The Way We Live Now

BIL INVESTMENT OUTLOOK 2021

FOREWORD FROM THE CIO

Fredrik Skoglund, Group CIO

It is not surprising that Merriam-Webster and dictionary.com have both chosen “pandemic” as the word of the year for 2020. March 11th, the day when WHO Director-General Tedros Adhanom told us, “pandemic is not a word to use lightly or carelessly” feels like a lifetime ago. Since then, the tragic health crisis has seeped into every part of our lives, touching every sector of society. It seems as if all events are now framed in terms of before, during, and since the pandemic.

In this outlook, we don’t focus on the past, rather, we look ahead at what we believe will shape the investment landscape in 2021 as the global economy recovers from one of the worst recessions on record.

As this is a man-made recession, we shun the typical recession playbook, believing that growth and earnings can recover at a much quicker pace than they would under a “normal” downturn. However, this is not to say it will be an easy year for investors. Winged by fiscal and monetary support, equities have rallied from their nadir, leaving little room for multiple expansion. At the same time, the hunt for yield in the fixed income world is as intense as it was 18 months ago. Selectivity and thorough analysis will prove more crucial than ever. The same perseverance, discipline and long-term mindset that helped us weather 2020 successfully remain valid, especially considering that bouts of financial market turbulence are likely until a vaccine is widely available.

Even after coronavirus subsides, its legacy will remain. Trends accelerated by the pandemic such as digitalisation and decelerating globalisation are unlikely to fall into reverse and these themes will be important when informing investment decisions in 2021.

As disruptive as the pandemic has been, it may prove to be a drop in the ocean compared to the next challenge ahead of us: Climate change. In order to avoid irreversible damage to our planet, concerted, coordinated global action is required. This will be resource intensive and every sector will have a role to play, especially the financial sector which has the ability to mobilise vast amounts of capital.

The beauty of rebuilding is that countries and industries have a rare occasion to fix what was broken. Next year will be constructive one, one of recovery and of problem-solving. We maintain an optimistic disposition, noting that there will be many opportunities on the road towards a bright, post-pandemic future.

INTRODUCTION

In keeping with our literary-themed outlooks, we borrowed this year’s title from the 1875 novel by Anthony Trollope. ‘The Way We Live Now’ is widely acknowledged as the masterpiece of the author’s prolific Victorian career. We found this title fitting as this outlook takes a look at how we live now, in the new normal ushered in by the pandemic and how this is being transposed onto the investment world.

Last year, we used the title of Hemingway’s book, ‘The Sun Also Rises’, in anticipation of an economic upturn after a pallid 2019. But then the pandemic arrived - an unpredictable and tragic black swan event that cast the global economy into a year-long twilight: Even Australia’s 28-year recession-free run came to a close, ending the developed world’s longest uninterrupted economic growth streak.

The pandemic, just like a war, will be remembered as a defining event of our time. The way we live has changed and the trends accelerated by the virus are now embroidered into the fabric of our society.

After the pandemic hit, over one-third of the global population was subject to some form of movement restriction. For the economy, this caused a simultaneous supply and demand shock and one of the worst global recessions in living memory. The rapid response of fiscal and monetary authorities was unprecedented in peacetime. The IMF estimates that fiscal spending and tax cuts worldwide add up to more than $11.7 trillion so far. In Europe, a EUR 750 billion fiscal package was agreed, the biggest in European history, far outstripping the post-World War II Marshall Plan: 2021 will see its bounty percolate into the real economy. The US unleashed a $3 trillion fiscal package and another is trying to work its way through Congress. Support from major central banks was borderline “unconditional”, with the notable exception of the PBoC, with Beijing giving preference to targeted fiscal support rather than broad-brushed monetary stimulus. Outside of China, the costs of “everything but the kitchen sink” policies will have to be borne, but if central banks had not been so quick to the mark, the damage would have been unthinkable, leaving deep, lasting scars on the global economy.

Through necessity, in many parts of the world, work and entertainment migrated online during the crisis and a lot of the digitalised model will stick. For those in white collar industries, WFH (work from home) was the acronym du jour. With the infrastructure to facilitate this now tried and tested, it is likely to be part of the modus operandi in many firms, even after the pandemic fades. Online shopping has proliferated with McKinsey suggesting the US has seen ten years growth in three months in this space, while the Economist writes that even Italian grannies have discovered online shopping in a country that had previously lagged in e-commerce. Tele-medicine and tele-learning will join tele-working as facets of our new normal, potentially widening access to thousands of people, if not millions. Even entertainment has entered the virtual realm; we can now visit an art gallery though our computer screens, or watch movies with friends without being in the same room. Testament to the online migration, in 2021, the Academy of Motion Picture Arts and Sciences that has demanded for nine decades that a film must be shown in a Los Angeles cinema for at least a week in order to qualify for the Oscars, will make streamed films eligible for Hollywood’s highest honour.

The advent of the fourth industrial revolution is upon us and big data, distributed ledger technology, cloud-based infrastructures and the Internet of Things will bring many benefits to human lives. However, the rise of digitalisation will also draw attention to its dark side. The Netflix movie “The Social Dilemma” which explores the human impact of social media, with tech experts sounding the alarm on their own creations, already saw many people disactivate their notifications and try to practice some social distancing from phone applications. Privacy, internet surveillance, tracking and profiling and the commoditisation of our data will all be prominent issues in the coming years, not to mention government efforts to prohibit monopolistic behaviour.

While we highlight many of the changes that have taken place, there will also be many constants. As the New York Times writes:

Many things will not change. That’s one of history’s lessons. The financial crisis of 2007-9 didn’t cause Americans to sour on stocks, and it didn’t lead to an overhaul of Wall Street. The election of the first Black president didn’t usher in an era of racial conciliation. The 9/11 attacks didn’t make Americans unwilling to fly… However, Events that hold the world’s attention for long stretches — and that alter the rhythms of everyday life — do tend to leave a legacy.

Indeed, the crisis also demonstrated humans’ innate ability to adapt to circumstances. Our key take away during the crisis was that it pays to be realistically optimistic, while avoiding complacency. We kept a neutral stance on risk through most of the year and a firm focus on long-term objectives, trying not to be thrown off course by short-term market moves. This ultimately allowed us to avoid panic-selling and then the subsequent dash to catch the train already travelling at full speed. Growth will return, earnings will return, and patience (a commodity that often runs short in financial markets) often pays dividends.

Ultimately, we expect 2021 to be characterised by a slow and steady economic recovery as we adapt to our new socially-distanced normal until a vaccine is available for all. It will also see the world adapting to a new US administration with Joe Biden assuming the White House on January 20th, probably creating a more stable landscape for multilateral diplomacy. We maintain an optimistic disposition, looking past short-term volatility and ominous news headlines, towards a bright post-pandemic future.

“A newspaper that wishes to make its fortune should never waste its columns and weary its readers by praising anything.” - The Way We Live Now, Anthony Trollope

Some policymakers even see the potential for an economic rebound akin to the prosperity that arrived after the Spanish flu a century ago. Olli Rehn, governor of the Finnish central bank has commented: “Post-WW1 and two waves of the Spanish flu at the start of the 1920s, economies and societies were quite devastated… We’ve had a financial crisis and now a pandemic, with savings rates going very high, so if there is no big increase in insolvencies we cannot rule out that there will be quite a big rebound — even if it is not quite the Roaring Twenties.”

If this is to be the case, fiscal injections and monetary stimulus must serve as the bridge between now and the roll-out of a vaccine to prevent companies and households from falling off an income cliff. The pursuit of a vaccine will be at the forefront driving markets, confidence, hopes and fears.

MACRO OUTLOOK

Last year, the global economy fell into one of the worst recessions in living memory: 2021 will be characterized by a recovery persisting into 2022 when the wealth lost during the crisis will be recuperated.

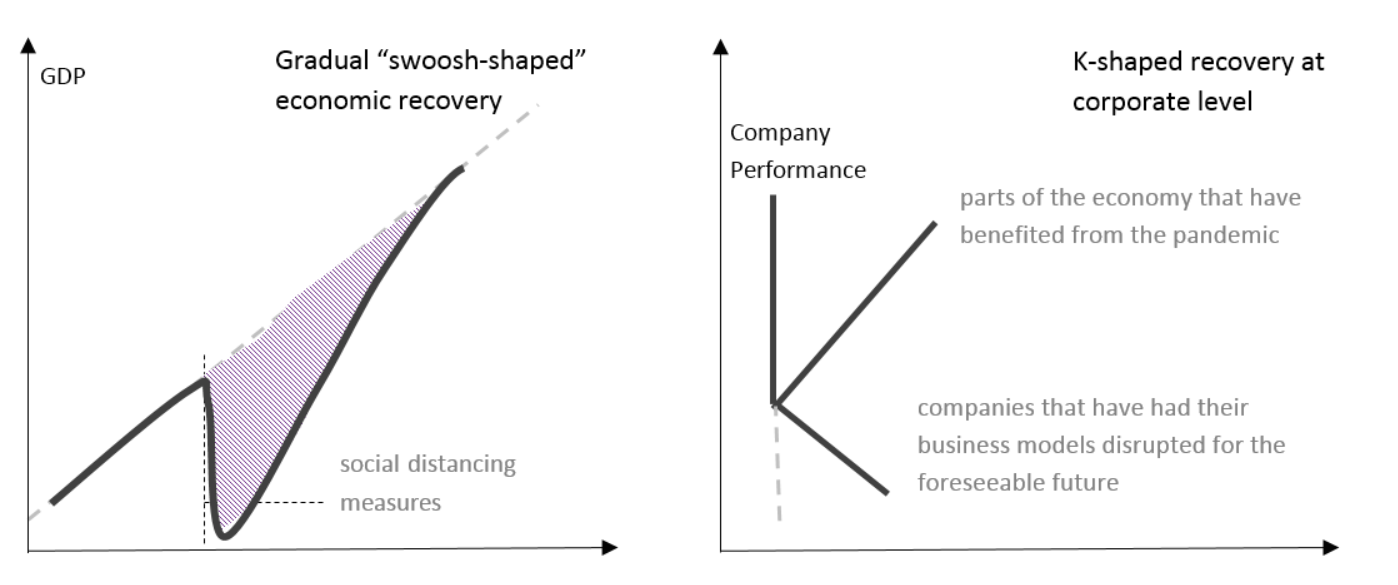

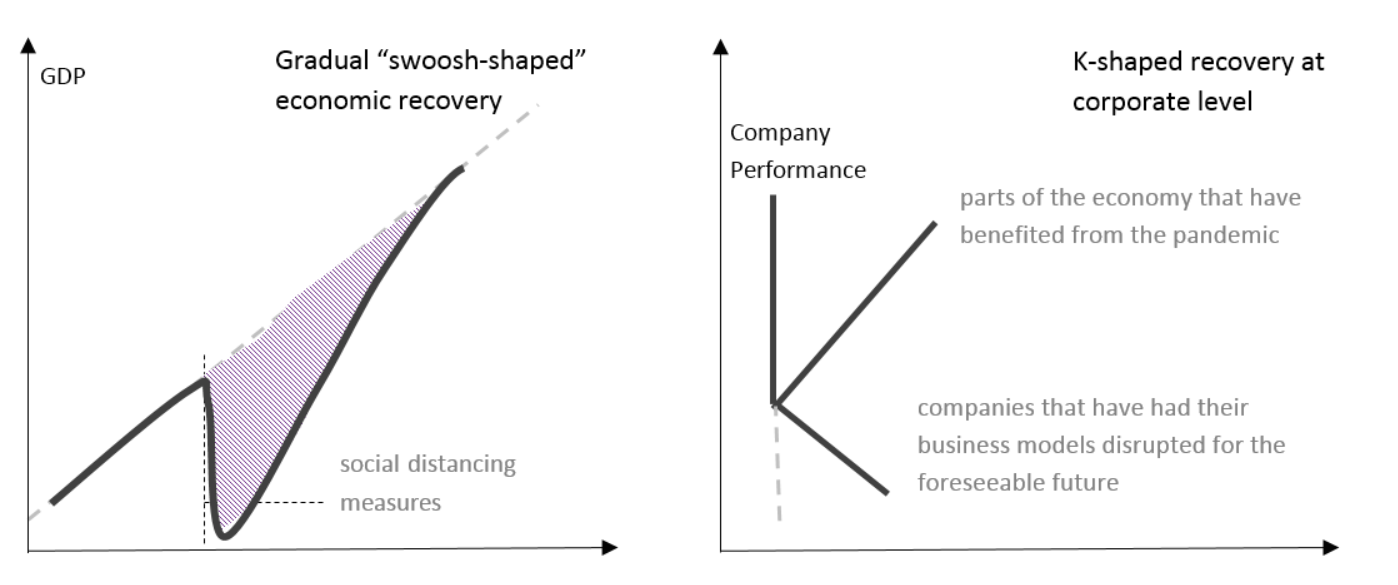

In formulating our base case scenario and recovery blueprint, it was clear to us that the normal recession playbook was not valid; this was a man-made recession caused by government imposed lockdowns, rather than the result of an economic imbalance. We envisaged a recovery resembling a “Nike swoosh” - a precipitous drop in activity, followed by a gradual normalisation, the speed dependent upon the extent and success of government containment measures and contingent upon continued policy support. Thus far, policymakers have shown that they will do, in the famous words of former European Central Bank President Mario Draghi, “whatever it takes” to save the economy, while further substantial fiscal support is still needed in Europe and the US.

