At BIL, we are long-term investors guided by stable, strategic asset allocation guidelines. However, our investment strategy itself is a living, breathing thing, proactively adapted over time, as we strive to deliver long-run performance for our clients. Certain times call for more adjustments than others. The election of Donald Trump and the subsequent red sweep across the US Congress significantly alters the landscape, promising to create ripples around the world. As such, the month of November saw more changes than usual to our investment strategy as we gear up for an entirely new environment.

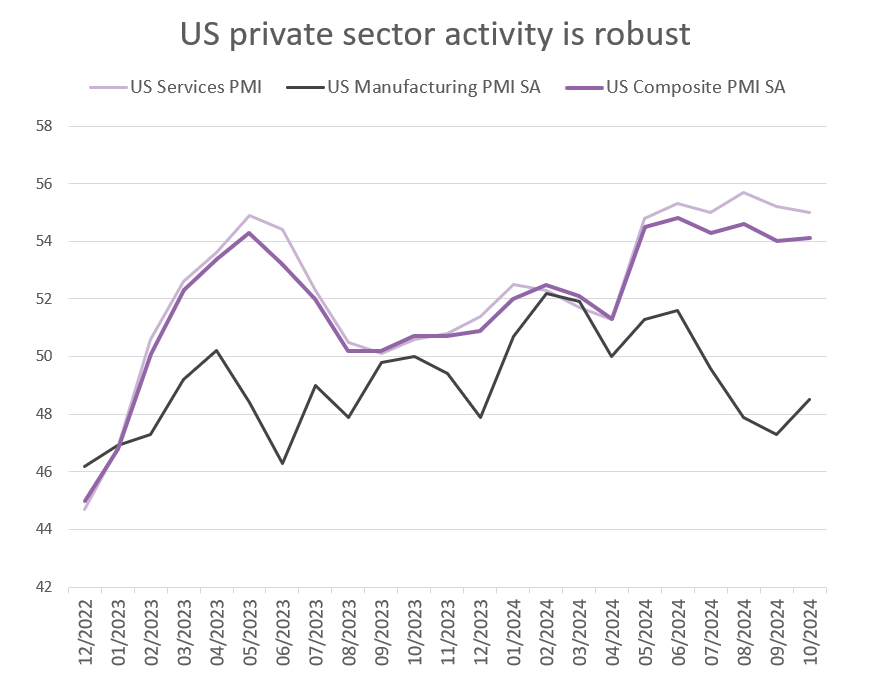

US exceptionalism continues when it comes to both the macroeconomic situation and corporate earnings. Growth has proven remarkably resilient, with consumption holding up despite headwinds. Indeed, Q3 earnings releases show that while shoppers are being more selective, they have not stopped spending, and retailers are optimistic about the holiday season. Note that consumer confidence ticked up as Trump’s chances of winning the election improved, and the same can be said for sentiment among small businesses. When it comes to larger firms, the Services PMI is firmly above 50 and the manufacturing downturn is easing. Some analysts expect a post-election surge in investment given executives should now have a better idea of how the land lies. We are cautiously optimistic on that front; many of Trump’s plans still lack detail and it is difficult to differentiate between bluster and true policy intentions.

Source: Bloomberg, BIL

Inflation worries are taking the gilt off the gingerbread in the robust US economy. Headline CPI ticked up to 2.6% in October and Trump’s policies (particularly on trade and immigration) could further rekindle pricing pressure. Alas, the US now faces a renaissance of the “higher for longer” scenario. Investors have pared back expectations for Fed rate cuts and see only a 50/50 chance of another quarter-point reduction in December. The policy rate is currently in the 4.50%-4.75% range: as Logan of the Dallas Fed recently pointed out, that is “right at the top” of the estimated range of the neutral rate, where policy acts neither as a headwind nor a tailwind for growth.

The fact that the Republicans have taken full control of both the Senate and the House, leaves Trump relatively unbridled when it comes to pushing a radical agenda through the legislature. The US already carries a $35tn debt burden and this will only get heavier amid tax cuts and big spending plans. Higher Treasury yields are a real risk and bond market vigilantes may be the biggest (or only) check on Trump’s power over the next year.

