Choose Language

December 2, 2021

FocusAn explainer on carbon pricing

- Putting a price on carbon emissions is a key element of the energy transition toolbox.

- Governments have implemented cap-and-trade systems, whereby companies have a designated amount of carbon they are allowed to emit. If insufficient to cover their operations, they must buy more permits on the open market through emissions trading schemes.

- Usually, each year the cap gets stricter and the shrinking pool of permits gets more expensive.

From an economic theory perspective, climate warming is a market failure in pricing externalities. Firms that emit carbon place a burden on the environment which is borne by everyone in the form of a changing climate, yet don’t incur a cost for doing so. Carbon emissions are what is known as an negative ‘externality’.

Putting a price on carbon emissions is part of the transition solutions toolbox. Reducing emissions by charging polluters is the rationale behind carbon markets and the establishment of a carbon price, acting as a way to switch away from fossil fuels.

One way governments are trying to reduce their emissions is through carbon emissions trading system (ETS), a market-based system that aims to provide the economic incentives for countries and businesses to reduce their environmental footprint. ETS aims to internalize the costs carbon emissions impose on society by placing a price on these emissions.

The first allowance trading programme was established in the US under the 1990 Clean Air Act Ammendments, a sulphur dioxide (SO2) pricing system to limit the devastating consequences of acid rain. This first ever “cap-and-trade” system succesfully reduced sulfur dioxide emissions below the programme’s goal in a cost efficient way by supporting new ways of cutting emissions in power plant operation. The lessons of this programme are still clear. It demonstrated that broad-based cap-and-trade systems can be used to achieve significant emissions reductions, stimulate innovation and diffusion, and reduce aggregate costs.

In 1997, the international climate-change treaty, better knowns as the Kyoto protocol, suggested applying the concept of cap-and-trade to carbon. In the years that followed, different countries and regions set up their own carbon markets, with many of these using cap-and-trade.

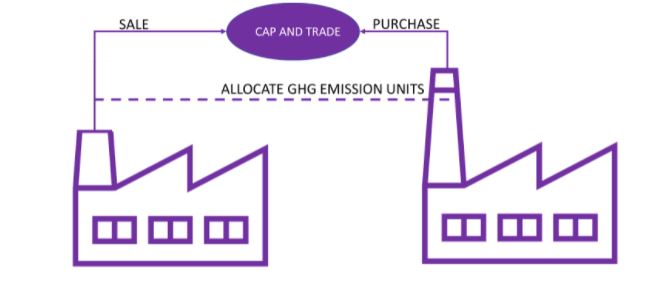

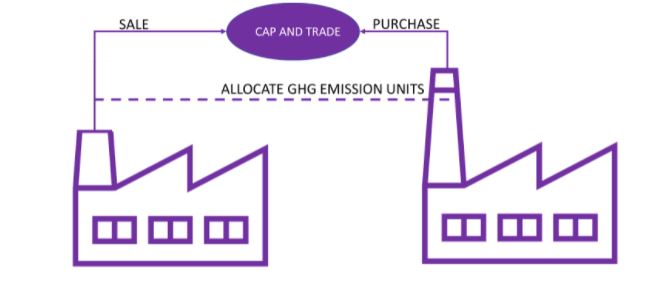

How do carbon cap-and-trade markets work?

Carbon trading is a legally-binding scheme that caps total emissions and allows organizations to trade their allocation. Hence the term “cap-and-trade”.

In a “cap-and-trade” scheme, policymakers set an overall legal limit on the volume of emissions that will be permitted over a specific period of time (the cap), and grants (via auctions or handouts) a number of permits to those releasing the emissions. Each permit gives the holder a right to emit one tonne of carbon dioxide (CO2e).

Each year, companies with a large carbon footprint are allocated an allowance, which can then be bought and sold on the secondary market. From there, companies need to hold, every year, enough allowances to cover their emissions or face significant fines. Companies that don’t have enough allowances need to cut their emissions or buy extra allowances from another emitter. Companies that have extra allowances can keep them for the next year or sell them.

