May 24, 2024

BILBoardBILBoard June 2024 – Time for equity investors to embark on a European tour?

A study has found that, this summer, Americans wishing to see Taylor Swift’s record-breaking Eras Tour might be better off coming to Europe to do so. With US inflation still uncomfortably above target and the Federal Reserve’s higher-for-even-longer stance boosting the dollar, in some cases it is cheaper to see her perform in Europe – even taking into account flights and a night of accommodation [1]. This is just one small anecdote as to how the US’s enduring economic strength might actually be beginning to have adverse effects. The Federal Reserve cannot start playing its dovish cards because inflation remains sticky, even if the services sector, consumption and the labour market all starting to lose steam. Meanwhile, as the old continent dusts off a mild recession, Eurozone inflation is cooling, giving the ECB leeway to begin cutting rates in June. We believe this sets the stage for investors to start reconsidering relatively cheap European equities.

The macro backdrop

Europe’s old economy is finding its feet again after a mild recession during the second half of last year. Growth sputtered back in Q1 (0.3% versus 0.1% expected), and from here we believe that the worst of the slowdown has passed, absent an unforeseen shock. The upward trend in composite PMIs, a growing services sector, and improved sentiment lead us to expect a tepid recovery throughout the rest of the year. One key factor underpinning this is expected to be a gradual consumption rebound given that European households have yet to make a sizeable dent in their pandemic-era savings, while real wage growth is on the rise.

One element preventing a stronger Eurozone upturn is the worsening downturn in the manufacturing sector, which has spanned 13 consecutive months. Germany, the bloc’s traditional growth driver, is hit disproportionately, with manufacturing accounting for around 20% of its GDP (compared to around 15% of the Eurozone’s overall economy). As a result, the geo-economic split between northern and southern Europe is less obvious than in the past.

Another factor capping the Eurozone’s potential is a host of structural issues, over which much ink has been spilled. Encouragingly, it seems that these issues are again moving up the political agenda, with European leaders keen to rekindle dynamism. For example, Germany is exploring tax cuts to encourage people to work longer hours.

Cooling inflation (latest headline print at 2.4%) keeps a June rate cut on the table, which will give the economy and additional shot in the arm. The pace of cuts thereafter is still up for debate and largely depends on three key factors: wages, sticky services inflation continuing to retreat, and the Fed’s policy pathway (too much policy divergence could result in a weak euro, and thus imported inflation).

In the US, some steam is coming out of the economy. Q1 growth undershot expectations, slowing from 3.4% to 1.6% QoQ, versus 2.5% expected. PMIs are retreating (both the ISM Services and Manufacturing readings <50) and consumer sentiment is waning as cracks begin to form in the labour market (the quits rate has fallen to 2.1%, wage growth is slowing, the ratio of open positions to jobseekers has fallen from 2 to 1.32). After two years of pent-up demand, fuelled in part by credit card debt and buy-now-pay-later balances, government stimulus and the run-down of excess savings, the consumption engine is set to slow this year and there is a risk that the pinch that is already being felt by low income households will spread to the middle class amid higher-for-longer rates.

US CPI inflation eased to 3.4% YoY in April, down from 3.5%, but remains quite a way off the 2% target. Fed Chair Jerome Powell commented, “we’ll need to be patient and let restrictive policy do its work”, leaving the markets with relative uncertainty around the Fed’s policy pathway. Its data-dependent stance could mean markets are very volatile around key economic data releases.

In China, Q1 GDP growth surprised on the upside, coming in at 5.3% versus 4.6% expected. This was largely driven by exports (PMIs suggest this component could remain strong in the months ahead). However, domestic demand remains weak, with consumers becoming increasingly cost-conscious, and the economy continues to flirt with deflation. A major risk presents itself in the form of new US tariffs. As well as a tariff increase from 25% to 100% on EVs, levies will rise from 7.5% to 25% on lithium batteries, from 0% to 25% on critical minerals, from 25% to 50% on solar cells, and from 25% to 50% on semiconductors.

