Choose Language

BILBoard September 2022 – Higher for longer

French Version: BILBOARD_FR_SEPT_22 German Version: BILBOARD_DE_SEPT_22 Dutch Version BILBOARD_NL_SEPT_22 English PDF Version BILBOARD_EN_SEPT_22 Luxembourgish PDF Version BILBOARD_LU_SEPT_22

In our July BILBoard, we discussed two competing narratives responsible for driving market sentiment throughout the best part of 2022: one focused on durably higher inflation forcing central banks to raise rates for as long as necessary to bring inflation down, the other on a potential monetary policy pivot in light of declining demand. The latter dominated through summer, and risk assets enjoyed a nice run; that was until the Jackson Hole central bank symposium on 26 August. In a hawkish speech, Fed Chair Jerome Powell dashed all hopes of dovishness, saying that wrestling inflation to normal levels will slow the economy enough to cause “some pain” for households and businesses and that policy will have to be restrictive for “some time” in order to prevent inflation expectations becoming de-anchored. With the ECB and other key central banks fighting a similar battle, “higher for longer” has set in as the prevailing theme in global markets.

Macro Overview

Despite the fact that the Fed has raised its benchmark rate from near-zero to a range of 2.25–2.5% in less than six months, the US economy has held up well. The labour market is still exceedingly strong with unemployment at 3.7%, a touch above a 50-year low, and almost two job openings for every available worker. At the same time, it is estimated that US households still have about six months of pandemic savings left. Emboldened by these two factors, US consumers are still spending, defying depressed sentiment indicators. Core retail sales – a proxy for consumption in the GDP calculation – rose 0.8% in July and we expect consumption to hold up in the near-term.

Already, we see consumers responding positively to softer inflation (CPI was 8.5% in July, down from 9.1%), and more specifically the drop in gasoline prices. As a consequence, aggregate spending power has risen quite rapidly and with this, consumer sentiment as measured by the Conference Board is beginning to rebound, hitting a 3-month high in August. High frequency data, for example on diner numbers at OpenTable restaurants and airline passengers, shows a convincing uptrend, while the AAA’s annual fall travel survey reveals that 73% of respondents planned to go on vacation after Labour Day, with 52% of those planning a road trip. Normally this US holiday on 5 September marks the end of the holiday season, but this year, it seems getaways have been pushed back into autumn, largely due to the affordability of petrol. This information takes the sting out of the worryingly low Services PMI, which came in at 43.7 in August.

On the corporate side, business confidence is also rebounding. The manufacturing sector is still ticking along at a stable rate, aided by moderating input costs and the slow realignment of supply and demand. A rebound in the automotive sector (the last big area of pent-up demand) where output rose by a huge 6.6% in July, should keep industrial production supported for the coming months as chip shortages ease. An increase in the supply of new vehicles should also positively affect inflation dynamics, with new and used cars accounting for 10% of core CPI.

In a nutshell, we believe the US economy will hold up in the near-term, returning to positive growth in Q3. However, as the Fed proceeds with its tightening campaign, cracks are likely to begin appearing early 2023 as the labour market adjusts, as higher rates impact corporates’ propensity to spend and as pandemic era savings taper away.

In the Eurozone, we foresee the onset of a technical recession already this year. The energy crunch is at the crux of matters. Before the conflict in Ukraine, Russia met about 40% of Europe’s gas demand. Now, just ahead of winter, it has ceased all flows through the Nord Stream 1 pipeline. While storage levels are healthy at roughly 80% full for the bloc as a whole, demand will still have to be curbed. The uncertainty around energy flows has played havoc with wholesale gas and electricity prices. Faced with the prospect of exorbitant bills, consumers are squirreling cash away for essentials and energy-intensive industries are shutting shop or scaling back production.

Energy prices are also a wildcard for inflation, which as of now, has not showed signs of peaking. In August, HICP and PPI both hit new all-time highs at 9.1% and 37.9%, respectively.

Even if governments intervene in energy markets, a recent record accumulation of stocks of finished goods with firms unable to shift products in a falling demand environment suggests little prospect of an improvement in production anytime soon. Meanwhile, the disposable income of consumers continues to be eroded by record inflation.

Looking east, China’s economy was hit with a series of headwinds in August: a Covid-19 flare-up that has sent around 70 cities into full or partial lockdown, softening global demand for manufactured goods, continued strain in the property sector with some declining to make mortgage payments, and an intense heatwave that resulted in reduced river transport and a power outage in key industrial hubs. The silver lining is that China is a clear outlier in the global tightening cycle. With inflation at 2.7%, below the 3% annual target, authorities still have room for stimulus. This has been forthcoming and a recent $44bn support package is still percolating into the real economy.