How does the cap-and-trade system work? (illustration)

With such a mechanism, the price of carbon is determined by supply and demand. Usually, each year the cap gets stricter and the shrinking pool of permits gets more expensive. By assigning a price to GHG emissions, the system provides a financial incentive for firms to reduce emissions.

The system has been praised for being a market-based instrument, as opposed to conventional command-and-control approaches where the government sets performance standards or dictates technology choices for individual facilities. Theoretically, cap and trade schemes offer a cost-effective tool for reducing emissions in a way that allows more flexibility in how participants decrease their emissions in comparison to a carbon tax. By selecting whether to invest in emissions reduction or buying additional allowances to cover requirements, the scheme optimizes the overall cost of GHG reductions, as the cheapest improvements are made first. In doing so, the regulatory authority has no responsibility except to regulate the total GHG ceiling to allocate emissions allowances.

As such and when done properly, the cap-and-trade system use a stick and a carrot approach. It gives an incentive to innovate, a carrot to get cleaner, leaving the market to unleash its animal spirits of innovation in favour of decarbonisation. It creates a race in which companies are motivated to cut emissions as fast as they can. The more they cut emissions, the less they have to buy permits and the more excess they have to sell.

Cap-and-trade differs from a tax in that it provides a high level of certainty about future emissions, but not about the price of those emissions.

In practice

So long for the theory. In practice, carbon emissions have continued to rise.

Indeed, in real life, incentives only work if they are big enough. Carbon prices have been far too low to motivate changes needed to decarbonise the world economy. While not necessarily comparable (1), different systems around the world are currently showing large differences (e.g. Sweden carbon price above $137/tonne; Japan carbon tax below $3/tonne).

According to the median view of about 30 climate economists polled ahead of COP26, the average global carbon price should immediately rise to at least $100, if we are to reach net zero emissions by 2050. According to the OECD (2), a price of $147/ tonne is needed by 2030 if the world hopes to reach net-zero carbon emissions by 2050.

In areas where carbon has a price, the coverage of carbon allowances is also an embedded limit to efficiency. According to World Bank calculations, current carbon pricing initiatives cover around 11.65 gigatonnes of CO2 equivalent, representing 21.5% of global GHG emissions. In that field, Korea is largely leading with around 97% of emissions covered

What’s even more obvious, even if carbon is priced appropriately, the fines for exceeding permitted levels are sometimes too low.

The EU Emission Trading System (EU ETS)

The oldest active carbon market and the second largest (surpassed in 2021 by China’s carbon market for the thermal power industry) in the world is the European Union’s Emission Trading System (EU ETS) which was launched in 2005. The market consists of trading through spot, futures and options contracts. It trades carbon permits called European Union Allowances (EUAs).

In 2020, the EU ETS accounted for nearly 90% of global carbon market value and much of the trade volume.

The EU ETS jurisdiction consists of the 27 EU member states as well as neighbouring countries of Iceland, Liechestentein and Norway (3). The European Commission grants credits to countries, which are then auctioned to factories, power plants, and other polluters that require credits for the carbon they emit.

The EU ETS is the cornerstone of the European Union’s strategy to tackle climate change, even more so since the revamp version of the ‘Fit-for-55’ package, a sweeping set of policy proposals spanning all major sectors of the economy to achieve emission reductions of at least 55% below 1990 levels.

As of today, the system covers approximately 36% of the EU’s GHG emissions, and regulates emissions from more than 10,400 power and heat plants and manufacturing installations, as well as around 350 aircraft operators flying between European Economic Area airports.

In the EU, compliance enforcement is managed by the fact that regulated entities must pay fines of €100 for each tonne of CO2 emitted for which no allowance has been surrendered, in addition to buying and surrendering the equivalent amount of allowances, while the name of the non-compliant operator is also made public.

Good to know is also the fact that the EU ETS is covering more GHGs than just carbon dioxide, with nitrous oxide (NO2) and perfluorocarbons (PFCs) emissions also covered.

While the ‘Fit-for-55’ package places the EU ETS at the heart of the EU’s decarbonization agenda, the system in its current form was not built in one day and major changes, that have yet to through the legislative procedure, are still ongoing.

