April 22, 2024

NewsParis Olympics 2024: Costs under control, unless we’re talking about real estate

This summer, 16 million visitors are expected to descend upon Paris for the 2024 Olympics.

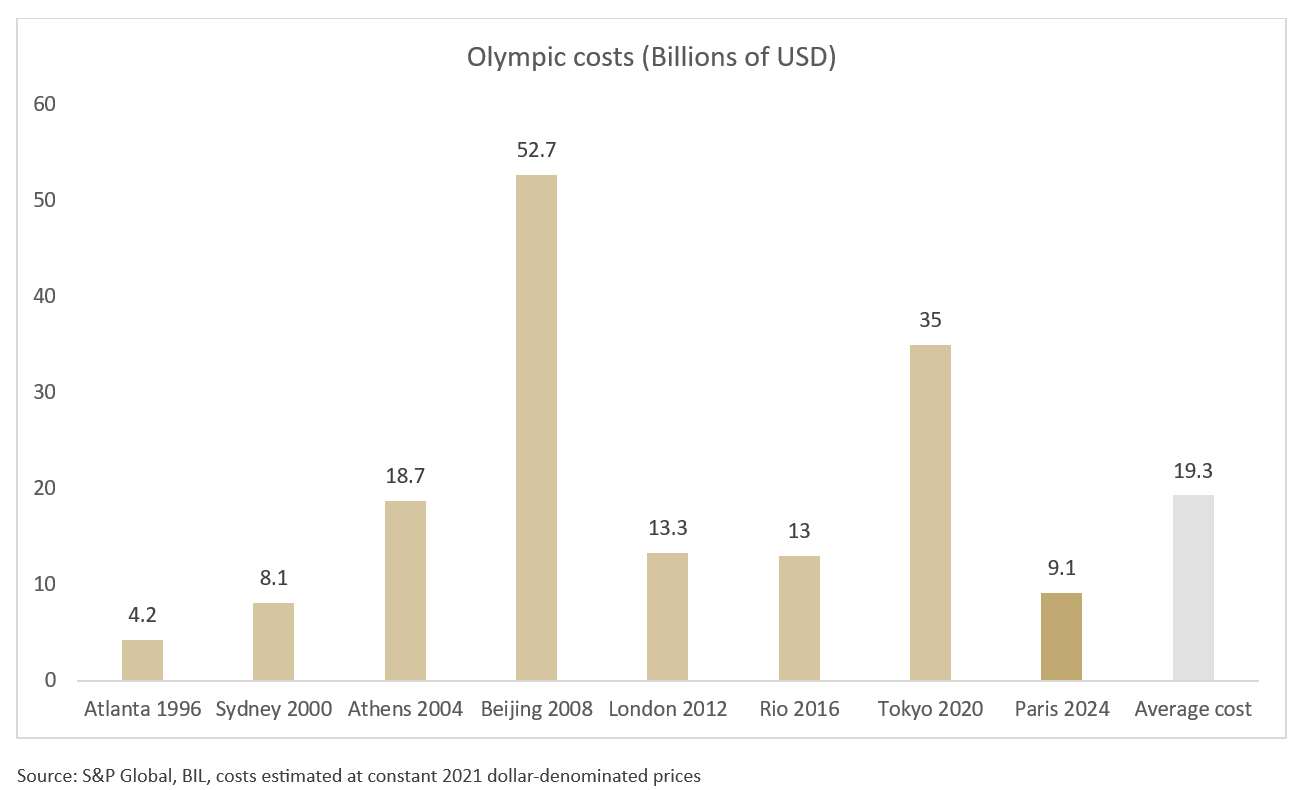

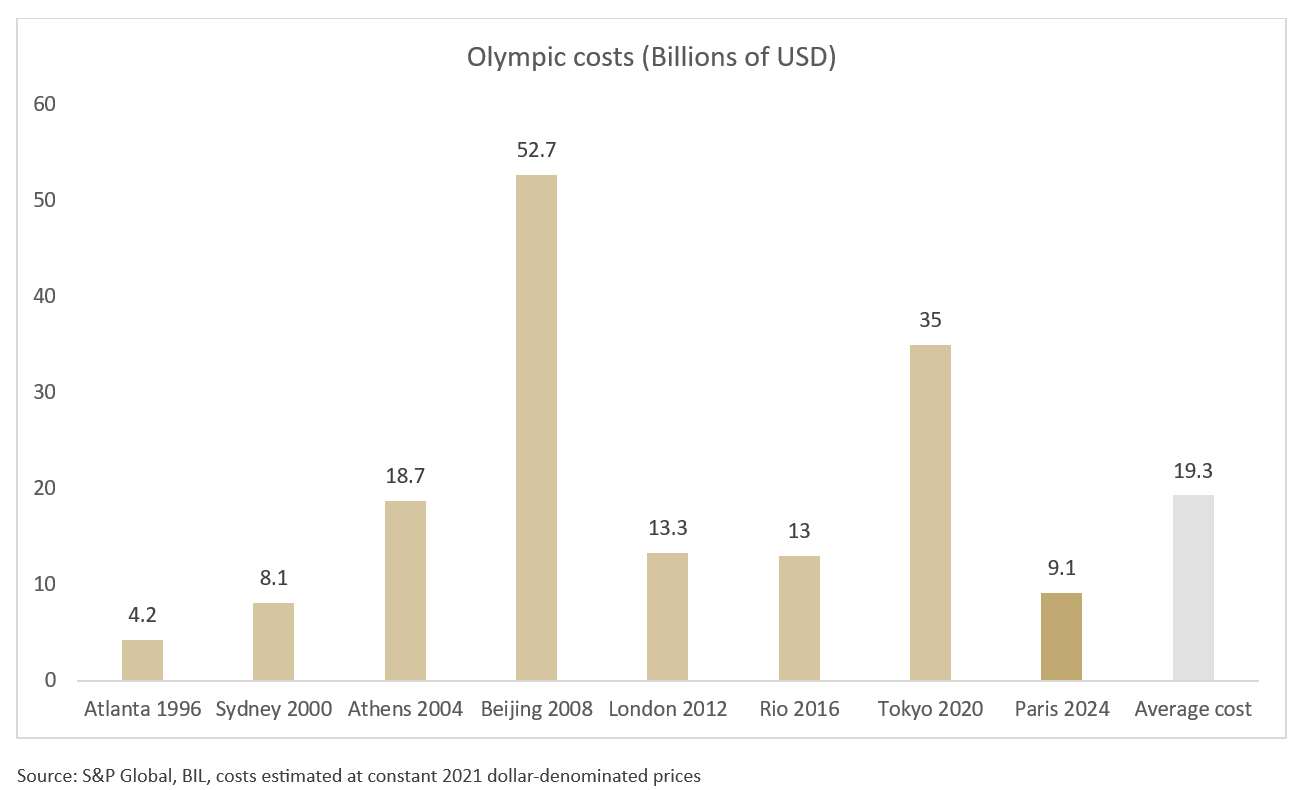

For the host country, the Games can be a costly affair. In 2016, for example, the state of Rio de Janeiro defaulted after event-related costs caused its debt levels to soar. With France’s public finances already under scrutiny – its deficit yawned to 5.5% of economic output in 2023 - a relatively modest budget has been set.

The price tag for the Paris Olympics is estimated at around EUR 9Bn. Of that, EUR 4.5Bn is set aside for venues and facilities: 95% of those used will be existing structures that need minimal or no refurbishment.1

Another EUR 4.4Bn is earmarked for operating expenses such as hosting and running transport networks. The International Olympic Committee (IOC) projects that 96% of the total operating costs will be covered by ticket sales, TV, and marketing deals. Should there be last minute overshoots, France's government has provided the IOC with a EUR 3Bn guarantee (about 0.1% of GDP). A tax windfall from tourism and visitor spending should also help cover the bill, with the government saying the economic benefits could be as high as EUR 10Bn.

