Choose Language

April 6, 2022

NewsFrench elections in focus

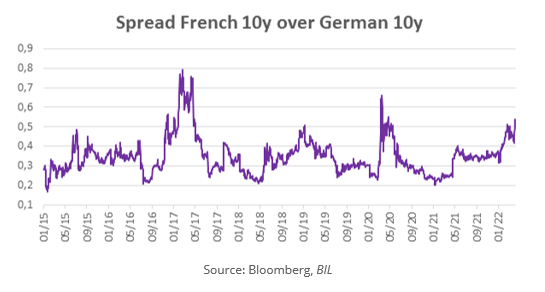

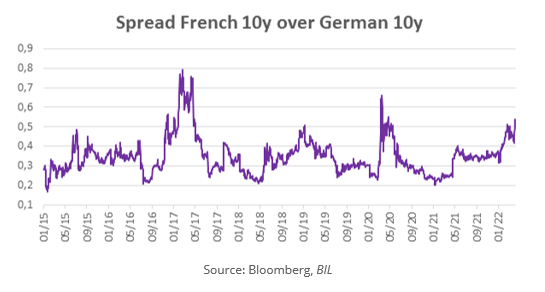

Sunday plays host to the first round of the French Presidential election. In the likely scenario that no candidate wins an outright majority, the two candidates who receive the most votes will go through to a runoff on Sunday 24th April. The outcome, which will have implications for the future trajectory of the French and European economies, is still very uncertain. Despite this, the risk premium for French government bonds (as expressed via the spread) has not risen substantially, as it did in 2017.

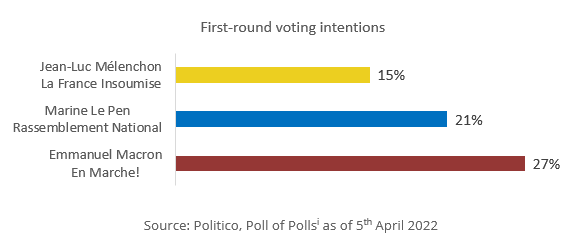

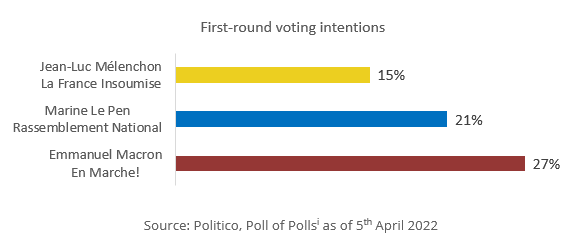

Incumbent, Emmanuel Macron is up against eleven other candidates from all over the political spectrum. According to Politico’s Poll of Polls, the current three front-runners are Marine Le Pen, the leader of the traditional far-right party Rassemblement National (National Rally); Jean-Luc Mélenchon, leader of hard-left party La France Insoumise (France Unbowed); and Macron himself, who positions himself on neither the left or the right. Emmanuel Macron is still the big favourite to succeed himself as French president for five more years.

However, poll results are only a snapshot and a lot can still change - especially difficult to predict is the outcome of the second round. Macron’s main opponent, Marine Le Pen, is closing the gap fast. In recent days, her campaign has gained momentum and on Monday, a poll conducted by Harris Interactive revealed that 48.5% of voters said they would vote for her in a likely runoff against Macron; the highest percentage she has ever notched. This, considering the margin of error, means a victory by Macron is not a foregone conclusion and Macron himself warned the far-right is a threat.

Investment considerations

Former banker, Macron, is perceived as the business-friendly candidate, having cut taxes and rolled out various reforms to spur growth and job creation. The French economy performed better-than-expected in 2021, recording 7% growth (higher than Germany, Italy and Spain), while unemployment sank to 7.4% in Q4 2021, its lowest rate since 2008. At the same time, France’s public debt remains substantial (112.9% of GDP in 2021, down from 114.6% in 2020, according to the national statistics office INSEE [ii]). Also, despite growth, studies have also found that some French people feel left behind and have referred to Macron as “the President of the Rich.” [iii]

For investors, there are some key factors in the election that could be meaningful for portfolio positioning.

