BILBoard January 2025 – Snakes and ladders

While western New Year celebrations are already behind us, January 29th will usher in the Chinese New Year of the Snake. People belonging to that year are said to be intelligent and intuitive, with refined taste. They are considered creative and extremely diligent. For investors, such attributes will be more crucial than ever in the coming year…

2024 saw markets continue to climb. The S&P 500 hit 57 new all-time highs, rising by around 25%. The Nasdaq enjoyed gains of over 30%, the Dow 12%, and even the EuroStoxx managed gains of around 8%. As we wrote in our 2025 Investment Outlook, the next twelve months promise a new state of play. Equity valuations are stretched, earnings expectations are elevated, fixed income remains vulnerable to renewed inflation fears, and the political sphere promises it’s fair share of volatility. Selectivity and adaptability will be key, with active management coming back into the spotlight.

The Macroeconomic Context

The US economy ended 2024 on a high note, and things look promising for 2025, with the Composite PMI now at its highest level since April 2022. Hopes are high that the Trump administration will push America First policies that ignite growth and take stock markets to new heights, but the flipside is that his agenda could also fan inflation, potentially halting the Fed’s easing campaign in its tracks. The Federal Reserve has already reduced the number of rate cuts it projects this year from four to two. Bond markets corrected strongly on the idea of higher-for-longer; a move which we viewed as overdone, and which has partially unwound. Trump’s first 100 days in office will be crucial in gaining more clarity on how he will operate this time around, and as to which items he prioritises. Several businesses remain in a wait-and-see mode, especially in the manufacturing sector and with regard to hiring.

For the Eurozone, we envision meagre growth. Any residual strength is concentrated in services, while the two-year contractionary streak in the manufacturing sector continues. The bloc’s major economies, namely Germany and France, will hardly grow in 2025, and risks are tilted to the downside, specifically from Trump’s trade policies. Deregulation and tax cuts across the pond also threaten to erode the competitiveness of European firms.

Inflation in the Eurozone is expected to gradually decrease, reaching 2.1% in 2025, and 1.9% in 2026, according to the ECB’s latest forecasts. Energy could create some bumps on the road, however. As of January 1, Russian gas is no longer being transported to the bloc via Ukraine, while a cold winter means gas reserves are being drawn down at the fastest pace since the energy crisis. Overall, however, a weak economy, and initial signs of cooling in the job market should keep the ECB on track for sequential rate cuts until it reaches the terminal rate. A potential get-out-of-jail-free card?: Consumer confidence has retreated, but if it can recover, the fact that the savings rate is at a three-year high means the potential for an uptick in spending is there.

China’s economy just, and only just, managed to meet the official 5% growth target for 2024. However, looking beneath the bonnet reveals that growth was imbalanced, driven by industry and exports. Export-led growth is partly due to factory gate deflation which makes Chinese goods more competitive on the international stage, as well as a rush by factories to send inventories overseas before Trump 2.0. Indeed, China’s trade surplus soared to a record last year, ahead of a potential deluge of tariffs.

Domestic demand continues as a pain point, while unemployment is creeping up too. It is yet to be seen whether the expansion of a trade-in scheme for appliances and more subsidies for digital purchases will lather up demand among households. The key issue is that the unresolved property crisis continues to weigh on confidence and coffers: Property investment contracted 10.6% in 2024, marking the worst year since records began in 1987. In a nutshell, improving growth will remain the priority in 2025 and fiscal policy will take the forefront, with the scope for further monetary easing constrained by mounting pressure on the yuan. Beijing will only reveal its specific economic roadmap for the year-ahead at an annual legislative meeting in March.

Investment decisions

Equities

In light of the current context, at our Asset Allocation committee on January 14th, we maintained our neutral allocation to equities, with a preference for the US. There, the economic backdrop remains solid, which in turn could keep corporate earnings supported. If this happens, the rally in US stocks could well continue, with broader participation likely in non-megacap tech companies. We see opportunities in, for example, small- and mid-cap equities that have a local US exposure, banks, and enablers of manufacturing reshoring. Companies with a local supply chain are expected to outperform companies with a global supply chain due to potentially antagonist trade policies. In acknowledging that markets could be rattled as Trump enters office and starts to hammer out his agenda, we do maintain hedging on 50% of our US equity exposure in case the market retreats below the level at which it began the year.

We remain underweight on the other key regions, namely Europe, Emerging Markets (including China), and Japan.

