October 17, 2023

BILBoardBILBoard October 2023 – Entry points and earnings

Written as at 13/10/23

Economic Overview

Globally speaking, growth continues to slow as the impact of tighter financial conditions becomes apparent. That said, the transmission of monetary tightening has occurred at varying speeds across economies.

Until now, US growth has held up remarkably well, and incoming monthly data implies that third quarter GDP will come in strong – the first estimate is due October 26th. Retail sales, remain fairly robust, helped by the fact that initial estimates of excess savings appear to have been too conservative. Also bolstering consumption is the fact that the vast majority of US mortgages are long-term fixed rate (70% are 30-year fixed, 9% are 15-year fixed and 10% are fixed across other timeframes), while the labour market is weakening gracefully, with a slight softening in wages but no significant uptick in joblessness. At 3.8%, the September unemployment rate pointed to a still-tight labour market, while average hourly earnings came in at 4.2% YoY quite above the level that the Fed believes is consistent with its 2% inflation target. Considering this, as well as higher energy costs and ongoing stickiness in services inflation, the Fed can’t rest on its laurels just yet. Whether it adds a final 25bp hike this year is yet to be seen, but what is sure is that it will keep rates at elevated levels for longer. Ultimately, this will lead to economic cooling and forward-looking indicators such as PMIs and consumer confidence are starting to turn.

In Europe, the hard data is already disappointing on several fronts. The bloc has been flirting on and off with a recession since the war in Ukraine began last year. Industry has not fully recovered from last year’s energy shock, while households are allocating a greater portion of their earnings toward expensive energy, credit, and mortgage repayments (note that about 30% of households in the member states have variable rate mortgages), which is eroding demand for other goods. With the services PMI “catching down” to that of the beleaguered manufacturing sector, the economy might have contracted in Q3. While the deteriorating macro picture most likely spells an end to the ECB’s tightening campaign, it is premature to expect any loosening. Inflation remains elevated (4.3% YoY), and the ECB doesn’t believe it will come back to the 2% target before 2026.

A faint glint of hope for Europe, is the fact that China’s macro data appears to be stabilising, with one example being industrial profits registering their first monthly increase since 2022 in August. Further stimulus from policymakers in China could further kickstart what could be a natural bottoming in global manufacturing cycle.

Investment Strategy

For several months, markets have been driven by expectations about the future path of interest rates. Central banks insisted that rates were set to stay higher for longer, but markets were in denial, with futures markets still baking in rate cuts as early as Q4 this year. Finally, markets capitulated, resulting in a bond market rout. To illustrate the extent of the sell-off, the US 10-year Treasury yield rose to 4.8%, its highest level since 2007. The German equivalent almost touched 3%, reaching levels unseen since 2011. Bond prices and yields move inversely to each other.