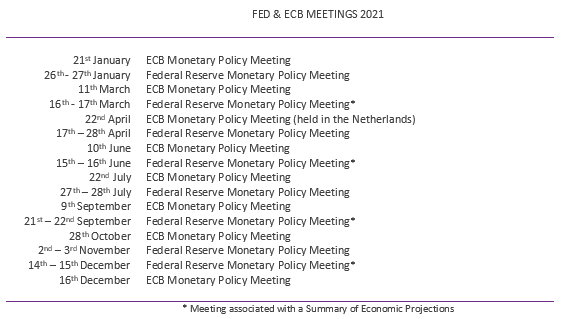

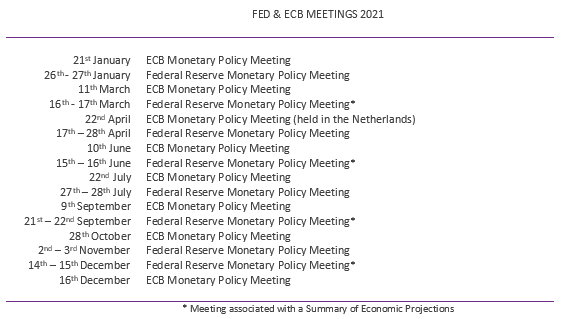

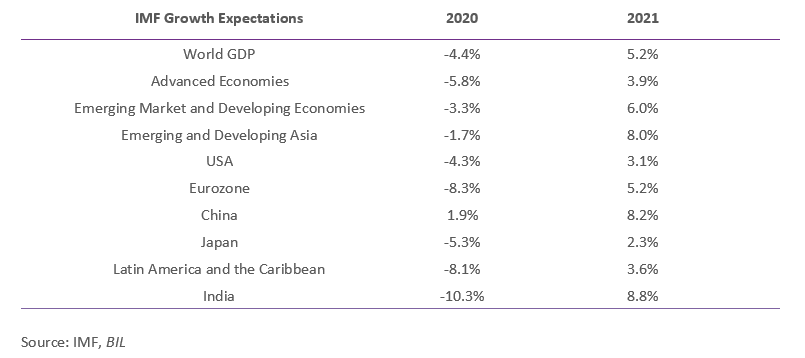

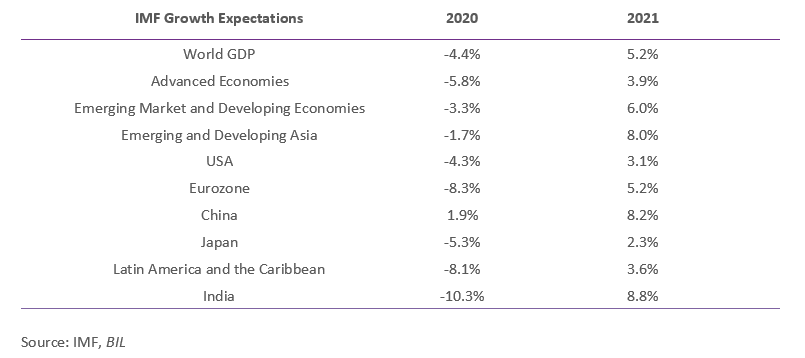

Below we show the IMF growth expectations for 2020 and 2021, which we believe are slightly pessimistic, potentially making way for an upside surprise.

As is visible in the above chart, the recovery will be an uneven one, largely dependent on epidemiological factors, with some countries, sectors and activities traversing the upwards slope of the swoosh much more quickly than others. In countries where the virus has been brought under wraps, such as China, activity is already approaching pre-pandemic levels. Elsewhere, the ascent will be more gradual as governments continue with “stop and go”containment measures until a vaccine becomes available. We do not think new restrictions will cause growth to fall into reverse with governments quite keen to avoid blanket lockdowns, taking a more balanced approach between public health interests and the economy.

On the vaccine front, Moderna and Pfizer/BioNTech have yielded very encouraging results in trials, posting efficacy rates around 95%. As is often the case, crisis has fostered human ingenuity and innovation and if these results are confirmed, these vaccines will rank amongst some of some of the most reliable the world has ever seen. With resources being funnelled into vaccine development, scientists have created these “genetic vaccines” which could pave the way for a new era in infectious disease prevention. However, the vaccines still have to be approved by the relevant health authorities and if they pass through this hoop, the road between now and mass inoculation is long and strewn with challenges, whether they be logistical in nature, or even psychological with opinion polls revealing a degree of scepticism.

Ultimately, we do think that a vaccine will be rolled out at some point in 2021.

With a “Nike swoosh” recovery as our base case, we could add another dimension. What is emerging as a plausible hypothesis at corporate level is a “K” shaped rebound which encapsulates two divergent paths. The line heading upward symbolizes those parts of the economy that have benefited from the pandemic: Companies with a strong foothold in digitalisation, online retailing and entertainment, technology, AI and robotics… Many of these names will continue to benefit from the structural trends accelerated by Covid-19 such as teleworking, telemedicine and e-learning. These will become permanent facets of our new normal; even without lockdowns have been lifted, working from home will remain prevalent, more university curriculums will take place online and business travel looks to be off the cards for the foreseeable future.

The downward slope of the “K” symbolises all those companies that have had their business models turned upside-down for the foreseeable future. As long as preventative measures ensue, the service sector (which often constitutes face-to-face interaction), will not be able to operate at full capacity. The composition of the economy will also determine the recovery time, for example, countries heavily dependent on service sectors such as travel, tourism and hospitality (concentrated in the downwards slope of the “K”) are likely to lag behind in climbing up the swoosh.

A key observation from 2020 is also the fact that the anxiety induced by the health crisis affected the mood amongst economists. Most of them were fast to adjust their growth projections downward significantly, but were slow or shy to adjust upward. Economists are increasingly turning to alternative data sources for a read on fast-changing economic conditions. We should expect that this is only the beginning of radical change in modelling and macro-economic forecasting.

The US

A new political chapter

The US opens a new political chapter in 2021, with Joe Biden to be sworn in as President on January 20th. On his transition website, he has outlined four key areas that he will focus on from Day 1:

COVID-19 ECONOMIC RECOVERY CLIMATE CHANGE RACIAL JUSTICE

The degree to which he can pursue his agenda is determined by the composition of Congress. The House of Representatives remains blue, though with a weaker Democratic majority, while January Senate runoffs in Georgia will determine whether the Senate is Republican or Democratic, but it is likely that it remains red. In all, this means a balance of red and blue across the three branches of government.

Despite initially anticipating a blue wave, markets have warmed to the idea of this “purple outcome”: A Democratic president keen to disburse more fiscal stimulus, who will not veer too far to the left due to a Republican presence in Congress that will ensure checks and balances. In a nutshell, this is somewhat of a Goldilocks scenario, somewhere in the middle ground of the highly-polarised US political landscape.

The outcome heralds good news for diplomacy. With Biden in the Oval Office, trade wars are less likely and we envisage a more stable foreign policy emanating from the White House, especially towards traditional US allies such as Europe. Trade tensions with China are unlikely to dissolve but we expect that they will be handled with more finesse. Albeit, four years of protectionist policies has accelerated a trend of de-globalisation and we believe that onshoring will continue.

The Trump policies which made Wall Street swoon are unlikely to be unwound by Biden. Biden’s proposed tax plan involves a partial reversal of the 2017 Trump tax cuts, from 21% to 28%, but the President-elect would have an uphill battle pushing this through the Senate, which bodes well for corporates. Economically speaking, we think the new President will bring new energy, injecting vigor into the economy with an ambitious infrastructure program (an area where bipartisan support is likely). The most pressing issue for now is finding an agreement on a new fiscal stimulus package.

“A man's mind will very generally refuse to make itself up until it is driven and compelled by emergency.” - Ayala’s Angel, Anthony Trollope

During the first set of lockdowns in the US, the impact on consumers and businesses was cushioned by a $3 trillion fiscal stimulus package. Integral to this was the CARES act which saw the forbearance of debt payments for 6 months become extendable to 1 year, preventing a widespread and deep consumer crisis. At the same time, some 4.5 million Americans are still collecting benefits under the Pandemic Emergency Unemployment Compensation program (which offers an extra 13 weeks of federal benefits to individuals who were previously collecting state or federal compensation but exhausted those benefits). This program will expire at year end.

Bickering on Capitol Hill over the size and shape of a new package means that new restrictions to curtail the virus have not come with the same backstop, putting millions of American households and businesses in danger of dropping off an income cliff. Democrat hopes for a $2.3 trillion package will likely be tempered by Republican conservatism. With the elections done and dusted, we believe that a more moderate fiscal package will arrive this winter: enough to tide over the US economy until a vaccine becomes available, but which avoids excessively inflating the already-burgeoning twin deficit.

