Choose Language

February 13, 2019

NewsTheresa May tells MPs to hold their nerve as March 29th looms

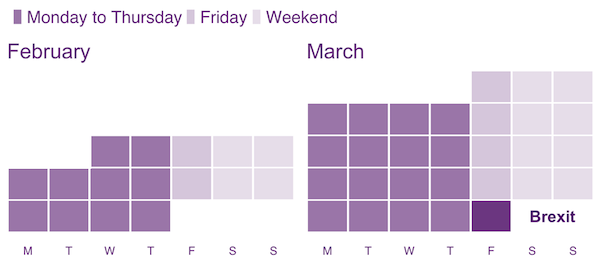

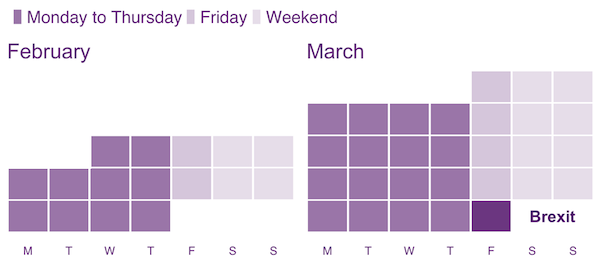

The House of Commons now has 27 normal working days until the official day of Brexit on 29th March.

N.B. The House of Commons occasionally sits on Fridays to debate individual MPs’ bills.

Source: Parliament, BBC, BIL

On 15th January, Theresa May’s Brexit blueprint suffered a historic defeat in Parliament. On January 29th, Parliament heard and voted on various amendments brought to the House by MPs on ways to improve the withdrawal agreement. An amendment that sought to extend Article 50 to allow more time for negotiations was rejected, meaning that for now, time is running out in the race to avoid a ‘no-deal’ Brexit. The amendment which was accepted by Parliament (by 317 to 301) gave Theresa May a ‘mandate’ to renegotiate the Irish backstop.

This has been one of the main points of contention throughout negotiations. The ‘backstop’ arrangement is a last resort plan, weaved into the withdrawal agreement, designed to avoid a hard border between Northern Ireland (which will remain a part of the UK) and the Republic of Ireland (which will remain in the EU). The current backstop plan sees Northern Ireland staying aligned to some rules of the EU single market if another solution cannot be found by the end of the transition period in December 2020. Pro-Brexit Conservatives and May’s coalition partners, the DUP, strongly oppose the backstop. But May is stuck between a rock and a hard place because the EU has been unwilling to re-open the Pandora’s Box of negotiations.

Theresa May yesterday, in her statement to Commons, said that she needs more time to seek changes to the backstop and asked MPs to hold their nerve. She said that if no agreement is reached by 26th February on an amendment, then MPs will get more non-binding votes on Brexit options on February 27th. The final meaningful vote on whether Britain leaves the EU on 29th March with a deal would be pushed back into March.

The Labour leader Jeremy Corbyn responded by accusing May of "recklessly running down the clock" in an effort to "blackmail" MPs into backing her deal, and asked when exactly MPs would get a final, "meaningful" vote. This was originally supposed to take place in December but was postponed.

In the meantime, to let MPs still unhappy with the withdrawal deal in its current form have their say, another parliamentary debate is expected to take place tomorrow on 14th February (similar to that which took place on January 29th) about Brexit more generally, without specific focus on the backstop. During this session, lawmakers will be able to propose amendments, which, if they receive enough support, could block, delay or change the shape of Brexit.

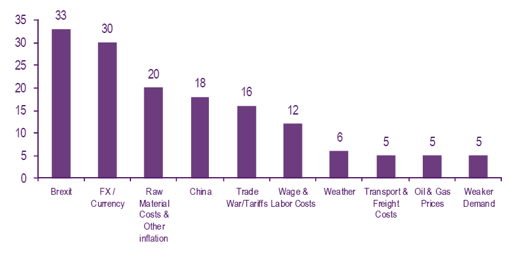

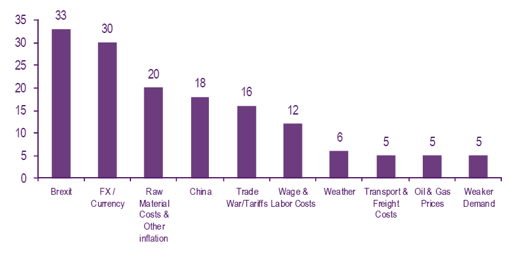

But the ongoing uncertainty is already taking its toll. In European earnings calls, Brexit has been cited as the key detractor from performance, more than trade talks.

Number of Stoxx 600 companies citing Negative Impact in Q418 Earnings calls

Source: BofAML as of 8th Feb

Industry research tends to see the most probable scenario as one in which UK MPs pass the current deal at the last minute in order to avoid the ‘worst case scenario’ of a no-deal Brexit. Deutsche Bank for example places a 50% probability on last-minute ratification of the existing deal, 15% on a softer deal, 15% on a new election, 15% on a no-deal Brexit and 5% on a second referendum. However, these are merely probabilities, and as we saw with the original referendum, anything can happen. For this reason, we have not taken specific Brexit bets. Whilst being reluctant on European equities, any exposure we have had has been centred around the eurozone rather than Europe at large. Because of the volatility that Brexit (alongside trade fears and other risks) could inject into the entire financial system, we have padded our portfolios with core Government bonds for downside protection. We have also de-risked by climbing up the quality curve in fixed income and by reducing our equity overweight and removing some cyclicality. In this way, we are hoping for the best, but preparing for the worst.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...