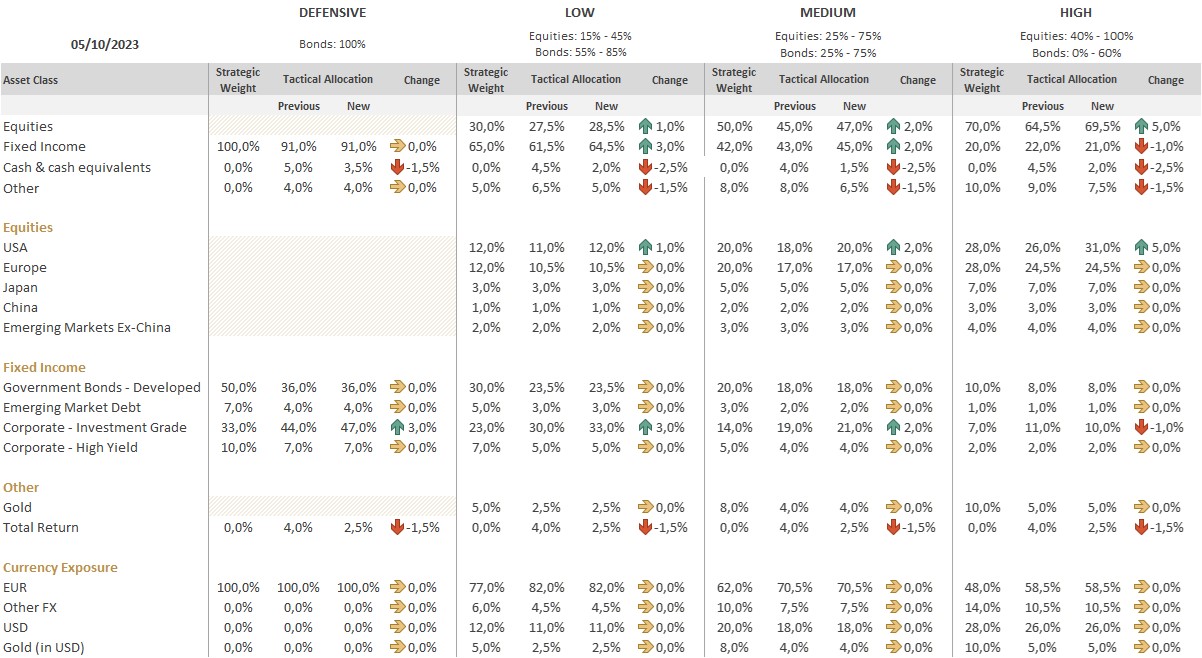

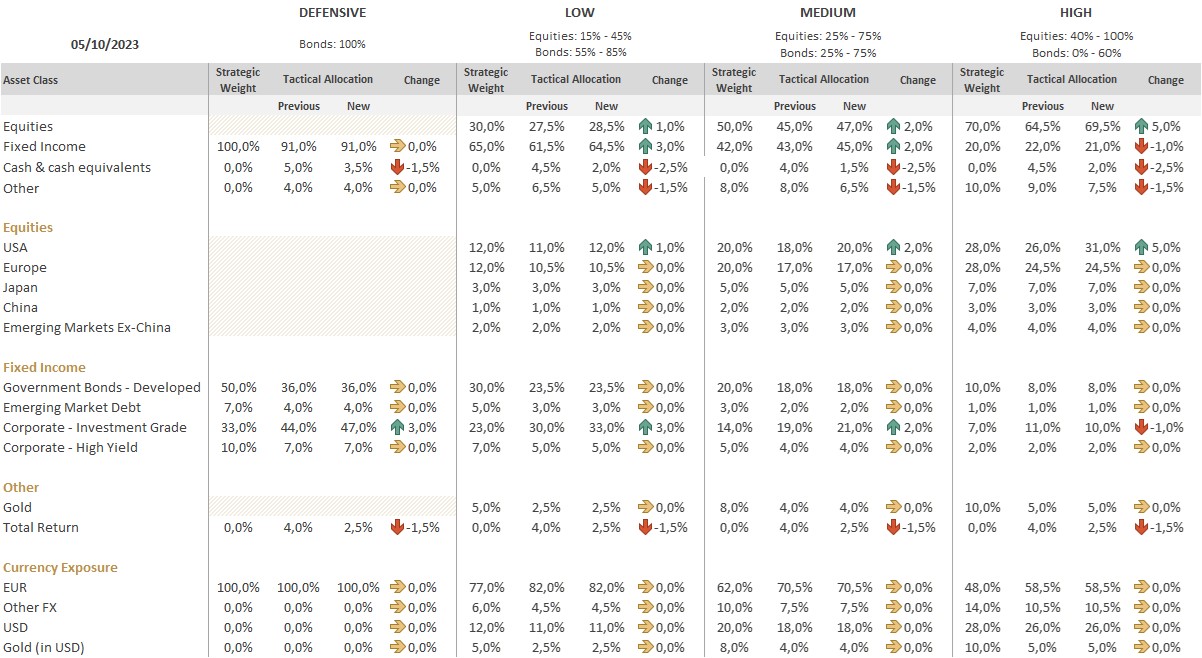

The bond sell-off was accompanied by a retreat in US equity markets. We took advantage of this (and more attractive valuations) to bring our exposure to US equities back to neutral (or slightly overweight in high-risk profiles). These trades were euro-hedged in order to avoid taking on additional FX risk.

