- Federal Reserve Chair warns that monetary policy will probably have to remain tight for quite some time as the US central bank acts to control 4-decade high inflation

- The speech pushed back on hopes for a dovish pivot while delivering a cautionary note about the risks of inflation becoming entrenched

- “Reducing inflation is likely to require a sustained period of below-trend growth, some softening of labour market conditions and some pain to households and businesses

On Friday at the annual central banking forum in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell delivered a highly-anticipated speech on US monetary policy.

A year ago at the same event, Powell posited that inflation pressures would only be “transitory”, largely driven by supply-side forces. This did not prove to be the case and soon the Fed had the most acute inflation problem in forty years on its hands, forcing aggressive action to try and force it back down towards its 2% target. In just four months, it has raised the benchmark policy rate from near-zero to a target range of 2.25-2.50% and more hikes are expected.

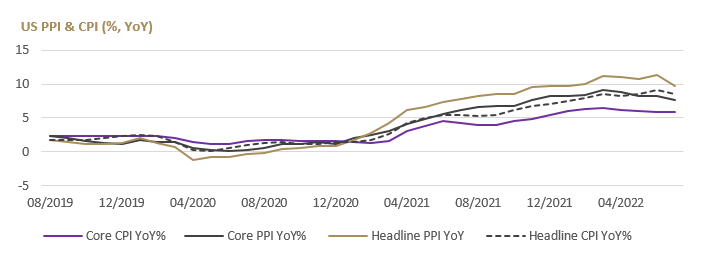

While both the producer price index (PPI) and the consumer price index (CPI) have edged downwards, owing largely to a fall in US energy costs, the Fed cannot yet declare victory over inflation which is still well-above target. Nonetheless, with inflation seemingly peaking and signs that economic data is softening, some market participants had expected that the Fed would soon adopt a more dovish stance and rate cuts were priced in for 2023. Powell pushed back on this idea saying that the Fed “must keep at it until the job is done” and that policy will have to be restrictive for “some time”.

Source: Bloomberg, BIL

He added that history cautions strongly against prematurely loosening policy, warning that “the longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.” The bad news for markets was the suggestion that the Fed is willing to forgo growth to control prices, with Powell commenting that while “higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” but that “a failure to restore price stability would mean far greater pain.”

Recently, President of the St Louis Fed, James Bullard, said he supported the Fed funds rate reaching 3.75-4% by the end of the year, noting that inflation could be more persistent than many on Wall Street expect.

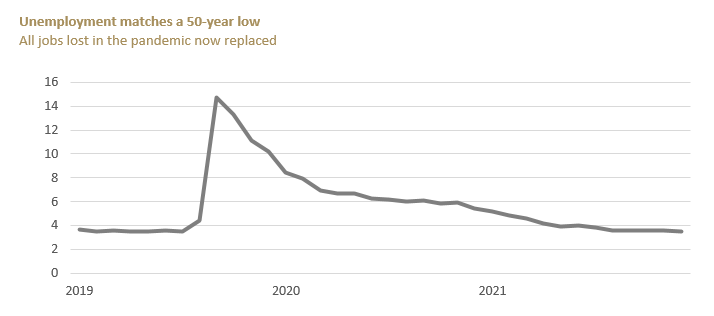

Source: Bloomberg, BIL

For now, labour market strength pushes back on notions of recession, with 528k jobs added in July and an unemployment rate of just 3.5%, matching a 50-year low. July also saw 10.9 million job openings (not much less than the record figure recorded in March of 11.9m) and companies continue to note shortages of workers (49% of small business owners reported job openings they could not fill in July, according the NFIB survey). However, as the Fed proceeds with its tightening campaign we could see dynamics soften and already, hairline cracks are beginning to appear; the ISM employment indices have fallen into contractionary territory while various household names such as Microsoft, Google and Netflix have announced plans to reduce staff or hiring freezes.

Market Implications

Throughout 2022, market sentiment has been driven by two competing narratives: One focused on durably higher inflation and rising rates, and the other on the growing risk of recession, ultimately compelling central banks to become more dovish. During the summer, the latter was dominant, benefitting equity markets and capping the rise in yields. Powell’s speech has once again swung the pendulum back towards a mood of “higher for longer” and the market has started to reverse bets that we will see rate cuts in 2023.

Following the speech, US stocks suffered their worst day in two months, with only five S&P 500 companies closing in the green. So long as markets are gripped by this mood, it will be difficult for equities to rebound.

Investor attention will now focus on incoming data on the labour market and inflation in order to gauge whether we can expect a third consecutive 75bp hike at the September 21 FOMC meeting, or a smaller one of 50bp.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 19, 2026

Weekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...

January 9, 2026

Weekly InsightsWeekly Investment Insights

Safe haven assets, including gold, rose at the start of the week in response to the US intervention in Venezuela which sparked questions about the...

January 9, 2026

News2026 Outlook

As we step into 2026, the theme of transition will only intensify. In many ways, 2025 marked the starting gun of a new race –...

December 19, 2025

Weekly InsightsWeekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....

December 15, 2025

Weekly InsightsWeekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...