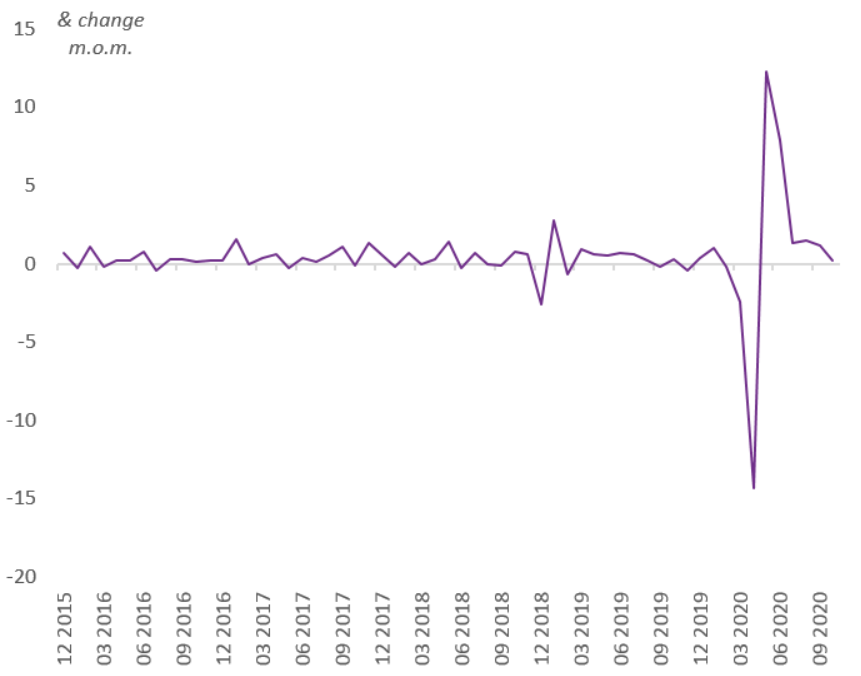

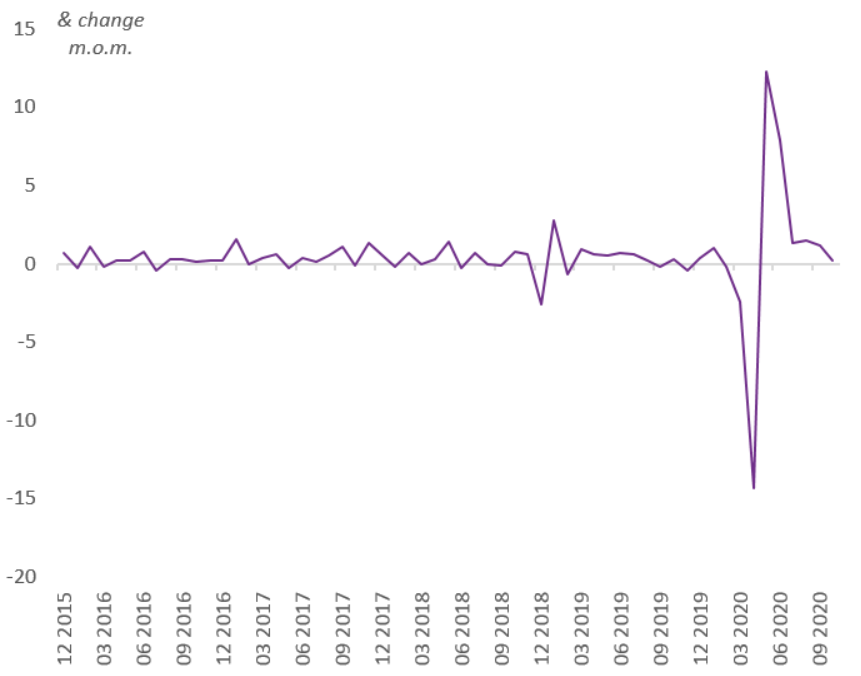

The resilience of the US economy, has taken most economists by surprise. Consumers are the backbone, having accounted for around two-thirds of overall output in recent years. The outlook for consumption in 2021 is promising, if our expectations for a second fiscal stimulus package hold. Consumer activity bounced back after the first set of lockdowns, and already retail sales are back above pre-pandemic levels (with a notable concentration online, in supermarkets and at building material stores), while the real estate market is buoyant as buyers seek to take advantage of low interest rates. Despite strong sentiment, savings rates are still high at 13.6% (relative to normal levels of around 8%), implying that consumption still has some way to go.

US Retail Sales already went past pre-crisis levels

Source: Bloomberg, BIL

Into 2021, consumption should be supported by improving labour market dynamics (already the unemployment rate is back down at 6.7% after peaking at 14.7% in April), as well as a degree of wealth redistribution under a Biden agenda that could be supportive of consumption at the lower end of the income spectrum (the cohorts with the highest propensity to consume).

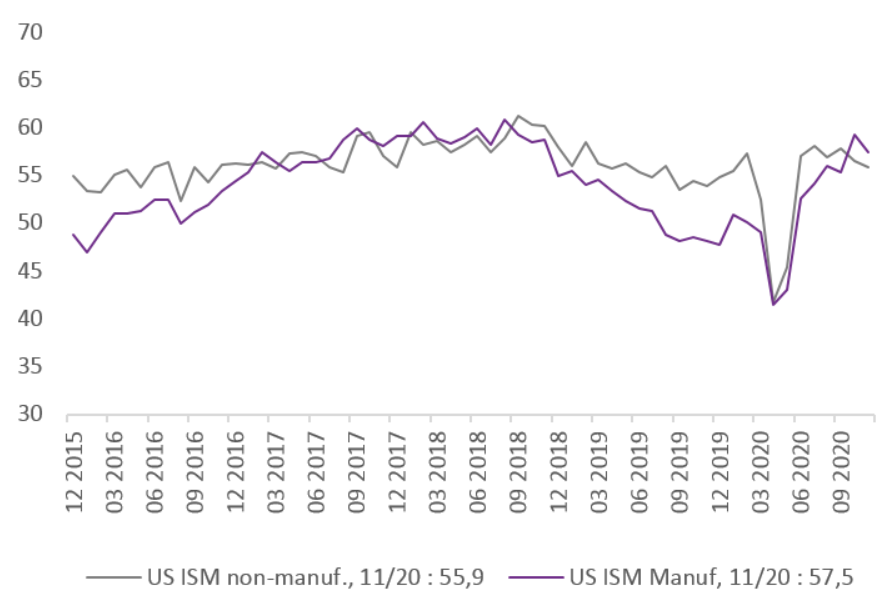

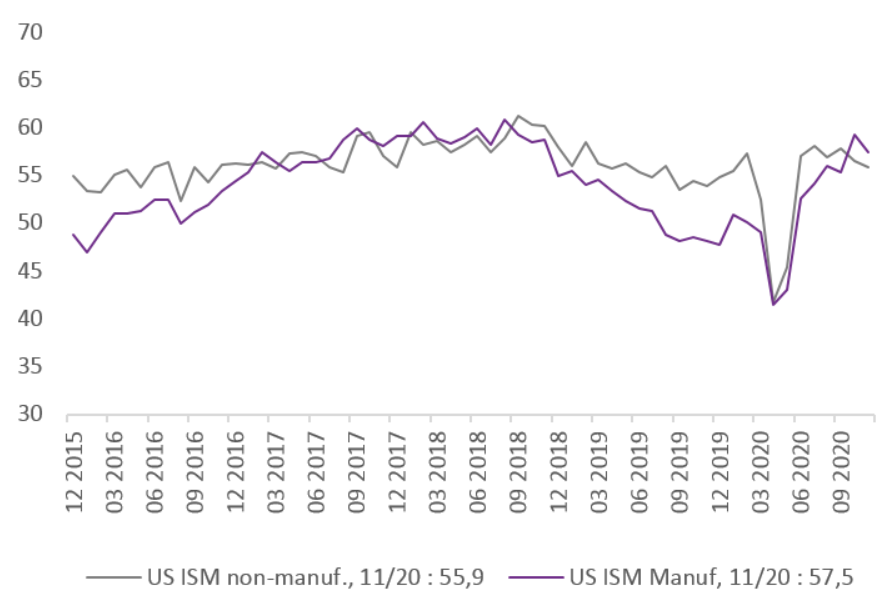

“…Companies and suppliers continue to operate in reconfigured factories; with every month, they are becoming more proficient at expanding output” - ISM manufacturing survey, October

On the corporate side, output is still below pre-pandemic levels but business confidence is improving. There is still a lot of fear in the system which will probably not dissipate until a new fiscal stimulus program is announced. Biden, who has been highly critical of Trump’s approach in dealing with the health crisis is expected to emphasize a federal approach rather than leaving states to craft their own responses and we think more stop-and-go style restrictions are on the cards. Nonetheless, we think the impact on corporates will be manageable with business surveys conveying that both the services and manufacturing sectors are adjusting themselves to this new normal.

“The US economy looks to have started the fourth quarter on a strong footing, with business activity growing at a rate not seen since early 2019. The service sector led the expansion as increasing numbers of companies adapted to life with COVID19.” - Chris Williamson, Chief Business Economist at IHS Markit

US ISM Survey: Business Sentiment is robust

Source: Bloomberg, BIL

The Eurozone

The Old-World Economy

The eurozone’s battle with its old structural demons of low growth and low inflation looks set to continue into 2021. As supply chains are mended and export demand picks up, countries like Germany which have manufacturing at the heart of their economies are set to lead. Those, such as Ireland and the Netherlands, with a stronger digital economy are also well poised. The laggards are likely to be those with service based economies, especially those reliant on tourism like Italy and Portugal. In essence – the pandemic has accentuated the North-South divide.

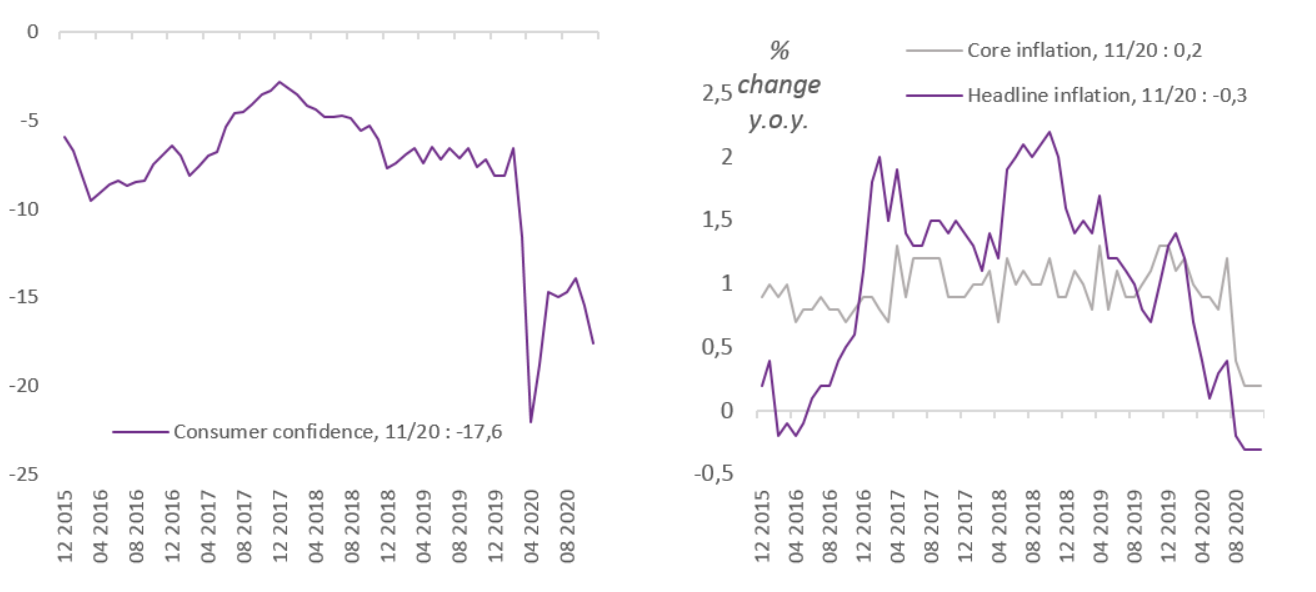

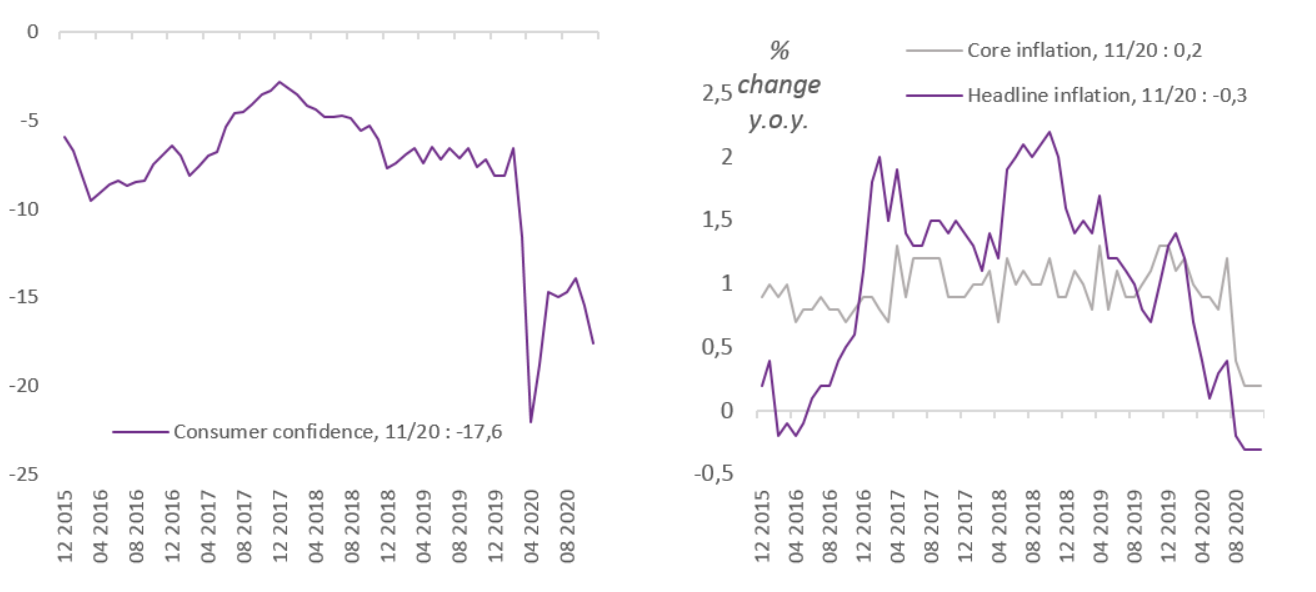

This creates a complicated task in fine-tuning monetary and fiscal policies to meet the differing needs. As Europe’s perpetual strive for consensus ensued with regard to fiscal stimulus, the ECB had no choice but to take the steering wheel. The central bank is expected to remain accommodative, but in reality there is little they can do to embolden consumers apart from alleviating the pressure of existing debt and keeping credit available. There is a clear need for fiscal support – especially with the second wave denting consumer confidence.