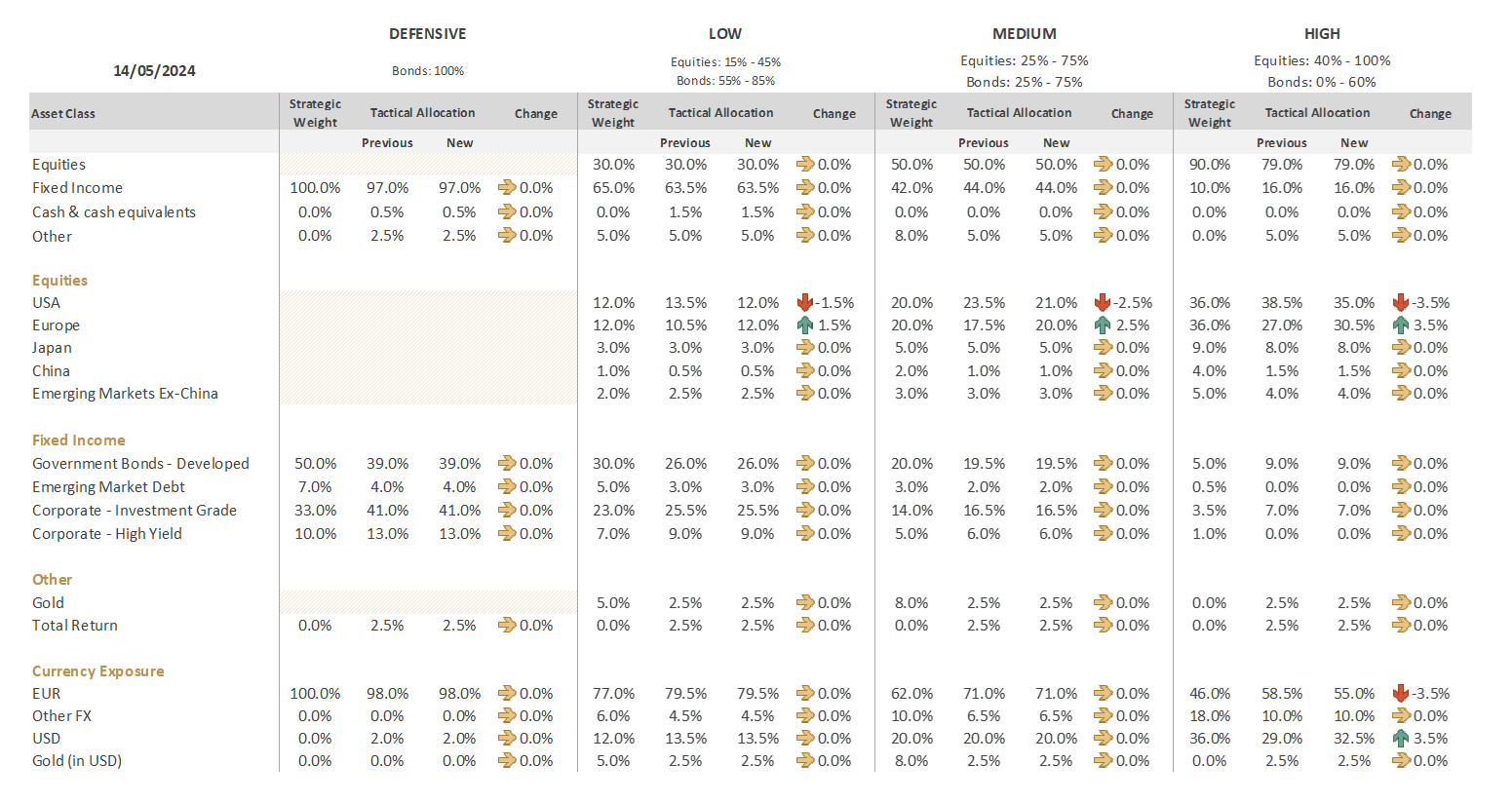

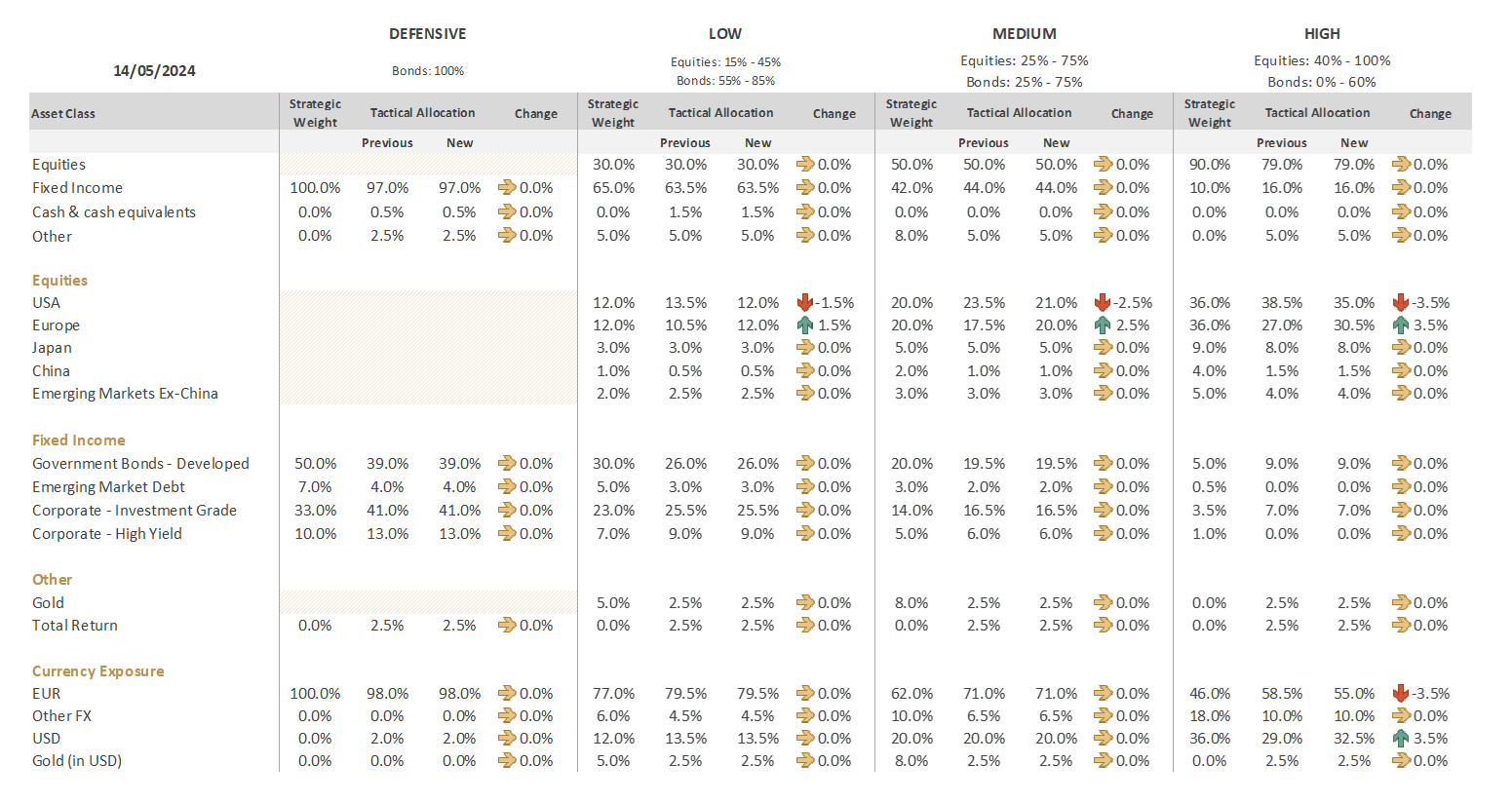

Investment decisions from our Asset Allocation on 14 May

Equities

In 2024, economic growth is likely to remain weaker in Europe than in the US, as it was the past two years. However, we note several factors that suggest European equities warrant a second look.

