Choose Language

November 27, 2017

NewsHigh-yield shakeout ; a canary in the coal mine?

A recent sell-off in European and US high-yield (HY) bond markets led some commentators to speculate that this could be a sign of trouble around the corner for global equity rally. On the contrary, though stock markets have gone through a brief tough spell, the outlook remains positive, with equities still able to take sap from the global economic rebound. Over the next week, we continue to monitor developments in HY and in global stock markets, but believe that markets are more likely to drift steadily sideways rather than sell-off in the short-term, at least until US tax reforms are announced.

Around mid-November, there was a shake-out in the high-yield bond market; a small market correction translated into a waterfall of outflows. In one week alone, funds and exchange traded funds (ETF) investing in HY instruments suffered outflows of $6.6 billion - the third largest weekly outflow amount on record. From peak to trough, the US high-yield market fell -1.5%, whereas the European equivalent fell -1.2%.

As a result, pessimistic headlines emerged, and some feared that the ominous developments in the high-yield space were a talisman of trouble in global equity markets given the historical correlation between the two asset classes.

However, looking at HY on a more granular level shows that much of the correction has been driven by individual names or sectors. In Europe, much of the spread widening in HY yields was attributable to individual issuers with company-specific problems (yields increase when prices fall). Whereas in the US, spread widening was largely contained to the telecom sector. In short, it seems investors have re-priced the risk of certain HY holdings, rather than switching wholly into a ‘risk-off’ mode.

Albeit, high-yield is not an asset class we favour, as we believe that investors are not adequately rewarded for the inherent risk therein, and we see more value in equities.

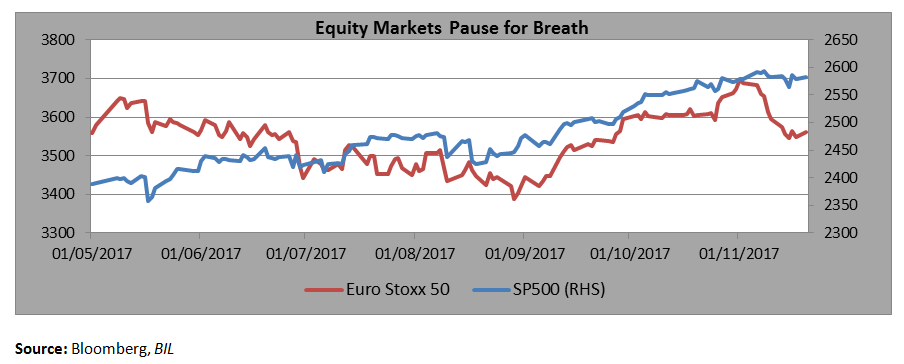

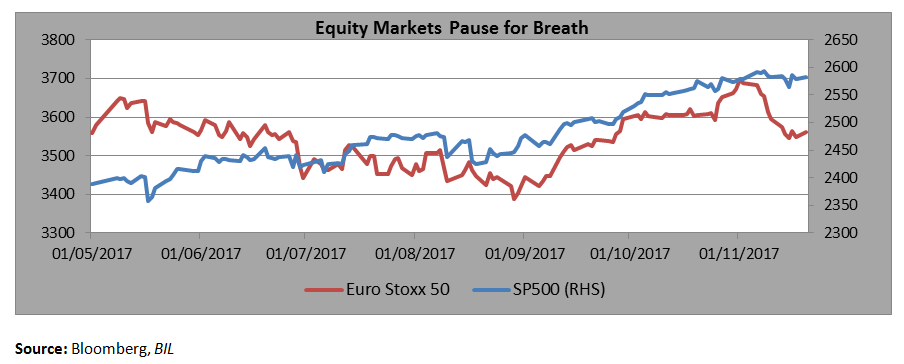

Equity markets; still some juice left in the orange

Though equity markets have hit a slight bump in the road lately, we believe this is somewhat due to portfolio re-balancing at the end of what has been a fruitful year for many investors and portfolio managers.

Furthermore, in Europe, the euro’s appreciation has been a headwind for European stocks, as well as the fact that earnings surprises were not as pronounced those in the US.

However, economic momentum remains strong. In Europe, the composite Purchasing Manager Index (PMI) reading for October was 56; comfortably far north of 50 (the level between economic expansion and contraction). Indeed, the eurozone remains on track to record its strongest year since 2007 with GDP growth in the third quarter tallying in at 0.6%. Strong growth coupled with favourable financial conditions and a prolonged period of monetary stimulus from the ECB creates a benign landscape for equities. It is also worth noting that analyst expectations around earnings revisions have historically correlated closely with PMI readings.

In the US, the LEI (Leading Economic Index, made of 10 components) increased sharply in October, suggesting that solid economic growth will persist into 2018. If Trump’s administration continues to valiantly push through on tax reform, this should inject further sentiment into the market. JP Morgan predicts that if the statutory rate were to fall from 35% to 25%, the average S&P500 earnings-per-share could increase by more than $10.

Further still, tactical risk indicators, which can be considered as another type of ‘canary in the coalmine’ - are not signalling imminent danger, and are currently flashing neutral, suggesting that in the short-term we shouldn’t expect large swings in either direction. All eyes are now on the roll-out of Trump’s tax reform which should be instrumental in dictating the trajectory of markets in the medium term.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 30, 2025

Weekly InsightsWeekly Investment Insights

At a summit in the Hague last week, Nato allies pledged to raise defence spending to 5% of GDP by 2035. This was music...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...