Eurozone Consumer Confidence (EC Survey) Eurozone HICP Index - Weak Demand shows in inflation

Source: Bloomberg, BIL

While manufacturing and construction operations will face less interruptions in 2021, restrictions on other sectors such as hospitality, travel and leisure will come at a huge economic cost with millions of jobs potentially at risk. The unemployment rate has been creeping up, with the latest release coming in at 8.4%. Until now, the full impact of the crisis on the European labour market has been masked by government furlough schemes.

With the pandemic ushering in a digital revolution before our eyes, now, more than ever, Europe needs to rejuvenate its old-world economy. The continent boasts plenty of world-class companies but not many of them were set up in the past twenty-five years. There is, in short, a lack of pizzazz, with the continent having very little in the way of FAAMG equivalents. Europe urgently needs to find its place in the new digital economy. The embedded exponentiality means that a couple of years lag could mean centuries of difference in scale.

Across the Channel, forecasts for UK GDP were recently downgraded to reflect an 11.3% contraction in 2020 and growth of 5.5% in 2021, with the economy only expected to return to its pre-pandemic level by Q4 2022. If estimates are on the button, this would represent the deepest British recession in over three centuries. This somewhat alleviates the risk of a no-deal Brexit as the British government is cognizant that a no deal departure would make a bad situation worse. The Office for Budget Responsibility warned that without a Brexit trade deal, GDP won’t return to pre-crisis levels until well into 2023. Moreover, Joe Biden has staunchly defended the Good Friday agreement and will likely take the opportunity to engage both the EU and the UK, helping to re-forge foreign policy ties between the two while plugging the US back into the conversation.

Emerging Markets

China is the outlier in the cycle

Broadly speaking, the outlook for emerging markets has been made slightly more positive with the election of Joe Biden who is expected to take a more traditional stance when it comes to foreign policy. Growth projections vary widely across the region, with Asian economies led by China at the helm, benefitting from the fact that the virus has largely been brought under control.

On the global stage, China is an economic outlier in that it is expected to post positive growth in 2020; the IMF predicts 1.9%, followed by 8.2% in 2021. The Chinese authorities have taken a very proactive approach towards stimulating domestic demand and pushing the transition towards becoming a service oriented society. This is, in part, a side effect of the trade war and abrasive US policy which saw China turn inwards to focus on its own domestic economy and capabilities. Output is back at pre-pandemic levels with both the manufacturing and service sectors showing strong growth.

First glimpses of the 14th “5 year plan” (which sets out the economic and social path) that will begin in 2021, reveal the intention to position the country as a technological powerhouse, emphasising quality growth over speed. Self-reliance in technology will be key, for which domestic capabilities in chip production will be crucial – these are the building blocks for innovations such as AI, fifth-generation networking and autonomous vehicles. Alongside Technology, healthcare and consumer sectors will be key.

Several other east Asian countries such as Singapore have also brought the virus under control and are faring better than had initially been expected.

Other emerging markets are still in the thick fog of the pandemic and the cost of response measures has left the finances of governments and businesses vulnerable. Looking forward, their ability to fund cumbersome debts through growth is uncertain. For example, the IMF predicts an -8.1% contraction in Latin America in 2020, followed by only +3.6% growth in 2021 as “the legacies of the pandemic cloud an already uncertain outlook”. In India, the economy is projected to contract by -10.3%, with losses not fully offset by +8.8% growth in 2021.

INFLATION

The most important long-term issue facing investors

In the pre-pandemic world, eyebrows were already raised about the global financial system stuffed with debt. The pandemic has contributed quite substantially to the pile-up and according to the IMF, national debt in advanced economies is set to reach 125% of GDP by the end of 2021 and to rise to about 65% of GDP in emerging markets during the same period. While absolute levels of debt to GDP are problematic, on the frontline of the crisis, concerns were brushed under the carpet.

"His debts and difficulties had hitherto been bearable, and he had borne them with ease so long that he had almost taught himself to think that they would never be unendurable" - Framley Parsonage, Anthony Trollope

One way policymakers can start to chip away at national debt burdens is to coax up inflation, akin to taxing the population. This leaves central banks walking a tightrope: they want higher inflation, but they don’t want it to go too high, knowing how painful it could be to bring it down again. As stated by Nassim Taleb, “the problem with inflation is it’s very non-linear. So, it’s like a ketchup bottle. Nothing comes out and then suddenly things jump out”. Many people have been expecting inflation to rise on monetary stimulus but nothing has happened because of the collapse in the velocity of money. The difference as of today, is the fact that monetary stimulus is now coordinated with fiscal policy.

By formally shifting its inflation approach, aiming to average 2% inflation over time, rather than taking this target as an absolute goal, the Fed made a historic change to its monetary policy framework in August 2020 and it is speculated that the ECB may soon adopt a similar approach. Financial market participants are not convinced that the adoption of an “average inflation target” effectively raised the inflation outlook in the US, but seem convinced this will give the Fed time to keep interest rates at low levels. For us this means a steady exit from the autopilot mode in which monetary policy had been cruising: A clear indication that monetary policy will stay loose for longer, even if inflation rears its head.

Accelerating inflation is not an immediate threat, as the world is currently facing its deepest recession ever recorded. Initially, the pandemic took the form of a supply shock, but second-round effects have now generated a massive aggregate demand shock. The overall impact on prices will depend on which of these two shocks dominates. However, if you take the view that a resolute Fed with little fear of overshooting has the ability to cause prices to generally rise, then we should brace for inflation to overshoot the 2% level in the near future and we should expect long-term inflation expectations to be anchored near 2%. Overshoots in the low single digits are probably fine if temporary. But high single digits would be a problem for investors and financial asset valuations, affecting portfolios by eroding the value of future cash flows.

Higher but controlled inflation is what is currently priced by financial markets for the US: A moderate increase in inflation that is positive for earnings, but not the idea that the Fed will fall asleep, ultimately not able to spot unhealthy price pressures before it is too late. This scenario would benefit real assets (e.g. equities, gold,..) over nominal fixed income assets (with the exception of bonds with coupons directly tied to inflation levels). In Europe, the ketchup bottle doesn’t deserve to be in the fridge anymore, as it is mostly empty with the continent facing little to no inflation.

There might be some significant relative price changes with increases in the prices of some indispensable goods due to pent-up demand and over the long-term the trend towards de-globalisation could increase overall costs for companies and consumers. On the other hand, prices of services and other goods could decline because of structural behavioural changes resulting from the pandemic.

FIXED INCOME

<< Rewind: the hunt for yield we seen 18 months ago is on again

With over $16 trillion of outstanding bonds offering a negative yield, it is safe to say that there is not a lot of juice left in the orange in the fixed income world. Investors hunting for yield must pluck up the courage to venture out of their comfort zone into riskier tranches of the bond market such as high-yield, subordinated debt and emerging markets, if income is still what they seek. Of course, down at the lower end of the quality curve, the chances of buying a lemon are much higher. Rather than buying an index, investors have to be discerning, separating the wheat from the chaff, assessing the merits of each individual investment while avoiding companies with unsustainable business models or those saddled with debt. Thorough analysis and vigilant selectivity is key. Active management in the bond space has never been more relevant in the pursuit of desirable risk-return dynamics.

“It might have been seen, I said, with half an eye, that Mr. Broughton did not like the state of the money-market; and it might also be seen with the other half that he had been endeavouring to mitigate the bitterness of his dislike by alcoholic aid.” - The Last Chronicle of Barset, Anthony Trollope

2021 will be about rising risk-free rates at the long-end of the curve, on both sides of the Atlantic as the economic recovery ensues and a vaccine becomes a less-distant possibility. In light of this, investors should be cognizant of the duration risk in their portfolios to avoid getting caught off-guard if yields start to rise quite rapidly. As we saw during the 2013 taper tantrum, this can have a domino effect across every tranche of the bond market. The Catch 22 is that investors are often forced to accept duration risk given that the short-end of the curve is awash with negative-yielding bonds. With regard to credit risk, default rates in 2020 were less than feared, despite the sucker punch that the pandemic dealt to earnings. Broadly speaking, credit risk, expected to rise in a controlled manner, is not a major concern moving into 2021, except in a handful of sectors, namely the US energy sector and in the travel / leisure space where many companies are hanging on by a thread, still burning through cash at an alarming rate. Bigger names will survive but a lot of smaller players in these areas may be shaken out or taken over.

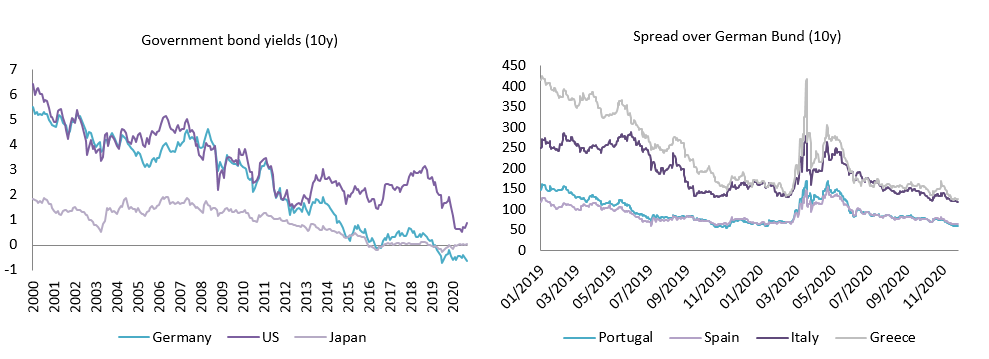

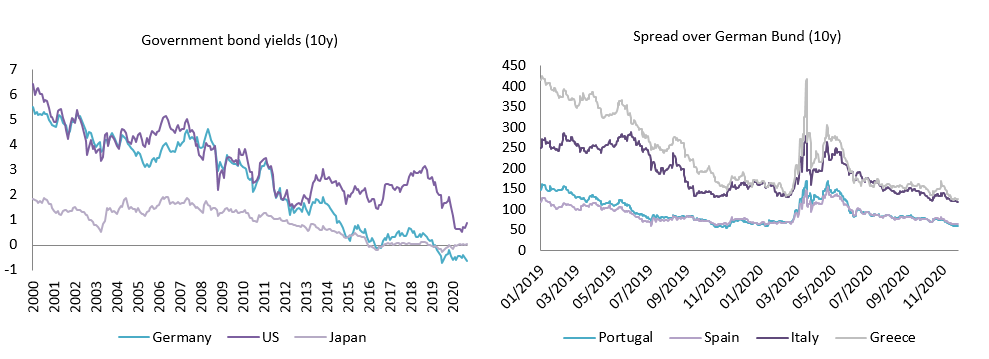

Monetary policy should continue to be easy in 2021 and we do not think that the major central banks have exhausted their policy jar, rather they have demonstrated their ability to concoct creative solutions.

With regard to central rates, we do not foresee a rate hike from the ECB nor the Fed in 2021 (in line with the consensus view and the Fed’s dot-plot), as both seem willing to tolerate a temporary overshoot in inflation while awaiting confirmation that economic growth is resilient beyond the recovery phase. If the situation in Europe was to worsen, the ECB, cognizant of the weight of negative interest rates on bank balance sheets, may go along the lines of expanding its long-term lending scheme to banks or its bond buying programs, rather than taking the scissors to rates.

