May 4, 2023

BILBoardBILBoard May 2023 – Getting defensive

Lingering inflation is keeping major central banks in a tightening mode, even as macro headwinds gather. Expecting a choppy investment landscape in the coming quarters, we added a further layer of protection to our portfolios by implementing a bias towards defensive sectors.

Macro View

Looking Stateside, the Fed appears to be nearing the end of its tightening campaign. Inflation, though still quite a bit above the 2% target, is declining, with the next leg down set to come from falling shelter costs (the Zillow rent index, which tends to lead CPI by 6-12 months, has come down convincingly). Further, as Richmond Fed President noted, “the labour market has moved from red-hot to merely hot”, as layoffs gather steam, wage growth eases and job openings fall.

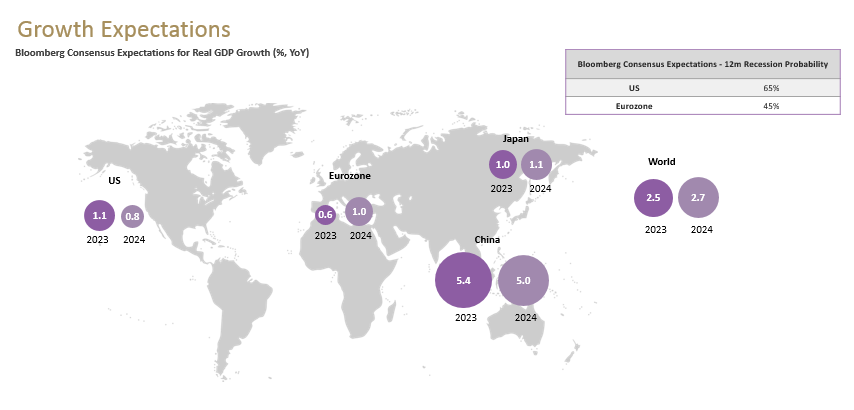

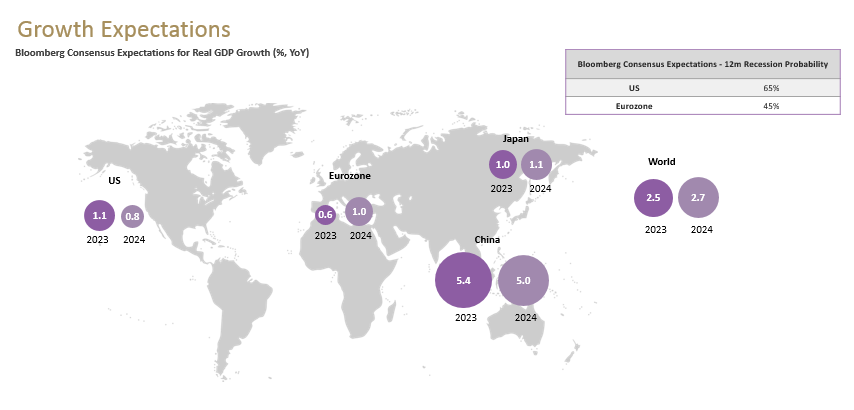

Facing a cloudier outlook, households are beginning to pull back on discretionary spending, while industrial activity is running at is slowest pace in two years. GDP growth is already decelerating sharply (1.1% annualised in Q1, down from 2.6% in Q4 and below expectations of 2.0%) and the market foresees a recession on the horizon (albeit a mild one). The key risk is that the Fed tightens too much, leading to a deeper downturn – we will almost always only know they have pushed too far after the fact.

Closer to home, the Eurozone economy returned to growth in Q1 (it expanded 0.1%, below expectations of 0.2% as Germany stalled). The common thread running through most of the regional reports is that elevated prices and still-negative real wages are weighing on consumption. Sticky core inflation is an ominous cloud hanging over the economy with second-round effects becoming more likely; as supply issues fade and energy costs retreat, demands for higher pay could become a new powerful driver of price increases. As such, the ECB will likely have to continue tightening in the near-term – and its war on inflation might last for longer than the Fed’s.