The Eurozone is clearly in greater need of a rate cut than the US. The upside of this is that we have more visibility on the ECB’s policy pathway. At the same time, US earnings expectations are very elevated, leaving a wide margin for disappointment, while those in Europe are more manageable. European equities trade at a significant discount to their US equivalents (the S&P 500 is trading at about a 50% premium to the Stoxx 600), while at the same time, 2024 is expected to be a record-breaking year for European dividend payouts. Keep in mind that the European stock market is not the European economy; its companies derive more than 50% of their revenue from outside Europe.

Lastly, we see less event risk in Europe. As of now, relative status quo is the expected outcome of the European elections. In the US, not only is the market really sensitive to every incoming macro datapoint, earnings from bellwethers like Nvidia had the power to send the market in either direction, while the upcoming presidential election is highly polarised and has the potential to become quite toxic.

In light of these developments, we continued to build on a trade that we initiated last month, further trimming our US equity overweight in favour of Europe.

We sold the EUR-hedged portion of the US equity portfolio, believing that higher-for-longer could allow the dollar’s strength to persist for the coming months. In high-risk profiles, we moved to further increase our US dollar exposure by switching 3.5% of EUR-hedged US equity exposure into an unhedged equivalent.

The Committee acknowledged the recent rebound in Chinese equities, but perceives it as a bear market rally for now and does not feel comfortable stepping in.