The Fed has been buying Treasuries of all maturities at a pace of about $80bn a month, however, some commentators believe that its bond-buying should shift towards longer-term debt to prevent a rise in borrowing costs. With the US corporate bond market standing on its own two feet, the Fed has been able to dial down its bond buying and will not extend its corporate bond buying program beyond December – news that markets digested calmly. Christine Lagarde, the ECB Chair recently reaffirmed the central bank’s support saying “The ECB was there for the first wave and we will be there for the second wave. We are, and we continue to be committed to supporting the people of Europe in this crisis”. The current Pandemic Emergency Purchase Programme runs at least until June 2021, with over half of its €1350 billion budget still available. The ECB is expected to continue buying bonds at a pace of up to €10 billion per month and economists expect more stimulus to be announced in December 2020 as well as an extension of the emergency program to end-2021.

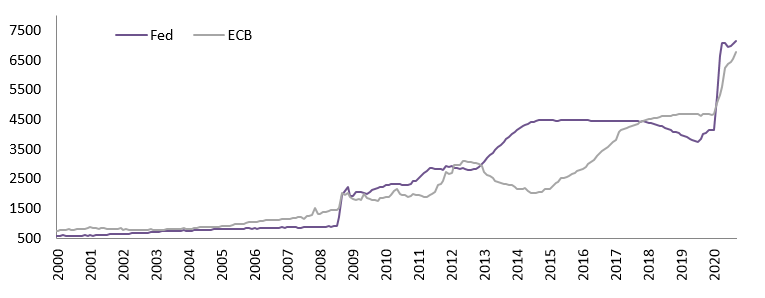

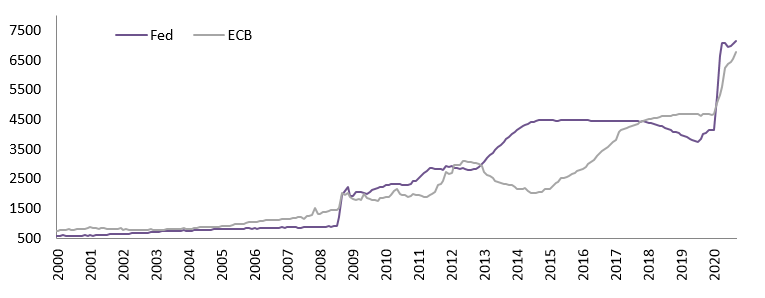

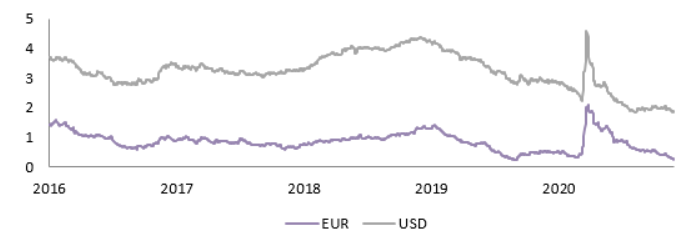

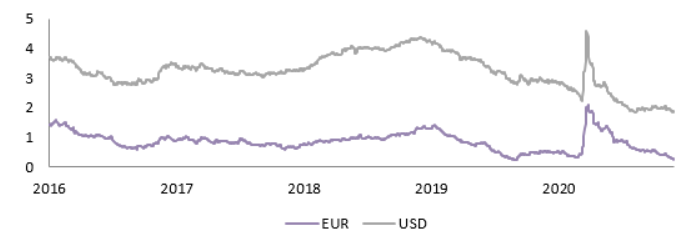

Central Bank Balance Sheets (billions $, billions EUR)

Source: Bloomberg, BIL

We could see some discomfort in markets if, towards the end of 2021 (provided the economic recovery has played out as hoped), central banks, namely the Fed, begin contemplating policy normalisation. Indeed, in their crisis response, the rule book went out the window, along with convention. In the US, the Fed pulled the lever on the money printing quantitative easing machine early and all previous records were smashed in the largest money creation event of all-time (as defined by M2, the measure of money in circulation), which calmed the markets down like a shot of aged whisky. The state of play without such support is a sobering thought.

Sovereigns

Government bonds still deserve a space in a diversified portfolio, albeit a smaller one. While the negative correlation with equity markets should stay the course, vanishing yields challenge conventional assumptions about their cushioning capacity. Current yield levels make the forward-looking risk/return profile of bonds unfavourably asymmetric. We believe it’s now sub-optimal to be overly reliant on duration for protection against equity drawdowns and prefer top quality corporates as buffer for the time being.

With regard to European peripherals, there are still opportunities for carry. Spreads against German government bonds are contained due to the perception that we are one step closer to some kind of European debt mutualisation after the announcement of the Eurozone’s EUR 750bn rescue program and the successful issuance of SURE bonds. While this was just a baby-step towards debt mutualisation in Europe, it is nevertheless a game changer, somewhat nullifying the risk of a eurozone break up. The “social bonds” format attracted a lot of demand, alleviating some of the scarcity problems in conventional AAA rated government bonds.

Source: Bloomberg, BIL

Investment Grade

We favour investment grade corporate bonds which continue to benefit from central bank largesse: On both sides of the Atlantic, central bank purchase programs should prevent any material widening of spreads. As companies move to take advantage of cheap financing, with yields artificially suppressed, issuance has been running at record levels and should continue to be high. One thing we do note is that the use of proceeds is tilted towards defensive purposes with almost half of issues used for refinancing and very little used for acquisitions or shareholder friendly operations such as buy backs and dividend increases. In terms of credit ratings, after a mass downgrades in the US and Europe, it seems we have passed the inflection point, with upgrades slowly returning.

Investment Grade - Yield to Maturity

Source: Bloomberg, BIL

High-Yield

The starting gun in the hunt for yield has been fired again and it almost feels as if we have rewound time by 18 months, when investors had shuffled down the quality curve en masse. While this segment does offer some yield, selectivity is key. Spreads are approaching record low levels while credit fundamentals are much weaker than they were before the crisis (interest coverage ratios have fallen, leverage has increased). The yield on US “junk bonds” hit an all-time low in Q4 2020. All this is driven by unwavering faith in central banks (there is even speculation that the ECB could begin buying high-yield debt), vaccine hopes and a belief that the economy will recover. Indeed, a meaningful economic recovery could bring down the high leverage ratios but, we should also remember that on the other side of the equation, government support (for example, moratoriums and interest holidays), are not eternal. The end of such schemes could represent an income cliff for some companies. In light of this, we curate a nuanced exposure to this asset class, focusing on firms with sound balance sheets, as well as selected subordinated debt (mainly of financial institutions).

Emerging Market Debt

2021 looks set to be a nice year for emerging markets as the global economic recovery takes hold. Moreover, a Biden Presidency seems to promise more stability for the region, with less sporadic policies emanating from the White House. Emerging market debt offers attractive pick up and investors are not yet over-allocated to this asset class, meaning there is room for spread compression. We give preference to EM corporates as they offer more favourable risk characteristics and often come with a shorter duration for a similar yield to the sovereign equivalent. In the local currency space, performance is inextricably linked to that of the currency in which they are denominated, bringing another dimension of volatility that we do not wish to add to our portfolios in the current context. Hard currency alternatives still offer nice premia over developed market corporates.

Worth mentioning in a category of their own are Chinese bonds. Chinese government bonds with a 10-year yield above 3% offer an attractive spread over US Treasuries and a positive real yield – something that is increasingly hard to come by these days. The shaping of a transparent regulatory environment and the ongoing RMB internationalization are positive trends that make China an increasingly investible bond market. Indeed, foreign investors actively increased their holdings of RMB bonds throughout 2020, while passive allocations have also soared due to the inclusion of Chinese government bonds in flagship indexes. However, investors should keep their exposure to currency fluctuations in mind.

In summary, with lower for longer interest rate environment seen as some sort of existential threat for most bond investors, building resilient portfolios is our key focus. It’s more important than ever to focus on the risks we are comfortable taking as we look to generate more income than traditional bonds.

EQUITIES

Selectivity is key

“Mr. Sentiment is certainly a very powerful man” - The Warden, Anthony Trollope

2021 looks to be a promising year for equities winged by accommodative monetary policy and underpinned by the economic recovery. On the heels of a much better-than-expected Q3 earnings season, revisions for earnings growth over the next 12 months have been turning positive in all regions except Japan – something quite unusual as analysts typically lower EPS estimates at this time of the year.

84% of S&P 500 companies reported earnings above estimates – the highest amount since FactSet began tracking this metric in 2008

Sentiment has been very strong and despite the pandemic and the economic impact, major US indices resumed their winning streak in the last quarter, breaching new highs and pushing rich valuations even higher. The positive sentiment has been driven by improving macro data, better-than-expected earnings results, stimulus packages that made up for a lack of demand, and vaccine hopes. For it to continue, we will need to see further improvement in macro data, success in containing the virus and a reopening of economies. The arrival of a vaccine will be extremely positive for equities, however early optimism needs to be tempered – it will take some time for any successful vaccine to be manufactured en masse and distributed. Future expectations must be balanced against the reality of the here and now; as we saw late 2020, relief rallies and style rotations are being cut short by concerns over mounting coronavirus cases.

The earnings hurdle for Q1 2021 is quite demanding, especially if you consider that Q1 2020 is the baseline, when Covid was only just starting to rear its head in the west, but could be achievable if there are no major setbacks on the macro front or in terms of fiscal stimulus. Normally it takes 4 or 5 years after an economic downturn for earnings to return to pre-recessionary levels, but this isn’t a normal recession stemming from an economic imbalance: it’s man-made which, indeed, may be different. Ongoing stimuli programs give hope that 2021 estimates will hold and already, results exceeded analyst expectations in Q2 and Q3.

