Choose Language

July 13, 2022

NewsAnother red-hot inflation print: when will prices cool?

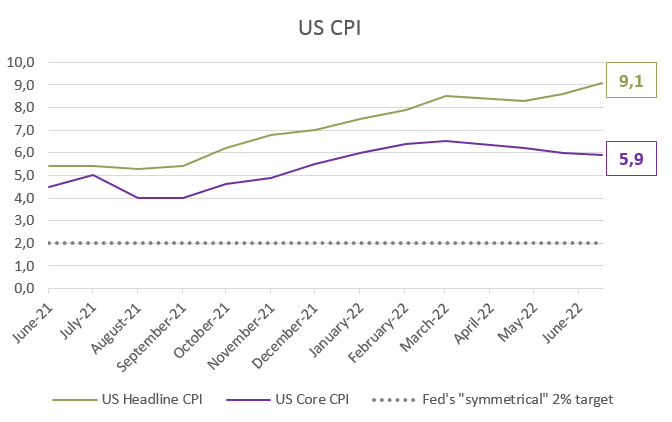

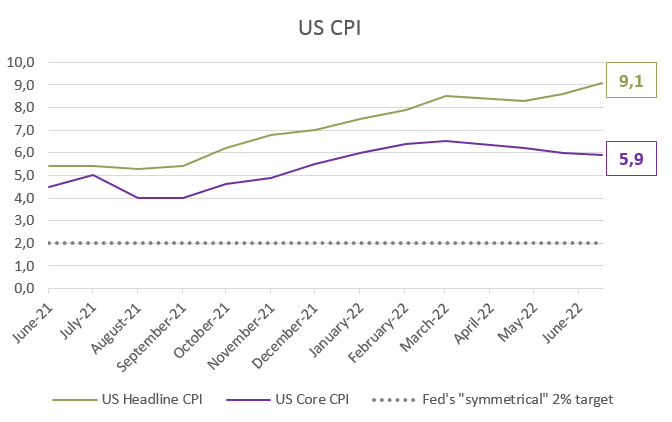

- US Headline CPI rose 9.1% in June, above estimates of 8.8%

- The increase was broad-based, with the indexes for gasoline, shelter, and food rising the most

- The Core figure edged lower to 5.9% from 6% but still surpassed estimates of 5.8%

- The next FOMC is scheduled for 26-27 July at which another 75bp hike is expected

So highly anticipated was today’s inflation reading that yesterday, a fraudulent version of the report later discredited by the US Bureau of Labor Statistics, which wrongly reported inflation at 10.2% appeared to influence stock prices.

The authentic report revealed that inflation still shows no signs of abating, coming in above expectations at 9.1% on an annual basis, the fastest pace since 1981 and above Bloomberg consensus estimates of 8.8%. The monthly rise was 1.3% following a 1% rise in May and the increase was broad-based, with the indexes for gasoline, shelter, and food being the largest contributors. The energy index rose 7.5% over the month and contributed nearly half of the “all items” increase.

Putting things in perspective: The monthly rise in CPI was 1.3% in June 2022. This is almost equal to the yearly rise of 1.4% recorded back in January 2021.

The core index which excludes food and energy rose 5.9% on an annual basis, or 0.7% month-on-month in June, after increasing 0.6% in the preceding two months. While almost all major component indexes increased over the month, the largest contributors were the indexes for shelter, used cars and trucks, medical care, motor vehicle insurance, and new vehicles.

Source: Trading Economics, BIL

Implications for monetary policy

The Fed is fully engaged in a battle to bring inflation down from four-decade highs, having already hiked by 150 basis points so far in 2022. Today’s print, paired with Friday’s strong employment report (non-farm payrolls rose 372k in June vs. 265k expected and just shy of May’s revised 384k), gives the Fed leeway to continue with its tightening campaign while conditions still permit. After June’s 75 basis point (bp) hike, the largest leg up since 1994, another 75bp Fed hike in July looks likely.

Currently, the federal funds rate is set at a range of 1.50 to 1.75 and policymakers have signaled their intent to raise rates to a level that begins to restrict economic activity by year-end (assumed to be around 3.5%). It is worth noting that changes to Fed policy take months to seep into the real economy.

Market reaction

Following the release, the dollar which was already sitting around a two-decade high (benefitting from increased fear of a global recession and the prospect of more Fed tightening) naturally strengthened.

