In last month’s BILBoard, we presented our revised base case scenario

for 2020 in light of the coronavirus crisis. In a nutshell, we see a deep,

government-induced recession spanning Q2, and most likely encroaching into Q3.

Thereafter, under a torrential downpour of government and central bank stimulus

and with a gradual easing of movement restrictions, economies should begin to

stabilise. Such a base case naturally carries an air of caution, given the unprecedented

nature of the crisis.

Macro: Into Q2 and into the abyss

While governments contemplate how to reopen their economies, much of the

global population remains under lock and key. The full, undiluted impact of

this is about to start showing up in macroeconomic data, and we expect to see the

speed of the deterioration peak in May. Already, the fragmented picture we have

is bleak. PMIs have tanked, displaying the devastating impact on demand and

activity, particularly in the Service sector with tourism and leisure off the

cards for the foreseeable future. Until now, the decline in consumption had been

cushioned by grocery store shopping and panic buying - this will probably peter

out and the true severity of the demand shock will become clear in upcoming

data releases.

Determining how bad it

will get is a shot in the dark, given the lack of comparable events in history

– Professor Yossi Sheffi

from MIT calls this the “Anna

Karenina principle”, paraphrasing Tolstoy; while happy economies are all alike,

every unhappy economy is unhappy in its own way. Looking at the current

environment, with a simultaneous shock to supply and demand, liquidity tensions

and a health crisis, we could borrow empirical examples from the Spanish flu,

the Great Depression, 2008 or even China’s experience with coronavirus, but the

utility of such a model would be limited, given the disparities in the social,

economic, technological and political contexts. No two disruptions are the

same, each comes with its own cascade of effects, meaning that we face “known

unknowns” and “unknown unknowns” – and the latter could render any attempt at

forecasting futile.

With government and central bank support bordering on the brink of “unconditional”,

the main “known unknowns” are behavioural and epidemiological. A

post-quarantine economic renaissance hinges on the behaviour of consumers and

businesses. Will consumer demand snap back? We expect to see some inertia in

the data, given that lockdown measures will be eased gradually to stave off a

second wave of infections. Moreover, consumption will be hit by rising

unemployment. Despite fiscal attempts to curtail layoffs (e.g. the US CARES Act

or the EU’s SURE program), businesses are letting staff go. 26 million

Americans have filed jobless claims (this will put dynamite under the

unemployment rate for April due to be published on May 8th). Whether they will

re-hire staff they let go is yet to be seen.

On the epidemiological front, the key unknowns include any potential

reacceleration in the number of new cases, testing efficiency and deployment,

and finally the time-to-vaccine and widespread treatment. Looking at the “known

unknowns” and base effects alone, we don’t expect GDP to recover its December

2019 levels before 2022.

Equities

Though looking into Q2 is like looking into a black hole, equity prices

seem to have skipped past the looming uncertainty and already seem to have a

V-shaped recovery in mind. The recent rebound of around 25% seems to be driven

by a combination of speculation, hopes and tweets rather than something more

tangible and, though we argued previously that markets will rebound long before

the economy, the pick-up is perhaps a bit premature.

At the same time, analysts are rapidly downgrading earnings expectations

in the opposite direction to prices, leaving valuations a bit stretched (we are

now at levels seen in February, before the crisis snowballed). The earnings

season itself is unlikely to be a game changer, with companies omitting future

guidance. With such uncertainty, we would be surprised if volatility didn’t

flare up again.

Until we have more clarity, we’re maintaining our neutral equity

positioning, content with the basket of hand-picked quality names added to our

portfolios before Easter (including well-capitalised firms with strong balance

sheets and low leverage, poised to weather the Q2 storm). In terms of regions, we

remain US-centric, where there are more secular growth stories, as opposed to

Europe which is more of a value play. We are also maintaining a very small

overweight to Emerging Markets (primarily China, which is now setting its

economy back in motion after getting the pandemic under control).

Fixed Income

Fixed income assets of all stripes are receiving central bank support,

whether direct or indirect. Renewed commitments from the ECB and the Fed to

credit were a game changer in markets – investors have returned en masse and

the new issue market is alive and kicking again. Both of these central banks are

vacuuming up corporate bonds, even “fallen angels” – investment grade names

that have been downgraded to junk.

In the government bond space, volatility has normalised but investors

are still weighing up the prospects of higher issuance against growing budget

deficits. This highlights the growing need to be active in the sovereign debt

market; we have already tweaked the layer of government bonds we hold to buffer

against equity risk, moving out of peripheral European govies to European Core

govies, with benchmark duration. We also have a selection of inflation-linked

bonds which will be helpful if fears about government spending with monetary

financing intensify.

We remain overweight on investment grade (IG) bonds – with central banks

having stemmed the March bleeding, quality corporate paper now offers a solid

investment case. After rotating towards US Treasuries last month, we are now doing

the same inside our corporate exposure, switching up European credits for the

US equivalent, in that approximately 20% of our overall allocation to credit is

now in USD IG (EUR-hedged). While the European credit market is undoubtedly

being cradled by the ECB, the Fed’s support is even stronger, with the central

bank going as far as to buy high-yield ETFs. As a result of this caretaker role

by the Fed, total return for US IG has turned positive year-to-date, while the

retracement in EUR IG spreads has been more timid.

Despite the fact that central banks are entering the upper echelons of the high-yield markets on both sides of the Atlantic (the ECB is not directly buying fallen angels, but those bonds can now be posted as collateral on repo operations), we are still steering clear of this segment, believing that risk is inadequately rewarded. Likewise, we are reluctant on Emerging Market debt. The rationale behind both of these stances is the fact that the oil price is at record lows, with futures prices even having turned momentarily negative. Energy firms make up a large proportion of the US HY market, and oil is a key export for many EM regions.

All in all, be under no illusions: we aren’t out of the woods yet. April showers are said to bring May flowers, but the slate of ominous data from this month will probably pale in comparison to what lies ahead. To navigate this tumultuous investment landscape, we must be unhurried, contemplative and logical, keeping our eyes on long-term investment objectives. To borrow from Tolstoy once again – “The strongest warriors of all are these two – time and patience”.

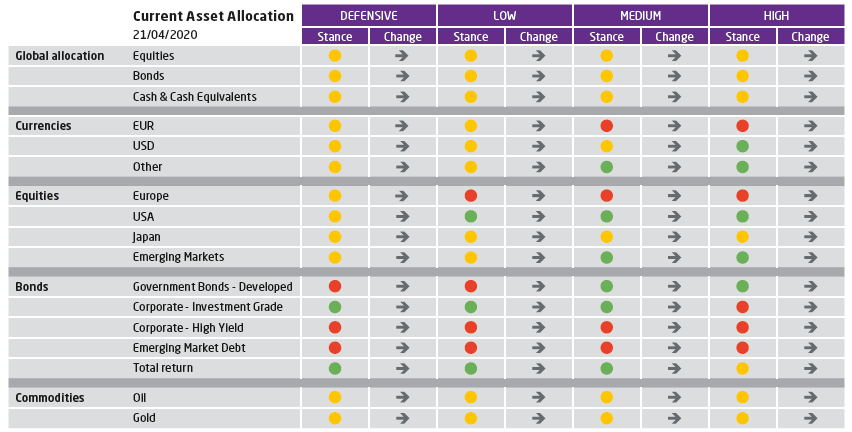

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 8, 2025

Weekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...