Last week brought more ominous news for the

European Auto industry, with ACEA[1]

figures revealing that new car sales had slipped by a substantial 7.8% in June.

The data

comes at a time when car manufacturers are already grappling with a host of challenges

such as heavier regulation, the demonization of diesel, Brexit, the trade war, changing consumer

attitudes towards car ownership and the shift towards electric vehicles

(meaning a lot of cash needs to be siphoned into R&D). The share prices of

major auto makers slipped on the news, with the market value of certain high profile

names already dented from profit warnings issued earlier in the year.

Sales

year-to-date are down 3.1%, and the ACEA predicts that for 2019 in its

entirety, sales will come down 1%: with total EU car sales projected to be just

above 15 million units at the end of the year. Previously it had predicted a 1%

rise.

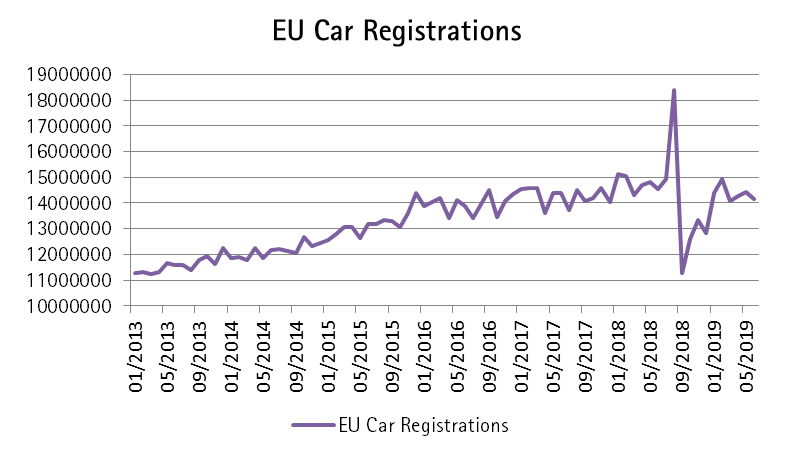

What is important to remember is the fact that the roll-out of emissions standards in September 2018 skews the data as is visible in the below chart. In August 2018, car registrations in Europe were given an artificial boost ahead of the new WLTP emissions test that was applicable on all new car registrations from 1st September 2018. This led most manufacturers to slash prices in order to offload pre-WLTP vehicles - it will be after September when a base-effect in the data stops having such a strong influence on this year’s figures.

But calendar

reasons aside, the automotive industry is in crisis mode, with margins being

squeezed from all angles. On one hand, there is the possibility that the car

market has hit its peak. Millennial generations do not have the same ‘emotional

connection’ to cars and see them rather as a means of getting from A to B. They

are consequently more drawn to alternative solutions such as short-term

rental (Uber model), peer-to-peer sharing (Blablacar or SnappCar), the

on-demand model (Flexdrive) to Airbnb-style models (Turo). Sales in China,

which was the new hot market for autos, are also on the decline. 2018 will be

marked as the first year in almost three decades that negative growth has been

recorded in China’s auto industry. 2019 continues on the same path with onslaught

of new CO2 regulations and with consumers postponing purchases because of trade

war uncertainty and in anticipation of government incentives which analysts say

could potentially materialize in 2020 (they ascribe a 20% probability to this).

Simultaneously,

whilst sales are falling, costs for car manufacturers are rising. The unprecedented

shift to electric and autonomous vehicles is capital intensive, as is the

investment needed to remain compliant with new ‘green’ regulations. Yet in

order for new ideas about electro mobility to have a chance, they must be

affordable to customers. Today they are more expensive than traditional

vehicles and it is going to be difficult for automakers to strike a balance

between affordability and a level whereby they can cover their costs.

Such margin

compression explains why car manufactures are trading at a 15 year low

(in terms of valuations) against the wider market. And this is just the tip of

the iceberg. There is also the risk of a no-deal Brexit, or Donald Trump’s threat of tariffs on auto

imports into the US which floats on the horizon – that could really be the

straw that breaks the camel’s back for industry which plays a crucial role in Europe’s

economic fabric.

[1] European

Automobile Manufacturers' Association

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 23, 2026

Weekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...