The pandemic, through necessity, has fast-forwarded the onset of the fourth industrial revolution at a speed no one could have foreseen. In the not-too-distant future, many aspects of our lives will be digital, with distributed ledger technology, cloud-based infrastructures and the Internet of Things (IoT) all prominent.

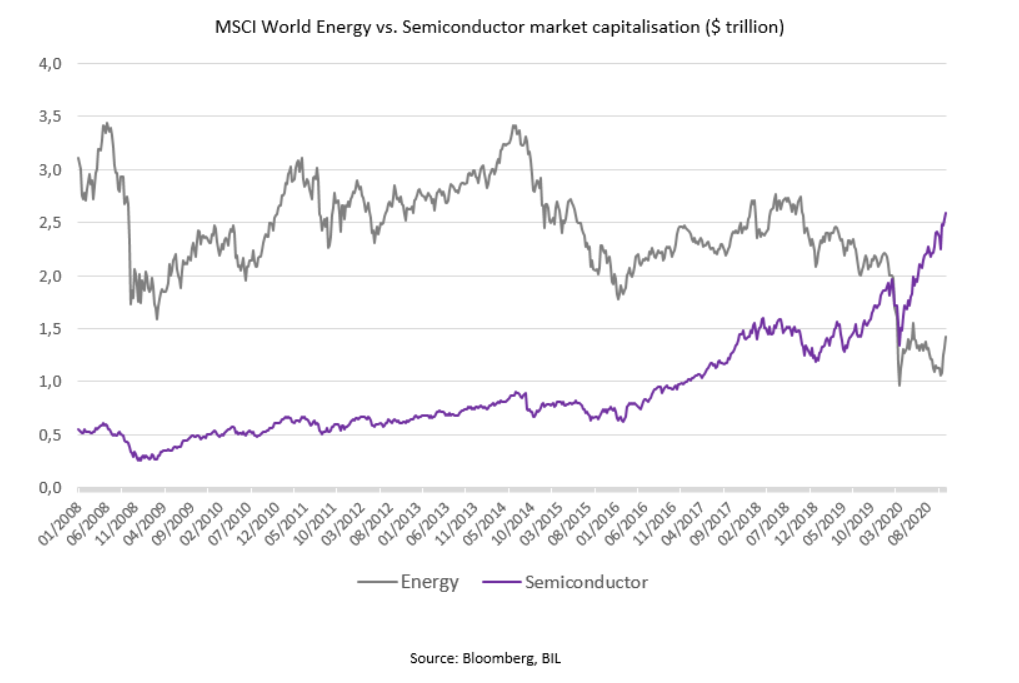

Our new digital infrastructures will run not on oil, but primarily on data. The term “data is the new oil” has been circulating for a few years already, but now the proof is in the pudding. One of the most striking observations from 2020 (next to the oil price’s momentary drop into negative territory) comes from the fact that the market capitalisation of semi-conductor producers in the MSCI Word index extended largely beyond the market capitalisation of the energy sector (which includes the world’s largest oil producers).

As humans, we generate data perpetually. Statista estimates that by 2025, there will be more than 75 billion IoT connected devices in use in what will resemble a vast nervous system, with the majority of these devices having the ability to track and store data.

Companies that effectively gather and analyze the abundance of data out there will have some of the most valuable market intelligence there has ever been. As the old adage goes, information is power, and companies are starting to act on this in almost every sector. Only recently, data giant S&P Global agreed to buy IHS Markit in 2020’s biggest merger worth some $44 billion in order to have a firm foothold in the increasingly competitive market in financial information to feed data-hungry algorithms.

Already, some of the most valuable companies in the world are actively harvesting and commodifying our data. It is no coincidence that these companies also have strong market leadership. For example, Amazon churns large amounts of data to recommend products that it knows we are susceptible to buy. Social media giants collect data about almost every aspect of our lives – our location, what venues we attend, who we speak to, what our interests are, our political views… In turn, this means we can be targeted with ads that are likely to appeal to us.

Data gives these companies immense power and the opportunity to make a lot of money – two things that the oil majors enjoyed throughout much of the 20th century. But the similarities between data and oil don’t stop there. The oil that comes out the ground needs to be refined before it is useful. Data is abundant, but without proper analysis, it has limited use. As Peter Sondergaard of Gartner states, “information is the oil of the 21st century, and analytics is the combustion engine.” Data engineering will become essential as companies move away from diagnostic analytics which look at what happened, towards predictive and prescriptive analytics which pre-empt future behaviours and trends.

Further still, just like oil spillages, data leaks are increasingly problematic and while oil is causing the greenhouse effect in the Ozone, data is causing glasshouse problems on earth whereby sometimes it can feel like privacy no longer exists. As big data and analytics become crucial resources for both private and public enterprises, privacy and security concerns will also gain prominence. The spotlight will intensify on companies who do not navigate these concerns responsibly as part of their business model (the BP oil spill of 2010 comes to mind…).

In selecting the companies we wish to invest in, we are increasingly drilling down into the business models of individual companies to understand their intentions in the digitalisation space, across sectors. If companies are to become and remain competitive, data and analytics are increasingly indispensable assets, allowing firms insights that can accelerate innovation cycles, help them stay ahead of competitors and more acutely address consumer needs.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 16, 2026

Weekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...

January 26, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...