October 15, 2024

BILBoardBILBoard November 2024 – Beyond the US election

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and the vastly different programs of the two candidates. With stability forming an integral pillar of our investment philosophy, we do not take binary bets on a specific outcome. In our eyes, this would be closer to gambling than investing. Rather, we ensure that our asset allocation is robust enough to withstand short-term volatility that could arise. After the result of the election, we will of course adapt our strategy if we believe that changes in Washington alter the economic landscape and our base case.

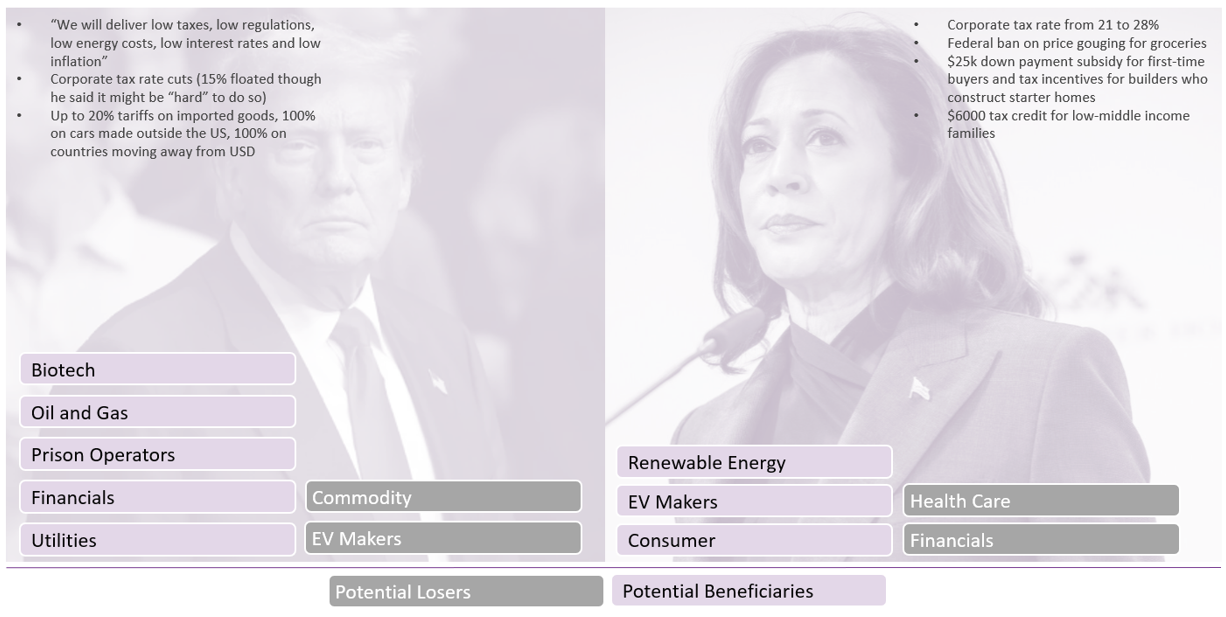

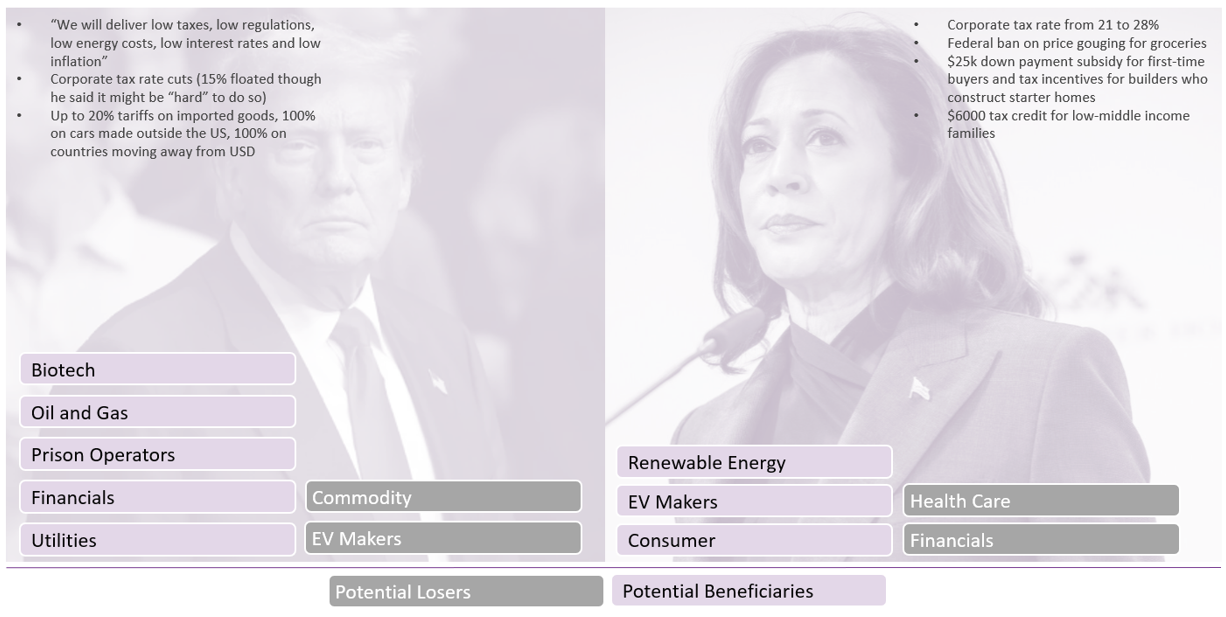

As we wrote in the last BILBoard, former President Trump is campaigning on low taxes, low regulation, low energy costs and higher trade tariffs. Potential beneficiaries are perceived to be big oil, financials and companies that have more of a domestic focus. Harris is a proponent of higher corporate taxes, tax credits for lower middle-income families, and a Federal ban on grocery price gouging. Health care providers could potentially suffer from Harris’ plans to expand Medicare and target drug price reform, whereas consumers, renewable energy companies and EV makers could receive tailwinds. When it comes to the multi-billion dollar Inflation Reduction Act (IRA), continuity is expected under Harris. Contrastingly, the program that received no votes from Republican party members in Congress and at campaign rallies Trump has vowed to “terminate” the IRA if elected.

US national debt stands at 99% of GDP and, under the status quo, is poised to increase to 125% over a decade, according to the Congressional Budget Office. A new report from the Committee for a Responsible Federal Budget (CRFB), a non-partisan group, forecasts that if Harris takes the Oval Office, that ratio could rise to 133% of GDP. With Trump, if he manages to push his pledges through Congress, it could rise to 142%. Shifting expectations about who will take the White House are already creating volatility on the long-end of the yield curve; when the odds rise for Trump, the longer end also rises on fiscal concerns. It’s also worth noting that Trump’s proposed input duties as well as a tougher stance on immigration could be inflationary, which could also contribute to higher long-term yields and a steeper curve.