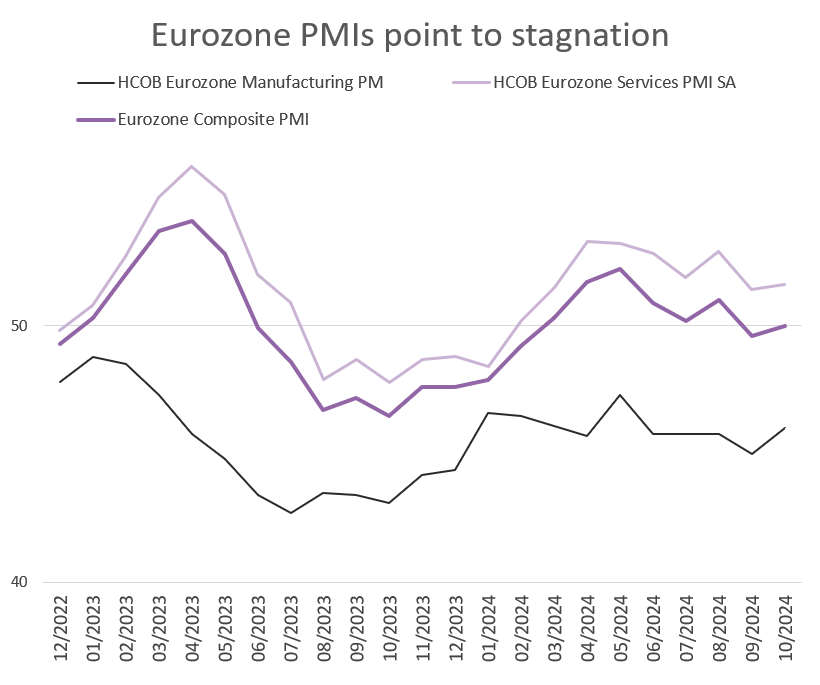

Trump’s election to a second term as President raises the bar for friends and foes alike, with the US poised to pursue “America First” policies and lower taxes while pushing tariffs and more defence spending onto other nations. For Europe, the timing is hardly optimal – both France and Germany are embroiled in political uncertainty, the war on its doorstep has reached its 1000th day, and the economy faces stagnation, with risks tilting to the downside. While weak growth and easing inflation should force quicker monetary easing, negotiated wage growth surged to 5.42% in Q3 2024, the highest increase since Q1 1993, warranting caution.

Source: Bloomberg, BIL

Trump 2.0 also complicates matters for China, which is already struggling to meet its 5% growth target this year. Beijing has unveiled a broad package of monetary and fiscal stimulus measures in an attempt to revive economic activity, but for now, the housing market is still under immense pressure and consumer confidence is in the doldrums. The President-elect imposed hefty tariffs on China during his first term and the Biden administration has maintained $360 billion dollars’ worth of those, while imposing additional ones of its own. Economists polled by Reuters expect that the US could impose tariffs of almost 40% on imports from China early next year, potentially slashing growth in the world's second-biggest economy by up to 1 percentage point.

The Trump administration should be positive for the US dollar. Indeed, the greenback notched its biggest one-day gain against peers the day after Trump was re-elected. The future trajectory of the currency partly hinges on whether (or how fully) Trump will enact the tax cuts and tariffs that are key elements of his economic platform. Those policies risk ramping up inflation and could keep US interest rates above those of other countries, thus enhancing the dollar’s allure to investors. In the event of continued dollar strengthening, emerging markets with dollar-denominated debt will come under mounting pressure.