Given that monetary tightening kicks in with a lag, it is probable, even plausible, that we haven’t yet experienced the full blow from this yet. Such concerns are compounded by the recent collapse of San Francisco-based First Republic: the second-largest bank failure in US history and the third in the country since March.

China is an outlier in the tightening cycle with inflation running at a feeble 0.7% (versus the target of around 3%). Its economy got off to a solid start, registering growth of 4.5% in Q1, though some of this might stem from backloaded activity from Q4 2022. While the export engine at the heart of the economy has roared into life (exports up 14.8% YoY in March), consumption is yet to bounce back meaningfully – we expect this to play out over the coming quarters.

Investment Strategy

- Broadly, we remain underweight equities and fixed income

- Within equities, we underweight the US, Europe and EM, while being overweight China

- We made several adjustments to our sector preferences to implement a bias towards defensive sectors

- Style-wise, we emphasize quality – cash is king

- We keep an allocation to gold as a hedge in case of stress periods on markets

Markets are still not pricing in a scenario of “higher for longer” in the Western hemisphere. In the US, futures prices imply one more 25 bp hike before a rapid pivot to sustained easing this summer. What is more likely is a Fed pause to assess the impact of its actions so far on the real economy, without ruling out more hikes further down the line. In Europe, while a strong downtrend in core inflation has not yet materialised, markets envisage a terminal rate of around 3.6% and expect the ECB to start trimming rates early 2024.

Absent a sudden unforeseen shock or collapse in inflation (which would, in any case, probably catalyse a flight to safety), it seems that there is still too much optimism around central bank easing baked into prices.

All things considered, we believe it is time to batten down the hatches and prepare for some for some volatile quarters ahead. We are therefore still comfortable with our underweight exposure to developed market equities and bonds.

Where we do hold equities, we made several adjustments to our sector preferences to reduce cyclicality and implement a bias towards defensive sectors, namely:

- Consumer Staples - earnings forecasts are relatively stable while the Q1 earnings season has demonstrated that consumer companies are successfully passing on higher prices for now.

- Utilities - the sector is benefiting from banking turbulence as investors adopt a more cautious view and shift into haven stocks; high dividends are the main attraction versus other defensive sectors while stimulus packages are set to provide strong tailwinds on both sides of the Atlantic. Moreover, in response to the US Inflation Reduction Act, a package that includes $369bn of subsidies and tax credits for clean energy technologies, Brussels has cleared the way for EU member states to “match” multi-billion dollar incentives as they fight to keep projects in Europe.

- European Healthcare - another winner from banking turmoil and the best performing sector since the collapse of SVB in the US. EPS growth over the next two years should be robust on higher revenues and margin expansion, with pharmaceutical and equipment companies contributing the most.

We also fortify portfolios with high-quality stocks – those with strong balance sheets, stable earnings, low debt and the financial firepower to weather a downturn in profits. As such, we maintain an overweight to IT, where many such companies are found. Good earnings releases from industry bellwethers so far confirm this stance.

We simultaneously downgraded Industrials to underweight and Energy to neutral, with both sectors beginning to flag as recession fears mount. It seems that the oil price rally in response to OPEC+ production cuts was a false dawn and that for a sustained rebound, China’s recovery will be key (+1.8mpd YoY potential demand growth). However, it is increasingly clear that it will take time before all the cogs of the Chinese economy are turning smoothly again after the prolonged pandemic shock.

Looking at fixed income, we are becoming more constructive on duration as central banks enter the final stages of the inflation battle and without trying to time the exact peak, we are monitoring for technical entry points to reduce our underweight. We have a slight preference for Treasuries over European equivalents, given that the Fed is coming closer to a pause in its hiking campaign.

For now, our fixed income holdings are concentrated in the investment grade space. As with equities, we emphasise quality in our selection. It seems that markets have become de-sensitised to the risks of high debt levels because of the extended period of low or zero interest rates since the global financial crisis. Now, with a sea change in the availability and cost of money underway, caution is needed, especially on those bonds at the lower end of the quality spectrum.