BIL Investment Strategy

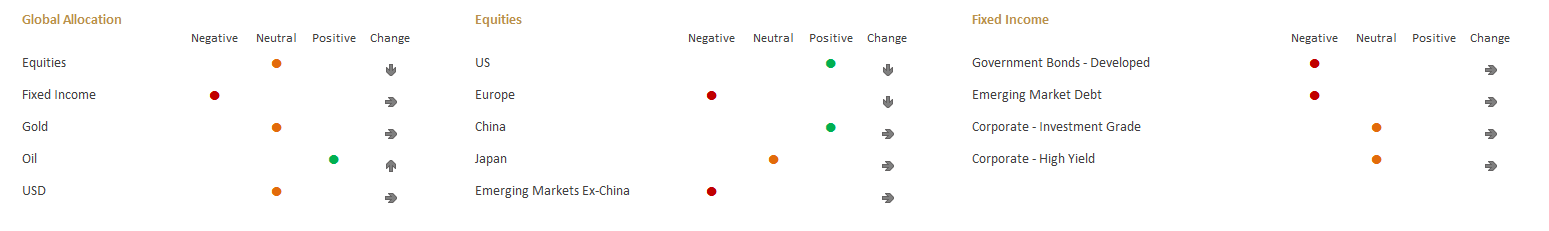

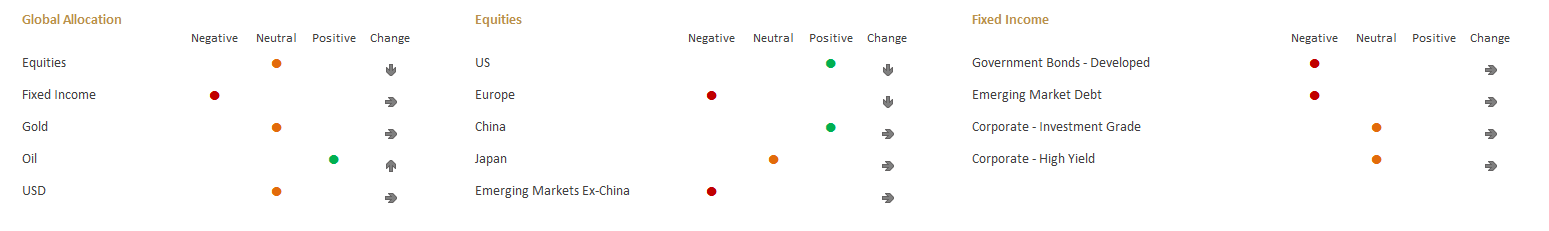

In light of the current context, we made some important adjustments to our asset allocation on 2 September.

Firstly, we brought our equity overweight down to neutral by reducing exposure to US and European equities in equal proportions. While deepening our underweight to Europe, this still leaves us with an overweight to the US, the region where we still see the most relative macro strength. The rationale is that the equity rally has faded along with hopes for a dovish policy pivot, and from here we think equity markets will continue adjusting to the macro reality, with the evolution of fundamentals such as inflation and the labour market dynamics key to monitor as financial conditions continue to tighten. We also now expect to see analysts start to downgrade earnings expectations for 2023.

In terms of sectors, we reduced our overweight to European Utilities as the current regulatory environment – with Brussels mulling windfall taxes – is too volatile for them to provide the defensive qualities we seek. Additionally, record power prices are presenting European Utilities with an existential problem: despite selling electricity at record prices, they face spiralling collateral requirements on futures markets which are essential for managing the provision of power and electricity. Finland has warned that the energy sector faces a potential “Lehman” moment if governments do not step in to provide emergency funding. Any move to control energy prices would be a positive catalyst for European Industrials, which we have brought from underweight to neutral.

We are overweight IT (still the growth engine) and Healthcare (a sector with strong earnings that has less exposure to many of the key risks in markets).

Within our Fixed Income allocation, we give preference to high-quality investment grade corporates where we believe risk/reward ratios are on the attractive side: companies are still well funded and leverage has dropped across the IG universe over the past 18 months.

In the Sovereign space, after a strong July, August saw the largest monthly correction on history (+72 bps for the German 10y Bund yield) and we moved from being in an overbought market early July to an oversold situation. From a technical perspective, a retracement of government bonds yields is therefore possible and we have decided to tactically increase the duration of our core sovereign positions (though we remain underweight duration on the whole). Additionally, exposure to Italian sovereigns was further reduced: with snap elections to be held in September, we prefer not to be exposed to potential volatility in the run-up and in the government formation process afterwards. Rising rates also put Italy’s debt back in the spotlight.

We are neutral on Gold. While it still holds value as a diversifier, rising real rates and the attractiveness of fixed income safe haven alternatives limit the upside.

We moved our stance on Oil from neutral to constructive. With Europe’s energy crunch at the fore, oil should benefit from the fact that there are few energy alternatives (low wind, nuclear plants closed, etc.), while OPEC+ has agreed to cut production by 100k b/d in October, completely reversing the September increase.

In the currency realm, we changed our outlook on the Japanese Yen from neutral to bearish. The BoJ is clearly bucking the global tightening trend and the ensuing policy divergence is pressuring the currency. The Chinese Yuan was brought from positive to neutral as looser financial conditions and portfolio outflows presenting clear headwinds.

Broadly, private markets face challenges stemming from higher rates and inflation. However, bright spots remain. Firstly, in the infrastructure space, deal activity is strong and the industry supported by government investment. High and persistent inflation is likely to benefit infrastructure assets which often have revenue streams tied to price indices. We also see potential in the secondary space, where more opportunities and discounts are becoming apparent. That said, partner selection is key.

Conclusion

Unrelenting central bank hawkishness, the idea of higher for longer and well-above-target inflation present a challenging environment for investors. Year-to-date, balanced portfolios consisting of 60% stocks and 40% bonds have plunged, with inflation diminishing the hedging power of bonds. From here, creativity will be called upon in order to ensure adequate diversification – note the addition of private asset coverage to our asset allocation process. Selectivity will also be crucial in order to identify those companies with adequate pricing power and those that have the most resilience in facing a weakening macro backdrop.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....