April 26, 2023

FocusThe Eurozone’s Wage Conundrum

The Eurozone, like many other jurisdictions, has undergone an inflationary shock, resulting in declining real wages. As workers try to recoup lost income, the risk is that consumers will foot the bill and that inflation becomes self-fulfilling…

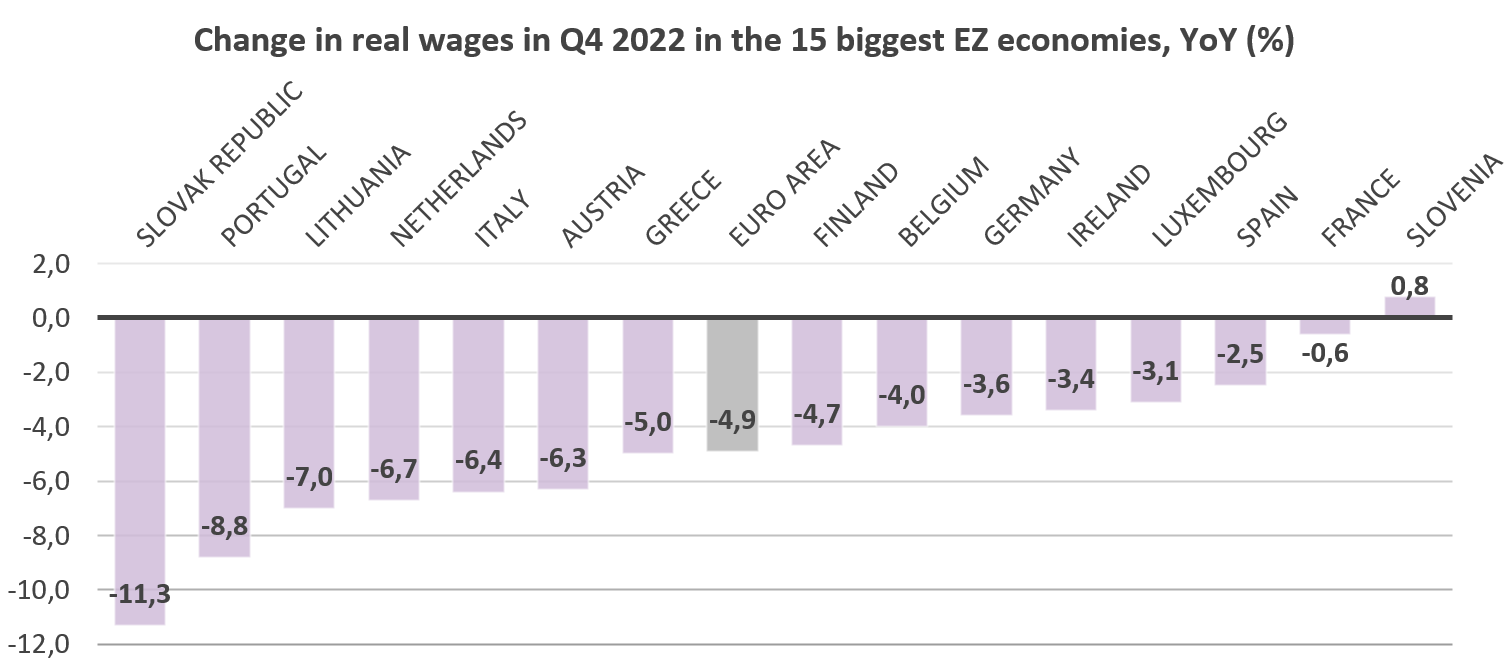

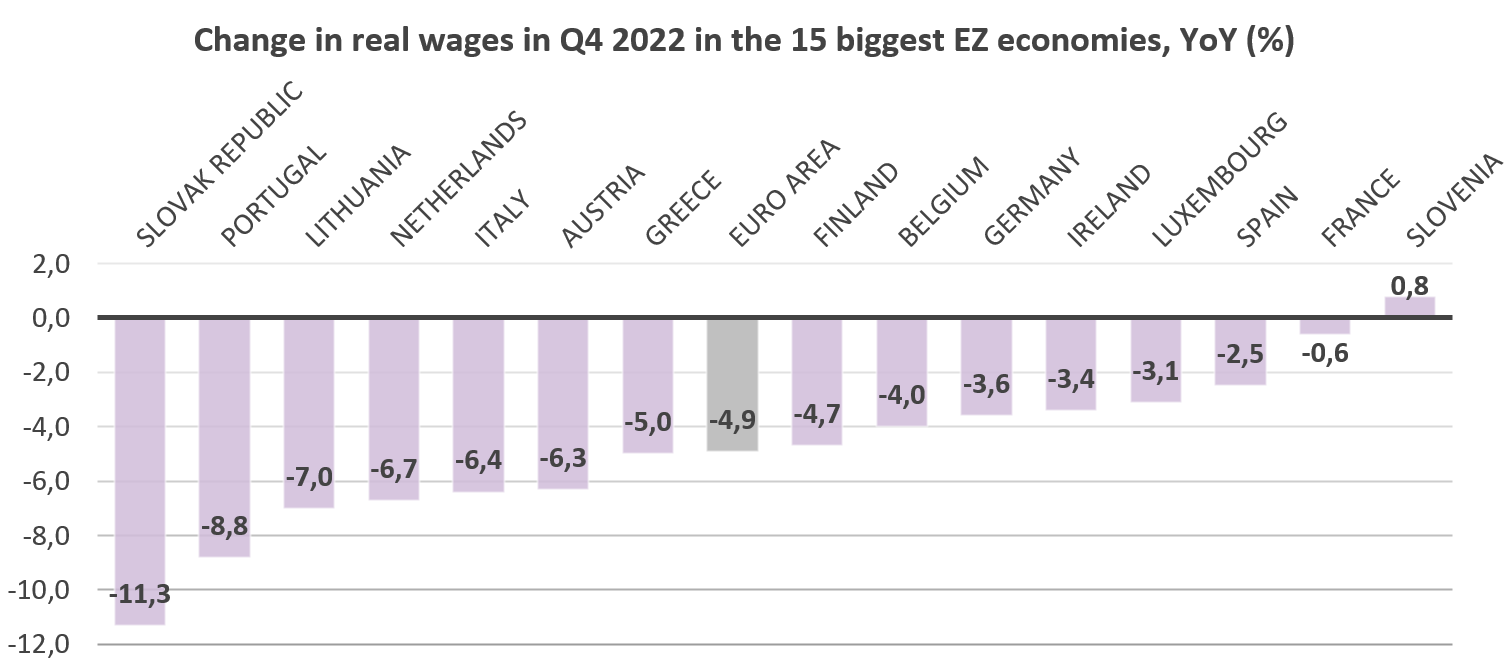

The decline in real income has been felt unevenly across the bloc due to various factors such as heterogeneity in government measures to shelter households from inflation, structural nuances and the differing cyclical positions of countries… In some states, purchasing power has been protected to a greater degree due to wage indexation. Here in Luxembourg, for example, whenever there is a 2.5% change in the CPI, wages are normally automatically adjusted by the same percentage. Similarly, in Belgium, salaries are tied to a so-called health index, which is essentially the CPI excluding certain products such as tobacco, alcohol and fuel. While France ceased indexation to avoid price-wage spirals, the minimum wage remains indexed to inflation, and serves as the foundation for the entire low-wage structure in the country. Real wages in France are amongst the “highest” in the bloc due to generous fiscal measures to protect households from rising costs.

Source: OECD, BIL

For countries that do not have automatic wage indexation, trade unions have played a role in securing higher pay for workers. In Germany, for example, in November last year, employers and unions in the manufacturing sector agreed to increase wages by 8.5% for almost 4 million employees. These measures were complemented by an increase in minimum wage from EUR 9.82 to EUR 12 in 2022, benefiting around six million of the country's 45 million workers. Collective bargaining is still ongoing in Europe’s largest economy, especially in the transport sector.

Because of these various mechanisms, hourly labour costs in the Euro Area surged by a record 5.7% in Q4 2022 from the same period in 2021. Among economic activities, labour cost growth was the highest in construction (6.9%), followed by services (6.2%) and industry (4.4%).

Until now, higher wages have not been enough to offset the increase in the cost of living, however, with the labour market still very tight and a severe energy crisis averted, workers are emboldened to use their bargaining power to recoup lost income – understandably.