US Treasury yields shot up, especially for short-term maturities, on bets that the Fed will have to continue with its aggressive tightening campaign in coming months. With the increase in yields, TINA (there is no alternative) has left the building and risk assets are under selling pressure. This is despite the fact that markets had been readied for a “highly elevated” CPI reading by the White House Press Secretary Karine Jean-Pierre on Monday, who said it would be largely attributable to high gas prices resulting from the conflict in Ukraine. She also added that the reading for June is “already out of date” as energy prices have declined this month and “are expected to fall further”. So far, the White House has said it will release over 1 million barrels of oil per day for 6 months from the Strategic Petroleum Reserve and US President Joe Biden will travel to Saudi Arabia July 14-16 for a meeting with Persian Gulf leaders; the oil market is probably a key agenda point.

Signs of respite?

If inflation starts to soften, the Fed may not have to press as hard on the brakes, giving it more chance of orchestrating a so-called “soft landing” for the economy.

In line with comments from the White House, Brent crude dipped below $100/barrel this week. Other key commodities such as copper also declined as investors start to contemplate a slower growth environment.

In terms of macroeconomic data, though the June US inflation print was still exceptionally high, other recent data releases brought very early indications that inflation might be starting to cool.

The US ISM Manufacturing Prices Paid Index for June, for example, was reported at 78.50, down from 82.20 in May and down from 92.10 one year ago.

While the NY Fed’s 1-year-ahead consumer inflation expectations rose to 6.8% in June (from 6.6%), expectations for inflation in ensuing years eased; the three-year outlook fell to 3.6% (from 3.9%), and the five-year outlook edged down to 2.8% from 2.9%, revealing some confidence that the Fed’s actions will be effective. Median year-ahead household spending growth expectations also retreated from May levels, declining by 0.6 percentage point to 8.4%. While still well above the 2021 average of 5.0%, this could be an early indicator of softer demand. The reported mean probability that the US unemployment rate will be higher one year from now increased by 1.8 percentage points to 40.4%, its highest level since April 2020. This is important for consumer sentiment and demand.

The NFIB small business optimism index revealed that the net percentage of firms reporting an increase in average selling prices was 69 versus 72 in May. The hiring plans component came in at 19, down from 26 in May.

Lastly, Adobe’s Digital Price Index also showed inflation for online goods cooling for the third consecutive month in June. The cost of goods sold online rose 0.3% year-on-year in June and fell 1% compared with the previous month, driven by a decline in the cost of electronics (down 7%) and clothing (down 4%).

The market is noticing these signs and market-based expectations of inflation have come down too (two-year inflation break-evens have fallen from nearly 5% in March to 3.2% today). Perceptions about inflation are an important driver of actual inflation.

Conclusion

Inflation has become the single most important issue facing households, policymakers and investors (and also voters in the upcoming US Midterm elections). The Fed is under intense pressure to rein in price pressures.

The market is oscillating between two competing narratives: one built around fears of economic overheating and another driven by fear of an impending recession. As the tug-of-war between the two continues, it will be difficult for expectations about monetary policy, and thus markets, to stabilize. As such, it is hard to overstate the importance of today’s inflation release.

9.1% inflation in the US undoubtedly means that the Fed must maintain its hawkish stance for now – for how long largely depends on the trajectory of inflation and on how the labour market responds to tightening monetary policy. This week will give more clues as to both with US PPI and Weekly Jobless Claims due tomorrow. We will also have more insight as to the health of the overall economy on Friday with Retail Sales data, the Michigan Consumer Sentiment survey and Industrial Production stats – all of which will further set the stage for the July FOMC.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

BILBoard January 2025 – Snakes ...

While western New Year celebrations are already behind us, January 29th will usher in the Chinese New Year of the Snake. People belonging to that...

January 13, 2025

Weekly InsightsWeekly Investment Insights

Looking back on 2024, it was a year marked by conflict and political uncertainty, but it also saw major advances in space exploration, the...

January 10, 2025

NewsVideo summary of our Outlook 2025

2024 - The US economy exhibited impressive strength powered by consumption, while Europe struggled with weak demand and a protracted manufacturing downturn 2025 - The...

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’...

December 20, 2024

Weekly InsightsWeekly Investment Insights

Having spent ten straight days decked out in red, the Dow Jones Industrial Average index recorded is longest losing streak since 1974. Other global...