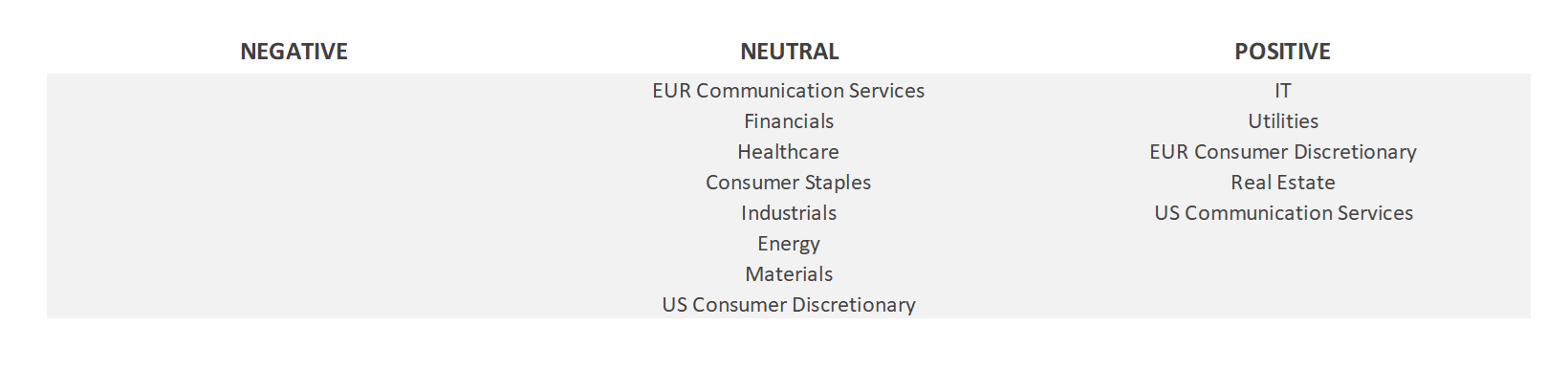

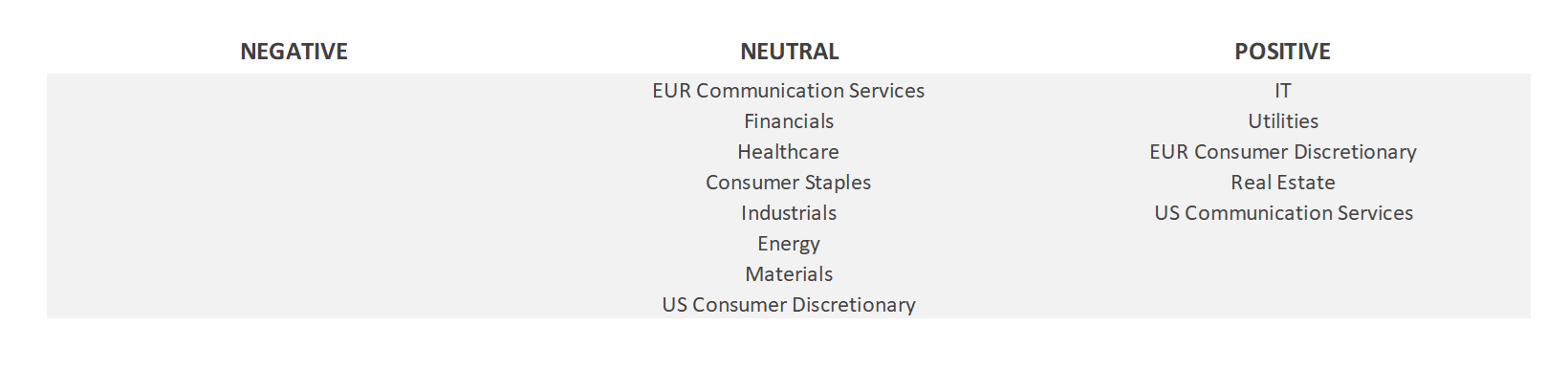

Within our equity portfolio, we made several sector adjustments.

While we continue to favour European Consumer Discretionary, we moved the US equivalent down to neutral: retail and home building are strong, but US carmakers are warning of a challenging year ahead on the back of rising costs, muted EV demand, and an intensifying price war in the Chinese market.

In turn, we moved US Communication Services from neutral to positive. Communications stocks have led returns for S&P 500 sectors this year, but valuations remain depressed. In fact, if you remove the sector’s three most expensive companies, its forward multiple becomes the second cheapest of the all the 11 GICS sectors (after real estate).

Energy was brought from positive to neutral (oil stocks have now caught up with rising crude prices) while Utilities, a more defensive play, were brought up to positive. Further rate hikes are unlikely which helps this interest-rate-sensitive sector and demand dynamics appear favourable: data centres will drive a 10–15% surge in power demand, while growing electric vehicle usage could also boost electricity demand. Renewables are slightly favoured as they operate with long-term price agreements, while their cost pressures are abating. US utilities saw earnings jump 26.7% in Q1, the second-highest growth rate amongst all sectors.

Fixed Income

Our fixed income allocation remains steady, with a preference for European Investment Grade (IG) Corporates and High-Yield.

Though spreads are tight, we are still comfortable holding European Investment Grade corporates, seeing no real catalyst for material spread widening on the horizon. In the US, however, IG spreads offer little risk premium and, as such, in that market, we see Treasuries as more compelling.

In high yield, incremental yield should drive performance, and we see potential for positive momentum to continue despite very stretched valuations. We emphasise quality in our selection process.

Volatile expectations around central bank policies make us reluctant to further increase duration at this point.

Conclusion

At our latest Asset Allocation, we further trimmed our US equity exposure in favour of Europe, meaning we now have a neutral stance on both regions (give or take, depending on the risk profile). Eurozone inflation is cooling, giving the ECB leeway to signal a June rate cut which could help breathe some more life into the economy. Across the pond, it could feel like a cruel summer for many American households and companies, as the Fed delays rate cuts, awaiting more confidence that inflation is sustainable on a path back to 2%. This could start to take a toll on lower income households with debt, and smaller companies with less of a cash buffer.

[1] Despite the tour playing on both sides of the Atlantic, the European leg of the Eras Tour has drawn five times as many Americans than the Paris Olympics this summer.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...

April 2, 2025

BILBoardBILBoard April 2025 – Tariffs, turbul...

Written as at April 1 The first quarter of 2025 was anything but smooth. Market volatility surged, equity markets diverged, bonds offered little in the...

March 28, 2025

Weekly InsightsWeekly Investment Insights

Another week, another set of changes to US trade policy – and that’s before the April 2 deadline where reciprocal tariffs on several trading partners...