On Thursday March 20th, the Northern Hemisphere marked the Spring Equinox. During this phenomenon, we experience an identical amount of daylight and night-time hours due to the Earth’s position in its orbit around the Sun.

In some sense, it feels like the US economy is experiencing its own Equinox. On the bright side, resilient hard data and the prospect of business-friendly policies continue to offer reasons for optimism. Yet looming over this is a darker cloud of policy uncertainty, trade tensions and deteriorating sentiment. Will the light win out as we are experiencing here with the first days of Spring? Much depends on the next steps taken by the White House.

An encroaching shadow

For some investors, it is becoming increasingly difficult to ignore ominous headlines about the health of the US economy, volatility in survey data and the resultant decline in stock markets.

On the corporate side, executives are growing increasingly wary of the escalating trade dispute. Surveys show hesitation on capex and investment decisions, with many firms adopting a wait-and-see approach. The April 2 trade announcement may bring clarity, but continued uncertainty risks bleeding into hard economic data. Some companies are already hiking prices preemptively—bracing for potential tariffs and adding to inflationary pressures.

Consumers, too, are on edge. The memory of post-pandemic inflation lingers, and tariffs—essentially a tax on households—have reignited fears of rising costs. The latest University of Michigan survey showed the sharpest monthly rise in long-term inflation expectations since 1993. Soaring prices for staples like eggs are only perpetuating these fears.

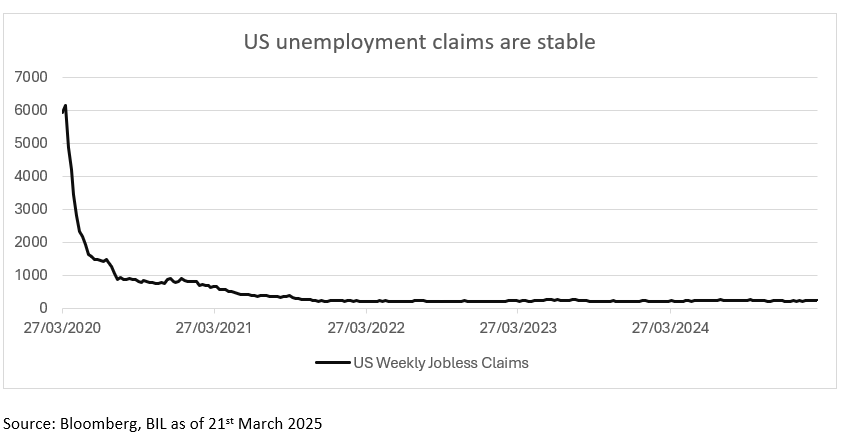

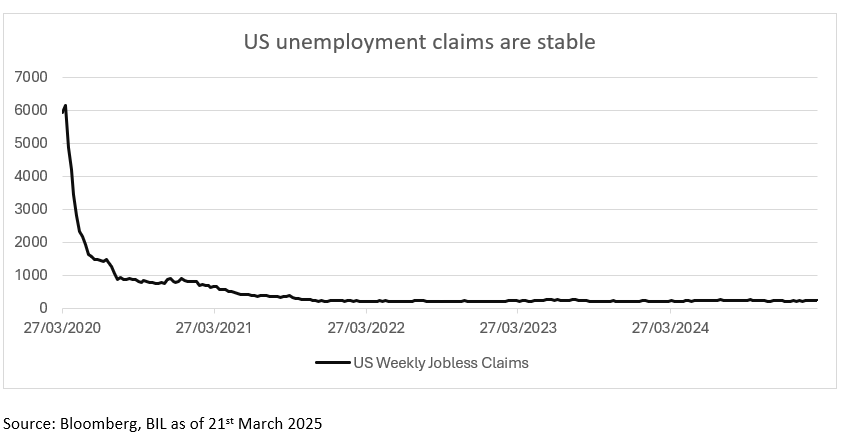

Adding to the unease are layoffs linked to Elon Musk’s Department of Government Efficiency. Although President Trump has urged a more measured approach—favouring a “scalpel rather than a hatchet” when it comes to jobs cuts—some of the impact is already visible in the data, especially on labour market perceptions.