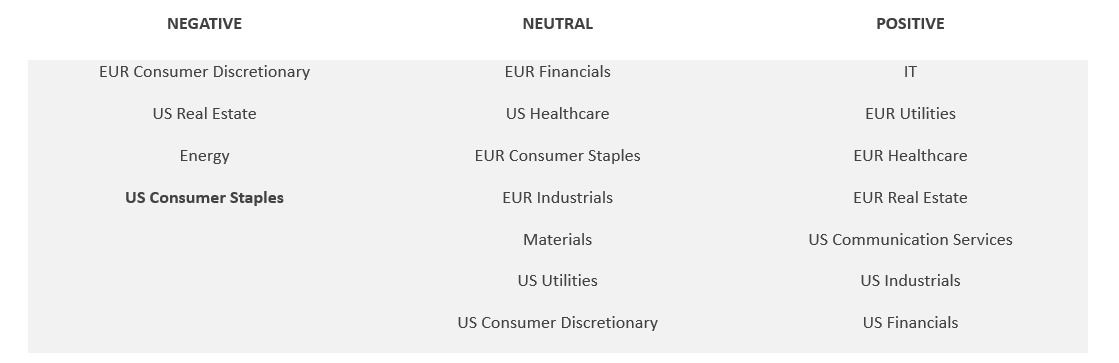

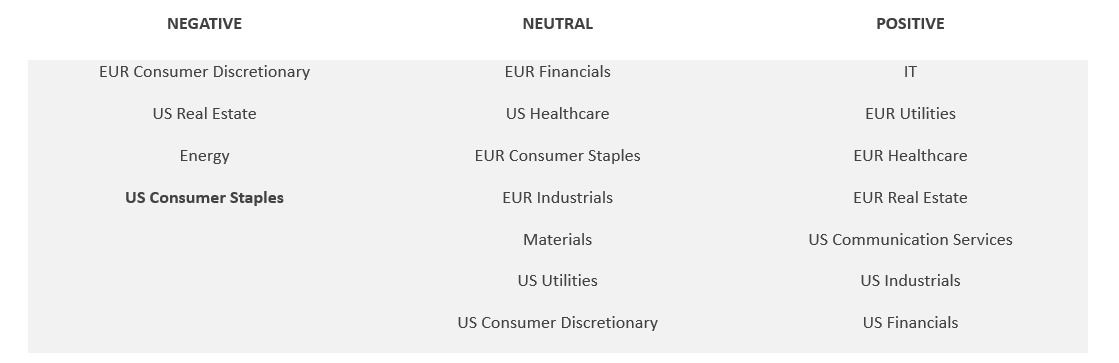

In terms of sectors, we downgraded the US Consumer Staples sector from neutral to negative. For a long time, investors didn’t have to worry too much about currency risk, but it is re-emerging as a watch item: The greenback has risen 8% versus the euro since September, edging closer to parity. Dollar strength could negatively affect income statements, especially those of big US multinationals which earn a good chunk of their revenues abroad. If such companies have not properly hedged their currency risks, they could see the value of their overseas profits come down. The upcoming earnings season will reveal which companies have been swimming naked.

We continue to overweight IT on both sides of the Atlantic. With that said, we emphasise that AI should be considered as a strategic play. While it might be easy to be charmed by compelling narratives about the game-changing impact that artificial intelligence and LLMs will have on our world, it is also true that companies are still seeking ways to monetise these tools. We do see a risk that the forward guidance of companies operating in the space fails to satisfy starry-eyed investors.

Within industrials, the tailwind that the new US administration is offering the defence sector are difficult to ignore. President Trump has opined that NATO members should spend 5% of their GDP on defence, a significant increase from the current 2% target. He seems to be playing the card that says either European NATO members increase their defence spending to keep the US in the alliance, or they spend more to adapt to a world without the biggest spender in the club. NATO estimated that 23 of its 32 members would meet its current goal of spending 2% of GDP in 2024.

Fixed Income

Our fixed income strategy remains centred around investment grade corporate bonds, complimented with high-quality high-yield to boost income.

Perceiving that longer-term yields had moved up too far too fast (primarily in the US, but European rates followed in sympathy), we stuck to our guns on duration, expecting a degree of normalisation on the EUR curve; indeed that has started to play out. For the time being we are keeping our hands off US Treasuries.

Note that in Defensive and Low profiles, we switched a portion of our Sovereign exposure into UK Gilts. Gilt yields had seen significant upward pressure ahead of our Committee, with sticky domestic inflation, an ambitious Labour budget and higher US rates pushing the 30-year gilt to the highest level since 1998. That left the pick-up over Bunds at the highest level since the nineties, a period where the UK was suffering from weak growth and high inflation (+8%). Believing UK inflation will trend lower and that economic growth could disappoint, opening the door for the BoE to turn more dovish, we suspected a normalisation in the rate differential between Gilts over European government bonds, leading Gilts outperform European Government Bonds.

In Defensive profiles, we also made the decision to lower investment grade in favour of increasing high-yield, simply to boost income generation (in the absence of equities to power gains). Low levels of distressed bonds (5%, lowest level since April 2022) and relatively high recovery rates (53% vs 42% in 2023) are reassuring elements for investors in the high-yield. Distressed levels for loans are even lower at 3%.

Conclusion

Investing might sometimes feel like a game of snakes and ladders, but over the long-term, data shows that not being invested is a sure-fire way to lose money, thanks to the corrosive effects of inflation. Relative to previous years, we have an inkling that 2025 could potentially hold more snakes than investors have become accustomed to as of late. By adhering to stable asset allocation guidelines that ensure adequate diversification, we are well-poised to help clients navigate the increasingly complex environment. Our experts have their eyes on the board, ready to adapt our tactical allocation as necessary to seize opportunities and avoid, or at worst, limit the length of any snakes that the market might present. As always, performance for our clients is the overarching aim of the game.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 23, 2025

NewsThe Gold Rush

In recent months, gold has experienced remarkable momentum, solidifying its position as a preferred safe haven asset. Contrary to what the collective imagination suggests,...

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...