Choose Language

April 2, 2019

BILBoardBILBoard April 2019 – Do you believe in the Philosopher’s stone?

The Philosopher’s stone, the elixir of life, used for rejuvenation and perhaps even immortality... If such a talisman was to exist for the economy, it would most certainly lie with central banks (CB) who yield the most influence over the trajectory of the cycle. After pursuing quantitative tightening to prevent the major economies from overheating, CBs are now breathing life into the ageing cycle by adopting a decidedly more dovish approach to monetary policy.

At its March meeting, the Federal Reserve (Fed) doubled down on it dovish stance, unveiling a new dot-plot which eliminated the 2 rate hikes originally anticipated for 2019. It also announced plans to slow its balance sheet reduction programme in May, before bringing it to a complete close in September. A policy error by the Fed poses the single biggest risk to the continuation of the cycle – as we have said before, economic cycles don’t die of old age - the most frequent contributors to modern recessions have been monetary policy tightening and oil price shocks. With the funds rate in a “broad range of neutral”, Chairman Powell has emphasised ‘patience’ before any further policy amendments, reducing the risk of recession, for another few quarters at least.

The European Central bank (ECB) has also pivoted towards a more accommodative stance in light of slowing growth and weak inflation. In March, it introduced a fresh TLTRO programme to provide banks with favourable loans. Unfortunately, the ECB doesn’t have much left in its policy jar should economic clouds continue to gather.

Dovish policy might not set equity markets on fire but it at least puts a floor under risk assets in the near-term. But with that said, markets are sceptical about how much CBs can shoulder alone and at some point, investors will have to see other risks subside (i.e. no deal Brexit avoided, trade war threats ease, declining economic data finds a bottom…). Otherwise, there is a danger that a negative feedback loop develops in investor confidence and recession fears stoke behaviours that in the end cause a recession.

Macro

With global growth becoming a headwind for the US economy, and as the glitter of fiscal stimulus wears off, the Fed has downgraded its growth expectations from 2.3% to 2.1% for the current year. However, underlying trends remain supportive (industrial production and consumer confidence are running strong, whilst unemployment fell to 3.8% in February…). We thus remain optimistic about the domestic economy, albeit a shade less bullish than before.

As we predicted, the eurozone is failing to live up to expectations and fears that declining data won’t stabilise are taking hold. The flash composite PMI for the region slipped to 51.3 in March, contrary to expectations which predicted a rebound to 52. Germany - the EU’s growth locomotive – is causing real concern: manufacturing output fell for the third consecutive month in March, with factory orders deteriorating to the greatest extent since the height of the financial crisis in April 2009. A US clamp down on car imports, if it materialises, could be the straw that break the camel’s back.

Recent eurozone PMIs galvanised growth fears, causing the German 10-year yield to fall below zero for the first time since 2016, and the US yield curve to invert. Yield curve inversion is considered by some to be a harbinger of recession. However, though every US recession since 1962 has been preceded by an inversion, not every inversion has been followed by a recession, rendering the yield curve as an imperfect predictive tool. Even if it was a reliable signal, if history is a guide, recession would be at least 9 months away, and those 9 months normally see equities have a nice run.

Elsewhere, in China, data is still mixed but the central bank has a full armoire of policy tools that already seem to be having a somewhat positive effect.