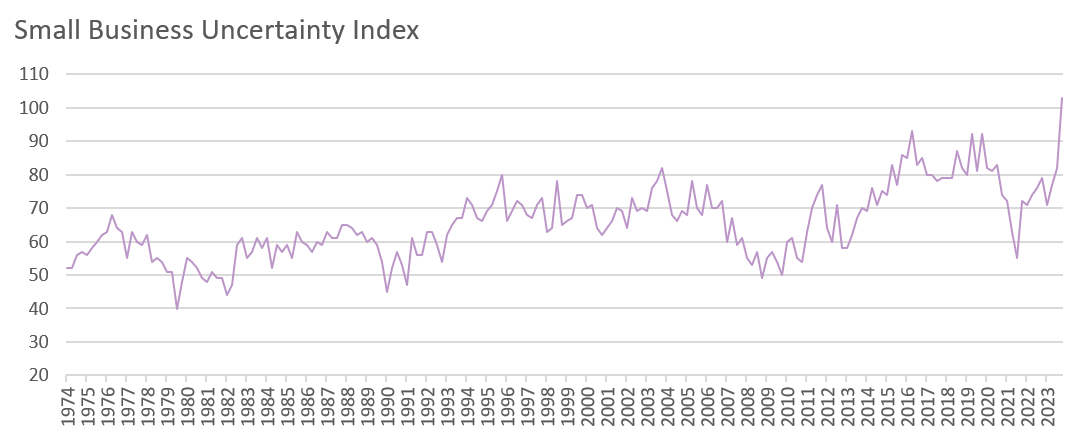

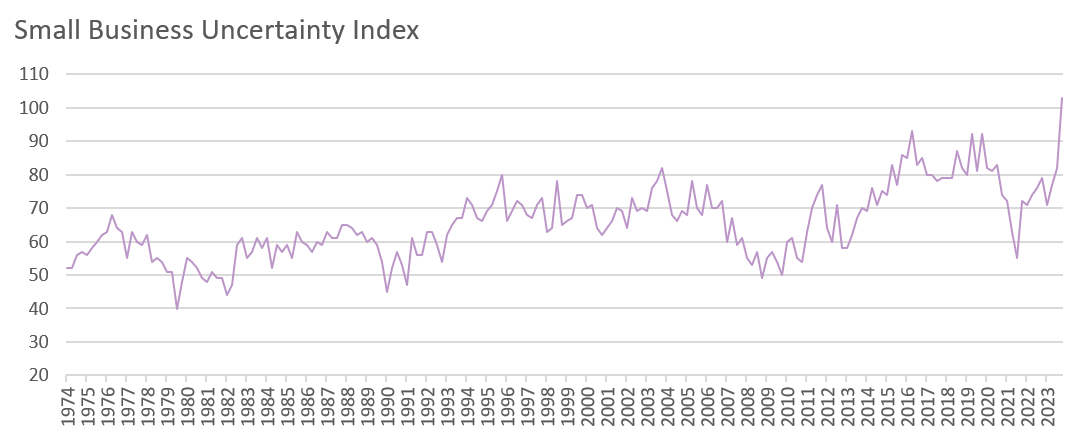

The polarity of the potential Election outcomes is weighing on US business sentiment. According to the NFIB survey, uncertainty among small businesses is at an all-time high. Looking at the PMIs, which cover larger corporates, business expectations for the year ahead have fallen to a near two-year low amid heightened uncertainty ahead of the vote. The ISM survey noted that demand is subdued as companies are unwilling to invest in capital and inventory due to monetary policy and election uncertainty. Illustrative of this, an FT investigation found that ahead of the high-stakes election, some 40% of the biggest US manufacturing investments announced in the first year of Joe Biden’s flagship industrial and climate policies have been delayed or paused, amounting to over USD 80 billion.

Source: NFIB, Bloomberg, BIL

One thing is certain: no matter which way the chips fall in the Election, the removal of this huge source of uncertainty early November should allow activity to thaw, as businesses go back to the drawing board and adjust their strategies accordingly.

Otherwise, the US economy is still holding up well. The prospects for a soft landing have brightened, with the strong services sector continuing to drive growth. Consumption is holding up, the labour market is cooling but not crashing, and inflation appears to be on the path towards the 2% target. The Fed kicked off its easing cycle with a bumper 50 basis point cut and the continuation of its easing cycle should help keep the economy ticking along.

The already-struggling Eurozone economy is also vulnerable to the outcome of the election. The US accounts for around 20% of EU exports and Trump has floated a 10% tariff on all US imports. Even if this doesn’t come to fruition, a rise in policy uncertainty would be enough to hurt growth. The last Trade War in 2018/19 demonstrated that when it comes to tariffs, sometimes the bark is worse than the bite. Europe’s economy slowed sharply during this episode, and in retrospect, this was more due to uncertainty around the scope and size of the tariffs, rather than the tariffs themselves. Additional uncertainty couldn’t come at a worse time for the Eurozone; its manufacturing sector is already in the doldrums and the services sector now softening as well. The one redeeming fact is that the ECB is now easing policy, having already delivered two quarter-point rate cuts. With headline inflation now below the 2% target, the EUR relatively strong, and growth weaker than expected, the ECB might adopt an even more dovish path moving forward.

We note that the UK economy remains on sound footing, with the Bank of England in an accommodative mode.

Looking to Asia, late September, Chinese policymakers unexpectedly kickstarted a series of concerted efforts to provide support, including both monetary measures and [limited] fiscal stimulus. These are largely aimed at restoring market confidence and will also boost liquidity (e.g. lower reserve requirements are expected to release RMB 1 Trillion into the system). While it is encouraging that policymakers are stepping up action, we cannot overlook the fact that the housing market is still under immense pressure, and the package is not big enough to fix this. Real estate is the primary household asset in China and until the situation in the sector stabilises, it is difficult to envisage a meaningful turnaround in loan demand, consumption and more broadly, the economy. China continues to face structural headwinds and questions about potential Japanification loom overhead.

