Choose Language

November 26, 2021

BILBoardBILBoard December 2021 – With winter, a new wave

As winter sets in in the northern hemisphere, cases of COVID-19 are resurging, compelling governments to reinstate restrictive measures. Austria has reimposed a full lockdown, while the German Health Minster said that COVID infections are developing in a way that means a new lockdown in Europe’s largest economy cannot be ruled out. Markets are now mulling over the consequences for growth and monetary policy, while inflation still looms large.

Macro Outlook

After some volatility in macro data in the autumn, economic surprises have begun to tick upwards again in western economies.

The US: positive all the way – The US is undoubtedly the place where the most macro strength lies. Manufacturing activity is running faster than it did prior to the COVID-19 pandemic, companies are hastily building their inventories, and retail sales are 21% above February 2020 levels. But industrial production is still struggling to satiate demand. Inflation pressures have not yet hampered consumption, but are starting to weigh on sentiment.

Europe: skating on thinner ice – Some eurozone economic readings have also taken a brighter turn; the most recent PMIs beat consensus estimates, both for the headline manufacturing index (58.6) and the services measure (56.6), and Q3 GDP also surprised on the upside, coming in at +2.2%. However, beneath the surface, European companies are much harder hit by ongoing supply chain dislocations, rising input costs and shortages and a renewed COVID wave only adds salt to the wound.

China: an uphill struggle – China was at the helm of the recent dip in economic data and, in the short term, its economy is struggling to make a comeback. The manufacturing PMI fell to 49.2 in October, while the non-manufacturing PMI edged down to 52.4. Fixed asset investment is generally stable but weak real estate investment presents uncertainty in the near future. In 2022, we expect expansionary fiscal policy that should (together with a gradual pick-up in consumption) reboot growth and set China back on its normal growth trend.

Inflation

Price pressures are broadening out and becoming stickier, driven by both supply and demand dynamics. In October, the US inflation rate was the highest it has been since the early 90s (headline +6.2%, core +4.6%), while in the eurozone, it hit a 13-year high (headline +4.1%, core 2.0%). Central banks have started to acknowledge that price pressures may be longer-lasting than initially thought but they have not yet expressed an urgency to act – especially ahead of winter, which will be the real litmus test for the success of vaccination campaigns.

The Fed has altered its wording on inflation, from “largely reflecting transitory factors,” to “reflecting factors that are expected to be transitory.”

Our base case is that inflation will moderate at more manageable levels after Q1 2022 as volatile energy prices retreat and more kinks in supply chains are ironed out. However, inflation drivers are starting to broaden out and there is a risk that what might have been a temporary burst of inflation could become more ingrained. In this scenario, central banks would probably be forced to tighten quicker than expected, putting growth in jeopardy.

Investment Strategy

Equities

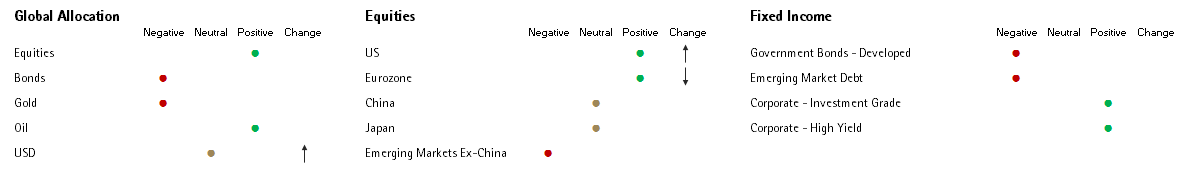

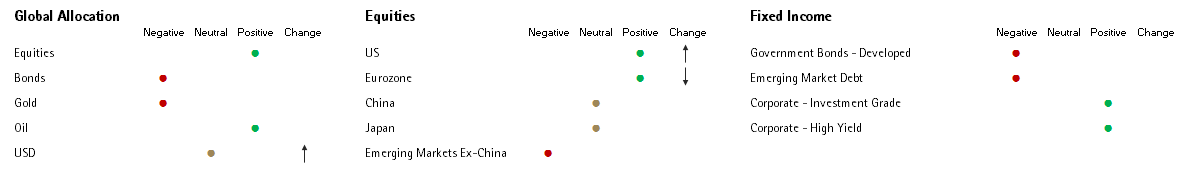

We remain overweight on equities, which are still supported by above-trend growth and a lack of attractive alternatives, given that negative real rates render other asset classes (e.g. cash and fixed income) uninteresting.

