Choose Language

February 11, 2022

FocusEU puts its chips on the table in the global race to secure semiconductor supplies

This week, the European Commission presented the EU Chips Act, described as a ‘comprehensive set of measures to ensure the EU's security of supply, resilience and technological leadership in semiconductor technologies and applications’. Involving over €43 billion, the package which still must be approved by all member states, is aimed at bolstering Europe’s competitive edge and enabling the digital and green transition.

Context: A global chip shortage

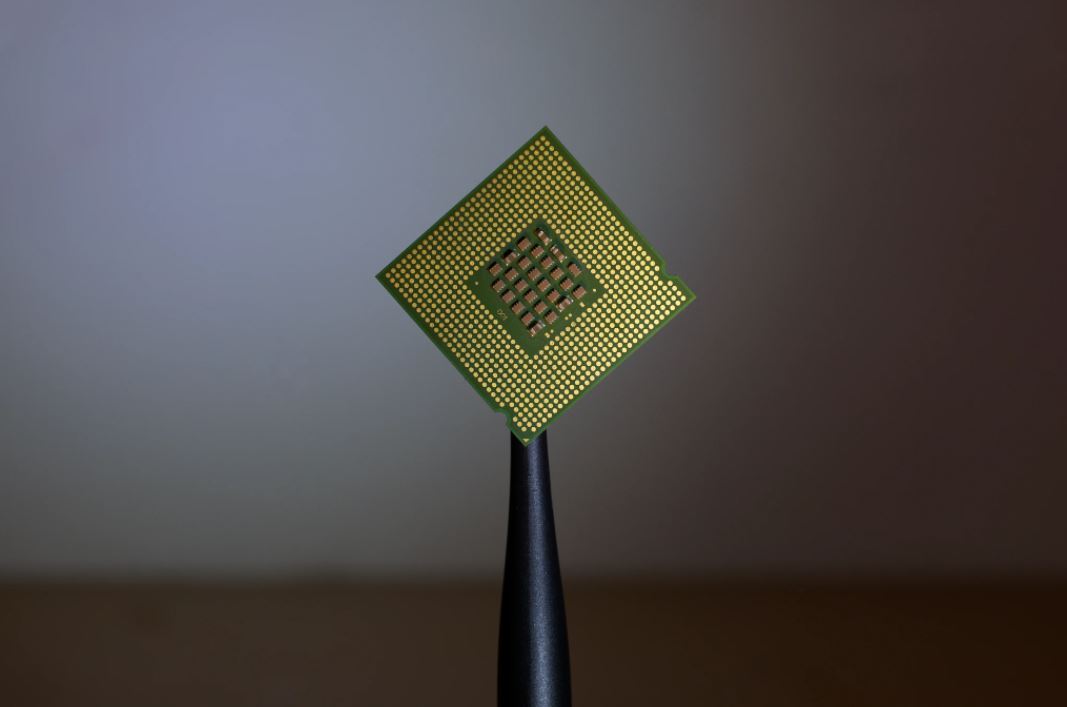

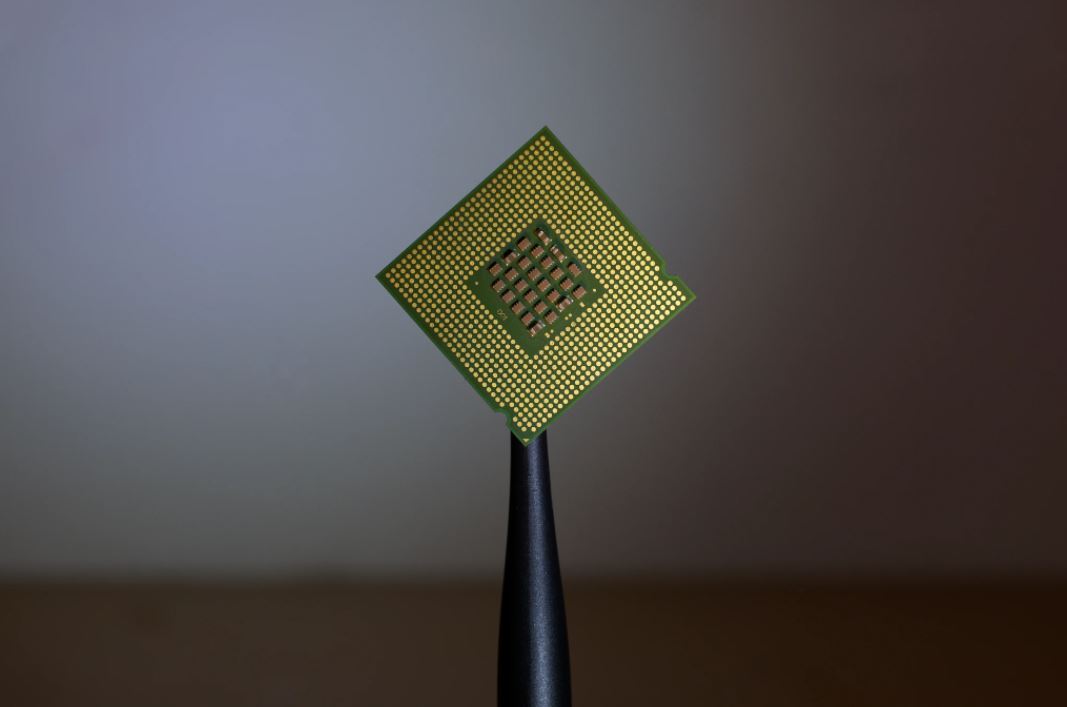

As has been well documented, due to factory closures at the height of the pandemic and a spike in demand for all manner of electronic goods, the world is grappling with an acute shortage of semiconductors (often referred to as chips, these are silicon-based computational building blocks used in everything from washing machines to smartphones to military systems). As such, a whole host of industries around the world has come under pressure.

Semiconductors are the silicon-based computational building blocks used in most electronic devices

In Europe, for example, the EU Commission reports that production in the auto sector in some Member States decreased by one third in 2021 on the back of the chip shortage. A report released by the US Department of Commerce in January found that the US faces an “alarming” shortage of semiconductors. Demand for the vital components jumped 17% from 2019 to 2021, with no proportionate increase in supply, leaving the market so tight that the median inventory amongst US manufacturers that rely on semiconductors had fallen to less than 5 days' worth of chips; pre-pandemic chip inventories were sitting at around 40 days. This means that even a small production hitch could destabilise supply chains for all manner of goods and Commerce Secretary, Gina M. Raimondo has warned that the situation is threatening American factory production and helping fuel inflation.

