• ECB raises its three key interest rates by 75bp, the largest hike in the history of the single currency

• Eurozone inflation is uncomfortably high and rising

• New ECB forecasts show higher inflation, lower growth

• More rate hikes are expected

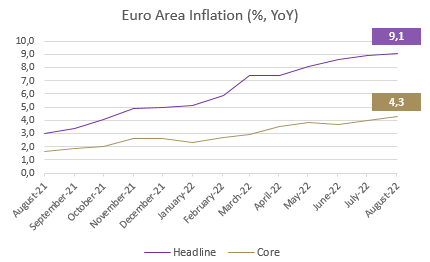

With inflation in the Eurozone exceedingly high and rising (HICP and PPI both hit new all-time highs at 9.1% and 37.9%, respectively in August), the ECB today decided to frontload its transition away from accommodative policy by hiking its three main rates by 75 basis points (bp). Accordingly, as of September 14th, the new rates will be:

• Main refinancing operations: 1.25%

• Marginal lending facility: 1.50%

• Deposit facility: 0.75% (the highest level since 2011)

Lagarde noted that future policy rate decisions will be data-dependent but the ECB is clearly on the same hawkish trail as the US Federal Reserve and expects to raise interest rates further to dampen demand and to try and prevent higher inflation expectations from becoming entrenched – something Jerome Powell warned against explicitly in his Jackson Hole speech. With the Fed much further ahead in its tightening campaign, the euro has come under intense pressure vis-à-vis the greenback with the exchange rate dropping to a 20-year low.

While US inflation is now showing signs of peaking, in Europe, soaring energy and food prices coupled with lingering supply chain issues are still driving prices higher. Looking ahead, ECB staff have significantly revised up their inflation projections. It is expected to average 8.1% in 2022 (from 6.8%), 5.5% in 2023 (from 3.5%) and 2.3% in 2024 (from 2.1%).

Source: Bloomberg, BIL

On the other hand, growth is expected to slow down substantially as inflation erodes households’ disposable incomes and as the conflict in Ukraine continues to weigh on business and consumer confidence. ECB staff now expect the economy to grow by 3.1% in 2022 (from 2.8%), 0.9% in 2023 (from 2.1%) and 1.9% in 2024 (from 2.1%).

The Eurozone unemployment rate remains at an all-time low of 6.6% but Lagarde noted that wage growth is still contained.

With regard to its bond buying programs, the ECB will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the smooth transition of monetary policy across the bloc. There was no new news on the Transmission Protection Instrument: It’s still there in the background to “counter unwarranted, disorderly market dynamics” if needed.

The initial market reaction was muted given that a 75bp hike was widely anticipated but during the press conference, the 10y German Bund yield rose 10bps to 1.69%. The shorter end of the curve, which is more sensitive to the policy rates, came under more pressure and the 2y German Bund yield increased by 16bps to 1.24%

While Draghi once famously stated “whatever it takes”, Lael Brainard of the US Fed coined a new phrase this week that seems to be at play on both sides of the Atlantic: “as long as it takes”. To elaborate, central banks seem willing to keep policy restrictive until inflation retreats back to their 2% targets in a convincing manner, even if that means lower growth.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 8, 2025

Weekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...