In the high-yield space, our exposure to contingent convertibles (CoCos), was obviously impacted by the Credit Suisse (CS) debacle (with some USD 17bn of these instruments written off while equity investors saw their shares partially converted to UBS equivalents). We held on to our positions rather than crystallising the losses and this has proven to be a good decision. The global market is rebounding, helped by the fact that other jurisdictions made clear their positions on the treatment of these instruments in the event of insolvency. To participate in this upturn, we have rebalanced our positioning upwards in order that these instruments account for the same percentage of our portfolios as they did before the CS affair.

We maintain our gold exposure in order to somewhat shield portfolios during any potential stress periods on markets.

Conclusion

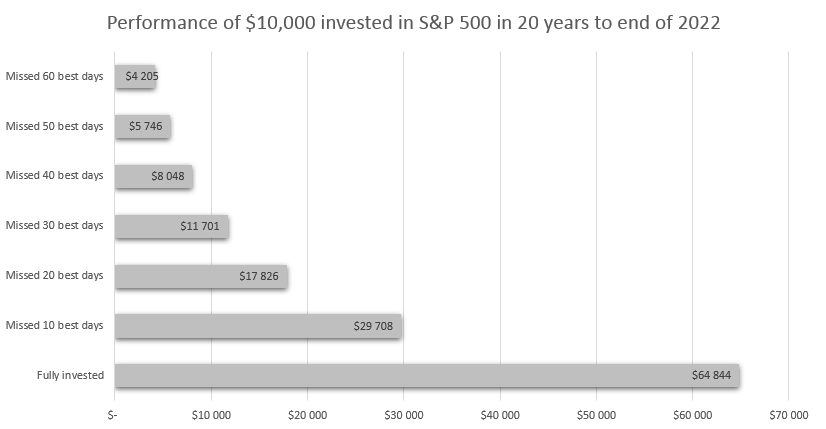

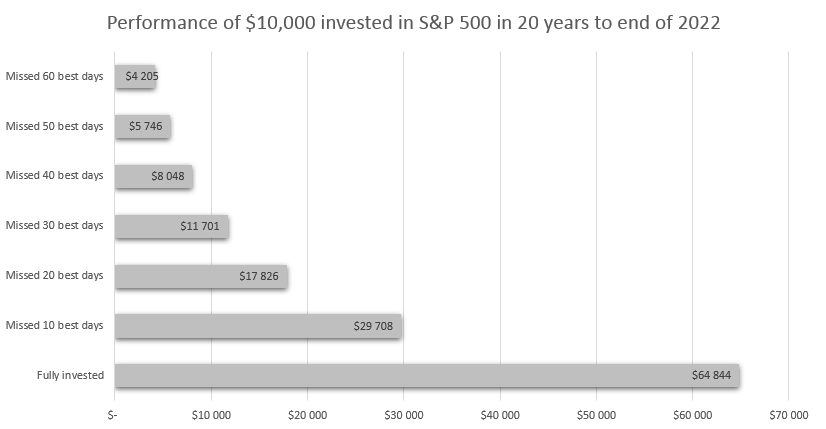

While we do have a larger-than-usual allocation to cash, we don’t advocate exiting the market altogether. Time and again, studies have shown that missing just a few good days on markets can adversely affect performance in a meaningful way. No one can predict when those days will be. Rather, it is better to stay systematically invested, while diligently managing risk. By adopting a defensive and diversified approach, we hope to limit the overall volatility of our portfolios, as well as the downside, should markets conditions take a turn for the worst. We do this by having a) a conservative exposure to risk assets b) a moat of safe-havens such as gold c) a defensive sector selection, and d) a preference for strong, dividend-paying businesses whose fortunes don't rise and fall with the economy…

Source: Bloomberg, BIL

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...

April 2, 2025

BILBoardBILBoard April 2025 – Tariffs, turbul...

Written as at April 1 The first quarter of 2025 was anything but smooth. Market volatility surged, equity markets diverged, bonds offered little in the...

March 28, 2025

Weekly InsightsWeekly Investment Insights

Another week, another set of changes to US trade policy – and that’s before the April 2 deadline where reciprocal tariffs on several trading partners...