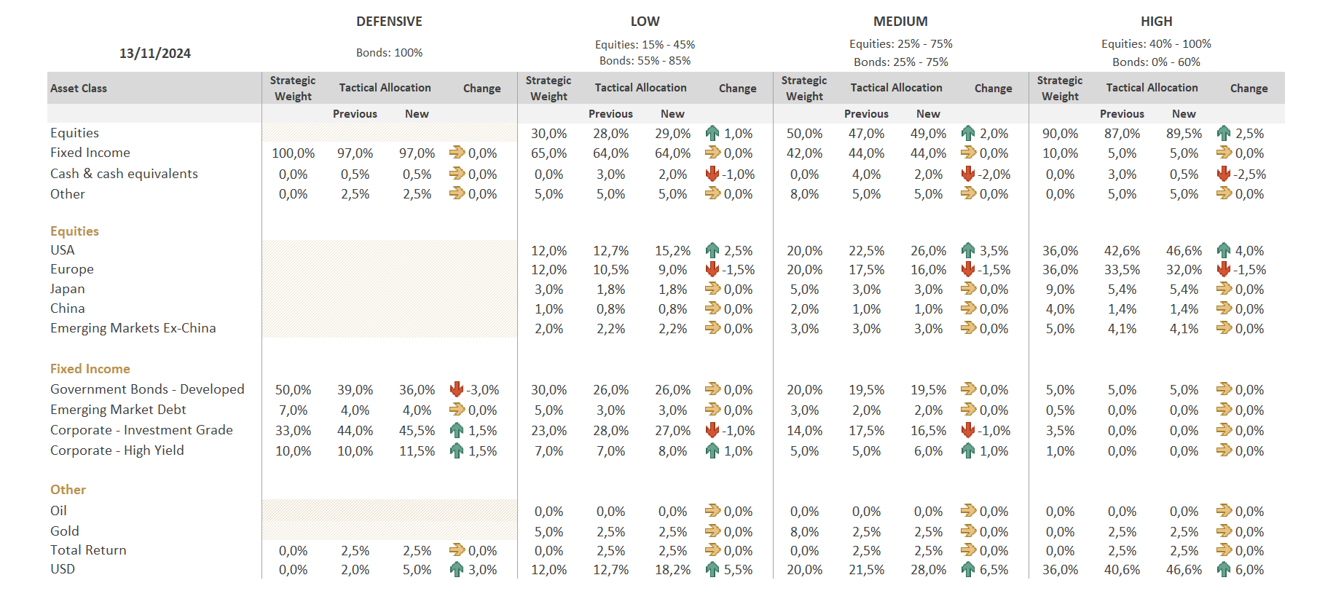

Asset Allocation Changes

Equities

Mid-November, we increased our overweight to US equities, believing that robust earnings growth should continue to drive the market into next year. That trade was funded using cash reserves and by increasing our underweight to Europe.

Simultaneously, we also added downside protection on 50% of our overall US equity exposure until late March. Several reasons underpin this decision. Firstly, we perceived animal spirits were in play, with the market perhaps too optimistic about the prospects of Trump’s win (indeed the Trump rally has since begun to fizzle out). Even with a red sweep, Trump isn’t the man in the red suit and January 20th won’t be like Christmas day, with all of his agenda magically delivered overnight. Policy changes will be incremental, and market sentiment could oscillate based on what his administration chooses to prioritise. In addition, there may also be a few lumps of coal for markets in Trump’s sack of proposed policies. Analysis shows that if his agenda (including tariffs and an immigration crackdown) is implemented in full, it won’t be all merry and bright. In fact, it could have a negative impact on the economy and business activity. For example, who will bear the burden of tariffs? Largely domestic companies and consumers, not foreign manufacturers. How will international trading partners retaliate?

One market segment, however, does seem poised to benefit from a new inward-looking administration: US small caps, since they tend to engage in less cross-border trade than larger multinationals. After switching 10% of our US equity exposure into small caps in October, at the latest meeting, we switched an additional 2%, 3% and 5% in Low, Medium, and High profiles, respectively.

All remaining euro-hedged US equity exposure was also switched into unhedged equivalents given that the Trump administration should be positive for the US dollar, as previously mentioned.

Within our reduced European equity exposure, we prefer to use actively managed products, covering the full capitalization spectrum. This offers greater flexibility to seek shelter from Trump’s tariffs.