The reason for our decision to increase US equities is that bond yields have driven markets until recently. Now that the painful alignment process between central bank guidance and market expectations is largely in the rearview mirror, it is time for earnings to drive the market. The third quarter reporting season is about to begin and the hurdle for companies to beat is low - profits are expected to rise by just 0.05%. As we noted in the macro section, hard data has held strong until now, and the hope is that backwards-looking earnings data will beat, as was the case during the first and second quarters, thereby pushing expectations even higher. As long as earnings revisions keep rising, the stocks will head higher. In short, a robust third-quarter earnings season may be the catalyst needed to support a year-end rally. Even in the face of worsening macro data, US equities could hold up in the short-term (bad news is good news in that it tempers rate expectations).

Sector-wise, we made two changes. Firstly, we upgraded our stance on the European Energy sector to positive. Tighter supplies as a result of OPEC+ production cuts combined with strong demand are creating a very favourable backdrop for energy stocks. This has made the Energy sector in Europe one of the best performing sectors lately, yet it still trails oil’s move. The sector offers low valuations, generous dividends, net buybacks and free cashflow yields and we could also see some earnings upgrades and improved investor sentiment. Moreover, the Energy sector can serve as a hedge during geopolitical flare ups, like that we are currently seeing in the Middle East.

Secondly, US IT was brought to positive from neutral. Valuations have corrected and we believe that it is time to adopt a positive stance on the sector again, which is supported by long-term structural shifts. While the valuation is still above the S&P 500’s 18x, the predictability of IT companies’ earnings growth makes the sector attractive. Add in some share buy backs and the earnings per share should grow above the level of the overall market.

Beyond those changes, we continue to favour Consumer Staples (a defensive play that should cushion portfolios if recession risk comes back into focus) and Consumer Discretionary (the sector tends to lag the market during times of interest rate increases and with peak rates in sight, the fact that it is underweighted in active funds, could quickly change).

On the fixed income side, in all profiles but High (where we have a greater equity exposure), we further increased our overweight to EUR Investment Grade Corporate bonds. With yields approaching the 5% mark (the highest level since the global financial crisis of 2008), this allows us to continue the process of capturing income, as well as slightly increasing duration. Fundamentals remain strong with low leverage and still high debt coverage ratios, meaning IG credit should be able to overcome an economic downturn without any major problems. These trades were funded via cash balances and by reducing exposure to Total Return strategies.

Conclusion

One of the biggest risks we perceived throughout this year was a wide chasm between central bank guidance and the trajectory of interest rates implied by market pricing. Finally, markets have stopped fighting against the “higher for longer” narrative and the painful adjustment is now largely in the rearview mirror. In the aftermath, valuations came down to more attractive levels and we took advantage of this to re-enter the US equity market, ahead of what could potentially be another benign earnings season. At the same time, we continued our quest to capture income opportunities, further adding to our investment grade corporate bond exposure.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 10, 2025

NewsInvestors begin to get back their app...

Written as at 6th March 2025 European equites have taken centre stage in 2025, defying expectations and outpacing their US counterparts. The Europe Stoxx 600...

March 3, 2025

Weekly InsightsWeekly Investment Insights

Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic...

February 24, 2025

Weekly InsightsWeekly Investment Insights

German stocks started the week with a boost as investors welcomed the conservatives’ victory in the national elections. The hope now is that the...

February 24, 2025

BILBoardBILBoard February 2025 – Repainting t...

When President Trump took office on January 20th, it was clear that tackling the US trade deficit would be a high priority. This is not...

February 17, 2025

Weekly InsightsWeekly Investment Insights

Stocks on both sides of the Atlantic finished higher last week. Stateside, the S&P 500 Index and Nasdaq Composite both closed the week within 1%...