Firstly, the candidates have varying energy policies; a topic that carries a lot of weight with Europe in the midst of an energy crunch. Without any significant raw materials in its soil, France has long relied on nuclear power and all the main candidates except Mélenchon agree on the need for more nuclear power to strengthen France’s energy independence. Macron has positioned himself as an advocate against climate change, arguing that with nuclear power, investment in renewables and energy saving measures France “will become the first great nation to exit from fossil fuels”. He wants to set aside €50 billion for the ecological transition.

Back in January, Le Pen’s spokesperson and MEP Nicolas Bay, presented her climate and energy program noting, “we cannot decouple the very legitimate concern for climate change from economic concerns and purchasing power.” Le Pen’s key proposal is to fuse environmental action and social assistance by lowering VAT on all energy products to 5.5% (from a current level of 20%) and to encourage households to improve the energy performance of buildings. She is opposed to wind turbines and would prefer hydrogen-powered vehicles over electric equivalents. “The battery-electric vehicle is a transitional model; it places us in a situation of strong dependence [regarding] rare-earth elements and Asia,” Bay commented, adding that “the real technological leap would be hydrogen”.

Mélenchon wants to freeze the prices of gas, petrol and food in the short term, impose a levy on polluters, end nuclear and fossil fuel-generated power by 2050 and end market determination of energy prices with a price stability guarantee.

According to research conducted by the Ipsos group, 58% of those polled said purchasing power is the most important topic to them. Healthcare and the environment followed, at 27% and 25%, respectively.

Secondly, there will be significant implications for domestic businesses in France. Macron seeks to reiterate the dirigiste (interventionist) approach Charles de Gaulle used in the 1960s for the fourth industrial revolution. He proposed to invest €30 billion on high-tech industries including semiconductors, life sciences and space exploration, and has called for the implementation of “an industrial strategy, meaning the deployment of 100% French supply chains”, saying he would invest to the tune of €50 billion a year, thanks to savings due to pensions and benefits reforms and cuts in government costs. Le Pen wants to intervene to set prices, distribute subsidies to prop up faltering sectors of the economy and set up a French sovereign wealth fund to invest in strategic sectors. Mélenchon hopes to pass a “social emergency law” after taking office, increasing the minimum wage to €1,400 per month, and capping salary differences between workers and CEOs at 1 to 20. He also wants to prevent the top companies listed on the French stock exchange, the CAC 40, from paying dividends and to implement a 32-hour work-week.

Another factor that hinges on the outcome is European integration. Marine Le Pen, who is entering the race for the third time, does so with a more diluted manifesto, aimed at appealing to a broader swathe of right-wing voters. Her party has dropped its Frexit rhetoric and unpopular plans to exit the euro. However, relations with Europe would likely become much more abrasive through moves to prioritise the French constitution over international law and to reimpose border checks. Mélenchon wants to withdraw from NATO and use a veto in the EU to block new free trade agreements, as well as enlargement without social and fiscal alignment. Under Macron, France has held the torch for European sovereignty.

What are the markets saying?

Until recently, bond markets showed little consideration for the upcoming elections. While the spreads of French Government bonds (OAT) over their German counterparts have increased since the beginning of January, it is only more recently that some investors have started to price in more so-called “Le Pen risk”. With only 3 percentage points separating Macron and Le Pen in polls, and taking the margin of error into account, it is surprising that markets have not repriced the risk more.

Looking at today’s spread of the French OAT over the German Bund, one can see it is still far from the levels seen during the French elections of 2017. This is despite the fact that Macron’s lead in polls was substantially higher back then. Maybe this is because Macron is now the President running for reelection, compared to being a relatively young tiger in politics.

If the gap between the candidates narrows further, one could expect to see the risk premium for French Government bonds (as expressed via the spread) opening up.

If the market is completely wrong-footed, as it was in the case of the election of Trump and the referendum on Brexit, we could be in for a turbulent ride with a sharp increase of the risk premium for France.

What is also worth noting is that after the presidential election, a new parliament will also be elected on June 12th. This vote is also very important because the outcome largely determines the extent to which the elected president can smoothly roll-out their political agenda.

[i] https://www.politico.eu/europe-poll-of-polls/france/

[ii] https://www.insee.fr/en/statistiques/6325548

[iii] https://www.aa.com.tr/en/europe/macron-called-president-of-the-rich-in-new-study/1725852

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...