Choose Language

September 23, 2022

NewsEurozone inflation broadens out in August

Eurozone headline inflation hit 9.1% in August, up from 8.9% and the highest level since the creation of the single currency. While energy is still the driving force behind this elevated figure, it is not the only one. Inflation is broadening out, compelling the ECB to act with greater haste.

Data released last week confirmed that while energy inflation in the Eurozone is still elevated, it actually softened last month, falling from 39.6 to 38.6% year-on-year. Whether it will continue to fall is a wild card. On one hand, oil prices are back below $100/barrel, and even gas prices have come off of their summer peaks, helped by proposed government intervention. On the other hand, if gas shortages materialise this winter, we could see renewed upward pressure on prices and not just for gas and electricity but also for oil which could be considered as a substitute in certain scenarios.

But what happens in the energy sector doesn’t stay in the energy sector. Elevated energy costs have led to second-round effects in other industries. Take for example, food alcohol and tobacco, for which prices rose 10.6% year-on-year in August. Not only have costs to transport produce risen, but also to heat greenhouses, to run machinery, to buy fertiliser and so on… With some fertiliser producers scaling back output due to higher costs of gas, carbon dioxide (a by-product in the process of making fertiliser) prices have risen to almost €3,500 per tonne from €100 per tonne a year ago. This leaves fizzy drink producers and beer brewers facing astronomical costs to put bubbles in our beverages.

The core inflation reading, which strips out volatile categories like food and energy, also hit a new all-time high of 4.3% in August, up from 4.0%. Non-energy industrial goods, such as clothing, cars and household appliances were up 5.1% versus 4.5% in July.

If this broadening out of inflation would continue, it could be more difficult for central banks to put the genie back in the proverbial bottle.

Inflation ultimately boils down to psychology. High inflation, if left unchecked or if people doubt central banks’ ability to contain it, can fuel fears about even higher future inflation, potentially creating a self-fulfilling feedback loop. The latest release of ECB consumer inflation expectations showed those were unchanged over a 1-year period at 5%, but expectations for inflation over 3-years inched up to 3.0%, from 2.8%.

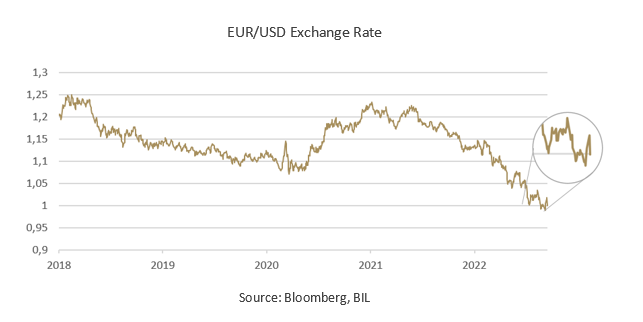

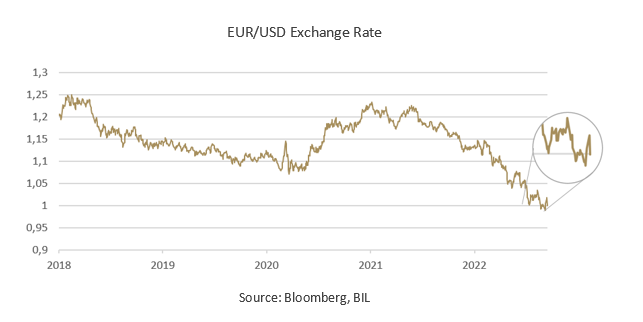

There is an additional factor complicating the ECB’s challenge to curb inflation: a weak euro. In summer, the euro hit parity with the dollar and the exchange rate has hovered around these levels. This is problematic because energy imports are typically invoiced in US dollars and indeed, the Eurozone just reported a trade deficit of EUR 34bn, the second-largest on record, as higher energy costs pushed up the overall figure for imports.

With all this in mind, it isn’t surprising that the ECB revised up its inflation projections this September. The governing council now expects it to average 8.1% in 2022 (up from 6.8% forecast in June), 5.5% in 2023 (from 3.5%) and 2.3% in 2024 (from 2.1%). Essentially that means that the ECB doesn’t believe that inflation will fall back to its 2% target before 2025.

In order to try and force it downwards, the ECB has been “front-loading” its interest rate hikes, raising rates by 50 basis points to zero in July – its first rate hike in 11 years – and then by 75bp in September. But August inflation data implies there is still some ground to cover.

Last week, ECB Vice President De Guindos said determined action is needed to anchor price expectations even as growth slows. While some might have thought that an economic slowdown would naturally depress demand and bring down inflation, he begged to differ, noting “the slowdown of the economy is not going to ‘take care’ of inflation on its own” and that the central bank will have to keep raising rates, prioritising the fight against inflation over growth concerns. But the ECB probably cannot fight this battle alone and bringing down inflation will also require coordinated fiscal action, particularly with regard to the energy sector. On this front, let’s see how European Commission energy talks go on September 27-29.

As policymakers wrestle with inflation, investors should acquaint or reacquaint themselves with the potential impacts that it could have on their portfolios – for several years up until the post-pandemic inflationary burst, this is something that many didn’t really have to consider. While investing at such a moment can be challenging, it is also important not to close ourselves to potential opportunities that might arise when it comes to building a well-diversified, long-term investment portfolio. The best move would be to talk to your bank/financial advisor to discuss the best options for you with regard to your own individual situation and risk tolerance.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....