However, looking at the bigger picture, this births a real risk of entrenched inflation. While headline inflation is likely to decline sharply this year, driven by falling energy prices, base effects and easing supply bottlenecks, underlying inflation dynamics remain strong. The ECB projects that it will be at least 2025 before inflation falls back to its 2% target. If wages continue to rise unchecked to bridge the gap, progress made in bringing down inflation could be undone. Why? Employers are likely to pass these higher costs on to consumers, and in turn, prices would continue rising, igniting a self-fulfilling feedback loop.

According to the ECB, wage pressures are already fuelling core inflation (which continues to hit new all-time highs, most recently 5.7% YoY). While wage-sensitive items contributed only around 0.5 percentage points to core inflation before the pandemic, that contribution has more than doubled in recent months. This is not so problematic for goods, as wages represent only around 20% of direct input costs for manufacturing firms. Contrarily, wages account for roughly 40% of direct input costs for services providers, and services inflation accounts for almost two-thirds of core inflation!

Cognizant of this, it is easy to understand why central banks are wary about a wage-price spiral taking hold. The key risk, as Lagarde herself has pointed out, is that employers and workers both try to minimise losses to their margins and their paycheques. This risk of such a “tit-for-tat” dynamic is heightened by the fact that labour markets are exceedingly tight with competition for workers high.

As the ECB pursues its “non-negotiable” goal of bringing inflation back down to target, wage growth will therefore be a key determinant of how much tightening is required, and ultimately, of whether the Eurozone faces a hard or a soft landing.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...

April 2, 2025

BILBoardBILBoard April 2025 – Tariffs, turbul...

Written as at April 1 The first quarter of 2025 was anything but smooth. Market volatility surged, equity markets diverged, bonds offered little in the...

March 28, 2025

Weekly InsightsWeekly Investment Insights

Another week, another set of changes to US trade policy – and that’s before the April 2 deadline where reciprocal tariffs on several trading partners...