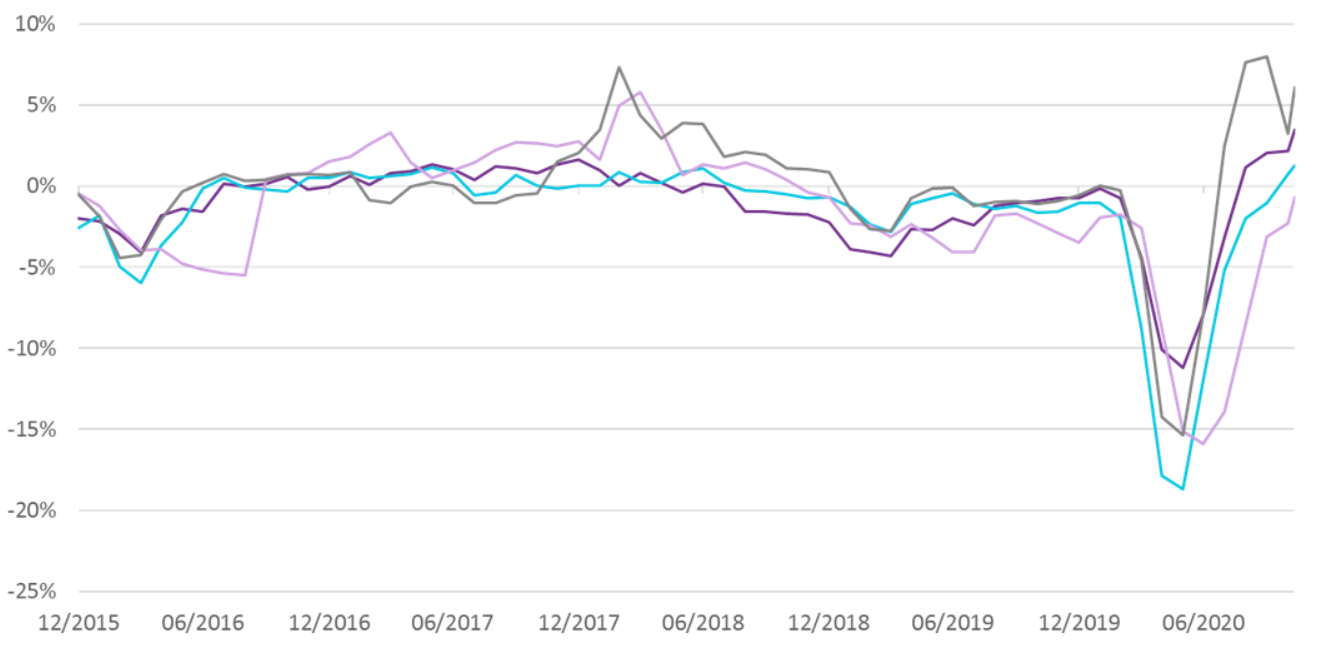

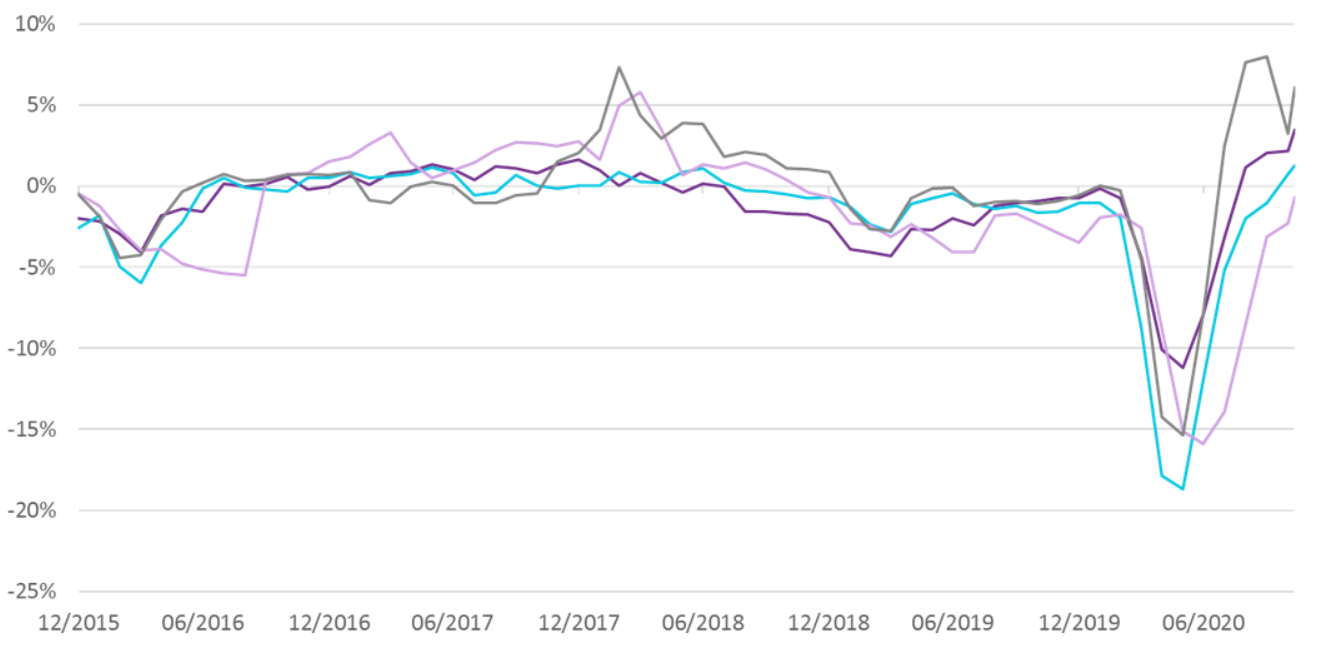

Relative Earnings Revisions

Source: JPM data, BIL

What we have to remember is that uncertainty is still higher than usual with analysts (and to an extent, companies) having an opaque view of what the future holds. Hopefully in February, full-year guidance will start to come through.

69 companies gave guidance in this earnings season – well below the 5-year average of 104 - FactSet

The new US administration is not overly important for equities, with performance over the longer-term driven by the economic cycle rather than the composition of the US government, however, there may be some fringe benefits for equities, stemming from a more harmonious global trade arena (prior to Covid, markets were often held hostage to trade talks) and a Biden infrastructure push which could benefit certain sectors.

Regions

We prefer the US (home of quality growth names and stay-at-home beneficiaries) and China (due to strong domestic growth)

We believe that US equity markets can finish 2021 higher than current levels, though rich valuations leave little room for multiple expansion – investors will have to be highly selective and conduct thorough research to find the gems. The US is the region where the most prominent growth and “stay at home” beneficiaries are located, making it expensive, but justifiably so in a context where asset prices are inflated across the board. Macro momentum is picking up and will be supported further by a new round of fiscal stimulus. At the same time, Jerome Powell has re-emphasized the Fed’s commitment to doing whatever it takes to rescue the economy.

In Europe, nothing on the macroeconomic front is particularly exciting and momentum looks fragile – especially with new movement restrictions at play. On a positive note, the ECB is still very active and a Biden presidency, with a potentially more amicable trade policy should be beneficial for the export-oriented Eurozone. Europe, like Japan, is more of a value play and it could enjoy outperformance during style rotations from growth to value. So far, these rotations, while pronounced, have proven to be short-lived but investors have to be ready for when a more protracted relief rally comes to fruition.

Chinese equities are thriving on the back of the strong domestic economy and the containment of the pandemic. Accelerating reforms are broadening access to foreign investors, attracting flows and lifting growth prospects even further. Targeted fiscal stimulus continues to support momentum, with sectors like technology, healthcare and consumption key beneficiaries.

We are reluctant on other emerging market equities with regions like Latin America and Eastern Europe still under pressure.

Style

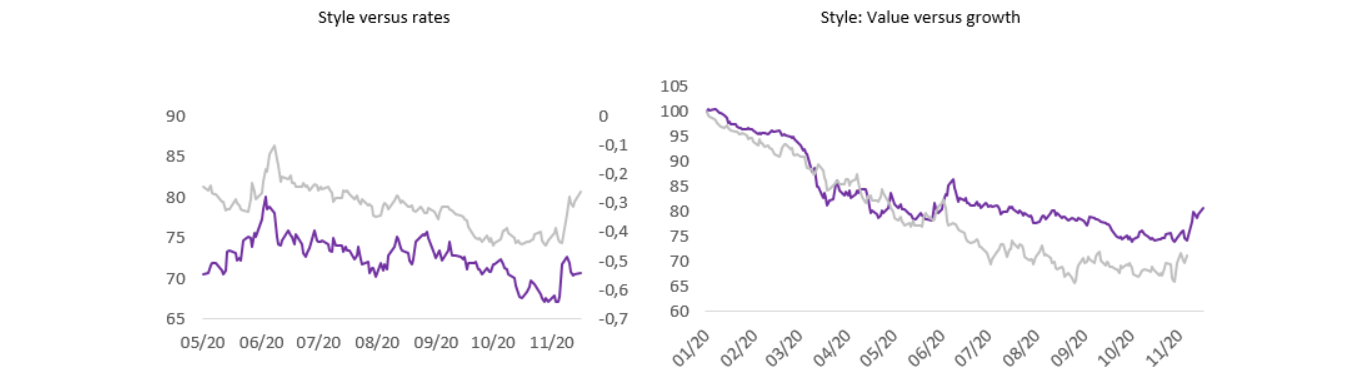

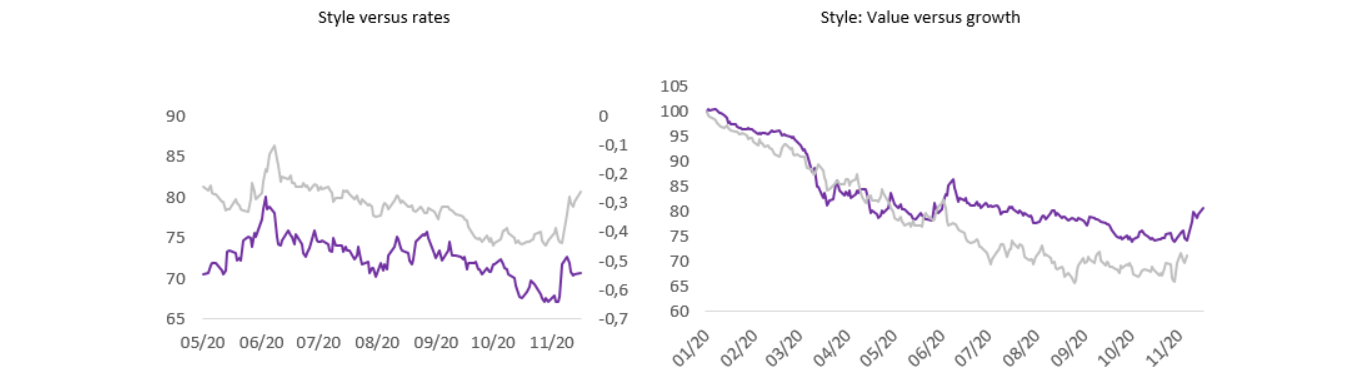

Later in the year as rates gradually rise (primarily in the US) a value renaissance could become more plausible: Until then we could see a few false starts.

The scenario of interest rates remaining “lower for longer” still favours the quality/growth style, and this remains our preference. However, as we witnessed in late 2020, relief rallies often come hand-in-hand with short-lived but violent style rotations. While we do not believe that the current environment is conducive to the prolonged outperformance of value stocks, portfolios require protection against any temporary shifts in sentiment that may arise. In order to achieve this, we have introduced some cyclicality via our sector bets, primarily by reducing exposure to Consumer Staples in favour of Industrials.

The low interest rate environment has prompted some questions as to whether we are considering high dividend stocks for income purposes. For now we are not, given that dividend paying stocks tend to be value stocks or even value traps.

Source: Bloomberg, BIL

Sectors

We prefer to cherry-pink names across sectors

Our preferred sectors are shown below, but on the whole we prefer to cherry-pick sound investments from each, rather taking a broad-brushed approach, going all in on any particular sector. Themes such as digitalisation, are driving returns across the spectrum of sectors, and the pandemic is exacerbating the divergence between winners and losers within individual sectors.

”Life is so unlike theory” ― Anthony Trollope

The concentration in returns, whereby a few top names are driving returns of the an entire sector remains quite extreme and this could continue for much longer than one would consider normal. We believe that as long as Covid disruptions continue, concentration in returns will continue too and selectivity will be key. Investors will have to drill down into the business models of individual companies and look past sectors into sub-sectors. As the year progresses, we will start to see relief rallies in beaten sectors, but believe that these will be the result of laggards catching up, rather than the winners falling backwards. Today’s winning stocks, across industries, tend to have business models that are tailored towards our “new reality” and the structural shift towards digitalisation over the longer term.

PREFERENCES

Healthcare IT Utilities Industrials Materials

Healthcare, is a defensive sector that has gained impetus from the pandemic, recording the highest earnings growth of all 11 sectors in Q3 at 13%. Telehealth had already been gaining momentum but it took off during the pandemic, with technology emerging as an effective tool in tackling the spread of coronavirus (for example, in Asian countries via phone apps) and in providing essential primary care. Because the highly contagious nature of the disease meant that healthcare workers had to put themselves in danger to help patients, while hospitals risked becoming hot spots for transmission, virtual visits and chatbots were adopted to diagnose patients without risking contamination, while at the same time, wearable devices were used to detect vital signs and symptoms.

“We’re basically witnessing 10 years of change in one week… You go to see your doctor, as it has been for decades, centuries. But that has changed completely.” Dr. Wessely, a British doctor in the New York Times

From here, we believe it will be driven by a proliferation of tech-assisted medicine and digital healthcare services which could widen access to millions of people, especially in far-flung locations. Healthcare, alongside Consumer Staples, is one of the few sectors still buying back their shares. We think this will continue into 2021 while other, more cyclical sectors focus on building back their balance sheets. In the US, Biden wants to build on the Affordable Care Act (better known as Obamacare), giving Americans more choice, reducing health care costs, and making the health care system less complex to navigate. This may be bad news for certain healthcare stocks and pharmaceuticals but in the short-term battling the pandemic will take primacy.