At our most recent Asset Allocation committee, we increased our overweight to US equities, based on the fact that this is the region where we see the most economic muscle. Profit growth is strong, with higher input costs yet to have any significant impact on margins, and revisions are still positive. Additionally, fiscal policy is still supportive; the recently passed infrastructure bill is worth some USD 1 trillion, while discussions around a new social safety net spending plan are ongoing. The US is also attractive from a flight-to-safety perspective on any potential risk-off sentiment (there are more quality stocks in the US that tend to perform better in a risk-off environment).

The trades were not currency hedged and, as such, our USD exposure increased proportionately. This is in line with our improving outlook for the dollar. The trajectory of monetary policy is likely to be the dominant driver of the USD going into next year, and tighter Fed policies (while the ECB remains relatively dovish), coupled with elevated inflation levels, should offer support.

Simultaneously, we trimmed our exposure to European equities, though we remain overweight on this asset class overall. Q3 earnings were very strong on the continent, albeit with fewer positive surprises than in the US, and the region offers a hedge against higher inflation expectations and rates as more of a Value play. However, the Delta variant has become a larger risk factor in Europe as cases surge again, while companies are still weighed down by supply chain issues (particularly in the auto sector). Dampened sentiment in the manufacturing sector is gradually seeping into services too.

In terms of style, we have diluted the relative weight that we allocate to Value inside of US equities. We still believe the Value style has further to go in this environment of higher inflation but feel a more balanced approach is prudent given that style rotations can happen all of a sudden and it can be painful to be on the wrong side of the trade when this occurs. We maintain a balanced allocation across cyclical and defensive sectors preferring healthcare, industrials, energy and financials.

Fixed Income

In the fixed income world, rates are expected to remain rangebound in the short term, given uncertainties around COVID, but we believe they will slowly succumb to the magnetic pull of the North Pole through 2022. As such, we are broadly reluctant regarding this asset class, particularly developed market sovereigns and duration. With a fine-tooth comb, investors can still find opportunities in the investment grade space. With most of the market priced for perfection, spreads seem to have found a floor; however, they might widen slightly for issuers/sectors which are rate-sensitive or companies at the risk of M&A activity (take for example, KKR’s recent bid for Telecom Italia). Returns must therefore be generated through carry and selectivity – we particularly like financials. High yield also offers some opportunities, but we advise our clients not to over-stretch when it comes to credit risk. Of particular interest is the BB space where a large pipeline of companies is set to join the investment grade universe – these “rising stars” are usually rewarded with spread tightening.

Commodities

Oil prices have dipped recently, largely driven by renewed restrictions in Europe, with some investors fearing that demand for fuel could dry up if the situation deteriorates. Additionally, President Biden has announced the release of emergency oil reserves – 50 million barrels worth – to combat high fuel prices. The impact of such measures are rarely long-lasting (the US burns through this amount in roughly 2.5 days) and OPEC+ could hold back a planned output boost, which would offset the single shot of new supply. Overall, the oil market is still very tight driven by a lack of investment and increasing demand, compelling our overweight stance.

An environment of policy normalisation, higher rates and a stronger US dollar makes us reluctant towards gold.

Conclusion

This will be the last BILBoard published in 2021, a year that has delivered double-digit returns on equity indices and exceptionally strong earnings growth. As we move into the new year, we maintain our equity overweight, believing that earnings should remain the key driver of returns, enabling equities to deliver sound, though perhaps not spectacular performance.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....