Choose Language

December 18, 2018

BILBoardBILBoard December 2018 – Getting reacquainted with fundamentals

After a Goldilocks 2017 when, economically speaking, everything was just right, 2018 was the year when Goldilocks finally met the three bears and things got pretty challenging. Volatility made a comeback, politics and trade tensions took centre stage and market participants readjusted their views and positioning in both equity and bond markets.

Throughout the turbulence, we have maintained a focus on fundamentals, which paint a picture of slowing growth, but not contraction. Of course, this merits tempered positivity, but investors, especially in equities, seem to have over-extrapolated the slowdown, positioning themselves as if we were in the midst of an economic downturn. As investment strategist Ed Yardeni commented, “You had a bear market in the P/E multiple, but a bull market in earnings.” Certainly, Purchasing Managers’ Indices (PMIs) have come down from stellar levels, but they still sit comfortably above 50 in most major economies – indicating further expansion. The investment committee believes that, in 2019, equity investors will bring their views back into sync with the true economic picture, especially in the US.

So where are we in the US cycle? Growth for next year is projected to be a sturdy 2.6%, with the risk of economic overheating subsiding substantially. The US is not exposed to the same risk factors as Europe and emerging markets (EM), with much of its economic strength coming from within. US consumers continue to show a high propensity to spend and all components of consumer spending have accelerated by around 4%. Talk of recession is, to us, unwarranted, especially given that real interest rates are still at around zero: we have never seen a contraction with real rates below 1.8%. With inflation rising gradually, as opposed to shooting upwards, we believe the US economy has the strength to prevail. This places us in a “slowing down” phase of the cycle – in which equities normally have a good run. A Fed misstep could de-rail the outlook, but, for the moment, Jerome Powell is proving to be pragmatic and data-driven. The market consensus is that there will be one more hike in December, and one in 2019, before a pause.

There is a noted desynchronization in growth between the US and the eurozone. The latter seems to have fallen by the wayside with the political risk that peppers the continent – Brexit, Italy’s budget drama, the gilets jaunes in France and the threat of populism (which could hit a climax with the European elections in May) – overshadowing the economic outlook. Whatever happens, the ECB will end its QE programme this year, but the big question is how the proceeds will be reinvested and whether the ECB will roll out a new TLTRO scheme.

EMs are a mixed bag. In China, the growth rate is normalizing, demand for imports has come down and trade tensions pose a real risk. That said, the government is funnelling stimulus into the economy, making an imminent crisis unlikely. Nonetheless, the slowdown will affect neighbouring EMs for which China is a huge export market. EMs that are more aligned with the US market, like those in Latin America, should enjoy a modest rebound in 2019, led by Brazil, in the wake of its economic reforms.

Equities

Our macro playbook goes hand-in-hand with our equity strategy, which is centred on the US, positive on EM, neutral on Japan and reluctant on Europe. US equities continue to outshine their counterparts. Consensus estimates for earnings growth of 9% and sales growth of 6% suggest that there is still juice left in the orange to be had next year. With a P/E ratio around 16, the US is more expensive than other regions, though we think this is for good reason.

Normally, at this stage of the cycle when growth is cooling, we start to see growth, quality and momentum stocks outperform and we have therefore embedded such styles into our individual stock selection. In terms of sectors, we maintain a preference for energy. The consensus foresees a rebound in oil prices in 2019 (to around USD 71) and forward EPS estimates suggest energy will outperform. The materials sector also has attractive EPS guidance whilst boasting a free cash flow yield of 8% and a dividend yield of 5%. Materials are also a natural hedge against potential inflation repricing. Technology, which fell from grace in the latter half of 2018, still looks attractive to us. EPS is growing nicely, and the correction has resulted in more compelling valuations. This sector looks set to receive a boost from an onslaught of buybacks in the new year.

In the EM space, both Brazil and Russia have started to outperform, with PMIs sloping upwards. The consensus view predicts EPS growth of 10% and sales growth of 7%. Therefore, it is hardly surprising that fund flows into EM have accelerated recently. EM, as a group, now outperforms developed markets whilst China is outperforming the broader EM index and the US. With a nuanced selection across specific countries, investors can really tap the opportunities that EMs offer.

Fixed income

The fixed income space is becoming something of a minefield with most bonds in a precarious position as central banks remove the support that has artificially suppressed yields. As yields are expected to grind upwards, government bonds, at first glance, are not attractive at all. But whilst they lack appeal in terms of expected returns, they compensate with the added benefits of downside protection and diversification in a downturn. We do not expect smooth sailing in 2019 and therefore take comfort in adding moderate exposure to this class in our more risk-averse risk profiles.