IT is traditionally a cyclical sector that has been given more permanency from the structural shift towards digitalisation. It is true that it is expensive as it houses the Tech mega-caps, but to an extent the higher valuations are merited due to resilient earnings growth, strong cash flow generation and healthy balance sheets. Short-term, the sector benefits from the stay-at-home theme, while it will continue to take sap from the digital transformation over the long term. We believe that investors are currently underestimating the impetus that the 5G rollout will have for this sector. However, investing in tech stocks is not a one-way ticket to higher returns as we saw in the violent sell-off at the beginning of September. The correction’s epicentre was the tech-heavy NASDAQ index, reminding us that these stocks are not immune to the laws of gravity. More regulation in big tech names seems to be on the cards, as we have already seen in China with the Ant Group IPO. It is unlikely that the US will kill its own growth companies and split up the likes of Facebook and Amazon, but rather, we might expect to see laws that promote competition. Looking beyond the obvious trailblazers to more niche players in the sector offers interesting opportunities.

Utilities is a defensive sector that is benefitting—and will continue to benefit—from the global focus on renewables and clean energy. US President-elect, Joe Biden, put clean energy at the centre of his proposed infrastructure plan, said he would re-enter the Paris climate accord and reduce emissions to net zero by 2050. He also pledged to decarbonise US electricity power generation by 2035. It’s already amazing to observe that NextEra Energy, the world’s biggest producer of green energy accounts for around 15% of the MSCI US Utility sector. According to some experts, this is a business model the biggest oil companies will need to embrace.

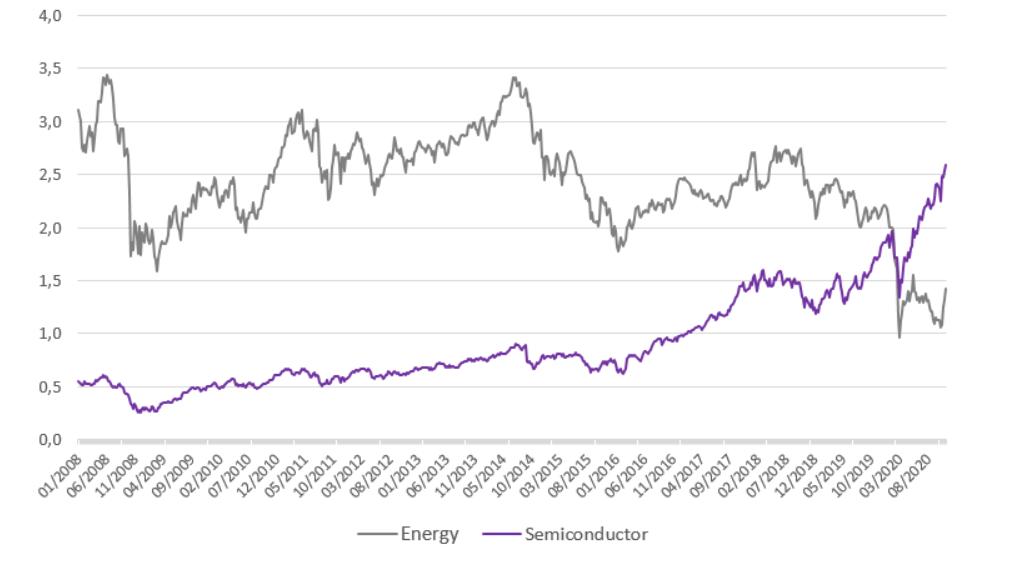

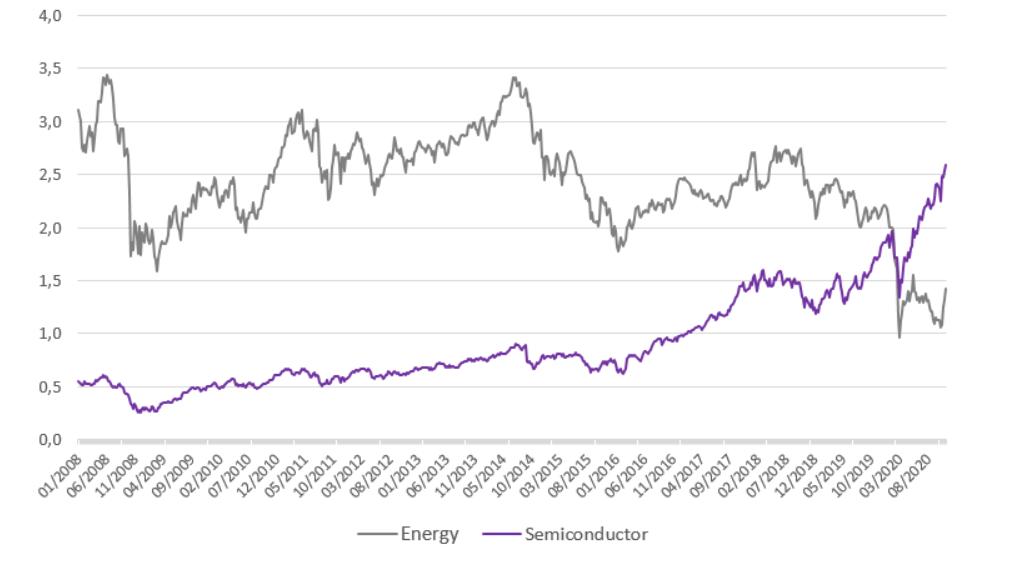

MSCI World Energy versus Semiconductor Market Capitalization ($ trillion)

Source: Bloomberg, BIL

When speaking about energy, one of the striking observations from 2020 comes from the fact that the market capitalisation of semi-conductor producers in the MSCI Word index extended largely beyond the market capitalisation of the energy sector. Data being the ‘new’ commodity is not science-fiction, it’s our current reality. Also noteworthy is the fact that US supremacy in the semi-conductor space is now one for the history books when looking at the technology leadership and market capitalisation of TSMC (Taiwan Semiconductor Manufacturing Company) versus Intel.

Industrials is a mid-to-late cycle sector that offers a play on rising PMIs (economic growth indicators) and will also be a key beneficiary of the large-scale fiscal stimulus packages in the US and the EU.

Lastly, we like Materials, compelled by the fact that China’s recovery and a pick-up in industrial activity are driving strong earnings revisions. On top of this, rising commodity prices, particularly for iron ore, has translated to earnings growth that outperforms stock returns within the Metal & Mining subsector. While the sector looks expensive at first glance, this is largely due to high valuations in the Chemicals subsector, and value can still be found elsewhere. This sector is also a PMI-play and should benefit from fiscal stimulus, as well as the green transition. The EU has already warned that shortages of elements used to make batteries and renewable energy equipment could also threaten the bloc’s target of becoming climate neutral by 2050. Countries are beginning to conduct strategic raw material audits and we expect to see attempts to secure the supply of those critical to their industries by emphasising exploration, investment and improved recycling. In November, the EU launched the European Raw Materials Alliance (ERMA) which will work to ensure reliable, secure and sustainable access to raw materials as key enablers for a competitive, green, and digital Europe.

COMMODITIES AND CURRENCIES

Gold

It is no secret that gold prices tend to benefit from rising uncertainty, whether they be in the economic or political arena. Influenced by its history as a currency, gold has often taken the role as an inflation hedge and a portfolio stabiliser during financial market turbulence. In 2020, gold became a go-to asset for many investors (including us at BIL) looking for enhanced diversification benefits in a world turned upside-down by the pandemic. As a result, the price of physical gold hit a new high over $2000 per ounce.

Gold is viewed as a store of value, unlike fiat currencies, considered as paper money. Against a backdrop of unprecedented, combined monetary and fiscal efforts, some commentators and gold bugs went as far as to question whether fiat money will be a passing fad in the long-term history of money. However, the money-printing machine of central banks is nothing new – one just needs to take a look at the economic history of Japan (described in great detail in “Princes of the Yen” by Richard Werner).

Positive news around vaccines and perspectives of a rapid recovery in economic activity removed some of the shining value of gold towards the end of the year. Selling pressures on gold-backed ETFs drove the price down, but we believe that long-lasting low US real rates and the persistence of a low-growth, low-inflation regime should enable monetary policy to remain unusually accommodative, supporting the gold price and demand. We believe that the vaccine news will only cap, not finish, gold's underlying benefit when included in diversified, multi-asset portfolios. This should be valid as long as the Fed remains dovish enough.

Cryptocurrencies or, more broadly, digital currency initiatives are also gaining traction as alternative way to hedge debasement effects. While these are still in their infancy, they are arguably an interesting topic for regulators and investors. Competitive pressure from those alternatives are evident but deserve a separate analysis.

Gold price ($)

Source: Bloomberg, BIL

Oil

The oil price was an oddity in 2020 with its price turning negative for the first time in history in April. Producers were paying buyers to take the commodity off their hands due to capacity concerns. This was primarily a result of technical factors but symptomatic of dwindling global demand conditions and extreme market volatility at the height of the pandemic

We enter 2021 negative on oil, with no reason to expect a rapid normalisation in demand. Movement restrictions and altered habits will not disappear with vaccine deployment. Even assuming success in OPEC+ production restraints (far from guaranteed when looking at compliance history), inventories will remain above average, capping any upward price pressures.

Structurally, upward price pressures open the door to an influx of additional supply. While OPEC+ is contemplating delaying January’s planned increase in crude production (by almost 2 million barrels a day), US shale producers are putting the apparatus in place to begin growing supply, Libya has potential for a faster than expected recovery in production and discussions around Iranian sanctions are ongoing, oil price pressures should remained muted.

WTI ($/barrel)

Source: Bloomberg, BIL

But let’s keep in mind that forecasting the commodity price is quiet hazardous, oil prices usually fluctuate unpredictably, most of the time in connection to geopolitics

Crude oil had enjoyed its premium status of a sound financial asset for years. However, things have been changing, ‘black gold’ is losing traction. The industry’s inability to address the world’s growing need to curb emissions to accelerate the clean-energy transition and deal with global climate change is having a negative impact on the commodity’s price. It is worth remembering that to meet the goal set out in the Paris Agreement, it’s now obvious that fossil fuels need to be kept in the ground. We are not there yet, but for us it’s getting more and more obvious that oil reserves are becoming stranded assets.

Currency

Confidence surrounding the post pandemic recovery will also be the key theme driving the FX market in 2021.

The consensus view amongst financial market participants is for dollar weakness, based upon the current account deficit in the US and on historical comparisons with previous economic cycles and recovery phases. But this time is different. While this is a dangerous assertion, it resonates like a valid argument when you consider the convergence in interest rates observed all around the world since the pandemic, as well as the current dollar valuation, close to fair-value. When combining those two factors, comparison with historical cycles could be hazardous, considering major differences in starting points.

Perspectives for a normalisation in American diplomacy and expectations around some de-escalation on the trade front, should allow non-dollar currencies to breathe again. We should also expect a more static US monetary policy. Outflows from precautionary dollar holdings are to be expected, driven by hopes for fewer anxiogenic event risks.

Combining all of the above, we expect a moderate weakening of the dollar, mostly from a cyclical perspective. While the convergence of nominal rates is now complete, divergences in real rates are still at play. The Fed’s shift to average inflation targeting means that negative real rates is a credible trajectory. Taking into consideration the impact of a negative nominal interest rate, most central bank efforts will probably focus on real interest rates, not nominal ones. This is clearly the desirable policy outcome of the Fed: A self-sustaining expansion and a successful rise in inflation expectations with a weaker currency clearly being part of the prescription.

In a world with limited interest rate spreads, the health of a country’s balance of payments matters. The few lucky countries in this respect should face upward pressures on their currencies. Countries battling against deflation will probably not accept stronger currencies, but outflows from precautionary dollar holdings are to be expected.

On a standalone basis, the European currency does not offer an appealing narrative. Stop and go strategies to fight Covid-19 intended to front-load the economic pain and build a robust recovery later, simply translated into a significant lag versus US growth. Headline inflation remains dismal and inflation exceeding the 2% target level seems unrealistic. Another set of monetary measures are on the agenda of the ECB’s December meeting. But if you believe that the inflation inertia is entrenched in structural problems, stable real rates should contrast with declining US real rates and support a stronger €/$. As of now, the Fed is simply more credible when it comes to its reflation strategy.

Other currencies that should benefit from their balance of payment surpluses are the JPY, the CHF and the CNH.