Credit rating agency S&P Global recently estimated that the “lean” Olympics are unlikely to do any lasting damage to France's finances. It currently gives France a AA rating with a negative outlook.

However, there is one sector where the Games are converging with others factors to push costs out of control: Real estate.

With spectators, volunteers, and journalists all racing to secure accommodation, demand for short-term rentals is skyrocketing – as are prices.

In a review of some short-term rental sites, our analysts note that during the period between July 26 and August 11, prices are as much as triple the current level. With no price cap in place for those who rent for below 120 days, it is not uncommon to find an apartment available for EUR 1000 per night, of course depending on the location. On aggregate, hosts on Airbnb are expected to collectively earn around EUR 257 million over the course of the Olympic and Paralympic Games.2

In order to capitalise on this fleeting golden goose, many Parisians plan to leave the city and rent out their accommodation. While difficult to prove, some are reportedly even throwing out existing tenants (who are subject to rent controls) to benefit from the lucrative opportunity. The government itself faced intense criticism when it decided to evict some 2,000 students from their rent-controlled apartments to host Olympic staff during the summer.

While the housing market in Paris and its metropolitan area has always been tense, the additional pressure of hosting a global sporting event, is pushing things to boiling point.

Over the past two years, the volume of seasonal rentals in the city, with shorter-term leases, has risen by 18%. This partially explains why, according to a study by SeLoger, the supply of traditional long-term rentals in the French capital has fallen 74% in three years. For France overall, the figure is 25% over the same period.3 Naturally, this has intensified competition among potential renters and pushed up prices.

The rental crunch is the result of several factors. On one hand, higher interest rates have put buying out of reach for many. In turn, they remain tenants for longer and don't free up their accommodation. On the other hand, international students and workers are returning, and they are opting for traditional long-term furnished rentals.

In Autumn, after the closing ceremony has played out, the rental market should begin to relax, with an influx of properties previously rented on a short-term basis. At the same time, ECB rate cuts, expected to begin in June, should be starting to percolate into the real economy.

However, if the challenge of the Olympics was the 100 metre sprint, the city’s rental market still has a marathon ahead if we consider the impact of the ecological transition. In the Parisian region, 55% of properties are rated E, F, or G on energy efficiency scales. As of January 1st, 2025, by law, landlords will only be able to rent out properties graded F and above. In 2028, this will become E and above. A decade from now, all properties will have to be D and above to be rented.

Without a wave of renovation work, the Olympics might prove to be only a warm-up.

[1] Infrastructure spending has overshot the initial budget by over 37% compared with its 2016 projection although it is more moderate once inflation is factored in. Its operating expense budget is 15% higher compared with 2019 estimates.

[2] https://news.airbnb.com/paris-2024-olympic-games-a-unique-opportunity-to-host/#:~:text=In%20total%2C%20Hosts%20on%20Airbnb,the%20Olympic%20and%20Paralympic%20Games.

[3] https://www.france24.com/en/tv-shows/france-in-focus/20240325-wanted-a-place-to-live-in-paris

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

November 8, 2024

Weekly InsightsWeekly Investment Insights

Last week, the result of the US Presidential election was finally announced, with Donald Trump elected as the President of the United States for...

November 7, 2024

NewsThe impact of the US election

The results of the US presidential election have been made clear, with Donald Trump elected as the President of the United States for...

November 5, 2024

NewsEurope heads into winter two years af...

The 2022 energy crisis was a wakeup call for Europe, revealing Europe's energy vulnerability. A lot has been done been since, from reducing dependence...

November 4, 2024

Weekly InsightsWeekly Investment Insights

With the US Presidential election on the doorstep, all eyes are on the US this week. People, companies, and even countries are awaiting an...

October 25, 2024

Weekly InsightsWeekly Investment Insights

Global trade has been a hot topic over the past week as the US election draws closer, and as Trump appeared to top polls...