In risk profiles where we have higher equity exposure, we have less cyclical fixed income assets in order to ensure sufficient diversification. In those profiles where we are still overweight on corporate investment grade (IG) bonds, we give preference to those at the higher end of the quality scale (with a higher credit rating) and to short duration.

We dislike high yield across the board. EM debt could start to look attractive if the Fed pauses its hiking cycle, in turn giving momentum to local currencies. However, for the time being, we believe it is premature to enter this asset class.

As the renowned investor Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” In 2019, we expect that investors will start to weigh up the sound fundamentals that are still in place, which permit a risk-on strategy, balanced with some safer assets for ballast during volatile episodes.

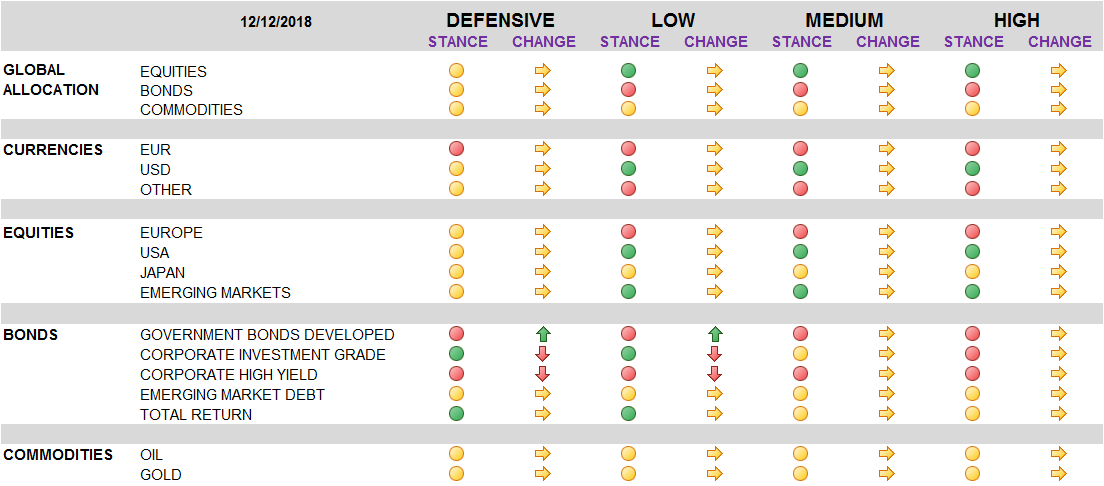

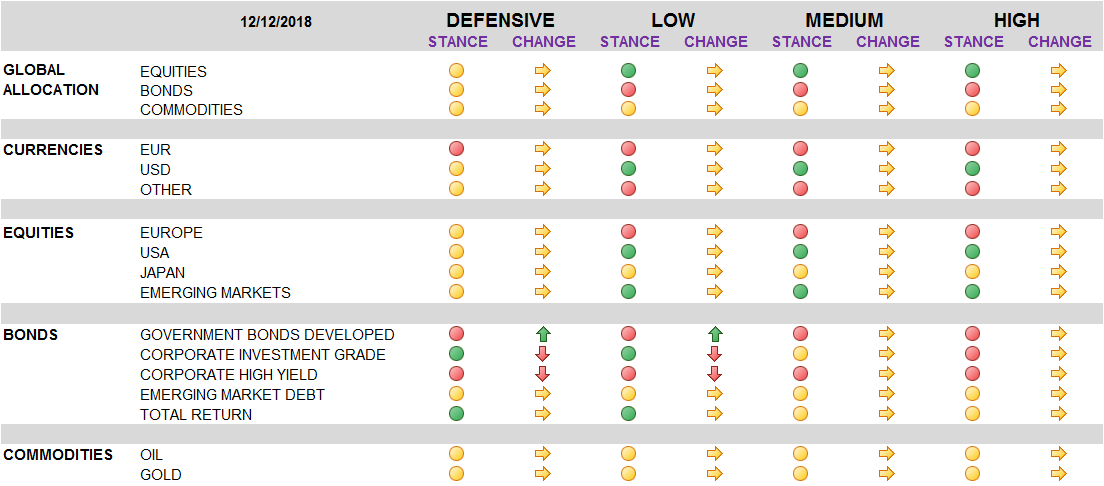

Strategic Asset Allocation

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of December 12th, 2019.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...