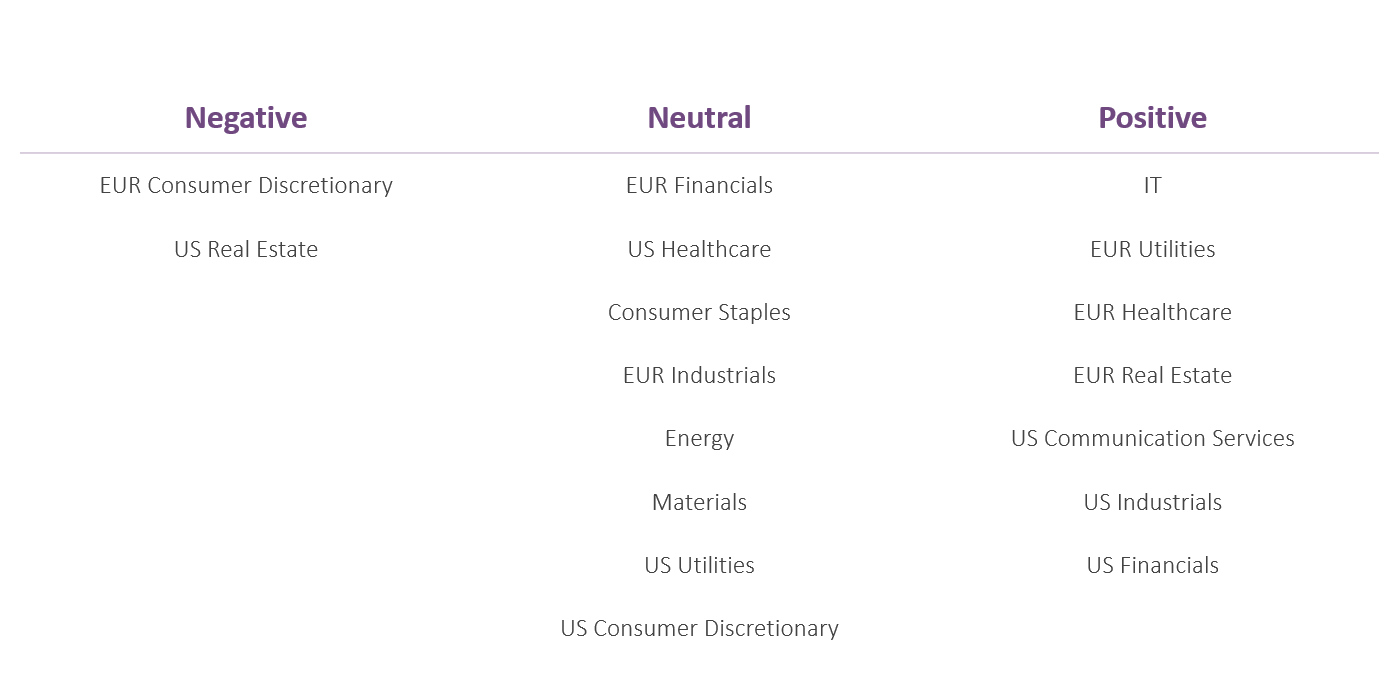

Equity Sectors

Beneath the surface, the Presidential election has substantially changed the outlook for some sectors. To reflect this, we have:

Upgraded US domestic industrials to positive. Returning US President Trump has promised protectionist trade measures, relaxed regulation and cheaper energy for consumers. Global manufacturers are firmly in Trump’s sights. He has threated 10% tariffs on all goods imports, and up to 60% and 100% for China and Mexico, respectively, for certain products. If enacted, the costs would be passed on to US buyers, raising prices and depressing import volumes. This will help US domestic industrials. More international manufacturers may try to get inside the protectionist wall by building US factories. “I want German car companies to become American car companies”, Trump said at a rally last month. The construction of those new factories will provide additional tailwinds for the sector.

Upgraded US financials to positive. While it could take some time for Trump to enact his intended agenda, there is ultimately scope for a more relaxed approach to antitrust regulation. Continued economic expansion and an increase in confidence among CEOs may also underpin a rise in corporate consolidation and act as a catalyst for IPO activity. All of the above would help financial companies involved in trading and corporate finance activities. At the same time, banks may also benefit from the rate environment: Trump policies could be inflationary which means rates and yields may stay higher for longer, boosting interest rate income.

Downgraded US real estate to negative. The higher for longer rate and yield environment is detrimental to the sector. Lately, we have seen a sharp increase in 10-year and 30-year Treasury yields which, in turn, will increase borrowing costs. Real estate companies may lag the overall market in the coming weeks and months.

Downgraded US utilities to neutral. Within utilities, there are several companies that have exposure to renewable energy which is not a priority for the President-elect. Higher for longer rates would also be negative for the sector. Nonetheless, we maintain a neutral stance because there are still positives: higher electricity demand from new and yet-to-be-installed data centres, and from the rise of electric vehicles. Electricity demand is on a structural growth trend. Selective stock-picking will be key moving forward.

Fixed Income

US Treasury yields have moved sharply higher in recent weeks, pulling international peers along in sympathy. There are two key drivers underpinning this trend: expectations of more expansive fiscal policies under Trump, and less easing by the Federal Reserve in response to sticky inflation.

In light of this, we also have also adjusted our fixed income strategy.

Firstly, we have switched US high-yield (HY) exposure into loans. US HY spreads recently reached the tightest levels since the GFC and as such, we took the opportunity to crystallise gains (largely on “fallen angels”) and move into loans. These floating rate instruments offer high carry with no duration, while ongoing economic strength tempers default risk.

In defensive profiles, we switched 3% of sovereign exposure into investment grade (IG). IG bonds have a limited duration and give a thicker cushion to protect against rising yields, while the carry on offer remains attractive.

In Low and Medium profiles, we moved 1% of our IG exposure into HY, again to reduce exposure to duration, as well as to boost the potential for income generation.

Conclusion

While the Wall Street valuation soufflé continues to rise, equities have yet to fully bake in the Trump uncertainty discount. For this reason, we have added downside protection, in case the market starts to be nervous about political noise or valuations. The lesson from Trump’s previous term in the Oval Office is that investors should remain humble and cautious in their interpretation of his messages. What might seem market positive at first glance could have unintended side effects and consequences further down the line.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 19, 2025

Weekly Investment Insights

Written on 19 December, The Weekly Investment Insights newsletter will be paused over the holiday period, returning on January 9. Thank you for your readership....

December 15, 2025

Weekly InsightsWeekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...