Choose Language

September 21, 2020

BILBoardBILBoard September 2020 – Waking up the economy

Typically an

unpopular month amongst market participants, September kicked off true to form

with a tantrum that left the tech-heavy Nasdaq in correction territory. We

understood the decline to be technical in nature, driven by profit-taking and

the laws of gravity, rather than the more ominous kind of sell-off, driven by a

deteriorating fundamental outlook. Indeed, US stocks had already completed a

round-trip from Covid lows, shooting back up past pre-pandemic highs, leaving

valuations (especially technology names and those that fall under the ”Corona /

Stay-at-Home” umbrella) looking extremely bloated. These valuations were inconsistent

with the macro picture – they suggested a global economy springing out of its deep,

lockdown-induced slumber, in a magnificent V-shaped recovery. As we know, it’s

not always easy to pull ourselves out of the sweet stickiness of sleep; the

global economy is only very slowly returning to normality, aided by a

double-shot of caffeine from monetary and fiscal policy makers.

MACRO

Our base

case for a gradual recovery remains intact, though this will be measured in

quarters, rather than months, and it will not be without setbacks. The US

elections, Brexit, US/China disputes, and the virus are just some of the

ongoing risks that could unsettle the outlook.

In the US,

to this point, Fed Chairman Jerome Powell has stated that “the recovery has

progressed more quickly than generally expected,” but cautioned that “activity

remains well below pre-pandemic levels” and noted that the pace may slow as

“the path ahead remains highly uncertain.” To support the economy, the Fed is continuing

with its dovish policy mix of bond-buying, credit facilitation and ultra-low rates

(which are expected to remain at 0-0.25% until 2023 according to the refreshed

dot-plot). Inflation pressures seem to be building, but these are unlikely to

trigger a policy remix, with the Fed now tolerant of inflationary overshoots

under its new “average inflation” targeting framework.

On the

bright side, the central bank upgraded its growth projections and now expects

to see a 3.7% decline in GDP this year, a smaller contraction than the 6.5%

decline expected in June. The US Fed is forecasting that the US economy will reach

pre-pandemic levels by the end of 2021. The manufacturing sector is pushing

ahead while durable goods orders suggest that business investment is slowly

recovering from a standstill. However, profits are still dwindling (down 15% in

Q1 and 8% in Q2) and for corporate margins to return to their former levels,

the US needs its consumers.

After the

post-lockdown “pursuit of happiness” shopping sprees, consumer confidence has

stalled, suggesting that purse strings could

be tightened again. Consumer activity relies on a healthy labour market and 11.5

million jobs having been wiped out since February. It therefore comes as no

surprise that full employment is now a key focus for the Fed, which expects a

median unemployment rate of 7.6% for 2020, down from the 9.3% forecast in June.

Fiscal policy measures have provided critical support for households and small businesses, but more will likely be needed. With gridlock on Capitol Hill, the amount and timing are still unclear. So far, the economy has proven resilient to the expiration of benefits, but without further fiscal aid, pent-up demand could easily fade away.

"In Europe, it seems the snooze button has been pushed on the recovery for now."

In Europe, it seems the snooze button has been pushed on the recovery for now. Recent data shows a loss of momentum in the industrial sector and disappointing consumer spending, raising doubts about the sustainability of the initial rebound, especially with infections and unemployment both trending upwards. Inflation is still in a deep slumber on the continent, removing any dilemma for the ECB, which kept rates at -0.5% at its most recent policy committee meeting, while pledging that it would run its €1.35 trillion pandemic emergency purchase program through to the end of June 2021 at least.

"China’s economy is less lethargic and its recovery makes it an outlier, being the closest of all major economies to its pre-pandemic activity levels."

China’s

economy is less lethargic and its recovery makes it an outlier, being the

closest of all major economies to its pre-pandemic activity levels. After its

corporate sector spent months in recovery mode, China’s consumers are finally joining

the recovery effort. Retail Sales rose for the first time this year in August, clocking

a 0.5% gain. This came as the unemployment rate inched lower to 5.6%, from 5.7%

in July. The trend of easing inflation gives the central bank more room to

manoeuvre moving forward.