Japanese policymakers have historically been the most vocal when facing stronger domestic currency against the USD. But the reality is also that Japanese authorities have not intervened against JPY since 2011 (at the time of the Great East Japan earthquake, the most severe ever recorded in the country). Furthermore, changing trade patterns are also evident. As of today, the Chinese Renminbi is more relevant than the US dollar for Japanese competitiveness, allowing a moderately relaxed attitude of Japanese authorities when confronted with a stronger JPY vs. USD.

The view on CHF is more complex. Philipp Hildebrand, the former Swiss central bank chief (now working for BlackRock) recently claimed that financial markets were underestimating the risk of higher inflation. Let’s make it clear that in the case of Switzerland, higher inflation is probably not a risk but well a necessity to escape the current deflation blackhole. With Switzerland’s benchmark rate held at -0.75%, the lowest in the world, for the last 5 years, FX market interventions are the main tool in fighting CHF appreciation. With the central bank balance sheet hovering around 135% of GDP, further FX intervention could put the country at risk of being labelled as a currency manipulator by the US administration.

GBP remains a wildcard. The Brexit transition period is nearly over, but at the time of writing we only have rumours and murmurs around ongoing discussions. A soft trade deal should give sterling a boost due to the removal of uncertainty, albeit a limited boost vs. the euro when considering collateral damage.

While fixed income investors are desperately chasing yield, foreign exchange market participants are looking for carry. An obvious solution is around volatility, with the idea that selling volatility is a form of carry trade.

Carry chasing should support emerging currencies. In some cases, it will nevertheless not be enough to hedge against some specific imbalances (e.g. weakness in the balance of payments).

Agendas to balance public debt burdens will remain focused on growth and inflation, avoiding austerity. But clearly, dealing with the fiscal fall-out of Covid-19 will be the main structural challenge for some countries.

Digging into country weights inside bond and equity indices, is especially valid for Asian FX. China is poised to have one of the strongest growth rates in 2021 which makes it an attractive destination for foreign capital. At the same time, China is actively opening up its financial markets to foreigners which should support the currency further. Expectations for some improvements in the relationship between China and the US could help but this is not expected to be a game changer. Realistically, the technology war will, at best, stay as is.

THEMATICS

Sustainable Investing

We believe that 2020 will be remembered as a transformative year. When looking inside financial and capital markets, it is, for us, obvious that a massive shift towards sustainable investment is ongoing. The growth of sustainable investing and the inclusion of environmental, social and governance (ESG) factors in

investment decision-making has reached a new level of awareness. We have seen massive changes in the behaviour of investors and financial market professionals and regulators are rolling out game-changing rules.

The pandemic has brought with it economic and social fragilities. It also tested the resilience of health systems and care systems across the globe. It is a clear demonstration that we are all connected, as people and as part of the ecosystem that support our lives. Considerable efforts will have to be implemented to prepare for future threats to preserve our health, our planet and to reach inclusive quality of life. Those at the lower end of the income spectrum were disproportionately affected, with some having little or no access to healthcare and little to no job security. During lockdowns, blue collar workers who could not install assembly lines in their living rooms were either furloughed, laid off or exposed to the virus. Those in in the hospitality sector suffered some of the worst spikes in unemployment as social distancing (whether enforced or spontaneous) and restrictions reduced activity to a thread of its former self. Steel collar workers (i.e. robots, particularly in manufacturing that typically replace blue collar jobs) have had the odds twist in their favour. This year, the World Economic Forum will focus on building new foundations of our economic and social system for a more fair, sustainable and resilient future. The organisation states that this requires a new social contract centred on inclusion and social justice whereby societal progress does not fall behind economic development. In a nutshell, they want to avoid a statistical recovery that masks a human recession after an event that compounded global inequality.

The next big threat is obviously climate change. Greenhouse gas emissions are projected to experience their sharpest drop in modern history while at the same time, the world remains on track to mark its second-hottest, if not hottest, year ever. Combining these two facts demonstrates the relentless pace of climate change and the extreme measures we need to take to slow it down. It’s a perverse race in which the later we cut emissions, the faster the planet warms. Denial is no longer an option. Financial markets have a major role to play to foster resilient, adaptive and mitigative solutions.

"The thickness of the winter’s ice is often in proportion to the number of summer mosquitoes" – Anthony Trollope

We should be proud of Europe positioning itself towards leadership in this sphere. The objective at the heart of the European Green Deal is to reach net-zero greenhouse gas emissions by 2050. As the European Commission noted, the scale of investment needed to transition to a sustainable and green economy is beyond the capacity of the public sector alone - the energy transition at hand is colossal, and will be resource and capital intensive, presenting myriad investment opportunities.

The COVID-19 pandemic has propelled climate action to the top of the corporate agenda as well, with companies recognising their own vulnerability to external shocks and the need to think strategically about the climate emergency. But the reality is also that while aspirations are high, action is sometimes concerningly lagging.

This is where Europe is set to lead, with EU regulation weaving sustainability concerns into the law. The Commission has created an EU-wide classification system, or "taxonomy", which will provide businesses and investors with a common language to identify economic activities which are considered sustainable and under what conditions. At the same time, the “Non-Financial Disclosure Regulations” (NFDR) lays down the rules, requiring large companies to disclose predefined information on the way they operate and manage social and environmental challenges. Hence the “Sustainable Finance Disclosure Regulation” (SFDR), under which asset managers will be obliged to provide minimum disclosure requirements, plus more specific ones for products marketed as sustainable or as those which integrate ESG considerations.

Specific initiatives around climate benchmarking, green bond standards, ecolabels and engagement also create new obligations for financial product managers. For asset managers, the pandemic highlighted the benefit of ESG integration in terms of alpha generation and risk/return optimisation. Combining this with European regulatory initiatives, growing investor demand and societal shifts, it is no surprise that PwC expects ESG fund assets to represent 50% of total European mutual fund assets by 2025. ESG is nothing less than an all-encompassing shift in the investment landscape.

We believe that EU initiatives represent a landmark change in the industry, that stand to transform sustainable finance from an optional consideration to a focal point of the European investment industry. Rather than constituting some kind of investment add-on, sustainable investing is becoming a vein in the marble, integral to the investment process.

Globalisation: a change in gravity

“Every man to himself is the centre of the whole world—the axle on which it all turns” – Anthony Trollope

Intuitively, the rise of economic globalisation observed since the 1970s and the sharp acceleration beginning in the nineties, played a massive role in company profitability. It has also been a major contributor to low inflation and interest rates.

As barriers between countries came down, companies had access to new markets, making cross-border deals more readily. They were able outsource manufacturing to countries where it was cheaper and harness global expertise to build products, helping both revenues and margins. A reversal of globalisation could see the opposite effect: companies range of potential markets will narrow, cross-border deals will fall away, and companies will find it more difficult to hire global expertise.

The links between cross-border trade intensity and US corporate profit margins over the past 20 years are clear. Trade policy uncertainty rarely serves as a major financial market mover, but proved to be highly disruptive when the US and China’s tit-for-tat trade tactics were at their peak.

Carmen Reinhart, World Bank Chief economist, made headlines mid-2020, when at that time she was still working for the academic world, by stating that “the pandemic has put the final nail in the coffin of globalisation”.

The 2008 financial crisis was a big hit to globalisation, as was Brexit, as was the US-China trade war, but according to her, Covid-19 is taking it to a new level. Observing that world merchandise trade volumes had already been slowing before the pandemic, depressed by persistent trade tensions and weaker global GDP growth, the Covid-19 pandemic produced a brutal contraction of trade in 2020. The latest estimates from the WTO are pointing towards a -9.2% decline in volume for 2020, to be followed by an increase of 7.2% in 2021.

Many companies are now rethinking their supply chains to bring them closer to home, preferring just-in-case instead of just-in-time procurement. Inward tendencies will slow down global growth. A new strategic mindset will flourish around self-reliance on some specific goods - the outbreak has revealed innumerable fragilities in the world economy and drawn attention to an overdependence on others for key technologies and supplies of crucial materials. Governments are now shifting their attention to bolstering medical supply lines. After a hapless chase for tests, masks, and protective equipment during the early days of the corona-crisis, many politicians feel it’s just too risky to rely on other countries for these things again. But it is also broader than that. France is talking about independence in technology and industry. French President Emmanuel Macron said, “If we don’t build our own champions in all areas — digital, artificial intelligence, our choices will be dictated by others”.

Tech sovereignty has become a viral phenomenon among European leaders. Strategic autonomy, regulatory sovereignty and digital sovereignty are becoming the buzz words in the European political arena - great rhetoric while also a concession that Europe missed the boat on building internet giants and must search elsewhere to find its niches.

The reshoring of selected critical industries, particularly medical supplies, is under discussion. How it would work in practice is yet to be defined. Will we see a wave of factories returning to Europe? Many multinationals may decide that the benefits of outsourcing will still prevail beyond the virus. According to some trade analysts, supply chain resilience is improved by spreading out production around the world, not concentrating it. In reality, the loser of deglobalisation would probably be Europe due to anaemic domestic consumption growth.

Joe Biden also campaigned around nationalism and plans to ensure the future is “made in all of America”. Under the new US administration, protectionism may be more targeted and subtle, but it will not all magically disappear.

The economic theory of free trade and comparative advantage is giving way to protectionism and hype of nationalism - the political reality is defeating economic principles. Globalisation is easy to hate and convenient to target. It has increased the power of multinational corporations, allowing for the exploitation of cheap labour and a lack of environmental laws in developing countries. But globalisation has also improved the inter-connectedness between countries in terms of transfer of knowledge, technology and management practices, helping significantly reduce the percentage of people living below poverty line.

While we believe that the post-pandemic future will constitute a less globalized economy, with countries turning inwards in a manner unlike anything seen since the 1930s, the epitaph of globalisation is currently unfounded. In November 2020, 15 Asian and Pacific countries signed the Regional Comprehensive Economic Partnership (RCEP) trade pact. This deal will clearly provide a significant counterbalance to rising protectionism elsewhere in the global economy. It is the first trade agreement linking Japan and mainland China, while India withdrew from the negotiations. With current signatories constituting around 30% of world GDP, the agreement reinforces the movement of the global centre of economic gravity to the east.

CONCLUSION

While the pandemic won’t be compartmentalised into the 2020 calendar year, the reassuring news is that it is unlikely 2021 can bring something as shocking and disruptive. We expect the following year to be a constructive one, one of rebuilding and of problem-solving, against a backdrop of ongoing policy support and strides towards inoculation – all this allowing countries to traverse the upwards slope of the swoosh-shaped recovery (albeit at different speeds).

Equity markets are poised to benefit in such a context, and we expect slight upside, though much of this is already priced in. Style considerations will be important and investors must be prepared for an eventual value catch-up, whereby unloved names once again brush shoulders with fashionable growth stocks – though we do not think this is something that will happen imminently. With regard to sectors, a nuanced approach is warranted: The new digitalised reality ushered in by the pandemic means some companies will sink and some will swim within individual sectors. Ensuring individual business models are future-proof has never been more crucial.

In the fixed income space, the derby in search of yield is full pelt and should likely continue through 2021, with central banks almost certainly poised to keep interest rates lower for longer. But yield should not be pursued blindly and investors should stay cognizant to the risks at hand. We build our exposure, primarily drawing investment grade corporate names from both developed and emerging markets. Investors should not get caught off guard by a modest uptick in inflation, since this is something central banks are clearly trying to conjure.

As the title of the outlook acknowledges, the way we live has been irreversibly altered, with megatrends such as digitalisation ushered in in the blink of an eye: Portfolios must be fine-tuned accordingly. After a year of uncertainty and insecurity, the desire for security has never been so strong. We seek to help our clients achieve this by building robust, well-diversified investment portfolios, oriented towards long-term profitability with the ability to withstand short-term market turbulence.

Happy holidays from us all in the Group Investment Office. Above all we wish you health and happiness – the most valuable assets on every metric.

Written as at: 8/12/20

More

April 23, 2025

NewsThe Gold Rush

In recent months, gold has experienced remarkable momentum, solidifying its position as a preferred safe haven asset. Contrary to what the collective imagination suggests,...

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...