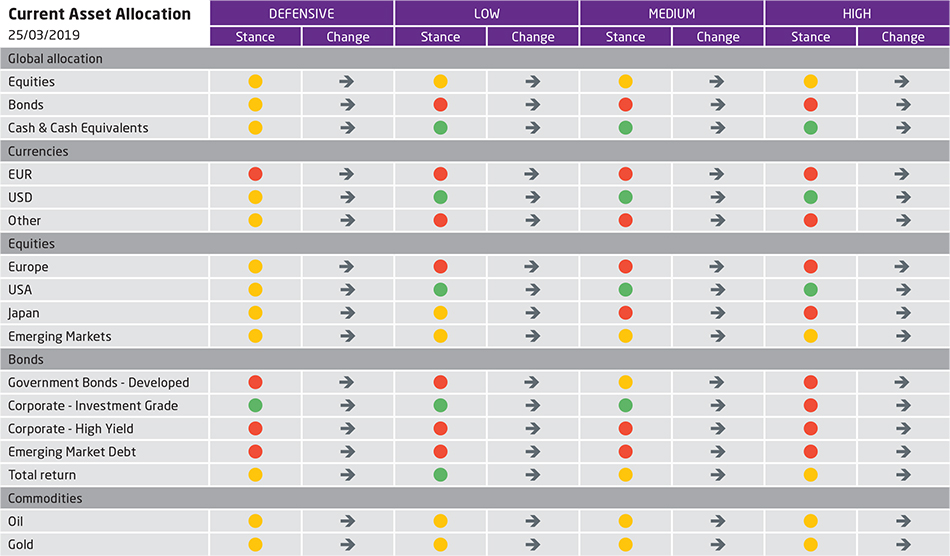

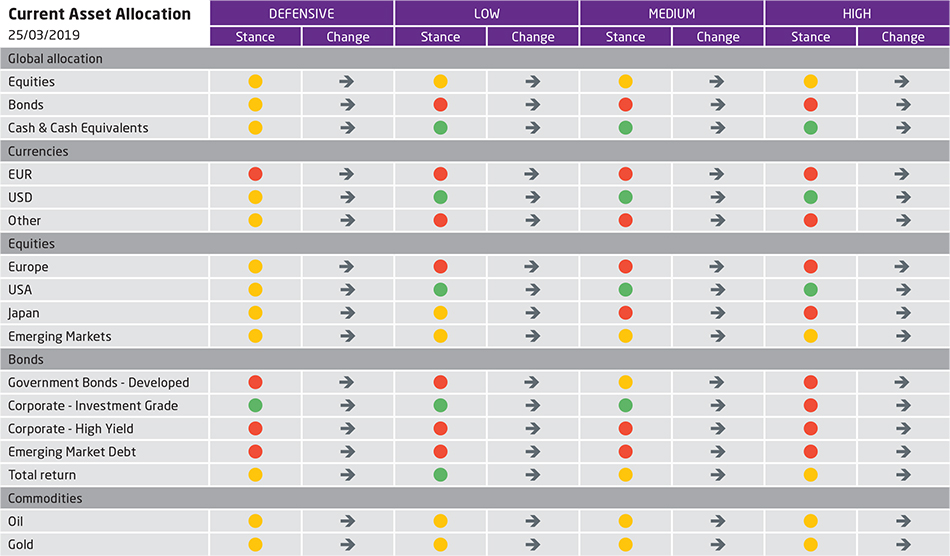

Asset Allocation

At an interim Investment Committee earlier this month, after a rapid ascent in risk assets, we brought our equity positioning down to neutral, locking in gains. We still think that there are opportunities left to be had in equities - with support coming from subdued earnings expectations and easy policy - but believe that the current environment calls for some restraint in the deployment of risk budgets. For the same reason, we favour Growth, Quality and Momentum styles over Value and focus on Large-Cap, low-risk stocks.

In terms of regions, we give preference to the US where the economy seems to be soldiering on. Although it has the highest valuation in absolute terms, on a sector neutral basis the US is not more expensive than Europe and is not exposed to the same magnitude of risk factors. We stay neutral on Japan and Emerging Markets and underweight Europe. Our preferred sector for the moment is IT as it outperforms in terms of earnings growth expectations and offers economic resilience.

Our fixed income allocation stays constant. In higher risk profiles with more equities, we have built up a small exposure to government bonds as a buffer against stock market volatility – an inherent feature of the later stages of the cycle. In lower risk profiles, we give preference to investment grade (IG) bonds, particularly in Europe. All-time high corporate debt levels in the US, as well as high hedging costs for European investors, taint the attractiveness of US IG bonds, whereas the latest ECB actions are positive for European credits, with continued dovishness expected. We keep a sprinkling of Emerging Market (EM) Debt for additional yield: a more dovish Fed should give way to a softer dollar, which should give support to EMs. Rating trends in the high-yield bond space, have moved further downwards in the US whilst remaining at a negative level in Europe, rendering this asset class quite unattractive.

Fundamentals in the gold market are starting to become compelling, however, we believed it was premature to buy in at this stage. Gold tends to be quite illiquid and for the time being, we prefer to have dry powder that can be readily redeployed into the equity space should Q1 earnings season go well, or if macro data finds a floor.

To stick to the Philosopher’s Stone reference, the patient Fed seems to be taking a leaf out of Hagrid’s book, who famously said: ‘What’s comin’ will come and we’ll meet it when it does’. We likewise adopt a wait-and-see approach in our allocation. Whilst there may not be a Philosopher’s stone, let’s see if the global central bank collective can achieve a suitable alchemy of monetary policy tools and calibrated communication that keeps the cycle alive for longer.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...

November 22, 2024

BILBoardBILBoard December 2024 – Red Sweep

At BIL, we are long-term investors guided by stable, strategic asset allocation guidelines. However, our investment strategy itself is a living, breathing thing,...

November 18, 2024

Weekly InsightsWeekly Investment Insights

Less than two weeks after the US Presidential election, Trump has made significant progress in nominations for top government posts, leading to some market...