Residual strength in the US economy

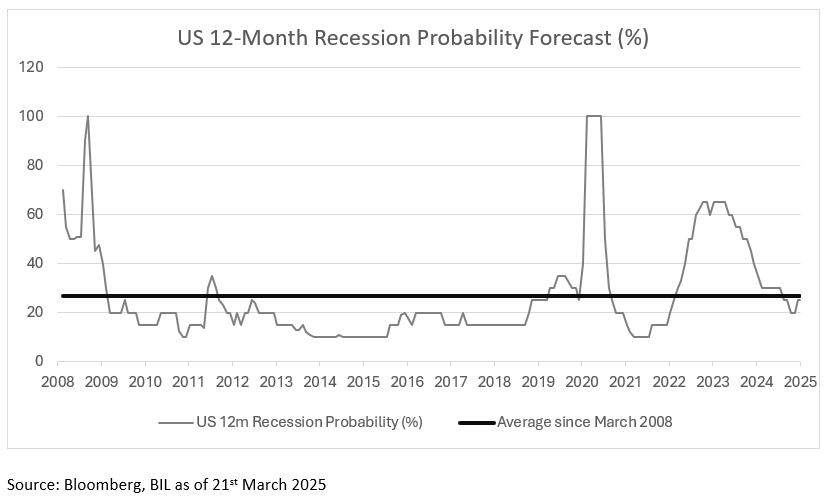

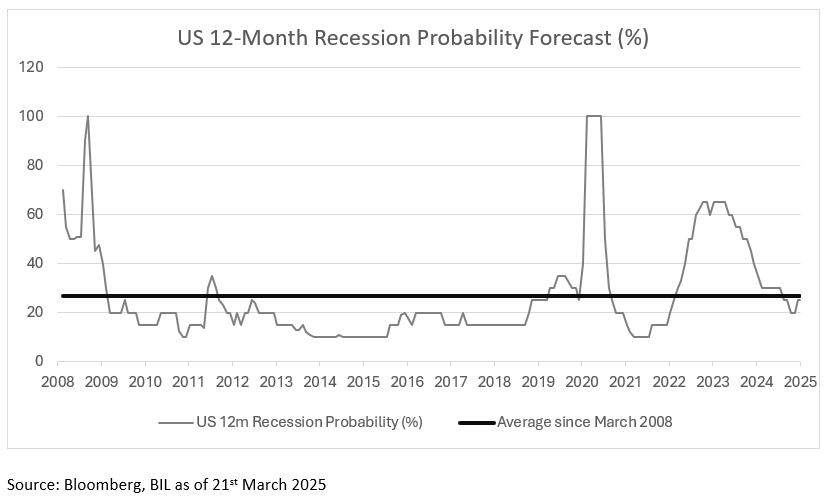

However, when it comes to hard economic data, the US is still outpacing other major regions. Growth is expected to come in at a still-respectable 2.2% this year, while consensus recession expectations remain modest, hovering around 25% - below the long-run average.

Consumer spending remains the primary engine of growth and the continuation of this largely depends on the strength of the labour market. Insofar as now, we are only seeing a gradual cooling therein. Job openings rose to 7.74 million in January, and the unemployment rate sits at 4.1%, comfortably below the long-run average of 5.68%. Moreover, wages continue to outpace inflation, providing households with modest real income growth.

Elsewhere in the economy, data on home sales points to an improvement in the real estate market, while industrial production has gained pace since Trump took office. Durable goods orders hint that this could continue in the near-term.

All this is before many of the President’s “pro-business” agenda items, such as tax reform, have been fully enacted; most are yet to pass through Congress. Notably, this week saw the activation of the Defense Production Act, aimed at bolstering domestic mineral production. The executive order mandates streamlined permitting and access to federal financing for mining projects—moves intended to strengthen strategic supply chains.

A Balancing Act

Insofar as now, while we are seeing volatility in survey data, the hard data implies that the US economy remains anchored on relatively solid foundations. Trade policy will be a key factor as to whether that can continue. Persistent uncertainty could tip the economy toward instability, while a more predictable approach, alongside planned tax cuts, could bolster growth.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 23, 2025

NewsThe Gold Rush

In recent months, gold has experienced remarkable momentum, solidifying its position as a preferred safe haven asset. Contrary to what the collective imagination suggests,...

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...