This is particularly visible in the US used car market; the shortage has reduced the supply of new cars and as a result, in January, used car prices were up almost 40% year-on-year, and new car prices up about 12%.

Demand looks set to remain firm with new markets for the chip industry emerging such as industrial automation, automated vehicles, cloud infrastructures, the Internet of Things, 5G/6G connected devices, the metaverse, supercomputers and so on…

The EU’s Response

The process of producing semiconductors is highly complex, consisting of many interdependent steps and it is knowledge and capital intensive.

The players in the semiconductor production process can be broadly grouped into four main categories:

- Fabless companies – these focus on one step in the supply chain (design)

- Foundries – these focus on the front-end manufacturing

- Outsourced assembly and testing companies (OSAT’s, back-end manufacturing)

- Integrated device manufacturers (IDMs), which integrate across the design and manufacturing steps, the core of the chip-making industry

Europe has a strong presence in some R&D intensive fields such as machinery (Dutch firm ASML is a global leader, making machines for the likes of TSMC) and in fundamental research (through university-linked research centres such as IMEC in Belgium or CEA-Leti in France). However, Europe is a relatively small player when it comes to actually manufacturing those designs, accounting for only 10% of the market for manufactured chips (via STMicro and NXP, for instance). As such, the EU has not been able to respond the global chip shortage from a position of strength.

Viewing semiconductors as a strategic assets for key industrial value chains, the EU wants to change this.