EU ETS: learning-by-doing in multiple phases

The EU ETS has seen a number of significant changes, with the first trading period described as a 'learning-by-doing' phase. The scheme has been divided in 4 phases or ‘trading periods’:

- Phase 1: 2005 - 2007. This was the pilot phase to test the system. During that period, member states had the freedom to decide on how many permits they allocated. Almost all allowances were allocated for free and were based on historic emissions (grandfathering). During that period, the scheme covered only CO2 emissions from power generators and energy-intensive industries. The price of allowances increased more or less steadily to a peak level of about €30 per tonne of CO2 in April 2006. At that time, a number of EU countries announced that their actual emissions were less than the number of allowances allocated. In other words, the ‘cap’ did not cap anything during that period. From there the spot price for EU allowances Phase 1 crashed and reached near zero at the end of the phase (phase 1 allowances could not be banked for use in Phase 2).

- Phase 2: 2008 - 2012. The EU imposed a tighter emission cap by reducing the total volume of permits by 6.5% compared to 2005. The scope was extended to include nitrous oxide and from January 2012 aviation emissions (within the borders of the EU following outcry from US and China). The price of allowances increased again to a peak level of nearly €30 when the global financial crisis hit financial markets and economic activity, causing another oversupply of permits and a fall to below €10 during the peak of the crisis

Phase 2 was also subjected to several frauds and scams:

In 2009, Europol informed that 90% of the market volume of emissions traded in some countries resulted in tax fraud, more specifically missing trader fraud (criminal reclaiming VAT on fraudulent trades) better known as the carbon carousel fraud.

On 19 January 2011, the EU emissions spot market for carbon was closed after computer hackers stole 28 to 30 million euros worth of emissions allowances from the national registries of several European countries within a few days time period.

- Phase 3: 2013 – 2020. During that phase, the EU introduced a yearly EU-wide linear reduction factor in the allowance cap of 1.74% (replacing national caps) and the allocation method was modified from free allocation to auction. In July 2014, the EU removed 900 million permits from auction (backloading) as a way to avoid another oversupply, some sort of short term fix superseded by the Market Stability Reserve (MSR) that started operating in January 2019.

Low EU ETS prices persisted for the first five years of Phase 3 from design flaws on supply not able to mimic significant changes in demand. But the set-up of the stability reserve paved the way for a radical change in market dynamics and newfound resilience of the EU ETS. In spite of a deep economic crisis triggered by the response of governments to Covid-19, the market recovered quite rapidly and the trust in the ETS as a tool to decarbonize the EU while providing a first-mover advantage to the EU’s industry is higher than ever.

Despite the third phase being marked by adjustments, recovery and low prices, the EU ETS’ environmental goals were achieved and surpassed. However, it was not ETS price signals that drove this accomplishment, but other policies which were mainly introduced in the power sector. In this, the EU ETS indeed has little credit to take. However, in recent years prices were sufficiently high to support coal to gas switching in the power sector.

The Market Stability Reserve was designed as an efficient and pragmatic solution to address the surplus of allowances and improve the system resilience to major shocks by adjusting the supply of allowances to be auctioned. The reserve operates entirely according to pre-defined rules that leave no discretion to the Commission or Member States in its implementation (4). The end of Phase 3 was marked by a significant increase in the confidence of market participants and the implications of the increased 2030 climate ambition.

- Phase 4: 2021 - 2030. A linear cap reduction of 2.2% applies

For the following years, as part of the package to deliver on the European Green Deal adopted in July 2021, the Commission proposed to reinforce and expand the role of carbon pricing to enable the EU to meet its heightened climate ambitions, but also to accompany the social implications of the various targeted technology disruptions and behavioral changes.

The EC’s proposals aim to align ETS’ functioning rules with the new intermediate GHG emissions reduction targets set for 2030 (-55% vs. 1990) through two main levers:

- The inclusion of new sectors (buildings and road transport regulated by a stand-alone ETS system, while maritime and air transport will fall under the existing ETS)

- By strengthening the rules applicable to the various sectors already covered by the ETS (power, refining, chemicals, cement, iron/steel, aluminum, domestic aviation), this via the accelerated reduction of available allowances in the market (from 2.2% to 4.2% yearly linear reduction) and the conditionality of the allocation of free allowances, based on the decarbonization efforts undertaken by the concerned installations.