Investment decisions

We maintain a slight underweight to equities, keeping some dry powder on hand should volatility create opportunities to top up. We did, however, make some adjustments within our existing equity exposure, switching 10% of our US equity exposure into small caps. With growth holding up, inflation falling and the Federal Reserve now in an easing mode, the headwinds that have beset small-cap stocks for the past few years are poised to fade over the medium-term.

Given efforts by Chinese policymakers to boost confidence, we also reduced our underweight to Chinese equities. The aim of this trade was to bring the proportion of China within our overall Emerging Market exposure in line with China’s weight in global emerging market benchmark index (c. 25%). The trades were funded by reducing Emerging Markets ex China exposure. It is worth noting that we do not expect a repeat of the rally which came after the unexpected policy announcement. However, we do note that much of that rally was fuelled by retail investors and was sentiment driven. The new liquidity that will be released by the policies is yet to come and could bring some tailwinds.

With regard to sectors, we continue to favour IT, European Healthcare, Real Estate, US Communication services and Utilities. The latter has enjoyed a very strong rally year-to-date, and our equity experts are actively monitoring for opportunities to lock in these gains on an individual name basis. We, however, remain positive on the sector which benefits from structural tailwind of AI and the subsequent proliferation of data centres.

In the Fixed Income space, we switched US Treasury exposure into core European Sovereigns. Weaker-than-expected growth in the Eurozone could trigger the ECB to adopt a more dovish path moving forward, whereas in the US, a soft landing scenario could push up the long-end of the curve, leading to steepening. This decision somewhat cushions portfolios against potential volatility on the US yield curve around the Election.

Conclusion

Election headlines have the power to move markets in the short-term, but these moves are eclipsed by the long-term gains created by market and business cycles. Because our investment philosophy focuses on generating performance for clients over the course of the cycle, we place greater emphasis on fundamentals and the factors influencing those (from technological innovations to globalisation), than on day-to-day election headlines.

But that’s not to say that policy doesn’t matter. The US administration’s stance on taxes, trade, antitrust, healthcare, industrial activity, etc. can of course have a significant impact on certain industries, which in turn can affect the broader economy. However, not only do policy changes tend to be incremental, but also history shows that it is very difficult to predict how any particular policy might affect the economy and markets. We thus adapt our investment strategy prudently.

The key takeaway is that across history, the S&P 500 has averaged double-digit gains whether Democrats or Republicans are in the White House, thanks to the powerful force of compounding.

