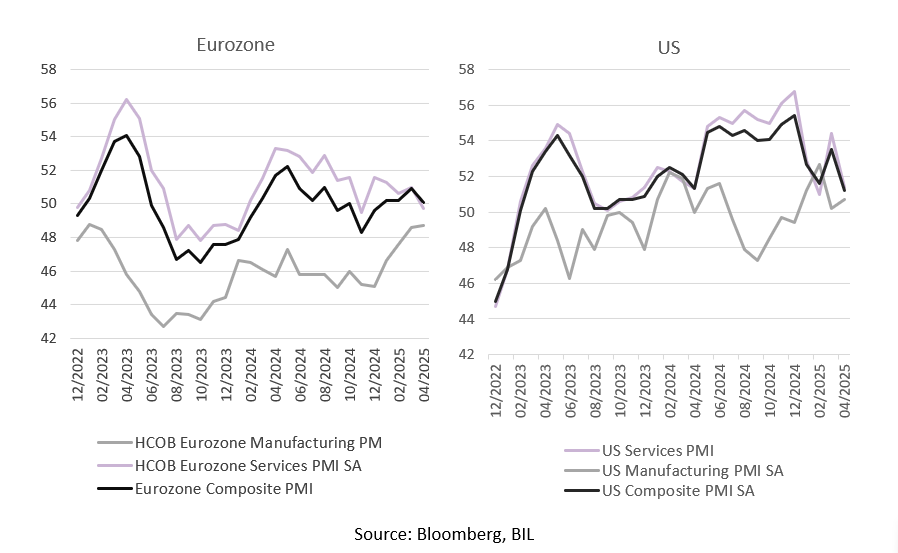

While the trade tariffs announced thus far have exclusively covered goods, the latest set of PMIs (considered one of the most important leading economic indicators) suggest that the services sector is far from immune from the chaos.

On Wednesday, the flash PMI showed that private sector activity in the Eurozone barely expanded in April. The Composite index fell from 50.9 to 50.1; a reading of 50 suggests stagnation. While the manufacturing downturn eased slightly, the services sector sunk into contraction (PMI from 51.0 to 49.7).

Businesses in both sectors saw an eleventh month with fewer new orders leading employment to stagnate. Looking forward, uncertainty on global trade policy lowered confidence to an over two-year low at the composite level. For services, business confidence fell to the weakest in almost five years.

On the inflation front, input costs rose the least in five months, and that seeped into output charges.

Overall, the PMI suggests that trade uncertainty has put the Eurozone’s fragile recovery in jeopardy. It adds another argument to the case that the ECB might have to do more to support growth, while the pricing indices show that its 2% inflation target could well be coming further within reach.

The US Composite PMI fell to 51.2 in April, suggesting the slowest private sector activity growth in 16 months. Services activity slowed (51.4 vs 54.4) while manufacturing improved (50.7 vs 50.2). Business expectations about the year ahead dropped to one of the lowest levels seen since the pandemic while prices charged for goods and services rose at the sharpest rate seen in over 12 months, with manufacturing particularly affected. The one piece of good news for the Fed as it pursues its mandate was that employment moved higher, suggesting the labour market is still in alright shape.

US Tech Giants get away with “modest” fines under the EU’s Digital Services Act

A few weeks ago, we discussed some of the potential ways Europe could respond to US trade tariffs. Currently the White House is imposing a 10% blanket tariff on EU goods, but if the two sides can’t reach a deal, that could double to 20% after the 90 day grace period. This is in addition to a 25% levy on autos, aluminum and steel. It is estimated that a 20% tariff could wipe 1% off of Eurozone GDP over the next three years.

Trump has already rejected proposals from Brussels to drop tariffs on all bilateral trade in industrial goods.

So, what can the European Commission do to appease Trump?

One possibility might be closer coordination with the US on China. Already, an ECB survey found that tariffs are not the primary concern among the bloc’s manufacturers. Rather, it is an inflow of cheap goods from China, so the EU was already in a spot where it would probably have to rethink industrial policies and protections. However, it is likely to take a softer stance overall that would not endorse "decoupling".

An other option might be increasing gas purchases from the US to narrow the trade deficit. It could also reduce non-tariff barriers (which Trump has been vocal about, referring to “lawfare” on US tech companies).

There was an essence of this last week when Meta (EUR 200Mn) and Apple (EUR 500mn) were hit by what were considered modest tech fines under the Digital Markets Act. These figures pale in comparison to the EUR 1.8Bn fine received by Apple last year.

While markets are clearly nervous about trade developments, they must also not rule out the idea that Trump's tariffs could actually increase globalisation if other countries move to lower trade impediments.

Calendar for the week ahead

Monday – Spain Retail Sales. France Unemployment. Canada General Elections

Tuesday – Germany GFK Consumer Confidence. Spain GDP Growth Rate (Flash, Q1) and Business Confidence. Eurozone M3 Money Supply. Italy Business and Consumer Confidence and Industrial Sales. Eurozone Economic Sentiment and Inflation Expectations. US JOLTs Job Openings, CB Consumer Confidence.

Wednesday – China Manufacturing PMI. Germany, Italy and France Inflation. Germany Retail Sales and Unemployment. US and Eurozone GDP Growth (Prel., Q1). US ADP Employment Change. US PCE Price Index (March) and Treasury Refunding Announcement.

Thursday – Bank of Japan Monetary Policy Meeting. US Weekly Jobless Claims, ISM Manufacturing PMI.

Friday – Japan Unemployment. Eurozone Inflation Rate (Flash, April), Unemployment Rate (March). US Nonfarm Payrolls, Unemployment Rate and Average Hourly Earnings (all April), Factory Orders (March).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more