- By taking additional steps are currently discussed with the introduction of a carbon border adjustment mechanism, to prevent carbon “leakage” and allow energy-intensive industries to remain competitive at a global level.

Carbon leakage and the proposed border adjustment mechanism

The term “carbon leakage” describes emissions occurring when European companies transfer their production sites to countries with less stringent emission reduction rules or when formerly domestically produced goods are replaced by more carbon-intensive imports.

Under the EU emissions trading system, industrial installations considered to be at significant risk of carbon leakage receive special treatment (higher share of free allowances compared to other installations) to support their competitiveness. This policy will continue in phase 4, but it will be based on more stringent criteria and improved data.

In order to create a level playing field for most of the activities subject to this ongoing overhaul of the carbon leakage rules and therefore prevent the risk of such activities relocating outside the EU in countries with lower emissions reduction ambition, the EC proposes the introduction of a Carbon Border Adjustment Mechanism (CBAM) covering five activities: cement, iron/steel, aluminum, fertilizers and electricity generation. This system will be fully operational from 2026 onward. From that date, EU importers will have purchased CBAM certificates to cover the amount of their imports' embedded emissions. These CBAM certificates will mirror the EU ETS so as to ensure the same “carbon price” will be paid for domestic and imported products. If, however, the importer can prove that the manufacturer of the imported goods has already paid a price for the carbon used in the production in a third country, the corresponding cost can be fully deducted for the EU importer. In the sectors covered, CBAM will therefore be gradually phased-in while free allowances under the carbon leakage mechanism are phased out.

Regarding the scope of carbon emissions covered the CBAM will only apply to “direct” (scope 1) emissions emitted during the production process of the products covered. By the end of the transition period, the EC will evaluate how the CBAM is working and whether to extend its scope to more products and services (including down the value chain), and whether to cover so-called ‘indirect' (scope 2) emissions (i.e. carbon emissions from the electricity used to produce the good).

Obviously, this will require validation from the World Trade Organisation and the ‘non-discrimination’ free trade principle by which the EU must abide. Looking at the other side of the same equation, free allocations of emissions allowances currently in practice, is already a form of subsidies to domestic companies. The EU could also defend its case by ensuring that revenue from this mechanism goes to climate action. We will have to stay tuned to get a sense of the agility of the EU climate diplomacy.

The EU has come up with three proposals for a border adjustment since 2007 but none of them made it through the legislative process, either because the system of free allowance allocations under the ETS was favoured or because concerns over WTO challenges were too strong. However, this time, the border adjustment proposal is an official part of the bloc’s attempt to reach the European Green Deal, and it is interlinked with a reform of the EU ETS.

Many studies show that carbon pricing is spreading across the world. It is increasingly clear that the EU is using multiple approaches to promote the use of carbon markets around the world by “leading by example” and persuasive diplomacy, inspiring other jurisdictions to design their own policy responses to climate change. The EU is also using a ‘stick’ approach to convince other countries to adopt more ambitious climate policies and/or carbon pricing mechanisms. The exploration of the use of a carbon border adjustment mechanism (CBAM), is a move in this direction.

Revenues

The EU ETS can also play a role in financing the transition to a low-carbon economy: Member States are expected to use at least half of the revenues from carbon credit auctions for climate and energy related purposes. In 2020 auction revenues increased from €14.6 billion in 2019 to €19.16 billion. In total, cumulative auctioning revenues amounted to €69 billion over phase 3 (2013 – 2020).

Addressing the socio-economic impacts associated with the transition to a low-GHG economy through revenue-recycling is also part of the EU ETS scheme. Member states are required to use at least 50% of the revenues generated from the auctioning of allowances, for climate and energy-related purposes . They must also establish dedicated funds, such as the Innovation and Modernisation Funds.

To ensure that rising carbon prices are socially and politically sustainable, next to the ETS, is the proposed so-called Social Climate Fund, “supporting citizens most affected or at risk of energy poverty”.