EQUITIES

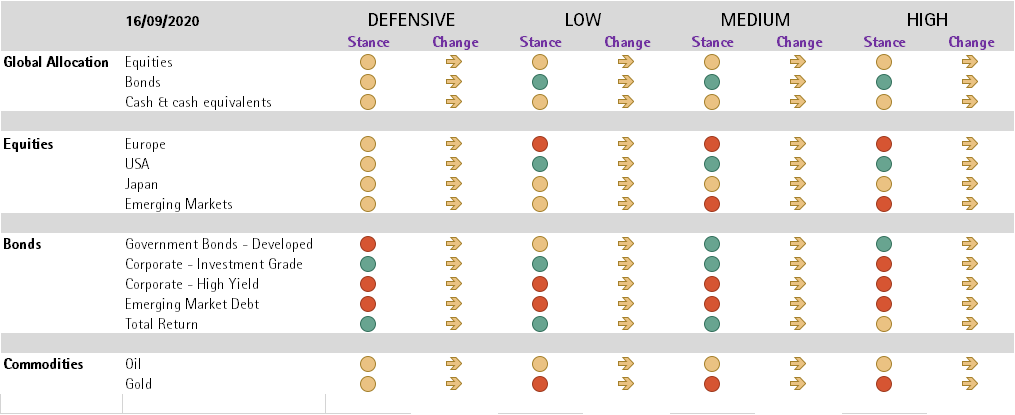

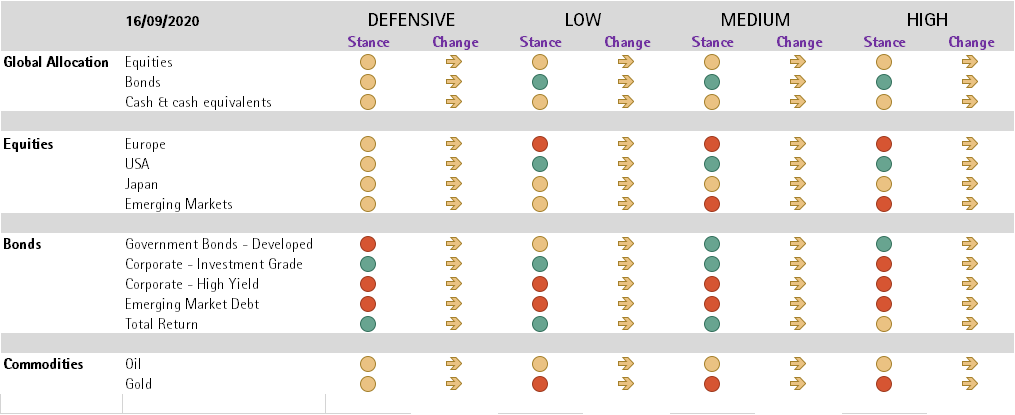

Changes: Emerging Market exposure adjusted to reflect our preference for China.

The market correction did not meaningfully

change equity valuations, which remain on the expensive side. This is

especially the case if you consider the fact that the better-than-feared

earnings season has not influenced revisions dramatically. In fact, the US is

the only region to have had a positive revision in aggregate earnings

expectations (and a minor one at that). We still give preference to the US despite

it being the most expensive region, due to the fact that it is home to the most

prominent growth, “stay-at-home” companies and digital champions, which are

expected to continue to prosper as long as the virus remains rampant. We remain

underweight European equities, which are underperforming the broader market.

Within our Emerging Market exposure, holdings were adjusted to reflect our

preference for Chinese equities which held up well during the recent correction,

and which are supported by stronger fundamentals. Other EMs, for example in

Latin America and India, are still battling their first wave of Covid.

In terms of style, the rotation from growth to

value was brief and primarily US-based. We currently do not see any strong catalysts

for a sustained outperformance of value stocks. Overall,

we prefer to cherry-pick quality stocks from the array of sectors given the

huge dispersion of returns, while closely monitoring some cheaper sectors and

those with positive earnings revisions.

FIXED INCOME

Changes: Emerging Market debt holdings partially switched from HC Sovereigns to HC Corporates

Continued central bank largesse

is inflating government bond prices and for now, yields seem stable. However, within

this space, we maintain our exposure to inflation-linkers, which should

continue to rise to reflect the likelihood of higher inflation over the longer-term

as the recovery trundles on.

In the corporate space, as the

hunt for yield intensifies, spreads have retraced a large part of their

widening and should move in a sideways fashion from here on out: Central banks

are preventing any material widening, whereas further retracement would require

a material catalyst, such as a vaccine. The negative trend seen in ratings

seems to have reached an inflexion point in Q3, supported by a strong issuance

of “general purpose” bonds as companies pursue balance sheet resilience. At the

same time, investors have demonstrated a strong appetite for new issues and a willingness

to hold fallen angels.

In the Emerging Market Debt

space, we believe that EM corporates should now reassert themselves, supported

by lower capex and financial discipline. To elaborate, declining local rates provide EM Corporates the

opportunity to replace hard currency (HC) debt with local currency (LC) debt,

improving balance sheet robustness. At the same time, valuations are attractive

with the yield differential over US Corporates, corrected for duration, still

wide from a historical perspective (c.316bp). In Defensive and Low profiles,

50% and 100%, respectively, of the current EMD exposure (now fully invested in HC

sovereigns) was moved to HC EM Credit.

CONCLUSION

If the economy was personified, it would be yawning, reluctantly stretching, contemplating getting up, maybe with the Greenday song “Wake me up when September ends” playing in the background. All the while, central banks and fiscal policymakers are there pulling off the duvet, trying to coax it out of its slumber. Markets running on hope, liquidity and momentum seem to have overlooked the fact that this will take some time, as well as the fact that only a vaccine (and associated effectiveness and trust in it) will convince the global economy to jump back onto its feet.

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 27, 2024

NewsBIL Investment Outlook 2025 – T...

Introduction from our Group Chief Investment Officer, Lionel De Broux As the oldest private bank in Luxembourg, we’ve been managing clients’ wealth for...

December 13, 2024

Weekly InsightsWeekly Investment Insights

It has been a big week for France, with Notre Dame finally reopening after five years of reconstruction, and Francois Bayrou being named France’s...

December 9, 2024

Weekly InsightsWeekly Investment Insights

December is here, and while the cold, dark days may not be everyone's cup of cocoa, the festive spirit is starting to set in....

December 2, 2024

Weekly InsightsWeekly Investment Insights

In an age where you can carry a computer, music player, phone, TV, camera, calculator and notebook all in one small device that fits...

November 25, 2024

Weekly InsightsWeekly Investment Insights

After last week's disappointing Eurozone economic data, another ECB rate cut in December is high on the wish list for Europe, with investors increasing...