“…most of our supplies come from a handful of producers outside Europe. We simply cannot afford this dependency and uncertainty any longer”

- European Commission President von der Leyen at the EU Industry Days 2022

Back in July 2021, the Commission launched the European Alliance on Processors and Semiconductor technologies noting that from smartphones to 5G to the Internet of Things and beyond, these technologies are crucial for a successful Digital Decade.

Building on this, the EU Chips Act proposed in February 2022, would mobilise more than €43 billion euros of public and private investments and aims to bring about a thriving semiconductor sector from research to production to create a resilient supply chain (€12 billion in additional public and private investment by 2030, on top of more than €30 billion of public investments already foreseen, backed by NextGenerationEU, Horizon Europe and national budgets). The goal is to enable the EU to double its current market share to 20% in 2030 - essentially quadrupling production given that the market itself is set to double in this time period.

The key components of the plan are:

• Chips for Europe Initiative – seeks to pool resources from the EU, third countries and the private sector to strengthen existing R&D and innovation, to ensure the deployment of advanced semi-conductor tools, pilot lines for prototyping, testing and experimentation of new devices for innovative real-life applications…

• A new framework to ensure security of supply by attracting investments and enhanced production capacities. Europe needs new advanced production facilities but these come with huge up-front costs. The plan proposes to:

-

- Adapt state aid rules, under a set of strict conditions, allowing public support for "first of a kind" production facilities, which benefit all of Europe.

- Provide aid to cover a maximum of 100% of the funding gap between a company choosing the EU instead of elsewhere.

- Create a Chips Fund to facilitate access to finance for start-ups to help them mature their innovations and attract investors.

- Launch a dedicated semiconductor equity investment facility under InvestEU to support scale-ups and SMEs to ease their market expansion.

• Set up a coordination mechanism between the Member States and the Commission to monitor the supply of semiconductors, estimate demand and anticipate /respond to shortages.

• Invest in R&D (doubling down on existing strengths), focusing for instance on transistors below 3 nanometres and on disruptive technologies for artificial intelligence.

(N.B. The nanometer number indicates the size of the transistors: A small number means a higher number of transistors can be packed per square millimeter on a chip; the more transistors on a chip, the more powerful and efficient the microprocessor.)

If successful (this is not a given, especially if we consider the Commission’s 2013 attempt to "double" Europe's share of global chip production to 20%), the plan will yield several key benefits for Europe.

It could boost growth and innovation and prevent future disruptions due to supply chain crunches. It will also allow Europe to chart her own course in the fourth industrial revolution and in the new era of “smart everything”, AI and connected devices. If chip design and manufacturing are not localised, then Europe will have to rely on imported systems from other countries, designed on the terms and standards of those countries.

The plan will also help the EU with its ambition to become the first carbon neutral continent by 2050, with semiconductors being a key component in the electrification of the economy. However, each new generation of semiconductors requires more energy, water and greenhouse gases to create. By bringing production home, the EU can create its own standards and subsidise companies that adhere to them.

The European Parliament and Member States will need to debate the Commission's EU Chips Act in the ordinary legislative procedure. If adopted, the Regulation will be directly applicable across the EU.

What are other countries doing?

Semiconductors have risen to the top of sovereign agendas the world around.

The US is already home to dominant semiconductor companies like Intel and Nvidia. However, according to the Congressional Research Service (CRS), the United States’ share of global semiconductor fabrication capacity has been on a steady decline for decades, falling from roughly 40% in 1990 to around 12% in 2020. Due to high costs and complexity, many US chip firms transitioned to a “fabless” model, focusing on designing new, more advanced chips while outsourcing their manufacturing abroad, primarily to East Asia, which is now home to nearly 80% of global chip fabrication. Some of America’s largest tech firms, including Google, Apple, and Amazon, rely on Taiwan’s TSMC alone for nearly 90% of their chip production. TSMC, alongside Korea’s Samsung, already mass produces 7-nanometer chips and as of now, these companies have unrivalled positions in high-end chip manufacturing capacity.