Carbon credits and offsets

During the Glasgow COP26 in November this year, a little-known and highly technical section of the 2015 Paris Agreement rulebook was finally ironed out after years of contentious disagreements. This Article 6 agreement set out the functioning of an international market for the trading of emissions reductions created anywhere in the world by the public or private sector and governed by a UN body.

While this COP26 achievement and the associated technicalities, as well as the embedded controversies could easily deserve a separate article, the take-away is that carbon credits will now follow clear accounting guidance. This will establish an integrity framework to support a credible expansion of carbon markets by strengthening mitigation projects and incentivizing further private climate finance. In short, this triggered a new growth momentum for the emissions trading system, with Article 6 being the engine of international integrity and cooperation.

Conclusions

Those who work in financial markets have long accepted that almost everything has a price. Yet when it comes to the cost of pollution and climate change, we believe not enough people understand how we can start to charge companies and consumers for the use of our most precious resource – our planet.

Carbon trading systems were launched more than a decade ago and at first failed to gain traction, with demand for emissions allowances unable to keep up with supply. For years, carbon prices suffered whipsaw volatility as trading volumes languished at low levels while carbon markets faced multiple challenges and scandals

European regulators made multiple adjustments to how the market operates since inception of the system. The EU ETS market moved from a situation of almost chronic oversupply of allowances to increasing levels of scarcity. Since the introduction of the Market Stability Reserve, carbon has enjoyed implicit “price support” from the EU.

With the Fit-for-55 ambition and the EU climate law, the EU ETS is now evolving into a tool to decarbonize all industries.

Investors can’t reduce decarbonisation discussions to solely investment in renewables, as some vital economic sectors need to be set on the right path. As an investor, you can support action against climate change by investing in carbon pricing. There is an active futures market based on the European Union carbon emission Allowances (EUAs), that can be used for hedging purposes for those firms that have an obligation to comply with ETS rules. But those futures can also be used by investors to express their views on price while supporting the price discovery process. Making greenhouse gas emissions costly creates a positive incentive for companies and investors to develop and deploy low-carbon solutions. The pivotal role of carbon pricing is to incentivize, through appropriate price signals, technology disruptions and to instigate climate-friendly behavioral changes across societies.

Source: Bloomberg; BIL; as of 30/11/2021

As of now, the volume of trading in the EUAs and futures based on EUAs is considerably larger than any other carbon market. Obviously, the carbon market has caught the eye of hedge funds and traders since 2018. EU emissions prices have more than doubled since the start of 2021 but we are still convinced that such an investment can deliver long-term investment returns while acknowledging that investing in ETS can be a short-term roller-coaster ride as politics, energy prices and hedging behaviour conspire to influence prices. Finally, carbon investing is also an opportunity to diversify your portfolio due to low correlations with asset classes like stocks or bonds, but as usual, before making any investment decision, you should consider the assistance of your financial advisor.

References

(1) Differences in the number of sectors covered and exemptions, allocation methods, as well as compensation methods.

(2) https://unfccc.int/news/investors-with-usd-6-trillion-call-for-a-global-price-on-carbon

(3) As of January 2020, the EU ETS became linked to the Swiss ETS, the first linking of this kind for both parties, enabling allowance transfers between both registries.

(4) The European Commission publishes the total numbers of allowances in circulation (TNAC) by 15 May each year. When the TNAC is above 833 million, 24% (12% beyond 2023) of the surplus is withdrawn from future

auctions and placed into the reserve over a period of 12 months. When the TNAC is less than 400 million allowances, 100 million allowances are taken from the reserve and injected into the market through auctions. From 2023 onwards, the number of allowances held in the reserve will be limited to the auction volume of the previous year. Holdings above that amount will be invalidated.

Sources

- What is carbon pricing – CNBC International, February 2021

- How do carbon markets work? – The Economist, October 2021

- VOX EU CEPR – “The US sulphur dioxide cap and trade programme and lessons for climate policy”, Robert Stavins, Gabriel Chan, Robert Stowe, Richard Sweeney 12 August 2012

- World Bank Carbon Pricing Dashboard

- International Carbon Action Partnership – The EU Emissions Trading System, November 2021

- European Commission – EU Emissions Trading System

- Natixis - Fit for 55: bringing EU’s decarbonization effort to the next level

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...