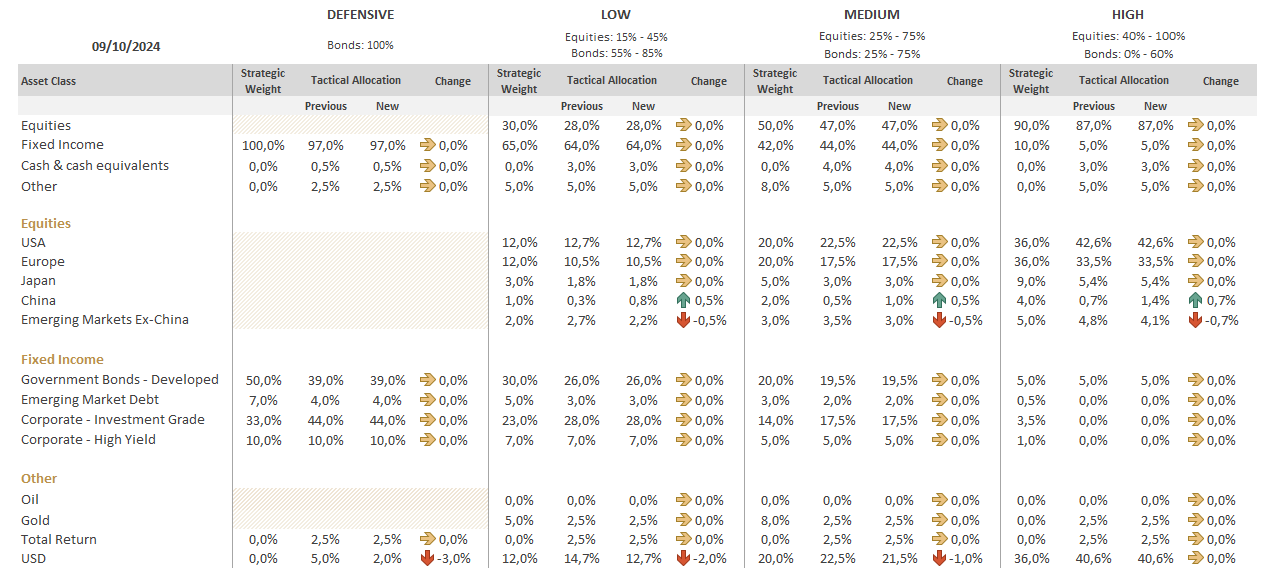

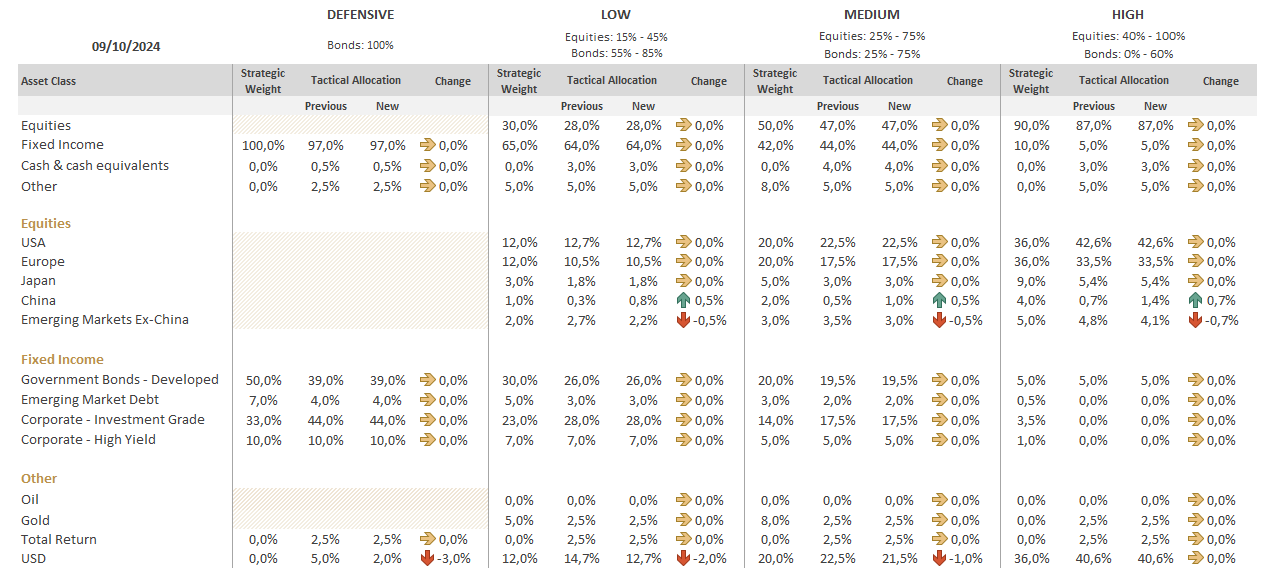

BIL Asset Allocation Matrix

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

April 23, 2025

NewsThe Gold Rush

In recent months, gold has experienced remarkable momentum, solidifying its position as a preferred safe haven asset. Contrary to what the collective imagination suggests,...

April 7, 2025

Weekly InsightsWeekly Investment Insights

So-called “Liberation Day” has catalysed a global market selloff, with US President Trump announcing sweeping new US tariffs, including a baseline 10% tariff on...

April 7, 2025

NewsMarket Update – 7 April 2025

The market sell-off following the announcement of new trade tariffs continues as investors try to assess Trump’s next move and the impact on the global...

April 3, 2025

NewsUS Tariff Policy Signals New Era of P...

US announces higher-than-expected trade tariffs Market reaction was clearly risk-off but still manageable Uncertainty is here to stay. As with previous announcements, Trump could still...