In January 2021, the US Congress passed the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act. This legislation, enacted as part of the National Defense Authorization Act, authorized a series of programs to promote R&D and fabrication of semiconductors within the US given that many strategic technologies such as quantum computing and AI rely on advanced semiconductors.

Later, in June 2021, the Senate passed the United States Innovation and Competition Act (USICA), which designates funds to finance the programs outlined in the CHIPS for America Act, including $39 billion in financial assistance for chip plant construction over five years, and another $11.2 billion for R&D. For now, the Act remains in legislative limbo as it has not been approved by the House, but there is bipartisan support for using public funds to ensure a more robust semiconductor manufacturing base in the US, suggesting that it could eventually pass once the details are ironed out. Already, TSMC has planned to build a $12 billion foundry in Arizona, while Intel has said it would invest up to $100 billion to build potentially the world's largest chip-making complex in Ohio

In China’s newly released 14th Five-Year Plan (covering the period from 2021-2025), semiconductors were explicitly identified as a strategic technology priority, with the objective of achieving “technological self-reliance.” China’s homegrown tech behemoths such as Alibaba, Tencent, Baidu and Meituan have all started investing into chip development while ZTE has emerged as a trailblazer recently, with the news that it is now using TSMC’s 7-nanometre chip production technology as well as its advanced chip packaging technology to build the processors that power electronic devices including smartphones, servers and base stations. According to the Semiconductor Industry Association, the Chinese government plans to invest well over $150 billion from 2014 through 2030 in semiconductors. It was recently announced that the government will subsidise up to 30% of investment in semiconductor materials and equipment projects up to $15 million in Shanghai.

Implications for investment portfolios

Long-term investors should bear in mind that the semiconductor industry is a highly cyclical one, subject to periodic booms and busts and a shortage could at some point become a glut, especially with so many key players ramping up efforts to boost production. However, the move by the EU and other governments corroborates our conviction that investment thematics such as digitalisation and sustainability are only set to gain traction, with political sentiment building.

The EU is serious about becoming the first carbon neutral continent by 2050, and the might of public policymakers is being thrown behind this goal. Digitalisation, while a structural shift in its own right, will be a key component of the green transition. There are various ways to play these themes and the sub-themes within, beyond having a laser focus on one sector alone (such as semiconductors). Companies that find themselves at the intersection of these two megatrends are well poised for the future.

References:

- European Chips Act - Questions and Answers (2022): https://ec.europa.eu/commission/presscorner/detail/en/qanda_22_730

- Digital sovereignty: Commission proposes Chips Act to confront semiconductor shortages and strengthen Europe's technological leadership (2022): https://ec.europa.eu/commission/presscorner/detail/en/IP_22_729

- Commerce Semiconductor Data Confirms Urgent Need for Congress to Pass U.S. Innovation and Competition Act (2022): https://www.commerce.gov/news/press-releases/2022/01/commerce-semiconductor-data-confirms-urgent-need-congress-pass-us

- Speech by President von der Leyen at the EU Industry Days 2022: https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_22_930

- Commission proposes New European Industrial Strategy for Electronics – better targeted support to mobilise €100 billion in new private investments (2013): https://ec.europa.eu/commission/presscorner/detail/en/IP_13_455

- Alliance on Processors and Semiconductor technologies (2021): https://digital-strategy.ec.europa.eu/en/policies/alliance-processors-and-semiconductor-technologies

- Semiconductor Industry Association: Taking Stock of China’s Semiconductor Industry (2021): https://www.semiconductors.org/taking-stock-of-chinas-semiconductor-industry/

- The CHIPS for America Act: Why It is Necessary and What It Does (2022): https://www.csis.org/blogs/perspectives-innovation/chips-america-act-why-it-necessary-and-what-it-does#:~:text=Research%20and%20Development%3A%20The%20Act,and%20secure%20microelectronic%20supply%20chains.%E2%80%9D

- https://www.reuters.com/technology/tsmc-says-construction-has-started-arizona-chip-factory-2021-06-01/

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...